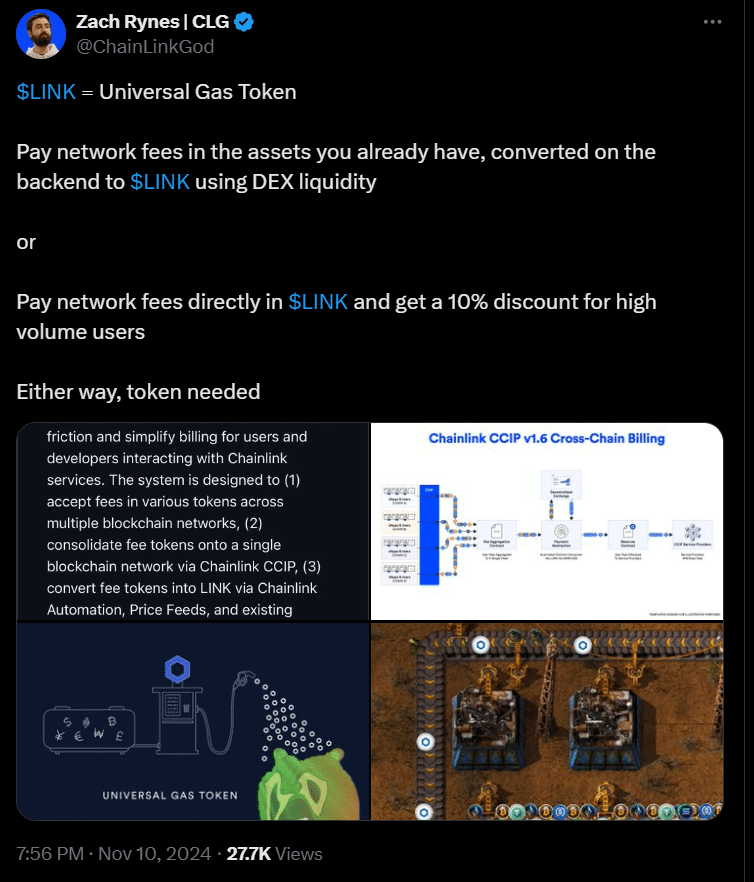

- Chainlink introduces LINK as a universal gas token for network fees.

- Chainlink CCIP enables Cross-Chain Billing with LINK as a core token.

As a seasoned crypto investor with a knack for spotting opportunities, I find the latest developments with Chainlink highly intriguing. The introduction of LINK as a universal gas token and the implementation of CCIP v1.6 Cross-Chain Billing solution are strategic moves that could significantly boost Chainlink’s adoption and price growth.

As Chainlink’s universal gas token, LINK, grows in popularity, the Chainlink ecosystem is flourishing, increasing usage and potentially pushing prices higher. With the token’s momentum, it’s possible that the previous record high of $22.87 set in 2024 could be surpassed in the near future.

Chainlink drives LINK’s demand

Chainlink is advancing substantially within the blockchain industry, aiming to establish LINK as a versatile fuel token for various transactions.

The token provides flexible options for users to pay network fees across blockchain services, either directly in LINK or by converting other assets through decentralized exchanges (DEXes).

With the latest update from Chainlink, users can now settle fees using LINK and enjoy a 10% reduction, making it more attractive for high-volume transactions. Furthermore, the Chainlink CCIP v1.6 Cross-Chain Billing system collects multiple tokens and converts them into LINK for payments, streamlining the fee process for developers, making it easier to manage transactions.

In essence, LINK, acting as a key currency for Chainlink, is playing an increasingly vital role in shaping its future expansion. This growing importance is sparking higher demand for LINK throughout the blockchain industry.

LINK’s steady upward momentum

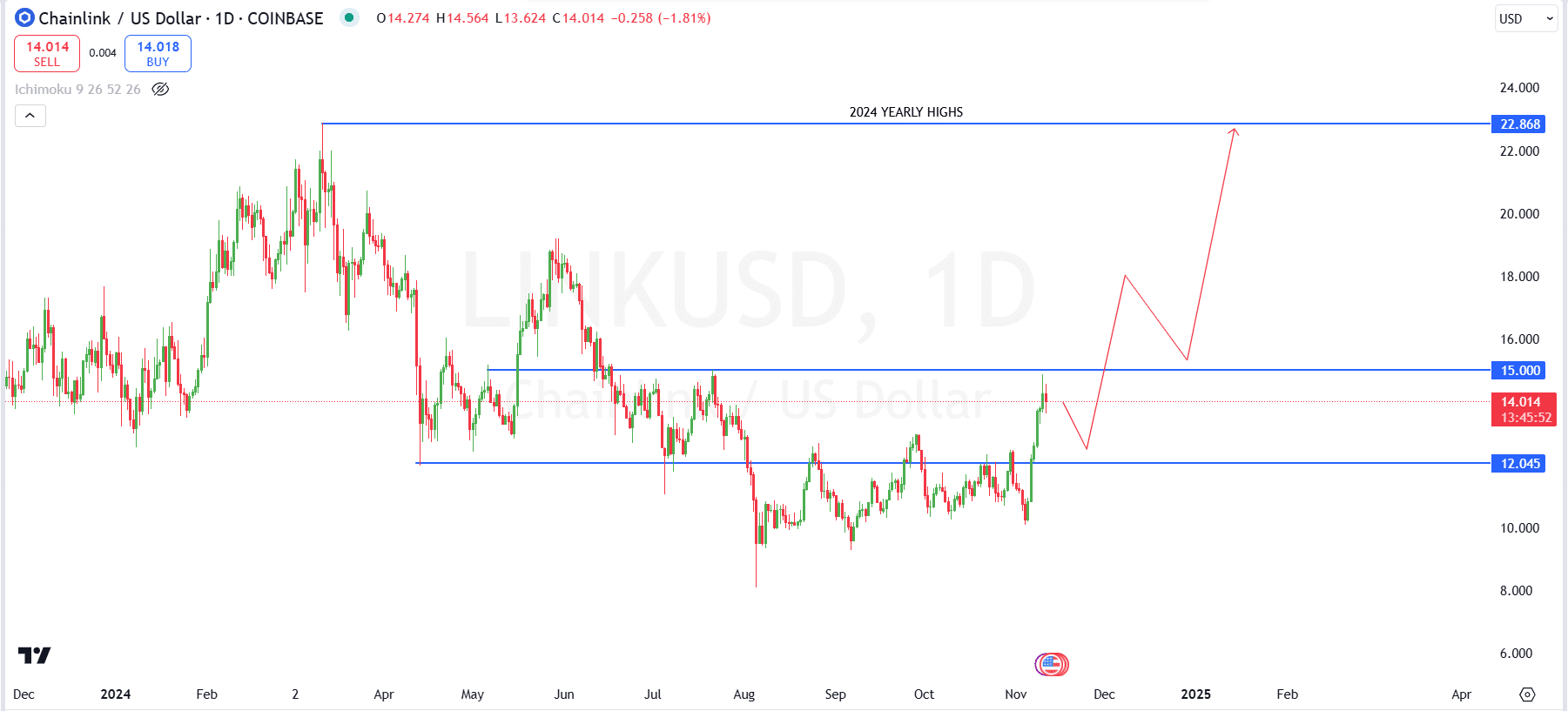

As a crypto investor, I’ve noticed that the value of my Chainlink tokens has seen some fluctuations lately. On a rather uneasy Monday, 11th November, the token was trading at approximately $14, a slight dip following a robust 6% surge it experienced just a day before on Sunday.

Regardless of the recent dip, the token is still displaying robust upward trend, largely due to the increasing use of LINK as a widespread gas token.

If Chainlink manages to surpass the current resistance at $15, there’s a possibility it could reach its estimated annual peak of $22.87 this year. Beyond that, there seems to be potential for even more growth in 2024.

On the negative side, if LINK falls, it might find support at around $12.04. This level could potentially function as a safety net during any downturn. Dropping below this support level might suggest increasing bearish sentiment, possibly resulting in another test of lower prices.

So, if the token maintains a value above $12.04, it indicates that the bullish momentum continues, and the route to reach $22.87 becomes more apparent.

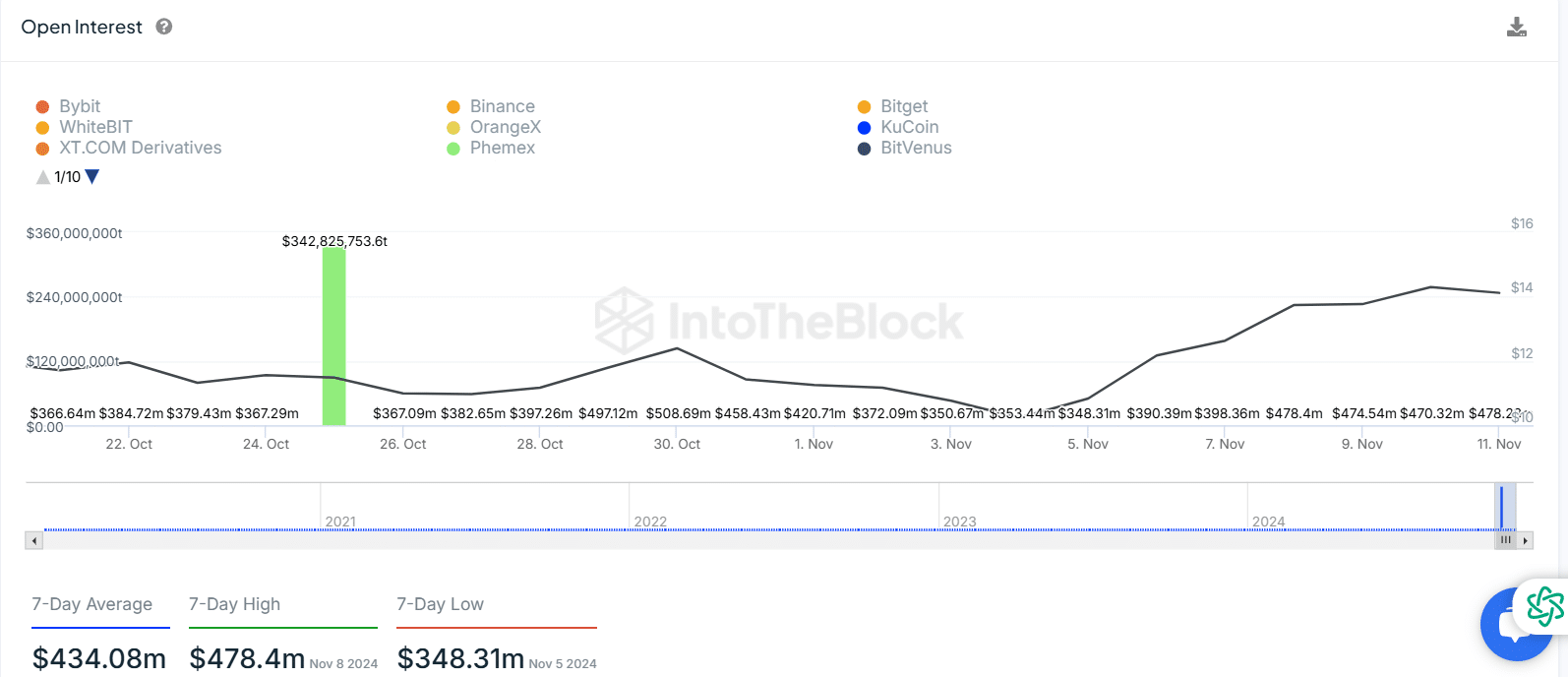

LINK Open Interest shows wide adoption

By the 11th of November, the daily average commitment in the futures market had reached approximately $434.08 million, indicating a high level of participation.

On the 8th of November, a significant surge in open interest, peaking at approximately $478.4 million, suggests that there was increased trading action and growing optimism about Chainlink’s future prospects.

The rise in open interest coincides with a wider pattern of escalating interest in LINK, driven by the token’s expanding application within blockchain solutions, reflecting its growing popularity.

With the growing size of the Chainlink network, there’s a surge in interest from traders, suggesting a positive outlook towards the token’s future prospects.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Bobby’s Shocking Demise

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Gold Rate Forecast

- OM PREDICTION. OM cryptocurrency

- 25+ Ways to Earn Free Crypto

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

2024-11-12 13:43