- PEPE coin has reached a significant milestone in this bull cycle, posting a new ATH of $0.00002524.

- However, an ongoing market shift could threaten its momentum, limiting further gains.

As an analyst with years of experience navigating the volatile and unpredictable world of cryptocurrencies, I must say that the current state of PEPE coin is intriguing yet challenging. While it’s impressive to see PEPE reach a new ATH during this bull cycle, the ongoing market shift could potentially hinder its momentum.

In this current market cycle, I’ve observed a significant change in the composition of capital exiting Bitcoin [BTC]. Contrasting with individual crypto exchange users, institutional investors and ETF buyers appear less inclined to invest in memecoins. As a result, these assets are consistently found at the bottom end of the chart, suggesting they are currently out of favor among this group of investors.

The PEPE coin has faced some difficulties too, experiencing a nearly 7% drop over the past week. Although this decrease might appear insignificant, it’s important to note that the difference in funds pouring into alternative coins becomes noticeably clear when these numbers are taken into account.

As a crypto investor, I can’t help but see this recent dip as merely a ‘momentary’ setback, not a long-term pattern. Just two weeks ago, the PEPE coin surged past significant thresholds in the post-election cycle, breaking through resistance at $0.000020 and hitting an all-time high of $0.00002524. This momentum suggests that we may be on the brink of another uptrend.

It was only natural for an adjustment to occur since the trading volume reached a historic high of 214 trillion, suggesting that the market was becoming excessively heated.

Consequently, two successive weeks have seen the PEPE coin drop below its previous resistance level, currently worth approximately $0.00001923 (as of this moment).

Is PEPE coin ready to break another ATH by December?

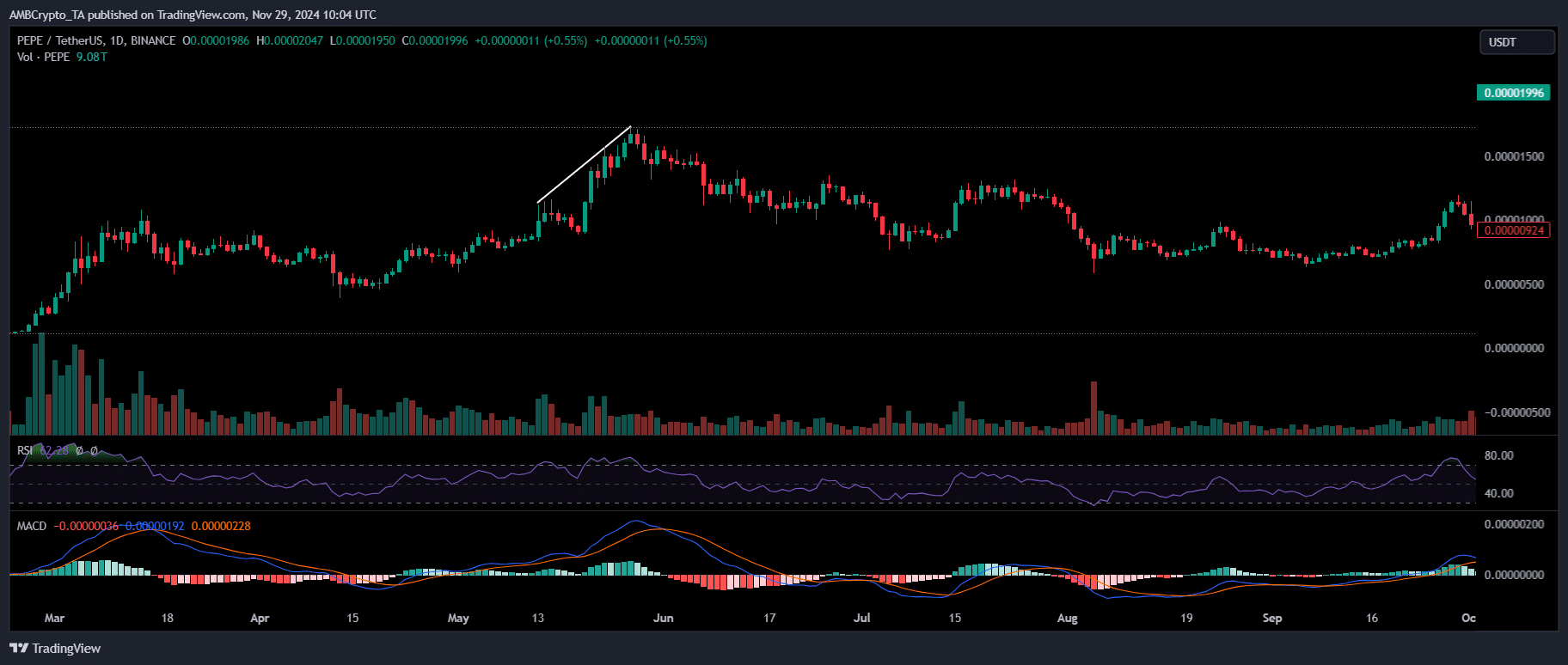

On the daily chart, the MACD (Moving Average Convergence Divergence) has shifted to a downtrend, indicating potential continued price decline. This implies that the market may not have reached its lowest point yet, reducing the likelihood of a recovery or surge before the end of this month.

In December, there’s a possibility that PEPE could surpass $0.00002600. Yet, achieving this won’t be simple due to the anticipated high volatility. The bulls are trying hard to drive BTC beyond $100K before the end of Q4, which adds to the difficulty.

Previously discussed, the current cycle has strengthened the position of altcoins as a preferred investment category. Consequently, an increase in the value of Bitcoin might propel meme coins towards their former resistance points. However, surpassing their all-time high could be challenging.

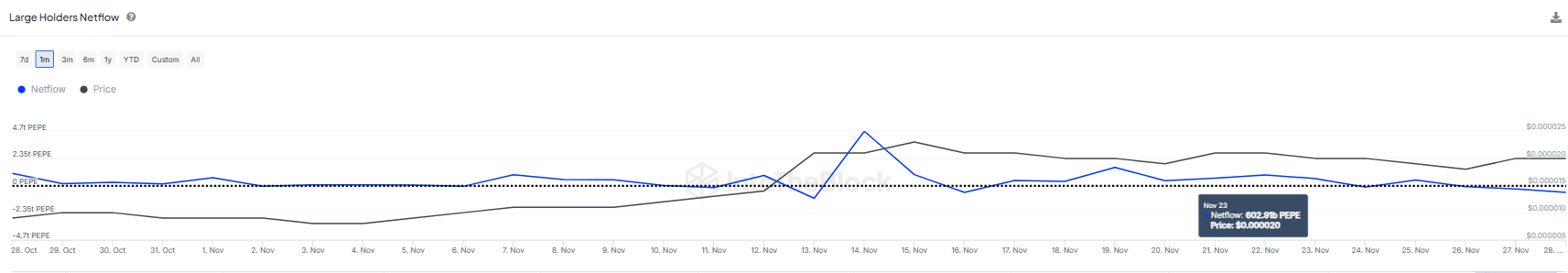

It’s intriguing to note that whales started acquiring PEPE coins the day before it reached its all-time high, withdrawing a staggering 4.1 trillion tokens.

Source : IntoTheBlock

Since that time, it appears that whales have been selling their memecoin holdings, which has contributed to its ongoing decline. Given that memecoins tend to depend significantly on a few major investors (whale holders) for breaking through key resistance levels, this behavior is not surprising.

In contrast to other traders, those dealing in the spot market have shown varying responses. Over the last three days, the PEPE coin has experienced a modest increase, with daily profits surpassing 2%. This upward trend has maintained its price within the range of $0.0000180 and $0.0000200.

This anomaly underscores the influence whales wield in dictating PEPE’s price action.

To hit a fresh all-time high before the current cycle ends, keeping an eye on whale behavior will be essential for identifying potential new local bottoms.

That said, the path forward is far from smooth

A historical pattern identified by AMBCrypto underscores the challenges ahead for the memecoin community as altcoins continue gaining notable traction.

Generally speaking, when Bitcoin gets close to a significant value that people find psychologically impactful, many investors tend to switch their attention towards higher-value cryptocurrencies. This is because they look for more affordable options to mitigate potential losses and optimize gains instead.

Up until the latest market peak, memecoins had been the main recipients of this approach, consistently reaching new highs whenever Bitcoin reached its market peaks.

To put it simply, during the latter half of May, PEPE coin experienced a streak of seven consecutive days with increasing value, amounting to a daily rise of 20%. This upward trend occurred when Bitcoin encountered resistance at $70K after reaching an all-time high (ATH) of $73K approximately two months prior.

Source : TradingView

Essentially, as Bitcoin’s surge in value continued, PEPE emerged as an appealing choice for investors seeking to reinvest their earnings, leading to a fresh all-time high (ATH) of $0.00001673.

Contrarily to the pattern seen in the past, this cycle has deviated. While Bitcoin reached new record highs at $99K, the surge held back PEPE from replicating its previous achievements. Even a week before Bitcoin hit its all-time high, PEPE had started a downward trajectory, with investors of lesser conviction being swept away.

If large investors (whales) didn’t continue supporting it, the PEPE price would lose its forward push and instead start to drop again.

Read Pepe [PEPE] Price Prediction 2024-2025

Consequently, the journey ahead for PEPE coin is likely to be bumpy. Should this current trend persist, memecoins will continue to be influenced by substantial HODLers, offering support only if investors start considering memecoins a viable asset class, causing them to redirect their interest away from altcoins.

If Bitcoin’s price surges beyond $100K during a bull run, it could potentially boost PEPE’s price as well. However, achieving a new all-time high for PEPE might continue to be challenging under these circumstances.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-29 23:04