- A Crypto VC projected a positive outlook for Celestia, citing rising Ethereum blob fees.

- However, more TIA supply was expected to hit the market in 2025, which could affect prices.

As a seasoned analyst with over a decade of experience in the crypto market, I have witnessed numerous trends and cycles that have shaped the industry as we know it today. The latest development surrounding Celestia (TIA) has caught my attention, especially given the rising Ethereum blob fees and the potential opportunities this could create for data availability providers like Celestia.

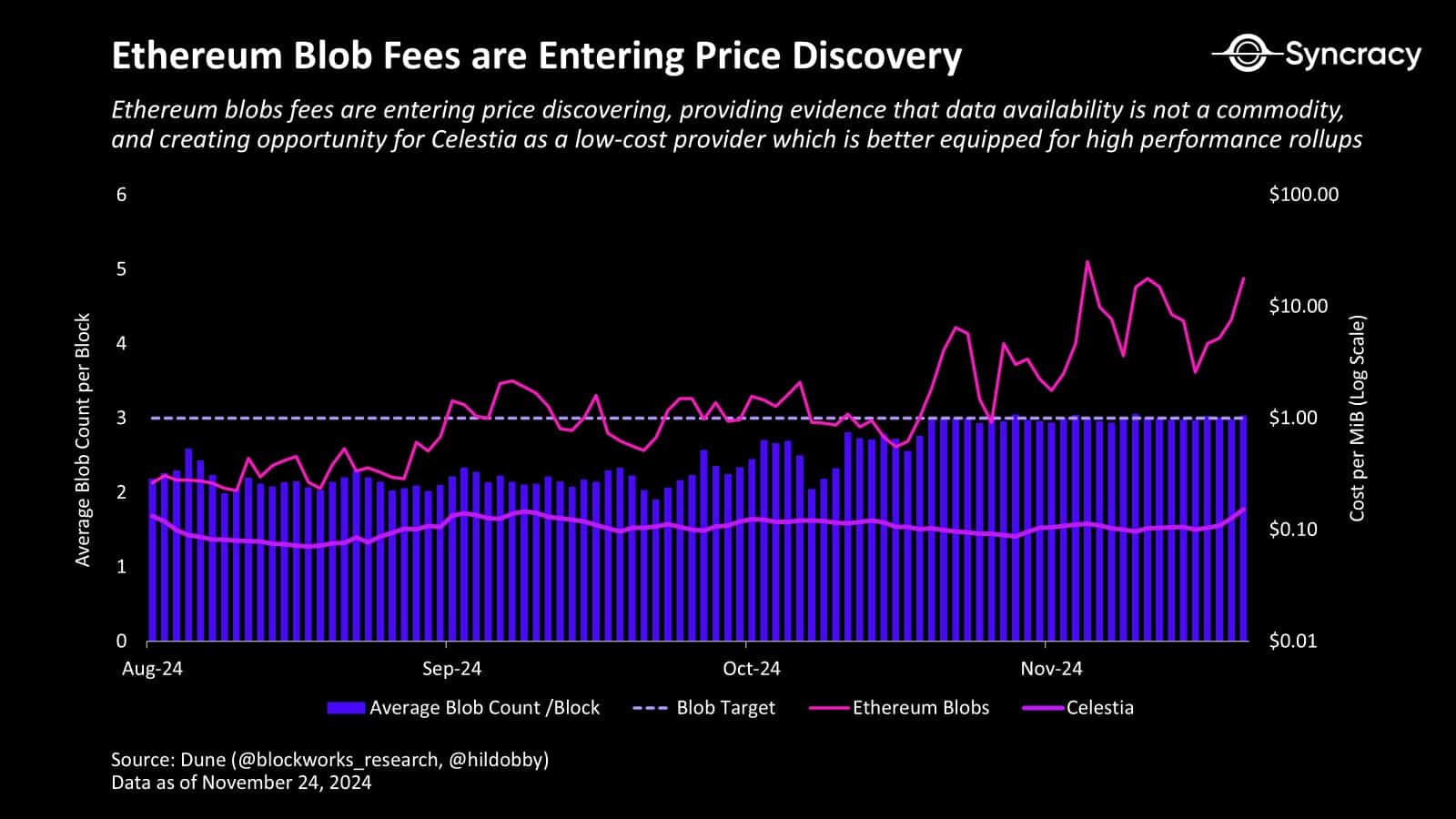

According to cryptocurrency expert and analyst Ryan Watkins from Syncracy Capital, the transaction fees for Ethereum [ETH] have reached unprecedented levels, potentially benefiting data availability providers such as Celestia.

Watkins projected that the increased L2 transaction costs (blob fees) could force some protocols to opt for Celestia.

He said,

As Ethereum transaction costs are now being determined by the market, an excellent chance arises for Celestia. This situation could enable Celestia to seize scalable Layer 2 solutions that Ethereum can’t handle efficiently due to its high fees and limited capacity.

Will TIA benefit?

Given the progress outlined earlier, Watkins thought that Ethereum’s long-term strategy focused on rollups might prove beneficial for Celestia in the future.

But will TIA price benefit from these positive fundamentals?

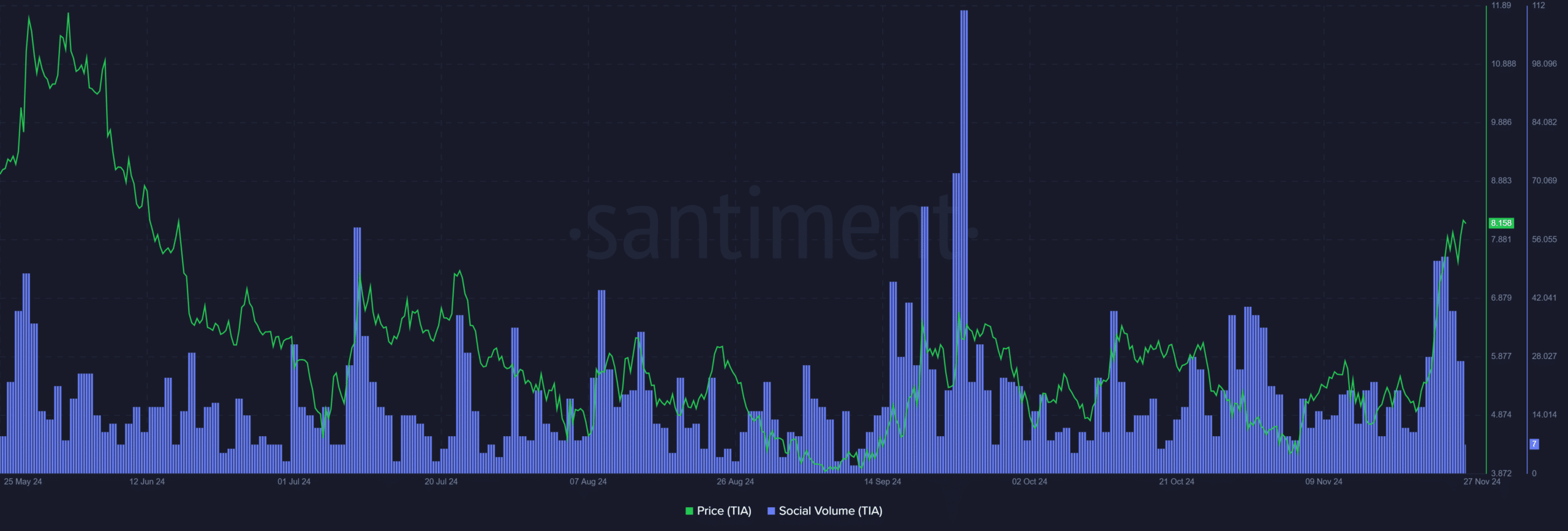

Interest in the Token Integrated Asset (TIA) reached a peak this month, as shown by an increase in social media discussions. Historically, increased interest on social platforms has consistently led to a rise in TIA’s price. At the time of publication, TIA had gained 10% for the day, with a value of $8.4.

Furthermore, the market lean was heavily biased towards buyers (bulls), as evidenced by Binance Top Traders’ positions. It appears that approximately 70% of traders were betting on a continued rise in the price of TIA, indicating a general expectation for further growth.

Yet, a minor issue arose, particularly affecting those intending to hold the token over an extended period, such as multiple months.

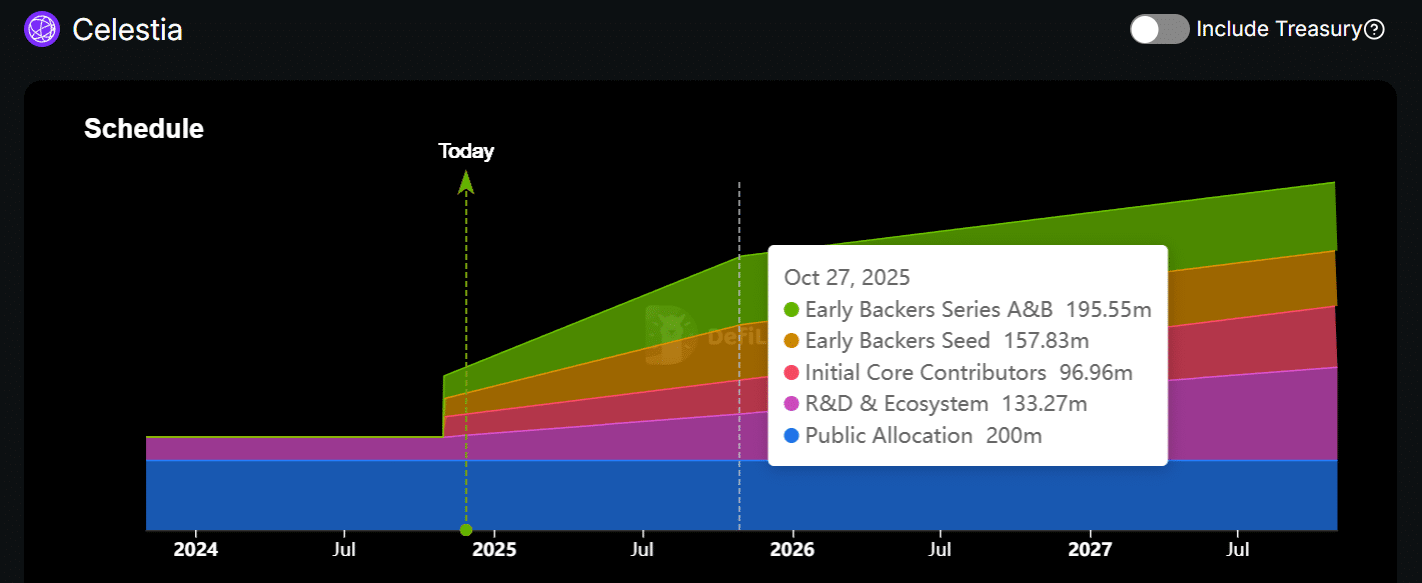

Currently, fewer than half of the TIA tokens have been released into circulation, and a significant portion, over 50%, is yet to enter the market. These remaining tokens will become available starting from October 2021, with a larger release expected around 2025.

About 7 million TIA tokens ($57 million) will be emitted in the next seven days.

For long-term holders, the potential surge in inflation and increased supply due to initial investors cashing out might influence the price trends of TIA, making it more volatile over a prolonged period.

Read Celestia [TIA] Price Prediction 2024-2025

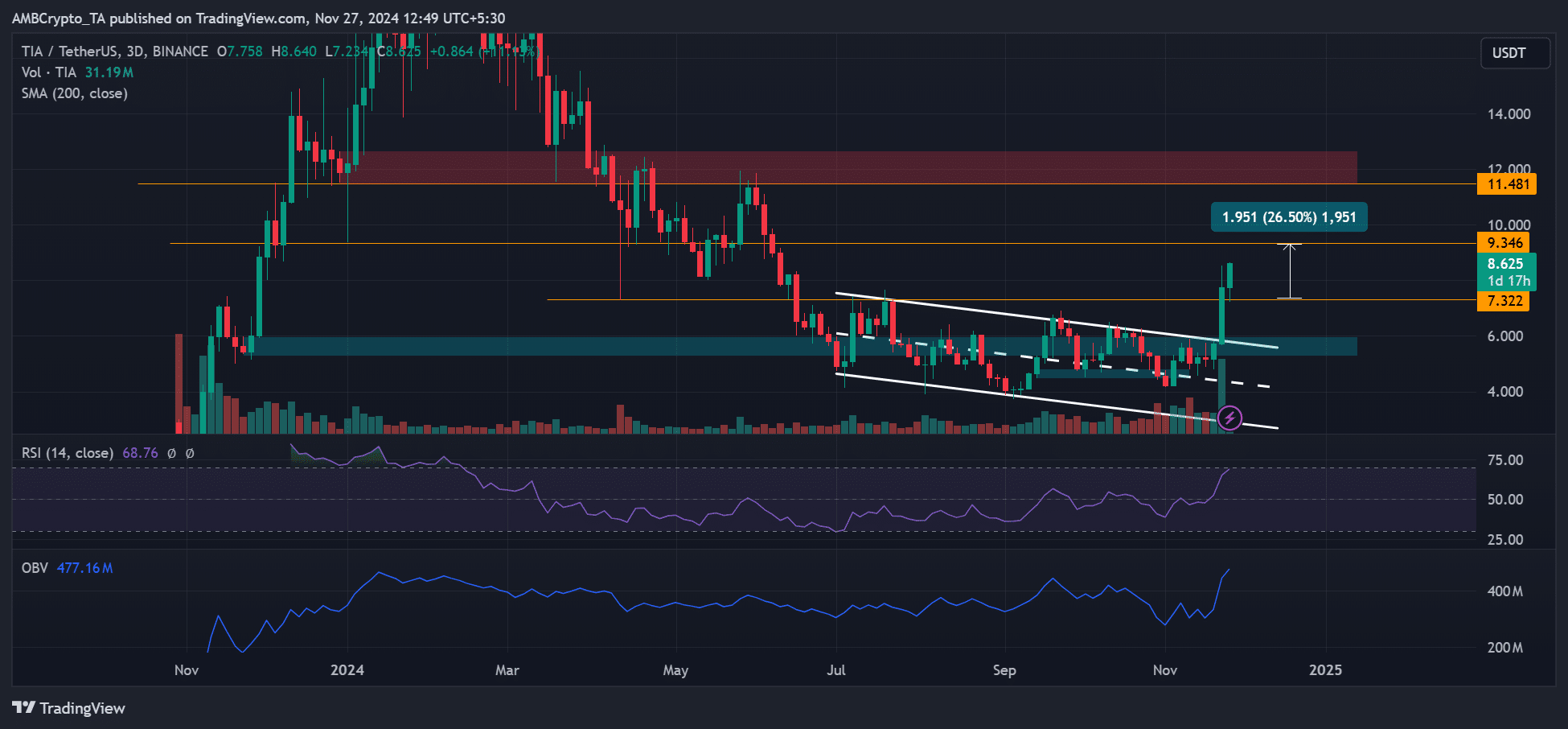

Based on the current market trend, it’s likely that traders will aim for the prices of $10 and $12. Given the high demand and the positive trajectory, optimistic investors (bulls) might strive to reach these potential price points.

Nevertheless, the key supply area was located at $12, a robust barrier that caused TIA to drop below $10 starting from May.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-27 14:31