- POL declined by over 5% in the last 24 hours.

- Network growth has also continued to drop.

As a seasoned researcher with years of experience navigating the ever-changing crypto landscape, I’ve seen my fair share of market ups and downs. The recent decline in Polygon’s price and network growth is certainly concerning, but it’s not uncharted territory for me or the crypto world.

81.60% of Polygon [POL] holders found themselves in a difficult position at the current moment, according to on-chain information, as they were ‘underwater’ or ‘out of money.’

This measurement, focusing on the profitability of wallet addresses by comparing their initial token purchases with the current market value, indicates that the majority of owners are experiencing a financial loss.

In a challenging market environment where POL appears to be having difficulty resuming its upward trend, the data presents an intriguing query: Is this indicative of a capitulation phase or the foundation for a forthcoming recovery?

Polygon’s price struggles

The ‘In/Out of the Money’ graph created by IntoTheBlock presented a clear and sobering image. The preponderance of red areas suggested that the majority of investors were experiencing losses, while few were enjoying profits.

The imbalance mirrored Polygon’s prolonged drop in price during 2024, a reflection of wider market movements and unique hurdles within the Polygon network.

Times such as these typically witness a rise in selling activity as disgruntled investors decide to offload their assets, thereby intensifying the market’s decline trend.

In addition, these periods could potentially signal a market low when long-term investors decide to invest, enticed by the opportunity for reduced prices.

Historically, periods with a large number of loss-makers have occasionally marked the beginning of recovery stages.

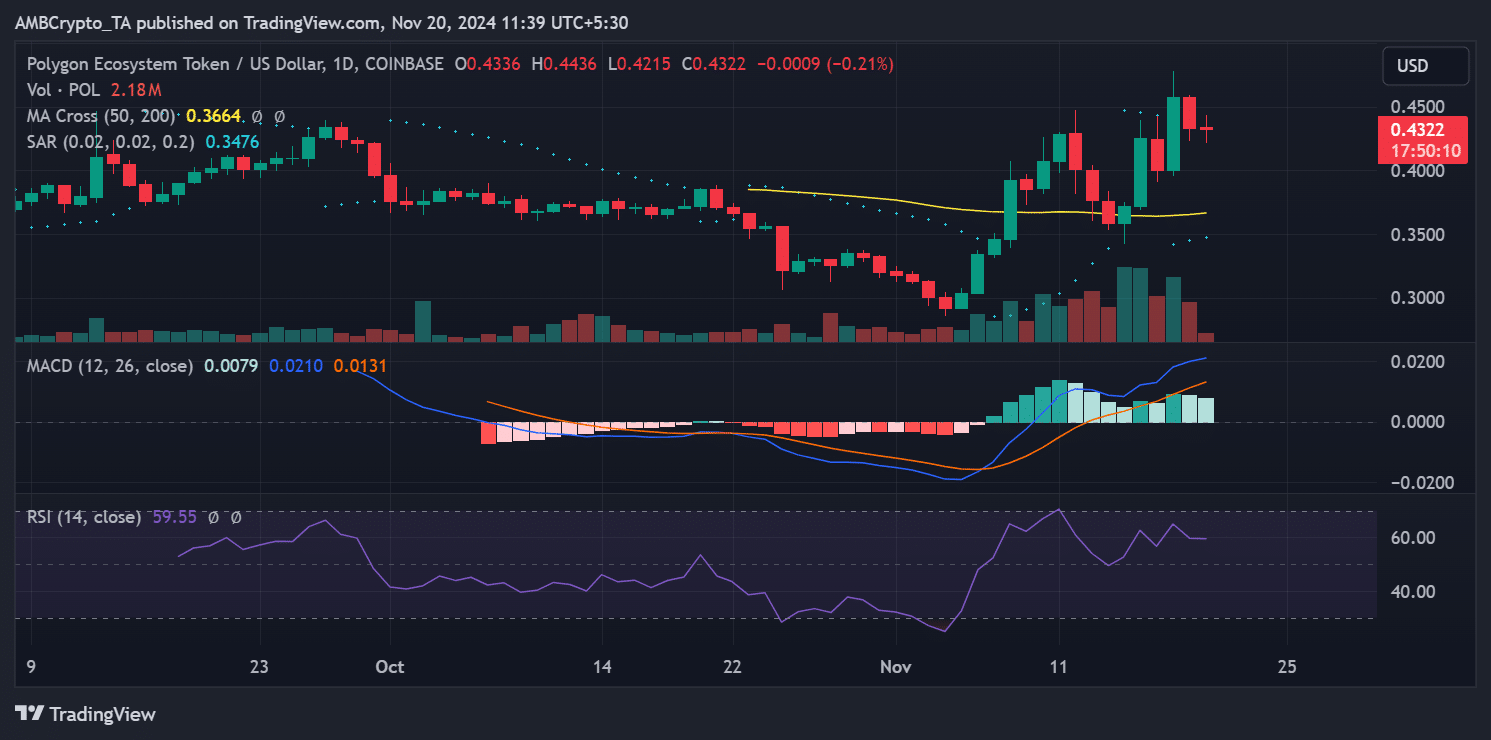

Technical indicators paint a mixed picture

Examining the given TradingView chart offered more understanding about Polygon’s trend. Specifically, the 50-day Moving Average (MA) was higher than the 200-day MA, suggesting an upcoming bullish signal or ‘golden cross’.

However, POL remained below these critical levels, suggesting that momentum was still bearish.

According to the MACD indicator, there seems to be a decrease in the strength of the bullish trend, as it suggests possible signs of a change or reversal, indicated by the appearance of the histogram bars.

Currently, the Relative Strength Index (RSI) is lingering near 59, suggesting a period of stability or consolidation as opposed to significant upwards or downwards momentum.

To resume a favorable momentum, POL needs to surpass its resistance points at $0.50 and $0.55, all the while ensuring steady trade activity.

A sign of recovery or decline?

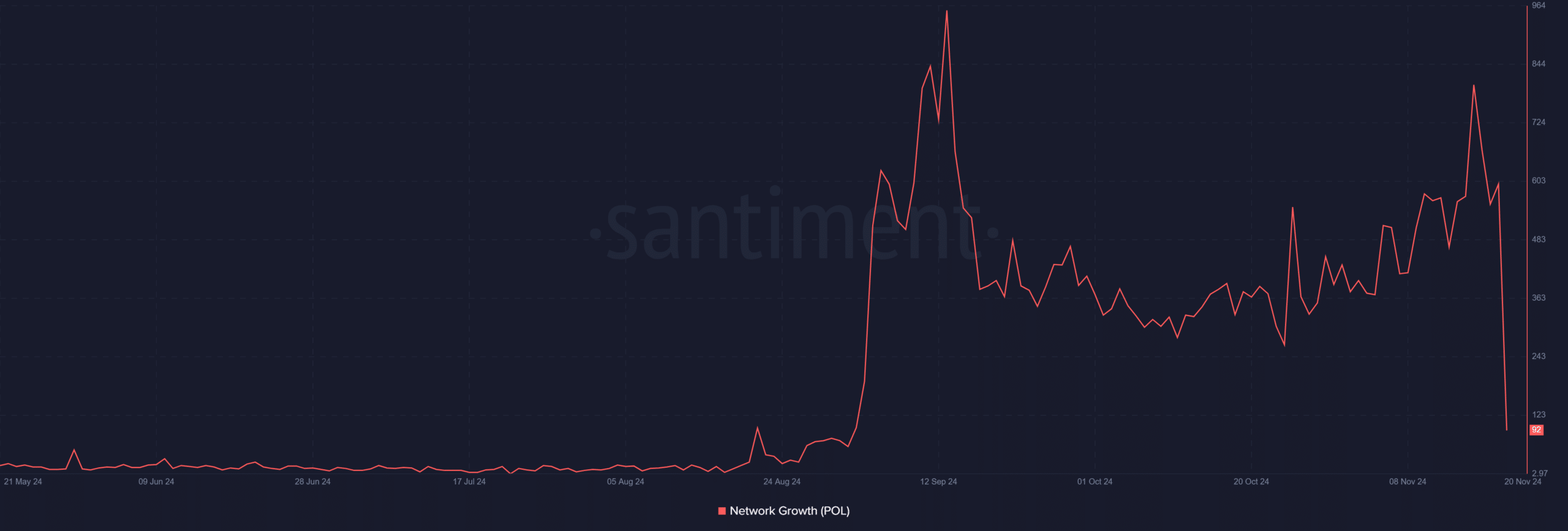

As I delved into the on-chain activities of the Polygon ecosystem using Santiment’s Network Growth chart, I noticed a series of fluctuations in user engagement, indicating shifts and changes within the system.

Lately, we’ve seen fluctuations in network usage which suggest occasional engagement with our platform. However, a continuous decrease in activity starting from early November indicates a reduction in both user and developer involvement.

Strong network activity and ecosystem developments are essential for POL to regain footing.

Outlook for Polygon

right now, Polygon’s situation seems challenging for its supporters and the community. In fact, around 81.60% of POL token holders are experiencing losses, which suggests a rather gloomy outlook on the market mood.

On the other hand, these circumstances have often marked significant shifts, providing prospects for strategic investing over the long haul.

The course of POL is influenced by its capacity to regain crucial technological thresholds and stimulate network expansion once more. Although the information suggests caution, it additionally implies a possible scenario for recovery if overall market circumstances become more favorable.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-20 15:04