- Bitcoin could be on the verge of another rally according to its Puell Multiple.

- Bullish optimism and extreme greed may point to possible reversal.

As an analyst with over two decades of experience in financial markets, I find myself intrigued by the recent analysis of Bitcoin’s potential rally based on the Puell Multiple. While past performance is not always indicative of future results, it’s hard to ignore the historical precedent that this indicator has shown.

As the positive Bitcoin [BTC] trend seen in October and the initial part of November seems to be diminishing, the question arises: What lies ahead for the crypto monarch, Bitcoin, as we near the end of 2024?

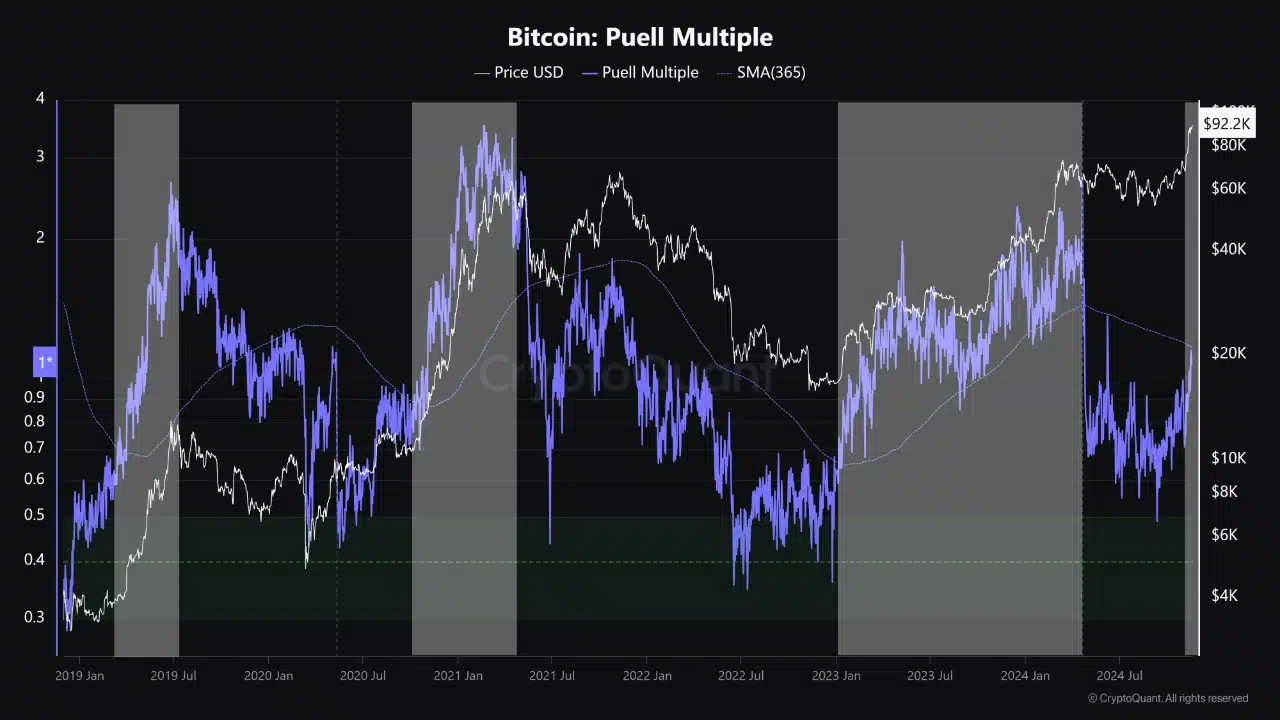

A recent CryptoQuant analysis reveals some insights in regards to Bitcoin’s next potential move based on the Puell Multiple. The latter evaluates mining revenues relative to market movements.

According to the analysis, the Puell Multiple recently pushed closer to its 365-day moving average.

Should the Puell Multiple intersect with its moving average, it might suggest the commencement of another significant upward trend, much like previous instances where these indicators coincided.

Should Bitcoin holders expect more upside?

According to an analysis by CryptoQuant, there’s a possibility that Bitcoin could pick up speed in the near future – be it within a few days or weeks. But keep in mind that this is only one indicator, and the market conditions could potentially change over the next few days as well.

Historically, the income from mining activities has often reflected the general mood or attitude of the market.

Miner holdings of Bitcoin typically increase when miners predict rising BTC values, allowing them to store (HODL) and eventually sell at a profit. The most recent data on miner reserves suggests they reached their lowest point since 2024 on November 18th.

Miner holdings could suggest a weak motivation to keep holding onto Bitcoin. It’s important to mention that Bitcoin has recently remained close to its all-time high, which might prompt miners to offload some of their coins.

The risk of an unexpected selloff

One likely explanation for the near-depletion of Bitcoin reserves could be the anticipation of a significant correction following the recent surge in prices. Essentially, there’s an increasing sense of doubt regarding Bitcoin’s future direction.

The Bitcoin Fear and Greed Index reached 90, indicating “extreme greed” – its highest level in quite some time. Since substantial drops often occur during periods of intense optimism like this, there’s a worry that a significant correction might happen suddenly and unpredictably.

Conversely, optimism continues to thrive, particularly due to shifting global financial conditions, such as declining interest rates. Furthermore, the recent U.S elections have sparked optimism within the cryptocurrency market, as the new administration is perceived to be supportive of digital currencies.

Read Bitcoin (BTC) Price Prediction 2024-25

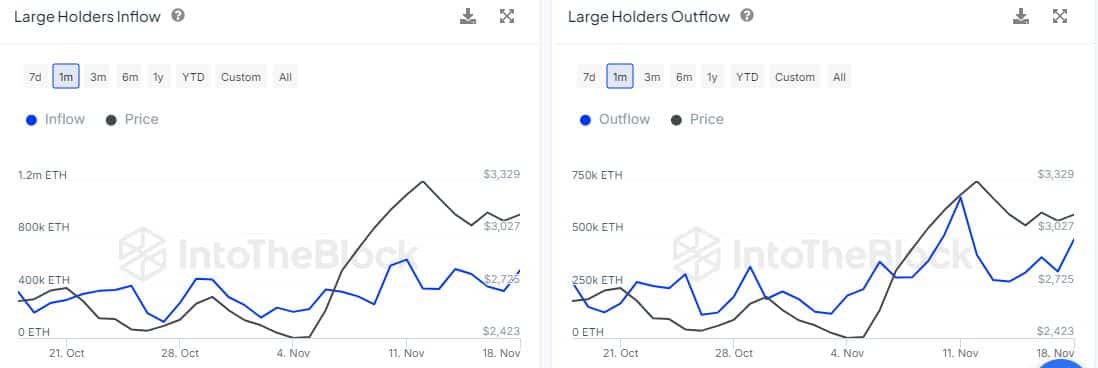

It appears that the peak of this rally might not be imminent, as suggested by these indicators. Meanwhile, whales continue to amass, hinting at potential plans for another significant surge in the market.

Over the past day, deposits into substantial wallets surpassed 516,000 Bitcoin, marking a significant increase. On the other hand, withdrawals from large-scale wallets (often referred to as whales) amounted to approximately $471,000, which is relatively lower compared to the inflows.

Read More

- TRB PREDICTION. TRB cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- CAKE PREDICTION. CAKE cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- JTO PREDICTION. JTO cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- HBAR PREDICTION. HBAR cryptocurrency

- Dandadan Shares First Look at Season Finale: Watch

- OM PREDICTION. OM cryptocurrency

2024-11-19 16:39