- Whale activity suggested growing confidence, as larger investors were mostly holding their positions.

- In contrast, retail investors may slow down the rally by selling off, which could delay further upward momentum.

As a seasoned researcher with years of experience under my belt, I find myself intrigued by the current state of Injective [INJ]. The past week has seen an impressive 49.15% surge, and the asset is showing no signs of slowing down, with another 16.09% increase in just 24 hours. However, my cautious optimism is tempered by the potential for retail selling to delay further upward momentum.

It appears that the upward trajectory for INJ is holding strong, as the asset has surged by 49.15% over the past seven days and posted a further 16.09% rise just within the last day.

To hit the $53 target for INJ, there needs to be a strong short-term support level that can counterbalance the selling pressure coming from retail investors and sustain the rally.

Smaller investors became less hopeful, yet the larger ones stayed positive. However, for their optimism to result in additional profits, the market requires robust backing over the immediate future.

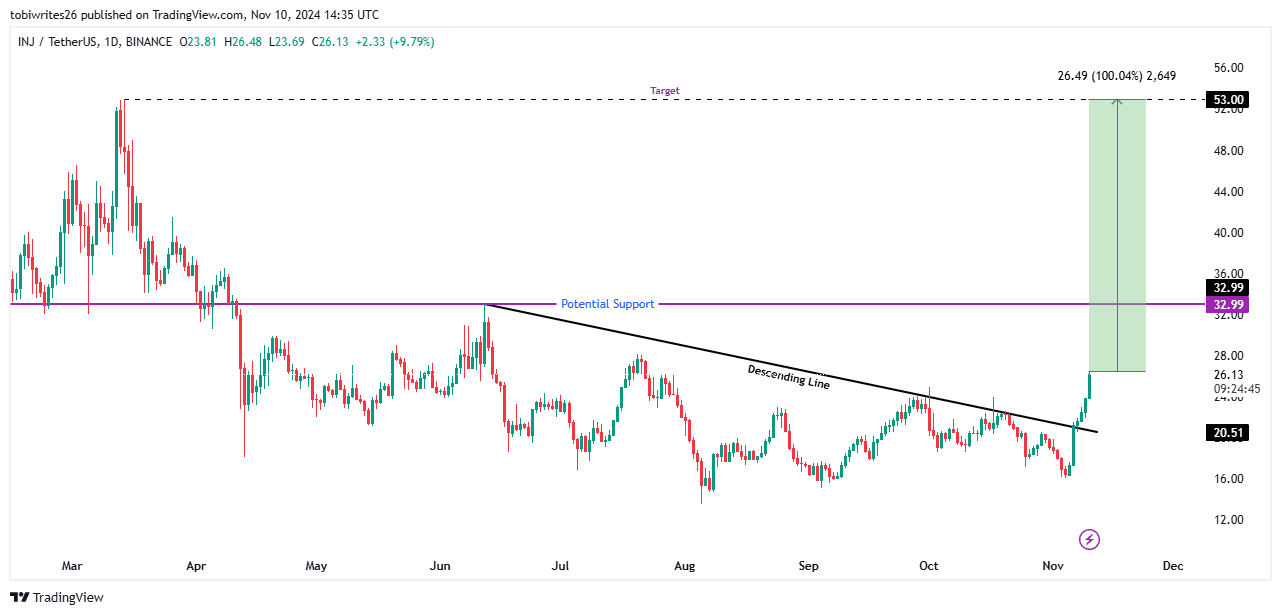

Injective: Roadmap to a 102% gain

As I analyze the current market situation, it appears that INJ is primed for a potential surge, following a trajectory that might lead it back towards its March 2024 peak of $53.00.

In simple terms, the current surge is linked to INJ’s jump over a downward trendline on the graph, which historically has been a strong indicator of rising prices.

To start with, this potential surge might push INJ up to reach approximately $32.99, representing a 25.3% increase from its present value.

Should INJ maintain its current price above the $32.99 mark acting as a fresh support, similar to how it’s behaved during previous upswings, we might anticipate a possible further rise, potentially resulting in a total increase of approximately 100.04%.

Previously, this level has often triggered significant rallies for INJ. It’s possible that it could spur another rally towards the $53.00 mark in the future.

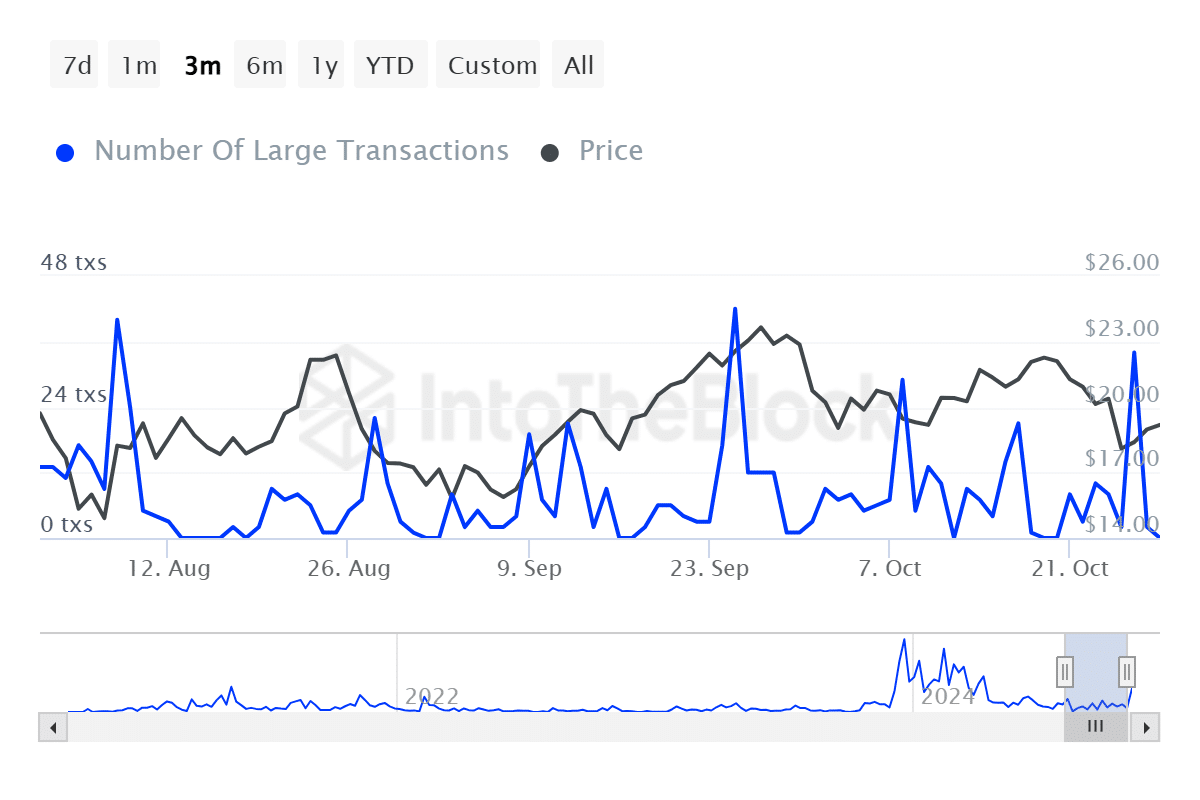

Whales pause selling as…

The pace of whale transactions seems to have decreased, as major traders appear to be halting their sell-offs following a substantial drop in trading volume which led to increased profits.

Whales, who own a significant portion (around 1%) of the total supply of an asset, possess substantial power over market trends and pricing movements.

A significant decrease in major trades often indicates that ‘whales’ (large investors) are choosing to keep their investments instead of offloading them.

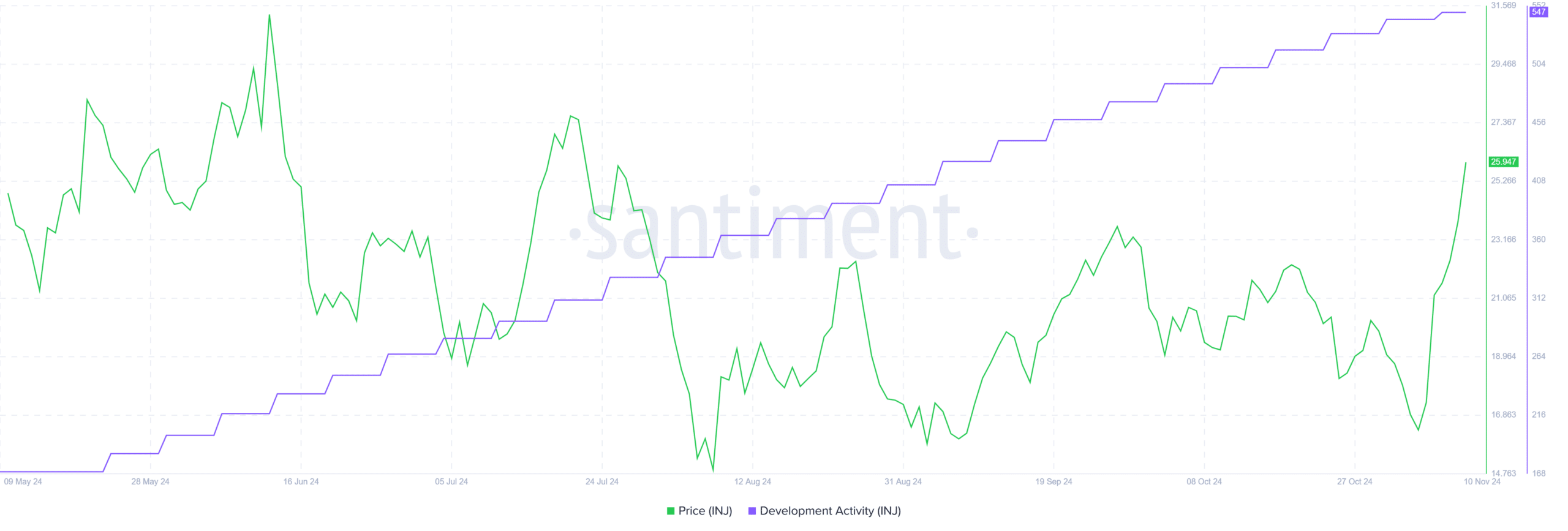

This change seems connected to a recent spike in construction work, hitting a record peak as we speak.

As a crypto investor, I’ve noticed that when I see increased development activities within a project, it usually sparks optimism in me. This is because such efforts are clear indications of continuous improvement within the ecosystem, which could lead to an upward trend in prices.

Should the progression of whale buying patterns and construction projects continue at their current pace, it’s possible that the price of INJ might hit a temporary goal of $32. This could pave the way for even more growth in the near future.

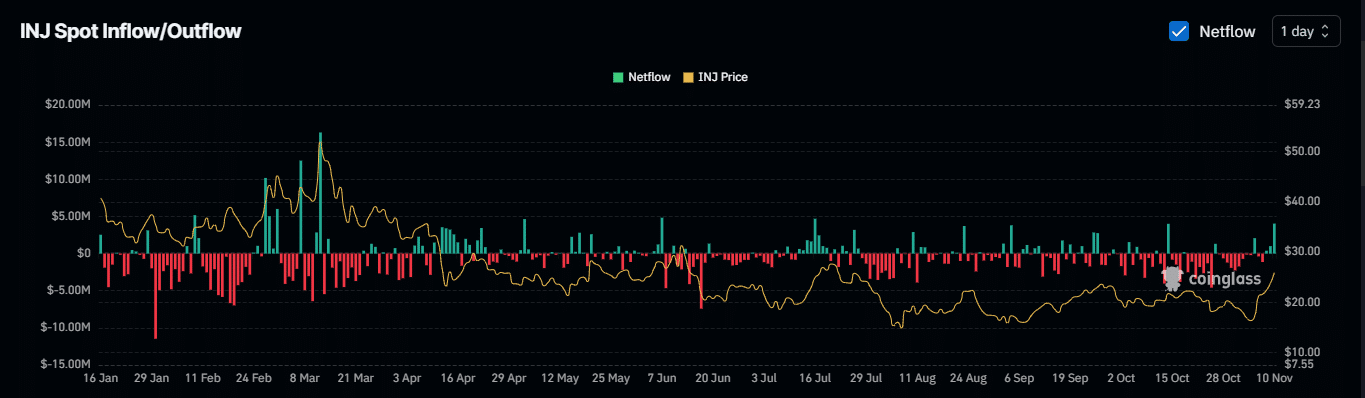

Retail selling could delay INJ’s rally

According to data from Coinglass, there’s been an uptick in the number of retail traders selling cryptocurrencies, which is suggested by a positive net outflow from the exchanges.

Over the past day, more INJ has entered exchanges than has left, with a noticeable excess.

Read Injective’s [INJ] Price Prediction 2024–2025

As a crypto investor, I’m noticing a trend that indicates retail traders might be cashing out their gains. Over $4 million has been shifted into exchanges, which could signal potential selling activity.

If sales in retail continue at the current rate, it may cause a deceleration in INJ’s growth trend, possibly altering its overall ascent.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-11 11:04