- Goatseus Maximus retained its bullish structure and momentum for a majority of the last two weeks

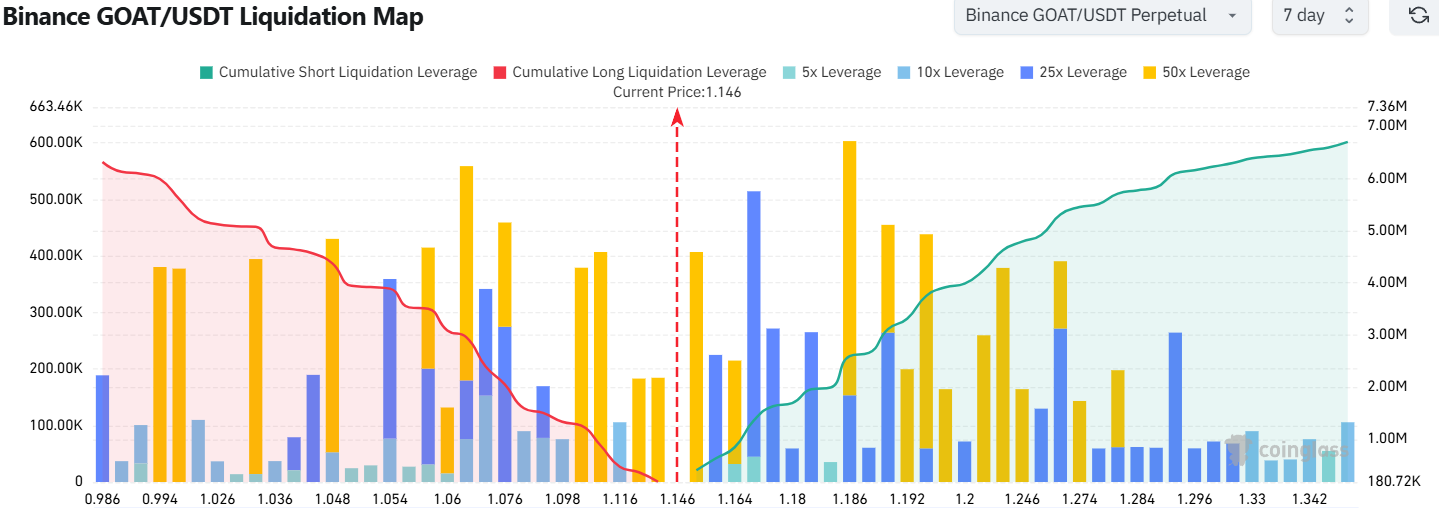

- Volatility and a liquidation cascade upwards were likely due to short liquidations clustered around $1.2

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. The recent surge of Goatseus Maximus (GOAT) has caught my attention, particularly its ability to set new all-time highs and push its market cap towards $1.26 billion.

Goatseus Maximus (GOAT) hit another record high at $1.25, pushing its market capitalization close to a staggering $1.26 billion. With a billion GOAT tokens in circulation, this digital currency has been gaining momentum, and it’s expected to climb higher as the weekend approaches, supported by the short-term liquidation map.

GOAT surges past $1, reaches $1.25

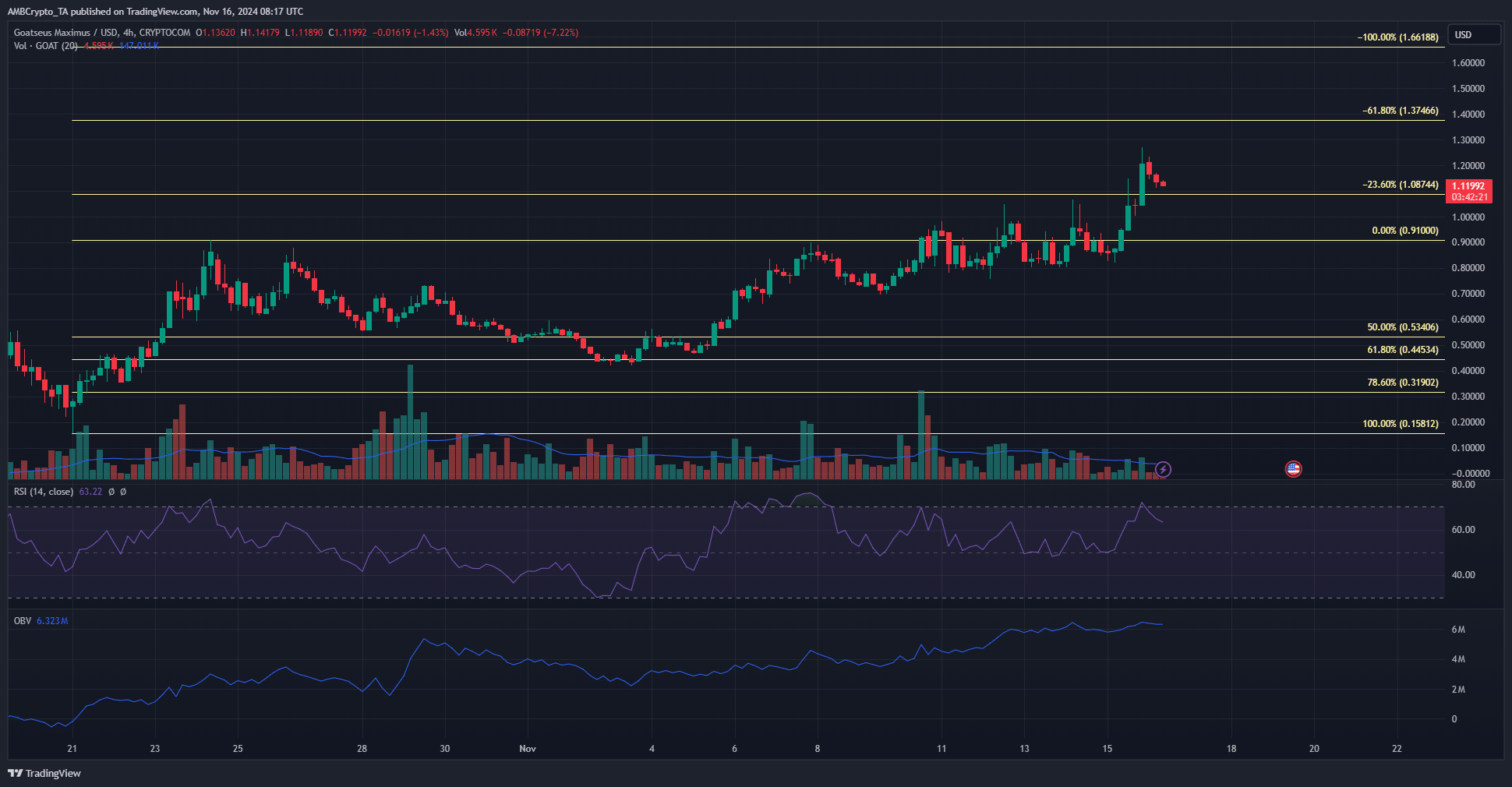

On the 4-hour chart, the market’s trend has remained bullish since early November and continues to be so. Over the recent days, the memecoin’s momentum temporarily slowed around the $1 mark, but it experienced a strong breakout on November 15.

For the last fortnight, the Relative Strength Index (RSI) on the 4-hour chart has consistently remained above the neutral 50 level, which, combined with the price trending towards successively higher highs and higher lows, strengthens the bullish outlook for GOAT.

The upward trajectory of the OBV also indicates a strong influence by the bulls. However, one potential worry for these bulls has been the decrease in trading volume starting from November 11. This week’s trading, in particular, has seen a lower than average volume of transactions.

Liquidation map hints at short-term gains

According to AMBCrypto, there were more short liquidation points between $1.16 and $1.2 compared to long liquidations ranging from $1.146 to $1.05. This suggests that a potential increase in price might occur because the market tends to be pulled towards areas with higher liquidity.

Realistic or not, here’s GOAT’s market cap in BTC’s terms

Therefore, it seemed probable that a shift towards $1.2 was imminent as of the press time, but what might happen next? The minimal trading activity suggested that the buyers might be losing strength.

The liquidation map indicated a possibility of a chain reaction leading to rapid profits in the short term. Yet, it also signaled an opportunity for the price to drop significantly from around $1.2 to $1.3, potentially decreasing further to approximately $1.00.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- XRP CAD PREDICTION. XRP cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- ETH PREDICTION. ETH cryptocurrency

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2024-11-16 20:07