As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed my fair share of market fluctuations and trends. The current surge in Ripple (XRP) is nothing short of extraordinary, and it’s an exciting time for crypto enthusiasts worldwide.

The cryptocurrency market is abuzz with excitement over the U.S. election results. With President Donald Trump, who has shown support for cryptocurrencies, in office, there’s a sense of anticipation within the blockchain community regarding potential changes and regulations that could stimulate growth in the Decentralized Finance (DeFi) sector.

Following the significant increase in Bitcoin‘s value, Ripple finds itself at a pivotal moment, marked by a soaring market capitalization and unprecedented price levels. Investors are actively setting their sights on a fresh XRP price objective, while traders eagerly anticipate its resurgence to the list of top five cryptocurrencies.

Let’s explore the potential of Ripple with XRP price analysis and trend prediction.

XRP Coin Performance

In the year 2024, I found myself stuck within the limits of $0.50 and $0.60 with XRP for most of the time. However, something extraordinary happened in November – a breakthrough! During the second week of this month, Ripple experienced an impressive surge, propelling itself from $0.55 to reach an astounding $0.70, marking a substantial 27% increase.

On November 16th, XRP reached the $1 mark for the first time in approximately three years, which was last seen in November of 2018.

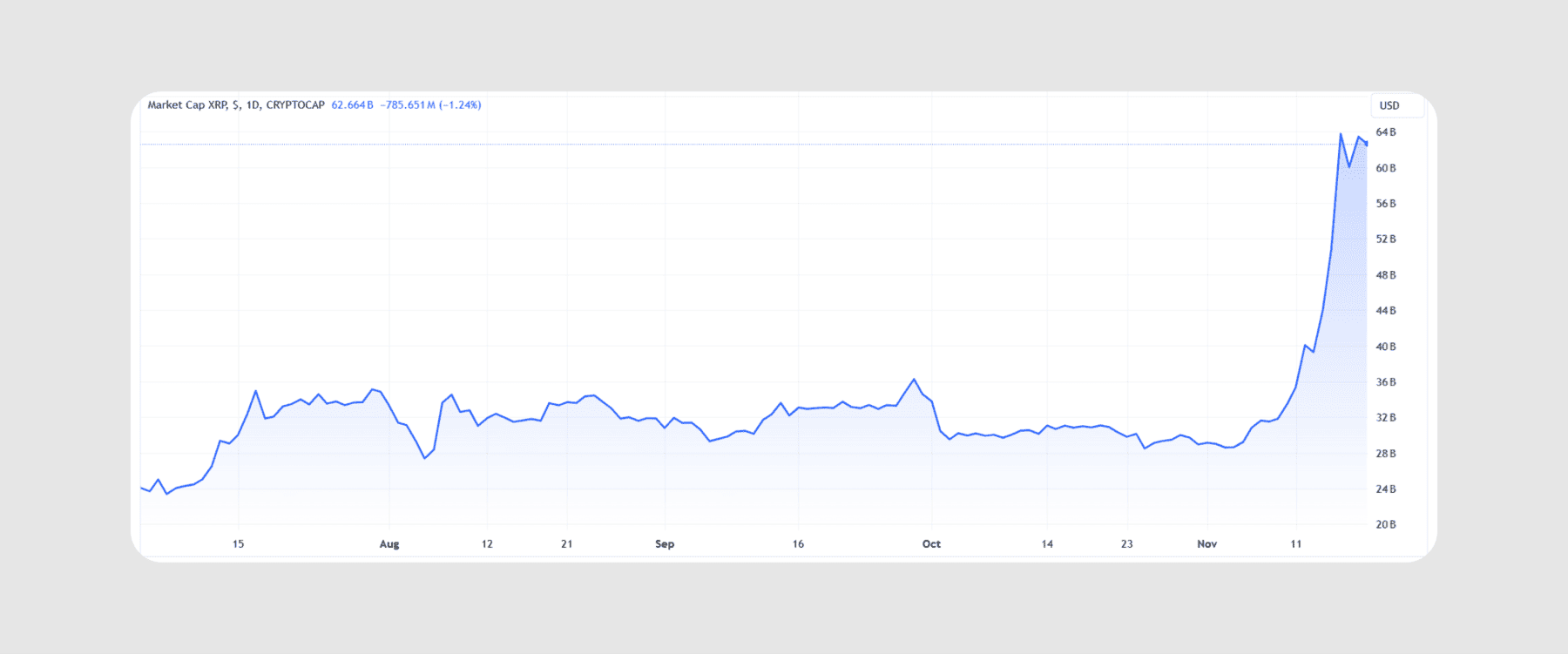

Concurrently, the market value and trading activity hit their highest points. The capitalization saw a substantial increase between November 10-16, nearly doubling from $33 billion to $63 billion within five days. As a result, XRP surpassed DOGE and climbed to the #6 spot among the leading cryptocurrencies.

Why is Ripple Going up?

The ongoing XRP bullish performance is attributed to various factors.

A U.S. president who’s supportive of Bitcoin could lead to the enactment of more favorable cryptocurrency regulations, potentially featuring fresh regulatory changes and expedited approval processes for XRP Exchange-Traded Funds (ETFs).

Ripple Labs is making strides in its legal struggle against the Securities and Exchange Commission (SEC). This advancement follows a wave of criticism against the regulatory body, with 18 states filing a lawsuit against the SEC, alleging excessive power grab and unfair actions towards them.

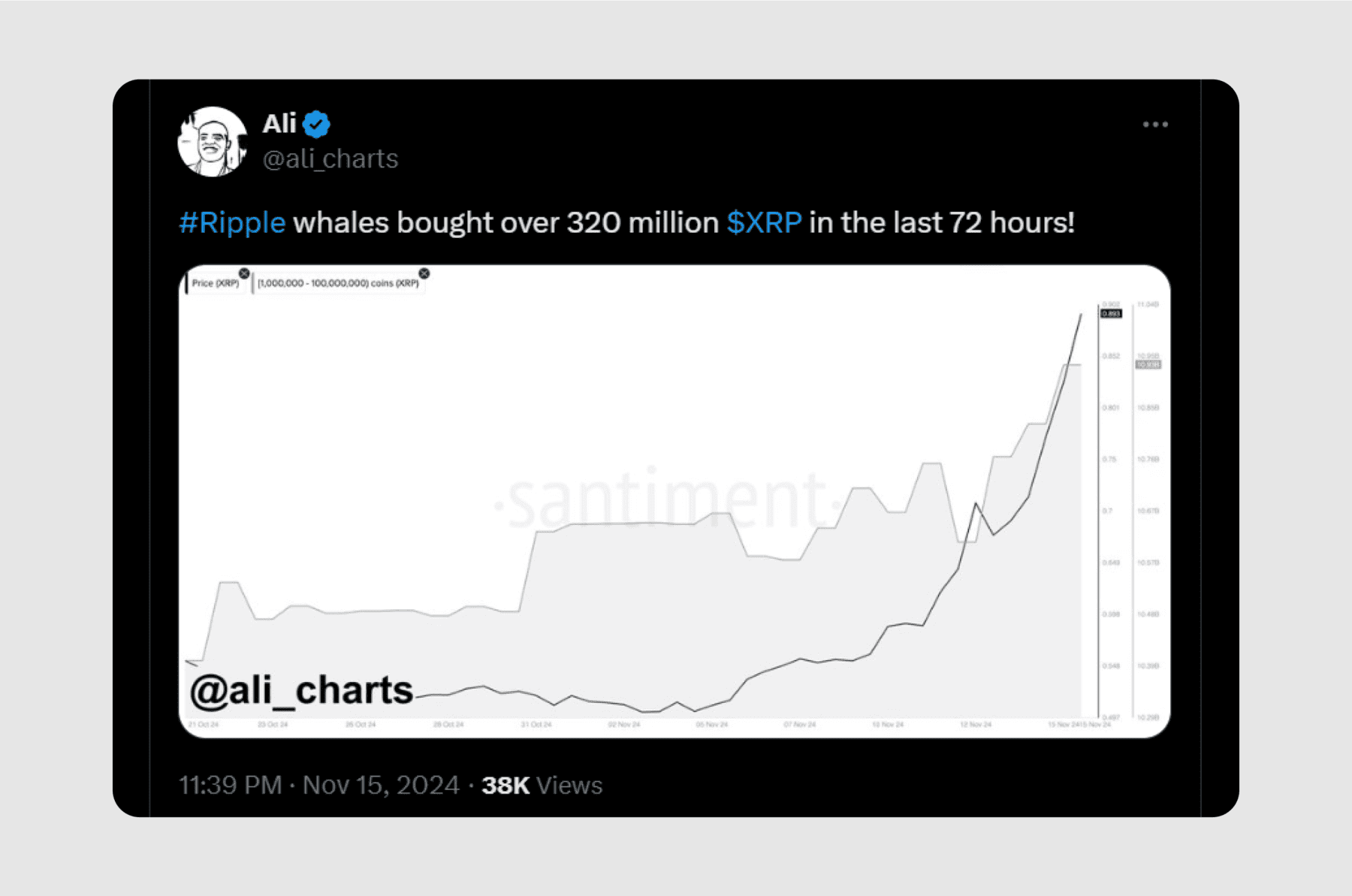

As an analyst, I’ve noticed that the escalating trading activities, particularly on platforms like Robinhood, a U.S.-based trading platform that recently listed XRP, have significantly fueled this surge in demand. This move by Robinhood has undeniably stirred more trading enthusiasm among its American users. Simultaneously, the appearance of a notable whale in the market, who acquired an impressive 320 million XRP, has sparked immense interest and curiosity, contributing to the overall increase in XRP’s popularity.

XRP Price Analysis

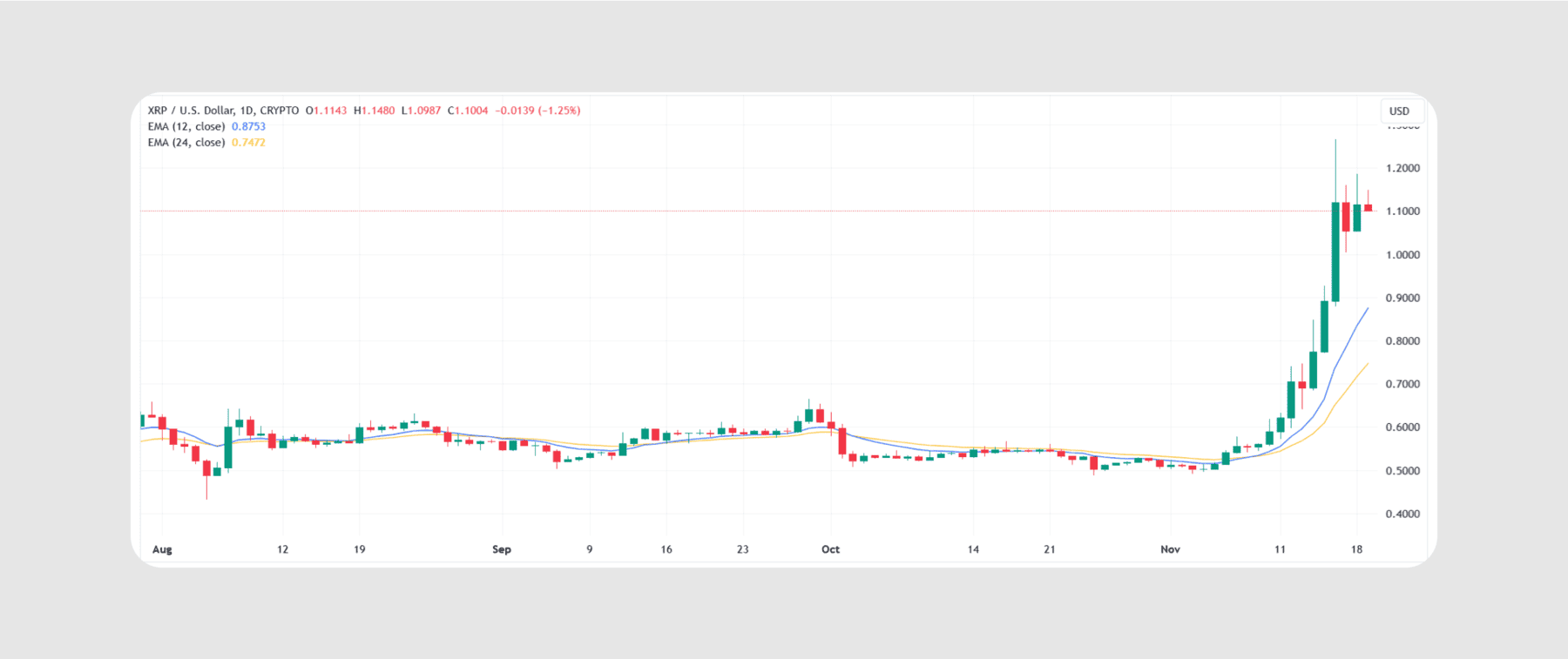

Instead, let’s examine the graph displaying XRP prices and interpret it with the help of the Exponential Moving Average (EMA) tool. By applying EMA across various timeframes, we can gauge both brief fluctuations and extended trends, potentially identifying any emerging patterns.

To examine short-term trends, we employ the 12-day and 24-day Exponential Moving Averages (EMA). Notably, the XRP price surpasses both EMAs significantly after fluctuating slightly above and below it, indicating a strong upward movement.

On the 7th of November, I observed a significant upward trend in the XRP market price that surpassed the Exponential Moving Average (EMA) indicators, creating some distance from them. This surge led the price to reach and exceed the $1 mark, and it continued climbing up to $1.09 by the time of my last update.

Looking at the EMA lines pointing upwards, it seems like we could be witnessing an imminent bullish trend in the coming days.

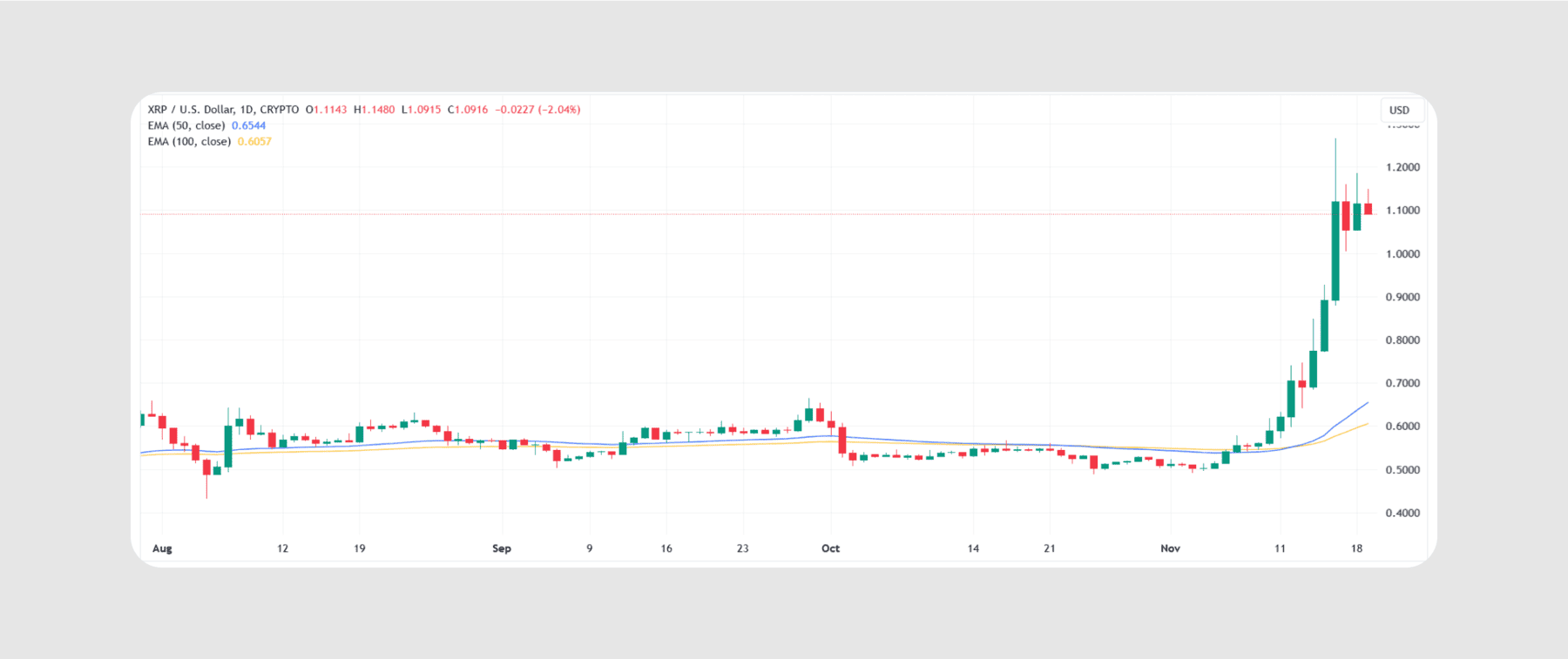

Examining the historical data over longer periods of 50 and 100 days, we notice a comparable pattern, albeit one with a less steep gradient. Both Moving Average lines are pointing upwards, indicating a positive or bullish market direction.

Although the gentle incline indicates a possibility of XRP’s price surging significantly over the coming days, it is likely to correct itself. Nevertheless, it should maintain levels above its usual historical benchmark.

XRP Price Prediction

After a span of three years, the value of the cryptocurrency hit one dollar, marking a notable milestone and a positive sign for its future potential. Interestingly, it’s worth noting that this digital currency used to be among the top three.

Experts propose that recent trends and performance resemble those observed in 2018, when the value of XRP hit its peak at $3.00.

In simpler terms, just like they did in 2021, bulls are looking back at when the price of the coin reached $2.00 and are eagerly anticipating another surge that could take it up to $2.00 again, before the year comes to an end.

Conclusion

Due to the excitement surrounding cryptocurrencies, Ripple has been performing exceptionally well, reaching notable price points and witnessing a significant increase in its market value.

As an analyst, I am observing that the current upward trend of XRP could persist for several more days. Speculative investors seem to be aiming for a minimum price point of around $2 as we approach the end of the year.

Note: The information provided in this article serves as a reference only. It does not constitute financial advice, nor should it be used to make investment decisions. Conduct independent research and seek advice from a financial expert prior to making any investment.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-20 20:04