- With the crypto greed index at elevated levels, asset prices could become inflated, and market volatility may increase.

- However, current key metrics signal a potential BTC short-squeeze to $85K.

As a seasoned crypto investor with scars from the 2017 bull run and the subsequent bear market etched into my psyche, I find myself cautiously optimistic about the current state of Bitcoin [BTC]. The crypto greed index at an all-time high is reminiscent of the euphoria that preceded the infamous “Bitcoin is the new internet” phase. However, this time around, I see a potential short-squeeze to $85K on the horizon.

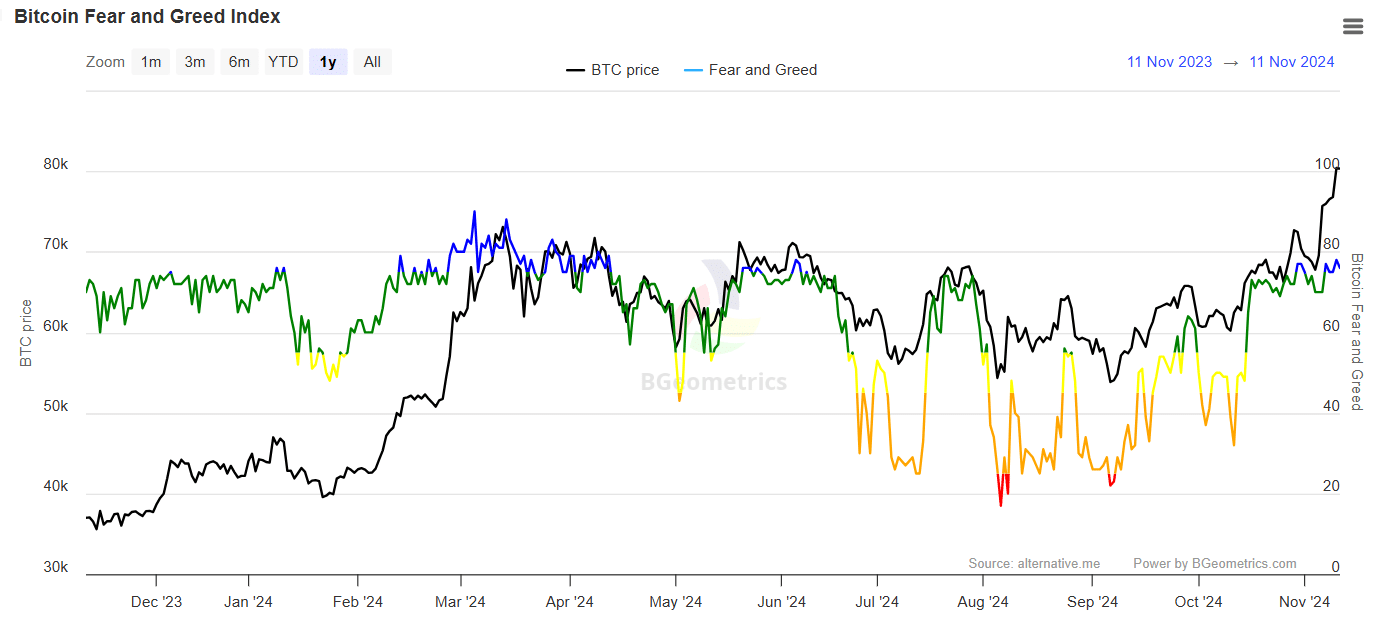

Almost every Bitcoin (BTC) owner currently finds themselves in a profitable position, causing a delicate balance in market feelings that oscillate between exuberance and apprehension. As BTC sets a new all-time high at $81K, the Crypto Greed Index has spiked to its highest level in seven months.

In this scenario, a surge in greed could potentially drive prices up further, but a quick change in opinion could lead to an immediate wave of selling.

Crypto greed index shows signs of overvaluation

In simpler terms, the Crypto Greed Index is a tool that allows investors to understand the general feelings in the cryptocurrency market, which can significantly impact buying and selling choices. According to CoinMarketCap’s data, the market is moving closer to intense optimism or greed.

Prior to Bitcoin reaching $80,000, the market had reached a stage of excessive optimism. This level of enthusiasm indicates that investors continue to anticipate further price increases. However, if this optimism becomes too extreme, it might indicate overconfidence, potentially increasing the likelihood of a market adjustment or correction, as observed during the March rally.

Source : BGeometrics

In early March, when Bitcoin hit $73,000, the Crypto Greed Index soared to 90, indicating intense greed among investors. With such extreme optimism, many investors chose to cash out their profits from the rally, causing the price to drop back to $67,000 within just a few days.

Currently, the Crypto Greed Index has peaked at a 7-month high, mirroring a widespread optimistic market mood. One might wonder: Could this spike indicate an upcoming correction for BTC, given that all its holders are presently enjoying profits?

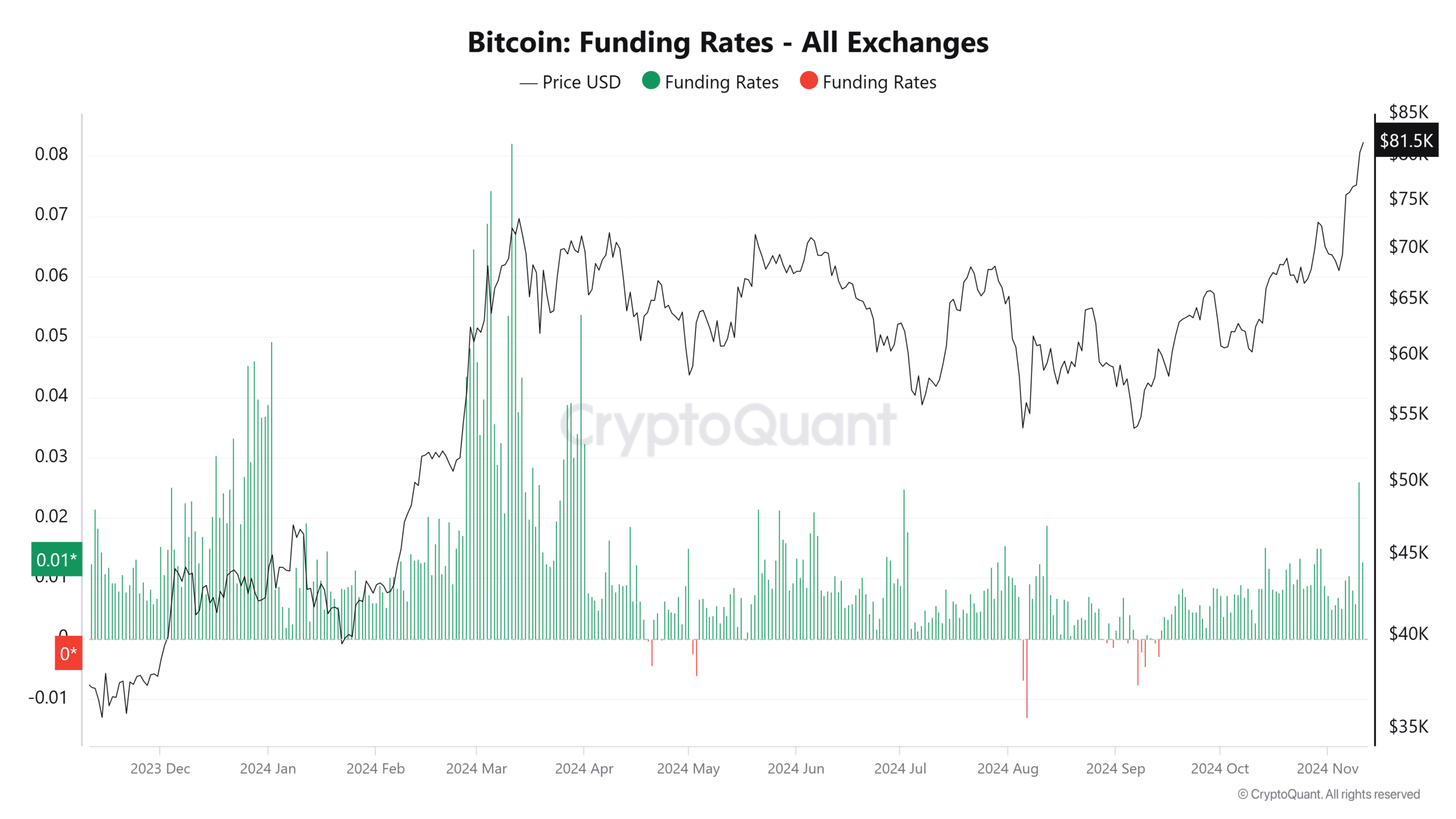

Bulls are betting on further upside

Despite being in a risky period, Bitcoin surged by more than 2% compared to its closing price yesterday, indicating that investors remain hopeful and bullish about Bitcoin’s future prospects.

The level of optimism is evident in the elevated Crypto Fear & Greed Index, suggesting that investors are demonstrating more daring trading behaviors than usual in the market right now.

From my perspective as an analyst, it appears that some investors might be neglecting underlying dangers in pursuit of excess gains, indicating a readiness to maintain their investments even when there are indications of inflated valuations.

To maintain stability for Bitcoin in the approaching days, it’s essential that this confidence remains strong to avoid falling below the significant $80K mark.

Source : CryptoQuant

As a crypto investor, I’m observing a trend in the derivatives market where the bulls seem to be leading the dance, outmaneuvering the short-sellers. This situation is pushing up the crypto greed index. Despite the persistent bullish sentiment, it hasn’t yet reached the fever pitch we saw during the March rally.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It seems like a peak might be postponed, given the ongoing growth in whale holdings, increasing numbers of new investors, a predominantly long-biased derivatives market, and a high level of investor optimism or “greed.

Such conditions may lead to an opportunity for a possible short squeeze in Bitcoin, potentially pushing its price up to $85K or more by the end of this month, given the heightened enthusiasm and increased appetite for risk among investors.

Read More

- CYBER PREDICTION. CYBER cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- DYM PREDICTION. DYM cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- SKEY PREDICTION. SKEY cryptocurrency

- EURC PREDICTION. EURC cryptocurrency

- PHB PREDICTION. PHB cryptocurrency

2024-11-11 17:12