- ENS has a strongly bullish outlook for the coming weeks.

- On-chain metrics signaled increased market activity and demand.

As a seasoned crypto investor with a knack for spotting trends and analyzing market signals, I am bullish about Ethereum Name Service (ENS) in the coming weeks. The recent breakout above the resistance levels around $20-$22, coupled with increased network activity and demand, is a strong indication of a bullish trend.

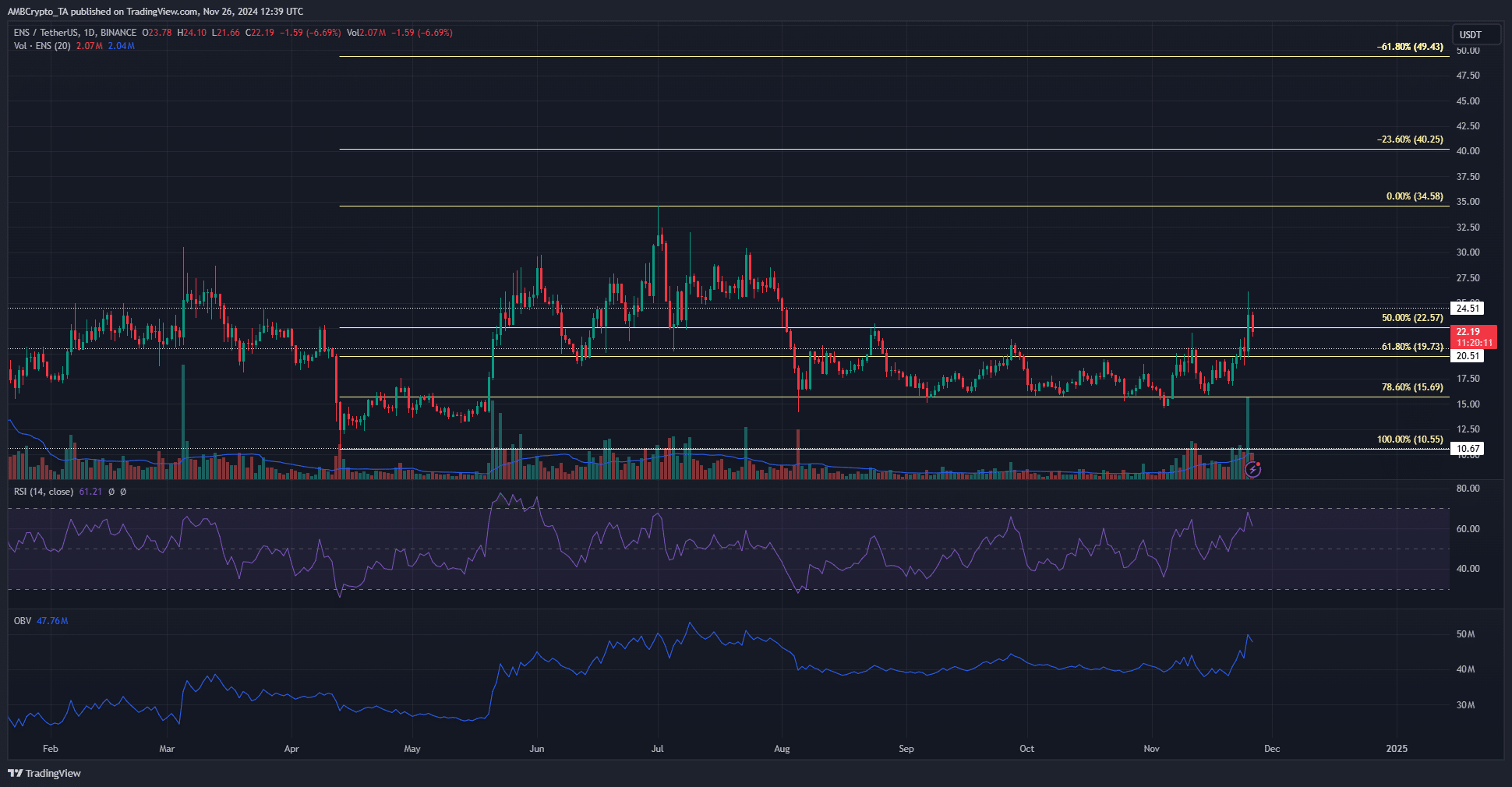

The Ethereum Name Service (ENS) has switched from a prolonged downtrend to an uptrend, successfully surpassing a group of resistance barriers in the $20-$22 range which have been testing the bullish sentiment since mid-August.

The network activity also told an encouraging tale.

As a researcher examining the Ethereum Name Service token, I find it plausible that we may experience a temporary price correction. Yet, my analysis indicates a strong potential for this token to continue its upward trajectory in the near future.

It has sizeable unlocks in the coming months that can dent the demand-supply equation.

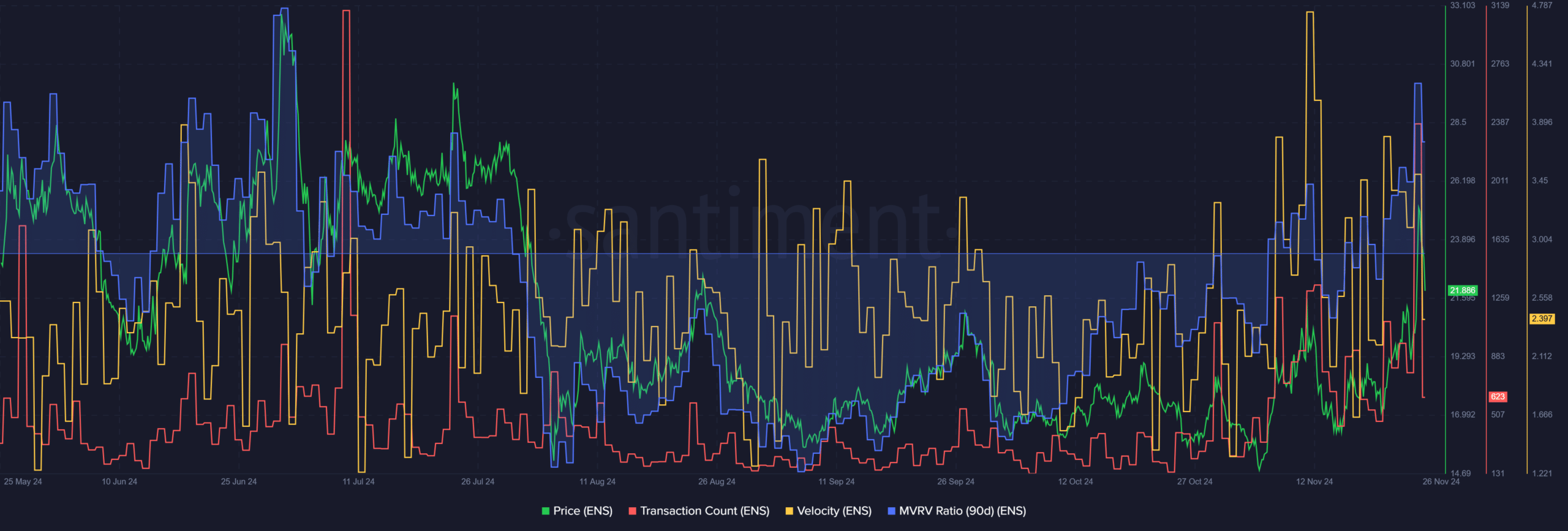

ENS metrics signal positive market sentiment

After the impressive recent price increases, the 90-day MVRV (Mempool Value Ratio Variance) showed a positive result, potentially encouraging profit-taking actions that could lead to a drop in price. Yet, the number of transactions and their pace indicated a more optimistic outlook.

Since late October, they’ve been showing a steady rise, which indicates heightened network activity. The number of transactions serves as a gauge for the distinct transactions taking place within a 24-hour period.

An increase in this metric is a sign of increased market participation.

Speed of exchange indicates how frequently a token gets passed from one holder to another. An uptick in price, frequency of transactions, and increased speed of exchange suggest that the token is being actively traded more often, which strengthens the notion of a vibrant, bustling market.

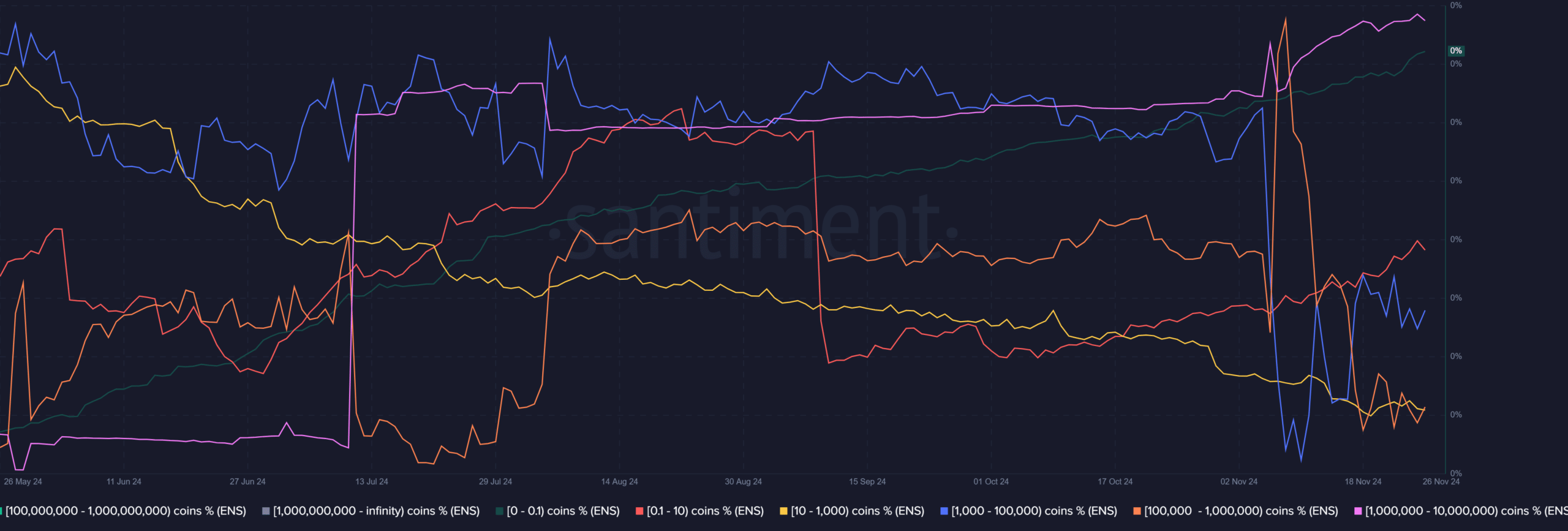

The distribution analysis based on address balances revealed a decrease in the amount of ENS held by addresses with a balance between 1,000 and 1,000,000 ENS compared to October levels.

The former cohort has begun to climb higher, showing some accumulation.

Smaller shrimp-type wallets with fewer than 10 Enigma Name Service (ENS) addresses were also amassing tokens, indicating their activity. However, it’s worth noting that larger ‘whale’ wallets holding 1 million or more ENS witnessed an increase in their share of the total tokens, suggesting that these large whales were also purchasing these digital assets.

Will this whale activity increase the odds of a rally?

Read Ethereum Name Service’s [ENS] Price Prediction 2024-25

With the price surpassing $22, ENS investors found themselves with plenty of room for growth ahead. However, fluctuations in Bitcoin‘s [BTC] value might cause ENS to dip below the $20 level temporarily. Yet, given the circumstances, it is anticipated that ENS will bounce back quickly, even if this situation arises.

Since early August, a significant effort has been made to maintain the market at around 78.6% or $15.7. If the market recovers from this point, potential future goals could be reaching $34.5 and even higher levels within the next few weeks.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-27 10:15