- Nearly half of Ethereum’s outflows are shifting to Sui Network, signaling rising competition.

- SUI’s lower fees and faster transactions attracted investors, challenging Ethereum’s dominance.

As a seasoned researcher with years of experience observing and analyzing the ever-evolving crypto landscape, I find it fascinating to witness the shifting tides in the blockchain space. The growing capital outflow from Ethereum [ETH] towards the Sui Network [SUI] is a clear sign that competition is heating up, and Ethereum’s dominance may be under threat.

The supremacy of Ethereum’s ETH in the blockchain domain is being put to the test, given that an increasing portion of its financial resources is being directed towards the Sui Network.

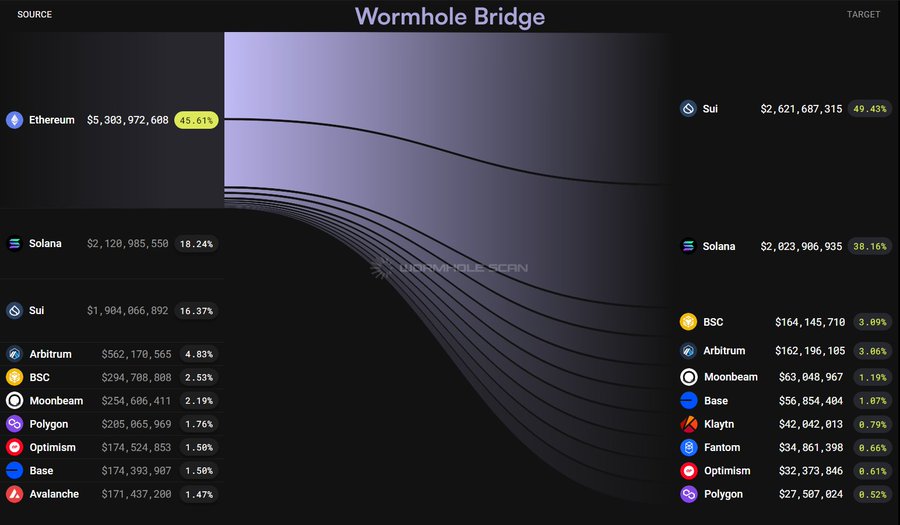

It appears that about half (49%) of the transfers out from Ethereum are being sent to Sui, a fast-rising layer-1 blockchain that’s attracting a lot of interest from investors, programmers, and market speculators.

This transition underscored the growing rivalry within the blockchain sector, as Sui emerged as a robust competitor to the dominant altcoin.

Possible reasons for the massive shift

Approximately half (49.43%) or around $5.3 billion worth of Ethereum’s funds have shifted to the Sui Network as of now, representing about 45.61% of the initial value being moved.

This upward movement might be due to both expensive transactions and scalability problems with Ethereum, pushing creators and financiers towards other blockchains that provide less costly and smoother alternatives instead.

Furthermore, the allure of Sui’s unique consensus mechanism and emphasis on quick transaction processing might draw users who desire faster transaction speeds.

Moving towards more varied blockchain systems implies that users are seeking fresh prospects outside the well-established infrastructure of Ethereum, hinting at a desire for change and expansion.

How does this affect SUI’s price?

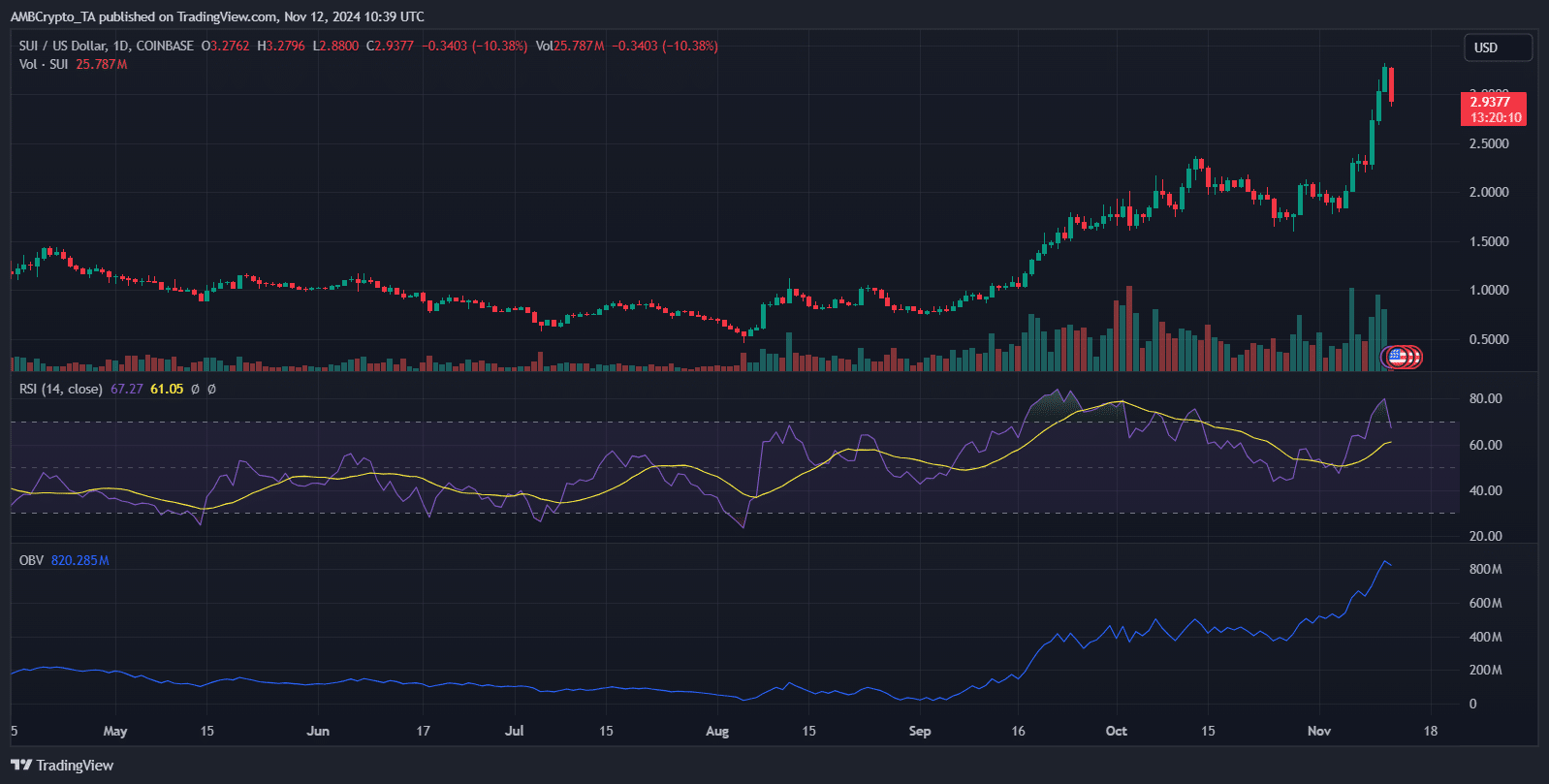

The cost of SUI has noticeably risen, peaking at $2.9968, but since then, it’s dropped by 8.58%.

This rise is linked to a significant increase in investment towards the Sui Network, which is evident from its substantial On-Balance Volume (OBV) of 823.042 million, suggesting intense buying activity.

At the moment of reporting, the Relative Strength Index stood at 61.19, indicating that the token might be approaching an overbought state. Nevertheless, it hasn’t shown any substantial bullish-bearish contradiction yet.

The sharp rise in trading volume supported the positive price momentum, driven by investor enthusiasm and increased adoption.

In summary, a significant increase in the token’s price is being driven by large influxes, but it’s important to exercise caution since the Relative Strength Index (RSI) indicates that the token might be approaching overvaluation.

Future market dynamics

As more people adopt layer-2 solutions such as Optimism (OP) and Arbitrum (ARB), the movement of capital on Ethereum could shift in the opposite direction, leading to an improvement in scalability and a reduction in transaction fees.

The network’s multi-chain operability focus could also attract inflows back to Ethereum. Meanwhile, as SUI expands, it may encounter the same congestion issues Ethereum faced, potentially leading to outflows.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The key question is how SUI manages its growth — and whether Ethereum can work to regain lost capital. The evolving competition between these networks will be crucial in shaping future market dynamics.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-13 06:15