- XLM topped the weekly losers list but defended a key level as support.

- Will the price consolidation above $0.4 extend amid whales’ lack of interest?

As a seasoned crypto investor with battle-hardened nerves and a knack for spotting trends, I find myself intrigued by Stellar’s [XLM] current predicament. After a wild ride that saw it top the weekly losers list following an impressive 173% surge, XLM is now testing its resilience at the key support level of $0.4.

Last week, Stellar [XLM] led the list of losses on CoinMarketCap, shedding approximately 8% of its value following a significant surge of 173% the week prior.

Is it possible that the pullback is simply a normal correction before we see further growth, but do the technical signals suggest a similar positive trend?

What’s next for XLM?

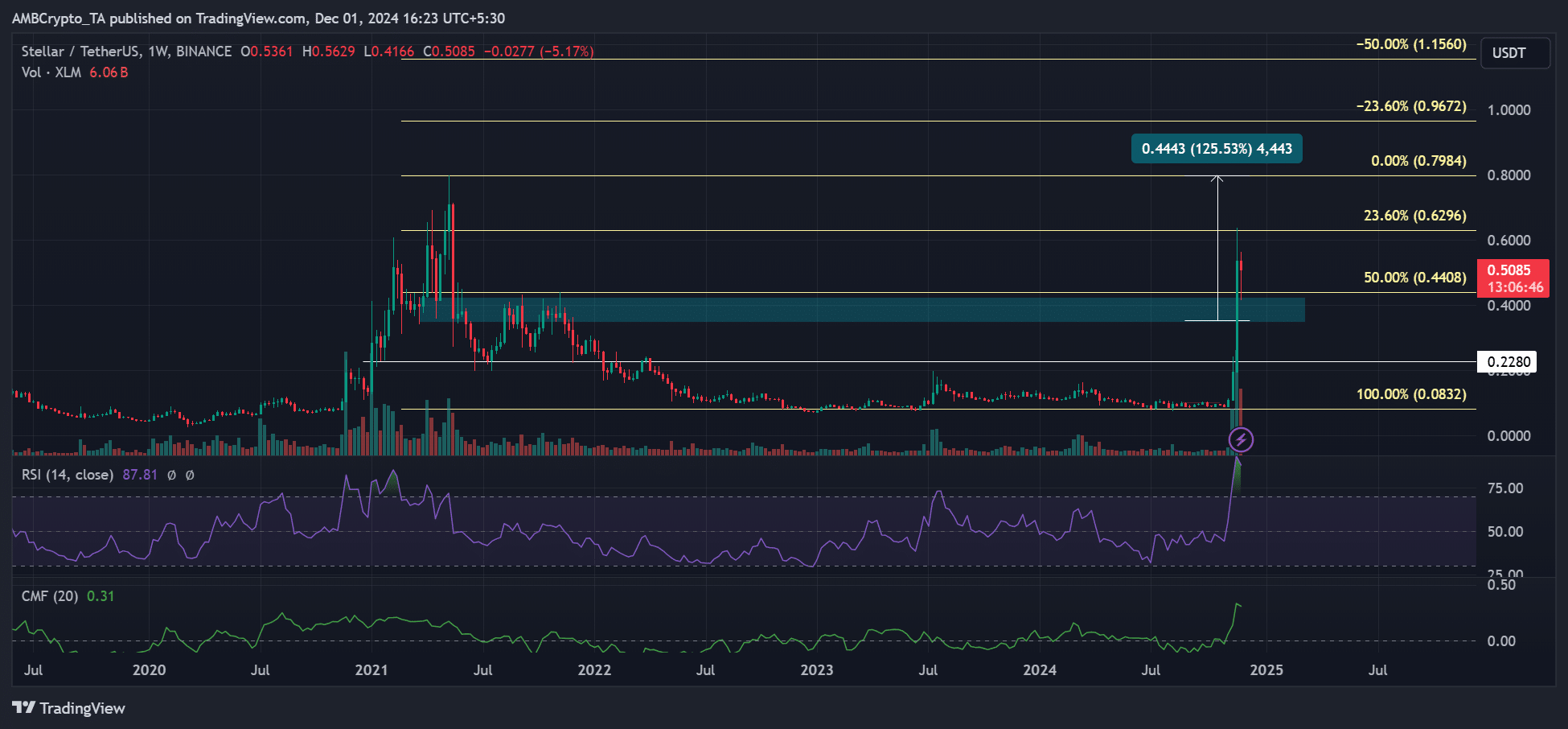

Looking at the weekly chart, XLM successfully held off a significant resistance level at $0.4, which now acts as a potential support. This strengthens the possibility that XLM may aim for its 2021 peak prices around $0.79 or even higher.

The uptick in CMF (Chaikin Money Flow) indicated record inflows, so the uptrend could extend after building enough momentum above $0.4.

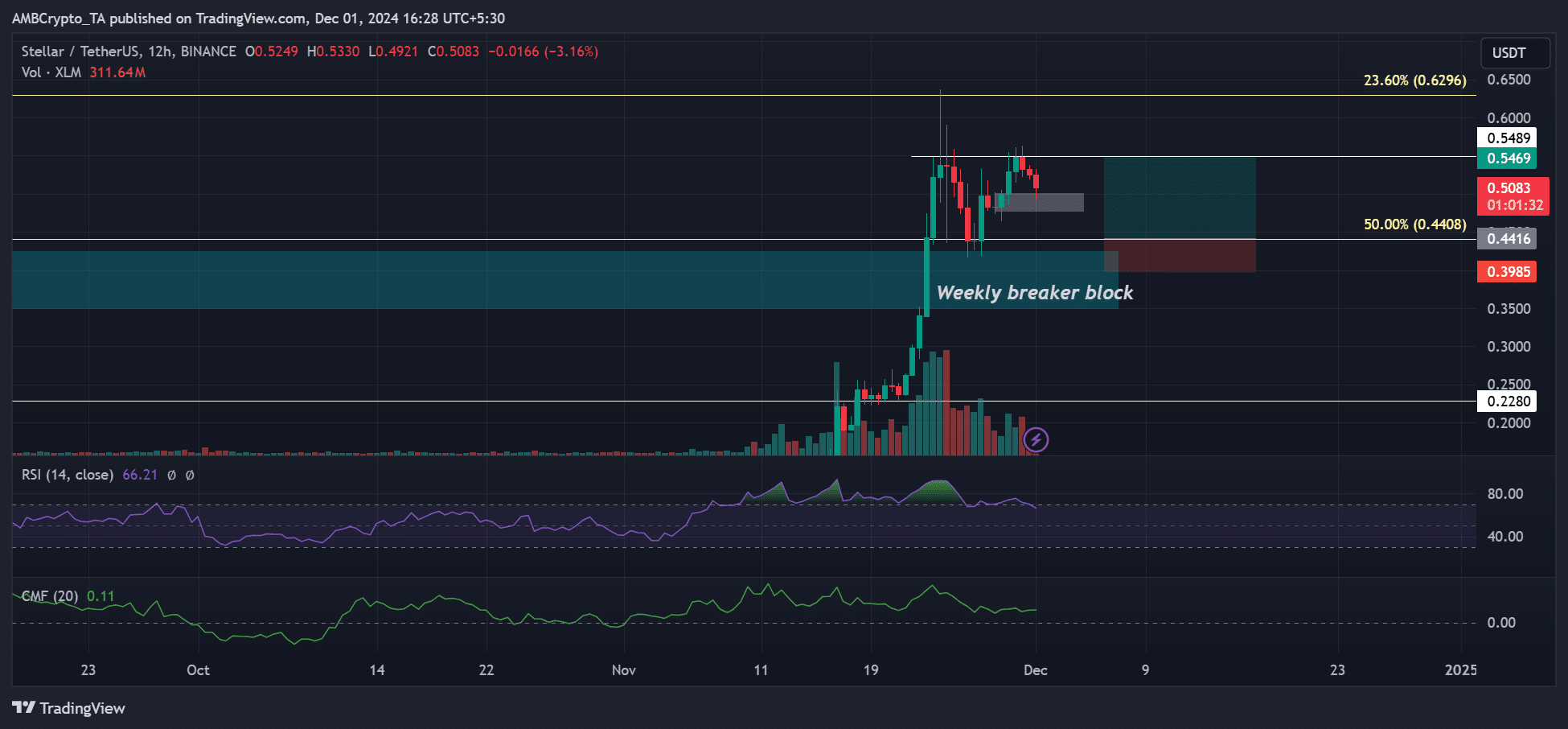

Despite the 12-hour chart indicators suggesting that the uptrend might persist for some time, the Chaikin Money Flow (CMF) has remained unchanged since November 20th, implying that inflows have slowed down and may dampen any possibility of a prolonged rally.

The trading volume also tanked, which could push XLM to retest the support and liquidity below $0.4.

For now, it’s possible that Stellar (XLM) may fluctuate between approximately $0.40 and $0.62. This movement might be followed by an attempt to move beyond this range, potentially in either an upward or downward direction.

Whale exit long positions

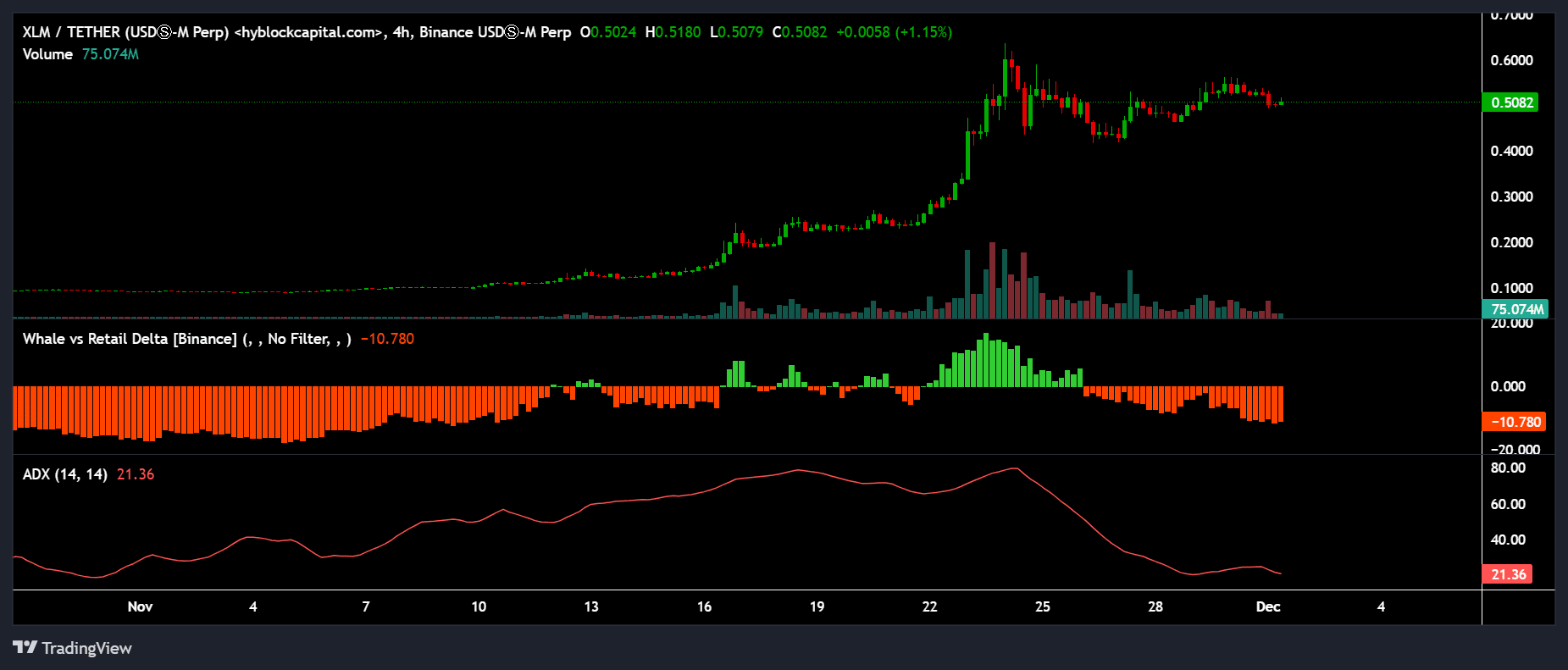

The strategic placement of whales in the XLM market had a significant impact on its price forecast. Following their gains from the previous week, these large investors chose to withdraw from their long-term investments. This shift is evident in the decline of the Whale vs. Retail Delta, which now indicates a negative difference between them and smaller retail investors.

In most cases, large players’ de-risking tends to trigger price consolidation or retracements.

As an analyst, I noticed that the Average Directional Index (ADX), which helps determine the strength of a token’s price trend, significantly dropped from almost 80 to 21.

Read Stellar [XLM] Price Prediction 2024-2025

If the value dips below 20, it strengthens the existing weak trend and could potentially trigger a shift that might make it risky to initiate any trading position, particularly for those following a swing trading strategy.

From my perspective as a crypto investor, while it seemed like Stellar (XLM) was poised for an ongoing upward trend, the temporary absence of whales might momentarily alter that optimistic viewpoint in the near future.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- ETH/USD

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

2024-12-02 10:15