- Analysts had previously predicted that FET might reach its March high after approaching a significant support zone.

- However, market sentiment is currently at odds with these bullish forecasts.

As a seasoned crypto investor with a keen eye for market trends and patterns, I find myself in a peculiar predicament regarding Artificial Superintelligence Alliance [FET]. While analysts predicted a potential rally based on its approach to a significant support zone, the current market sentiment seems to be at odds with these bullish forecasts.

Over the last week, there’s been an increase in selling of stocks within Artificial Superintelligence Alliance (FET), causing a significant decrease of approximately 16.94%. This has kept the token’s value close to the one dollar mark.

Over the last day, there’s been a slight uptick, as buyers have applied some influence, leading to a minor increase of approximately 0.69%.

As an analyst, my findings suggest that, while there might be some short-term fluctuations, the overall market trend seems to be tilting towards a possible downturn. This analysis suggests FET could potentially dip to lower price points in the imminent future.

Could FET reach 2024 highs?

As reported by crypto expert Mihir, at the current moment, FET is being exchanged within a rising channel formation – a pattern often indicative of a bullish or upward movement.

The diagram showcased a series of price changes happening between two straight lines, which were referred to as ‘support’ and ‘resistance’ boundaries. Within these boundaries, the price typically oscillates while it continues its upward trend.

As per the graph, FET just reached a common support point within its channel, which is usually a precursor for a significant increase in price.

Mihir thus expected FET to potentially reclaim its March 2024 high, stating,

“$FET could recover by mid-to-late December.”

Large holders are selling

As a crypto investor, I noticed that although FET seemed to have hit a point where usual buying activity surges, surprisingly, it’s selling pressure that’s dominating right now.

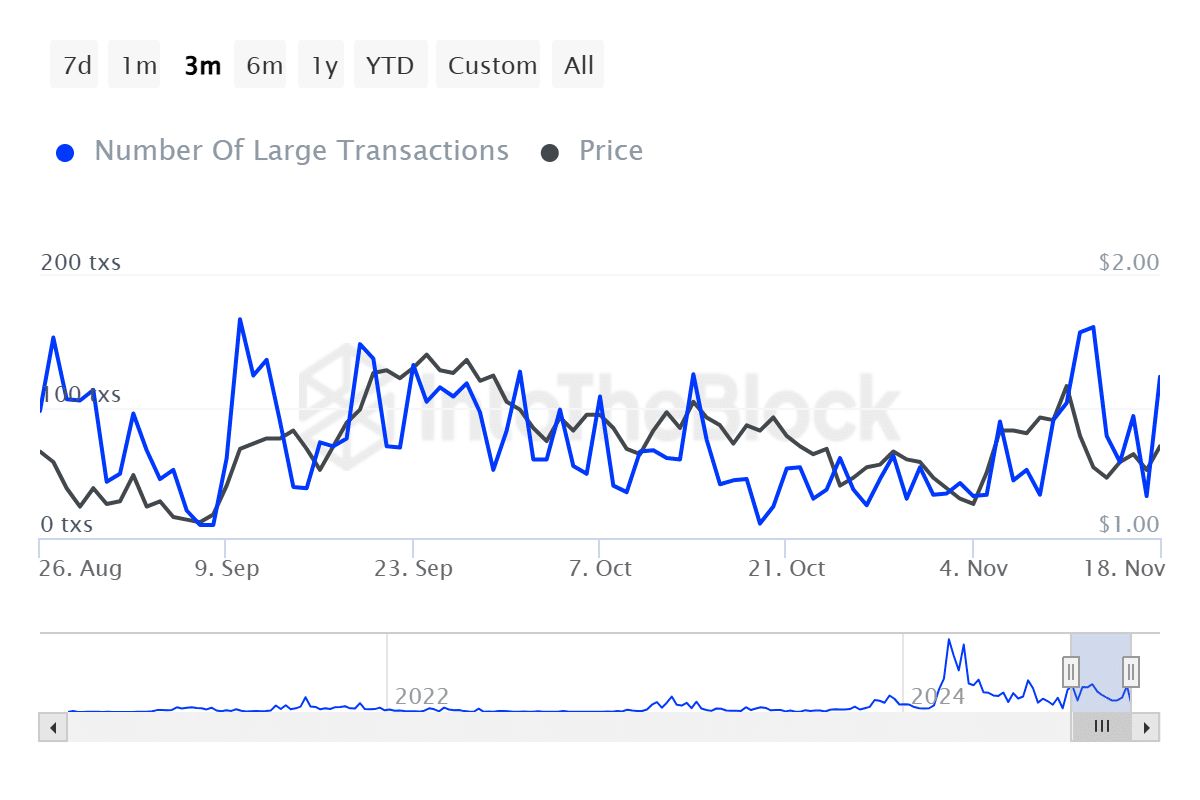

As reported by IntoTheBlock, there’s been a significant increase in larger trade activities, which suggests that traders with sizeable amounts of FET are becoming more active in the market.

This activity can signal either buying or selling.

On the other hand, the decrease in active wallets might indicate that the rise in significant transactions is probably due to substantial investors unloading their FET.

It might be because they’ve lost faith in the value of the asset, causing them to cash out their gains to prevent potential future losses.

Over the last day, we’ve seen 123 significant transactions amounting to a total of 19.05 million FET. At the same time, the count of active addresses has decreased to approximately 1,860, which is a drop of around 12.02% compared to the previous week.

Increased sell-offs in the market

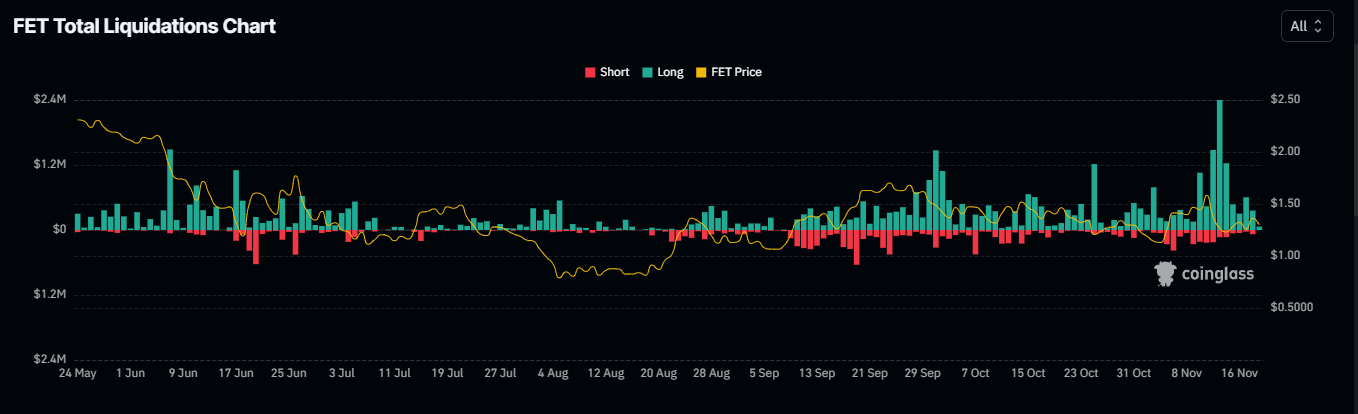

This development has also reached derivative traders, who are currently unloading their FET assets onto the market.

Initially, there’s been a drop of approximately 2.42% in Open Interest for FET within the last 24 hours, which now stands at about 134.25 million FET.

This trend indicates that at present, the market seems biased towards short sellers, as there are fewer active long positions compared to short ones.

Read Artificial Superintelligence Alliance Price Prediction [FET] 2024–2025

Moreover, the compulsory selling off of long positions on FET worth approximately $387,170 suggested that derivative traders had been actively manipulating the market in a manner contrary to the predictions of bullish investors, thereby causing the decline in price.

Coinglass

If big investors and derivative traders persistently unload their shares, it could postpone the anticipated surge for FET.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-19 23:36