- Neiro, Cronos, and Cardano are the biggest winners of the past week.

- POPCAT and Mogcoin had the biggest losses in the past week.

As an analyst with over two decades of experience in the financial markets, I’ve seen many bull runs and bear markets come and go. This past week was no exception as we witnessed some significant movements within the crypto space.

Over the last seven days, the crypto market has shown a significant surge, primarily fueled by Bitcoin‘s (BTC) persistent climb to unprecedented record levels.

As an analyst, I observed a significant ripple effect from Bitcoin’s surge, with assets such as Neiro [NEIRO], Cardano [ADA], and Cronos [CRO] experiencing substantial growth.

However, a few tokens, including Popcat [POPCAT], bucked the trend and ended the week with losses.

Biggest winners

Neiro [NEIRO]

Last week was quite dynamic for Neiro, kicking off with a 5% drop, trading at around $0.0013. On November 4th, the price continued to fall. However, midweek, there was a significant rebound, and Neiro experienced a nearly 55% increase, reaching approximately $0.002.

It continued this upward trend, ending the week at $0.0025 with an additional 15% increase.

According to CoinGecko, NEIRO was the week’s top performer, posting an impressive 107% gain.

Currently, the market value of this token is approximately $1.2 billion, representing a 22% surge over the past 24 hours. The trading volume has also experienced a significant boost, rising by 38% to reach around $867 million.

Cardano [ADA]

This week, Cardano (ADA) ranked as the second-largest cryptocurrency experiencing significant growth. Initially, there was a slight decline of approximately 4%, causing its value to drop to roughly $0.33.

Initially, it moved downward, but then changed direction rather swiftly. It bounced back from the $0.366 level, which acted as a strong support due to the 50-day moving average, and managed to surpass the $0.50 barrier.

According to CoinGecko’s report, ADA experienced a significant weekly growth of more than 69%. Currently trading near $0.587, ADA experienced a daily rise of approximately 18.35%.

1) In simpler terms, the 50-day trend line has risen above the 200-day trend line, suggesting a positive market trend for ADA. However, the Relative Strength Index (RSI) currently stands at 84.88, which could mean that ADA may have been bought too aggressively, potentially leading to a price decrease or correction.

If the upward trend persists, it’s possible that Cardano (ADA) might try to break through resistance near $0.60. However, if there’s a downturn, a support level could form around $0.50.

At the moment of reporting, Cardano’s total value (market capitalization) was around $20.44 billion. The day’s trading volume amounted to approximately $2.4 billion, representing an increase of 128% compared to the previous 24-hour period. The overall market mood appears quite positive.

The value of the cryptocurrency ADA’s market capitalization was approximately $20.44 billion, representing a more than 33% surge within the past day. Furthermore, its trading volume exceeded $2.4 billion, showing an over 128% increase over the same period.

Cronos [CRO]

According to CoinGecko, Cronos experienced one of the greatest increases in value during last week. Following a rather tranquil beginning, CRO witnessed substantial growth in the middle of the week, jumping from around 0.017 dollars to almost 0.10 dollars by Friday.

Trading at over $0.10 at press time, CRO posted a 14% daily increase.

In the past 24 hours, both the market capitalization and trading volume for CRO have increased significantly. The market capitalization now stands at approximately $3.2 billion, marking a rise of 11%, while the trading volume has spiked to around $173 million, representing a substantial increase of 39%.

Top 1000 gainers

In the wider market this week, Zerebro (ZEREBRO) took the lead with an impressive surge of 1,137%. Close behind was Fartcoin (FARTCOIN), which also experienced a substantial growth of 360%, and Bong Cat (BONGO) came in third with a significant increase of 357%.

Biggest losers

Although the majority of the top 100 tokens saw gains due to the market’s optimistic outlook, there were a few exceptions like Popcat [POPCAT] and Mog Coin [MOG], which experienced slight declines instead.

Popcat [POPCAT]

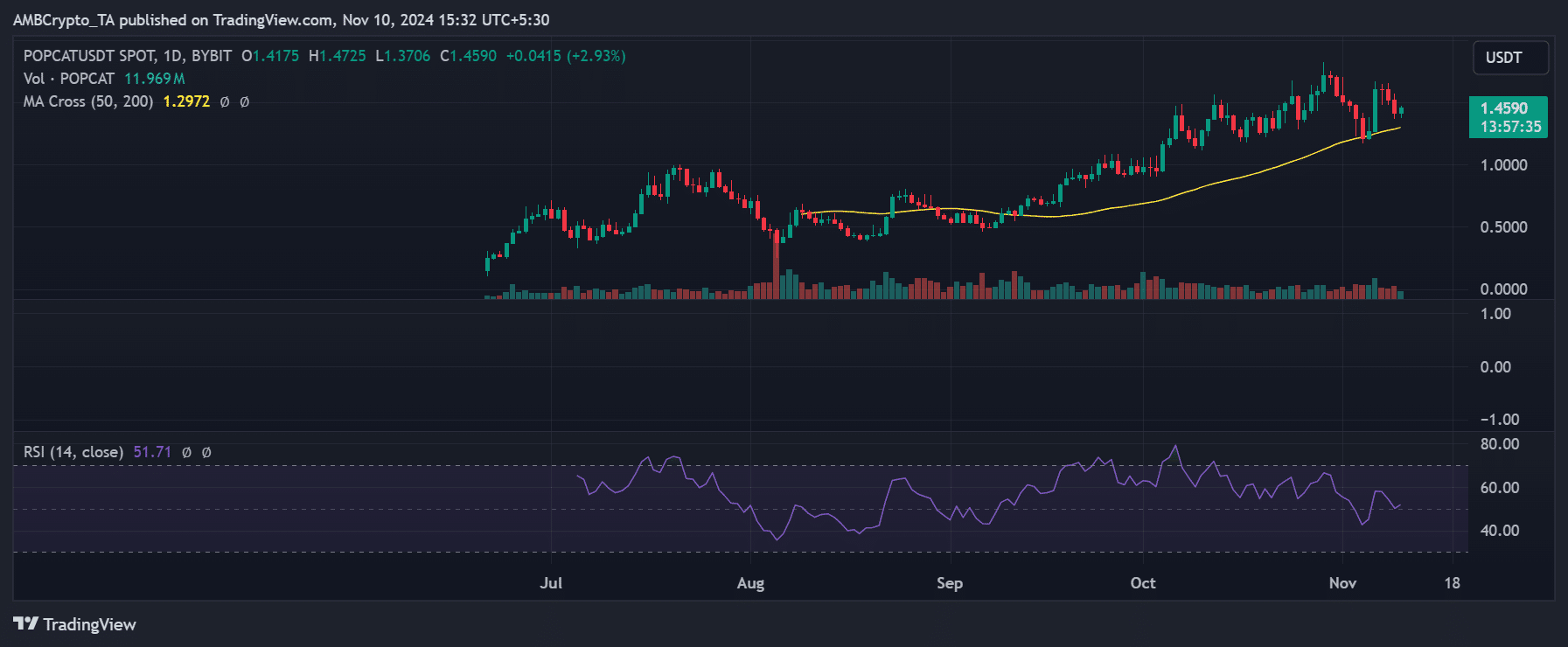

Last week, Popcat experienced a minor decrease, placing it among the rare losses for the week. Initially, Popcat was trading at approximately $1.3 at the start of the week, but dropped to $1.2 the following day.

Following a midweek increase that peaked at approximately $1.60, the value dropped once more, concluding the week around $1.40. At this moment, POPCAT has experienced a slight recovery, currently trading at $1.4590, which represents an uptick of 2.93%.

In simpler terms, the Relative Strength Index (RSI) reading was 51.71, suggesting a balanced movement in the market with a possible pause or stabilization before witnessing a significant shift.

Should bearish trends persist, the price of POPCAT may once again approach its $1.30 support level. Conversely, if bullish momentum takes hold, the price could challenge the $1.60 resistance level.

Mog Coin [MOG]

Over the past week, the price of Mog Coin (MOG) saw a slight dip, decreasing by nearly 1%. Initially priced at approximately $0.0518, MOG spiked more than 17% to reach around $0.0522 in the middle of the week. However, it failed to hold onto that increase.

By the end of the week, MOG settled around $0.0520.

As we speak, MOG’s market capitalization stands around $792 million, showing a minimal dip of almost 1%. Simultaneously, the trading volume amounts to approximately $33 million, marking a drop of 4%.

Top 1,000 losers

Out of the 1,000 most common terms, MAGA HAT experienced the steepest weekly drop by 48%, triggering a fall in the value of PolitiFi tokens.

In simpler terms, Ozone Chain (OZO) experienced a significant decline of about 45%, and Trump (MAGA) came in third place with a decrease of approximately 42%.

Conclusion

Let me share this week’s overview highlighting the top performers and underperformers. Remember, the market is unpredictable, with prices often fluctuating swiftly due to its volatile nature.

Thus, doing your own research (DYOR) before making investment decisions is best.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-10 22:16