- Bitcoin shorts could contribute to higher prices in a short squeeze scenario

- At press time, bulls remained in control despite the recent highs and growing expectations of downside

As an analyst with over a decade of experience in the financial markets, I have seen my fair share of market fluctuations and trends. Based on the current data and trends, it appears that Bitcoin’s bullish momentum remains strong despite the recent highs and growing expectations of downside.

Previously, I pondered about potential long liquidations for Bitcoin should it retrace from its latest record-breaking peak. To my surprise, even with signs of overbought conditions, selling pressure has been relatively subdued across the market. As we speak, my fellow BTC investors are holding strong and continuing to ride this bullish wave.

One significant factor that has prevented intense Bitcoin selling is the resilience of market faith following its recent peak. This stability was bolstered by substantial inflows into Bitcoin ETFs over the past day. It’s worth noting that ETF flows often serve as a reliable indicator of investor confidence. As Eric Balchunas from Bloomberg puts it, these flows have shown to be quite accurate in reflecting market sentiment.

As an analyst, I observed a remarkable influx of funds into Bitcoin Exchange-Traded Funds (ETFs) yesterday, with a staggering $1.4 billion poured in – a figure significantly boosted by the so-called ‘Trump effect’. The individual fund, IBIT, accounted for an impressive $1.1 billion of this influx. Over the past month, this trend has accumulated a massive $6.7 billion, and year-to-date, it stands at a colossal $25.5 billion. In just one day, these ETFs amassed approximately 18,000 Bitcoins – more than quadruple the daily production of 450 Bitcoins. Currently, they are 93% close to surpassing Satoshi’s initial 1.1 million Bitcoin stockpile.

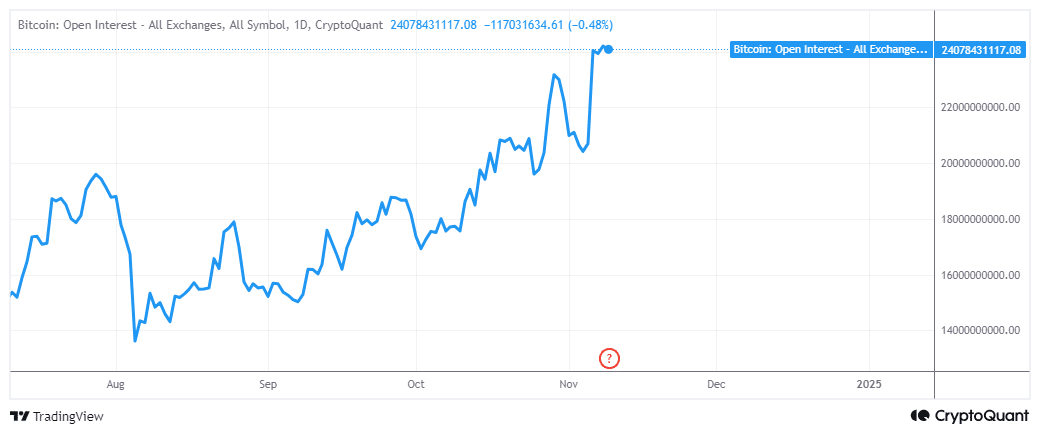

An increase in investments toward Exchange-Traded Funds (ETFs) might propel Bitcoin to even higher peaks. A recent study by cryptoQuant has hinted at this scenario potentially leading to a short squeeze. As per the research, although the Open Interest was substantial, the funding rates were showing a negative trend.

Historically, when funding rates turn negative, it suggests a change in market opinion, particularly towards pessimism in the futures market. This trend is backed up by Coinglass’s Bitcoin long/short ratio, as the number of short positions has been greater than long ones for the past three days.

It’s possible that the increase in short positions occurred due to derivative traders expecting the earlier peak to function as a barrier for further growth, potentially leading to temporary selling for profits and causing another dip. Yet, these short positions could face the possibility of forced closures if the price starts to rise significantly.

Over the past few days, it seems that Bitcoin’s Open Interest has been holding steady following its all-time high. On November 8th, this figure reached a peak of approximately $24.19 billion.

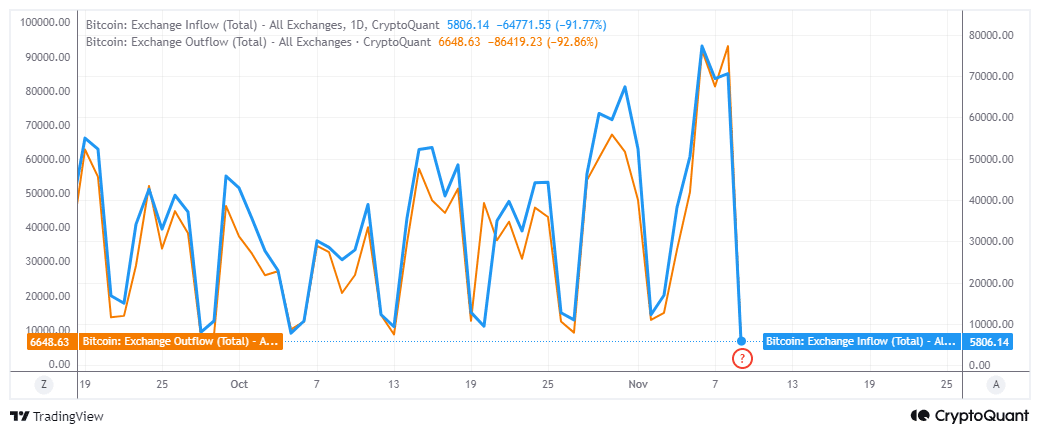

Exchange flows indicate that demand was still higher than sell pressure

Lately, there’s been a significant decrease in the rate at which flow data is being traded, suggesting possible signs of bullish exhaustion. Interestingly, even with this observation, more Bitcoin was being withdrawn from exchanges compared to the amount being deposited.

On November 9th, I noticed that Bitcoin saw a significant outflow of 6,648 BTC from exchanges compared to only 5,806 BTC inflows. This discrepancy indicates that the demand for Bitcoin is still leaning towards the bulls, suggesting that the price could potentially continue climbing.

From the information given earlier, it appeared that bullish energy was persisting, which kept the bears at bay. Add to that the interest in Bitcoin ETFs, and you have a reason for the widespread positivity. But keep in mind, this doesn’t guarantee that things will stay the same.

The behavior of Bitcoin’s price suggests that the buyers are finding it difficult to drive prices upwards. This could indicate a decrease in demand, which might eventually open the door for a downtrend if selling pressure begins to increase significantly.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- XRP/CAD

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-11-09 23:03