- ENA’s Open Interest surged by 18% in the past 24 hours, indicating growing confidence of traders.

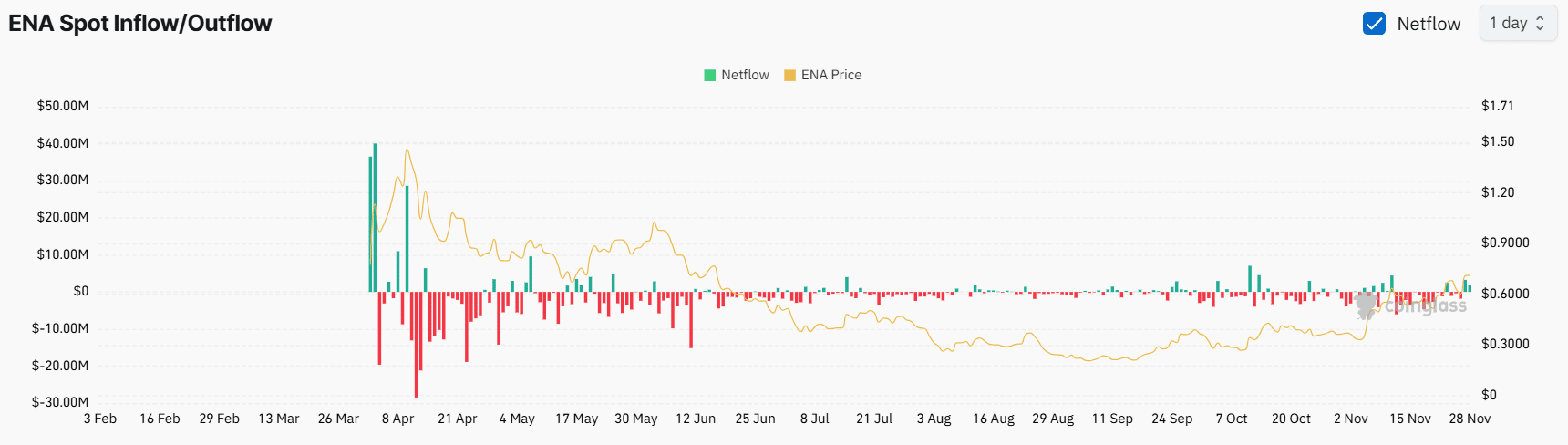

- Coinglass’s ENA spot Inflow/Outflow data indicated that long-term holders have significantly increased their holdings.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market trends and patterns. The recent surge in Ethena [ENA] is certainly one that catches my attention. With a 18% increase in Open Interest within 24 hours and long-term holders significantly increasing their holdings, it’s clear that traders and investors are increasingly confident about this token.

On November 28th, 2024, Ethena (ENA) took the lead in the cryptocurrency market, surging as the second-largest daily gain among all digital currencies, capturing keen attention from traders and investors alike.

At present, there’s significant interest in ENA among cryptocurrency enthusiasts, as its strong upward trend surpassed a vital resistance point, leading the general market outlook to lean more towards optimism (bullishness).

Rising open interest and whale activity

Data from the on-chain analytics firm Coinglass indicates that whales and traders have shown strong interest and confidence in the token.

Based on recent figures, the predicted Open Interest (OI) for ENA has risen by 18% over the last day. This suggests a rise in investor confidence and a spike in active trading.

The recent breakout appears to be the potential reason for this significant rise in OI.

Increasing whale withdrawals

As an analyst, I observed an uptick in Open Interest (OI) alongside Coinglass’s End of Day (EOD) inflow/outflow data, which suggests that long-term investors are actively accumulating more cryptocurrency assets.

For several days now, there’s been a trend of significant token withdrawals from exchanges, starting on November 12, 2024. This pattern indicates that large investors, or “whales,” may be transferring their tokens to their personal wallets.

Conversely, since the price surpassed the previous resistance point over the last two days, there’s been an increase in token deposits moving from wallets to exchanges, a trend often referred to as inflows. Nevertheless, these inflows are notably smaller compared to the amount of tokens being withdrawn by large-scale investors or “whales.

Analyzing the present activity by both traders and long-term investors indicates a strong likelihood of the upward trend persisting further.

Ethena’s technical analysis and key levels

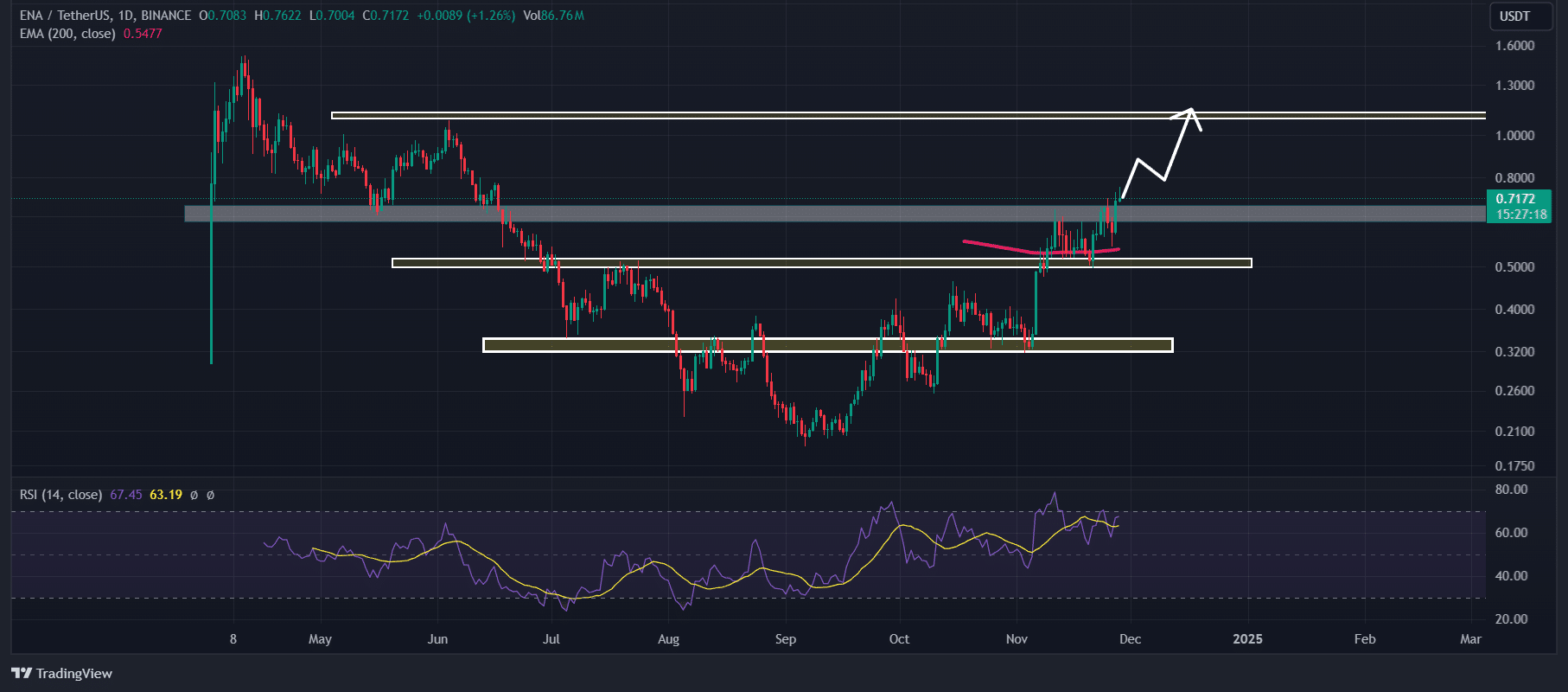

Based on the assessment of technical specialists, ENA seems optimistic following its surge beyond a robust resistance point at $0.70. This burst in value comes after an extended phase where the price was consolidated close to the resistance level.

Given the latest trends in its pricing, it’s quite likely that ENA might experience a significant increase, potentially climbing up to around $1.10 over the next few days.

In simpler terms, the technical indicator known as ENA’s Relative Strength Index (RSI) indicates that there could be more growth potential for this altcoin in the near future. At the moment, its RSI value is 64, which means it hasn’t yet reached the overbought zone where sellers might start to emerge, suggesting room for further price increases.

Read Ethena [ENA] Price Prediction 2024-25

At press time, ENA was trading near $0.72 and has registered a gain of 18% in the past 24 hours.

Over that timeframe, the trading volume experienced a significant increase of 23%. This suggests a greater involvement from both traders and investors as compared to the day before.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-28 22:31