- BNB’s volume has dropped by around 15% in the last 24 hours.

- Its price has trended without any significant moves in the last few days.

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself intrigued by the current state of BNB and its rival XRP. While XRP has taken center stage, leaving BNB in its wake, it’s essential to delve deeper into the metrics to gain a comprehensive understanding of what lies ahead for Binance’s native token.

Recently, the significant rise of XRP has pushed Binance Coin (BNB) out of the top five cryptocurrencies by market capitalization. The disparity between their values is growing, as XRP’s market cap currently stands at over $109 billion, while BNB’s is approximately $94 billion.

Over the last seven days, the value of XRP has jumped by nearly 37%, compared to minimal growth (less than 1%) for BNB. As more investors are focusing on XRP’s upward trend, the price fluctuations and performance indicators for BNB may provide clues about its future direction in the Binance ecosystem.

XRP’s momentum dominates headlines

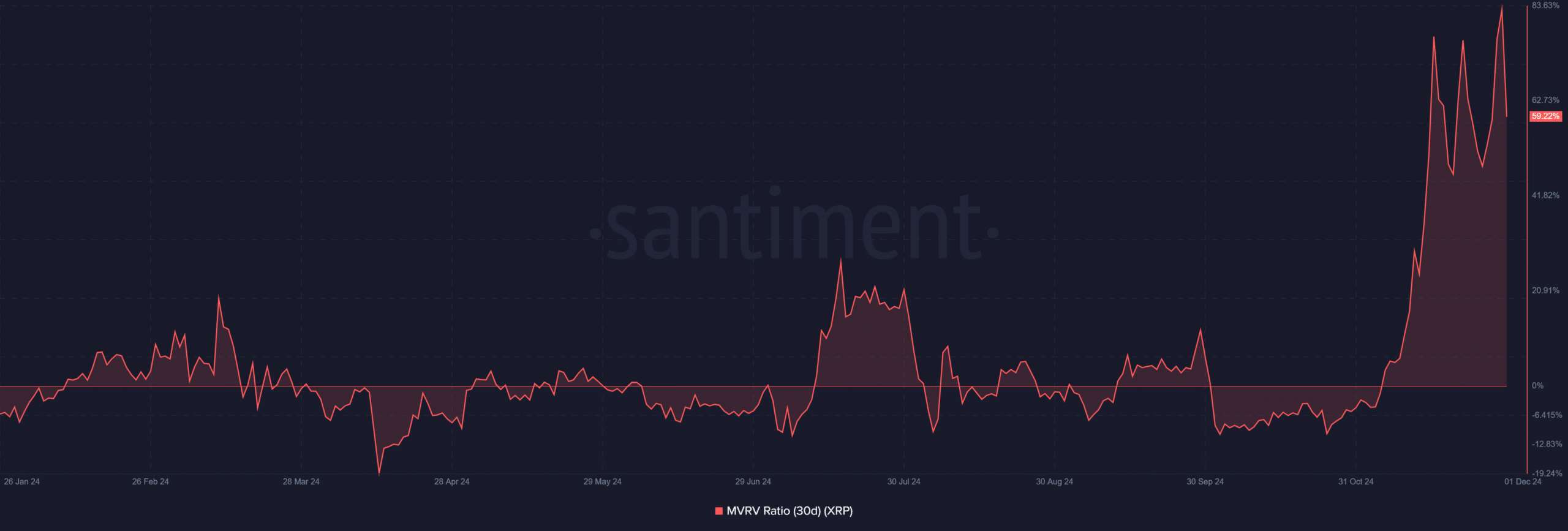

The significant increase in XRP’s price is being driven by increased investor attention and robust foundations, causing a shift in the market structure. The 30-day MVRV (Market Value to Realized Value) ratio for XRP suggests its upward trend, with the figure exceeding 59%, indicating that it may be overvalued at present.

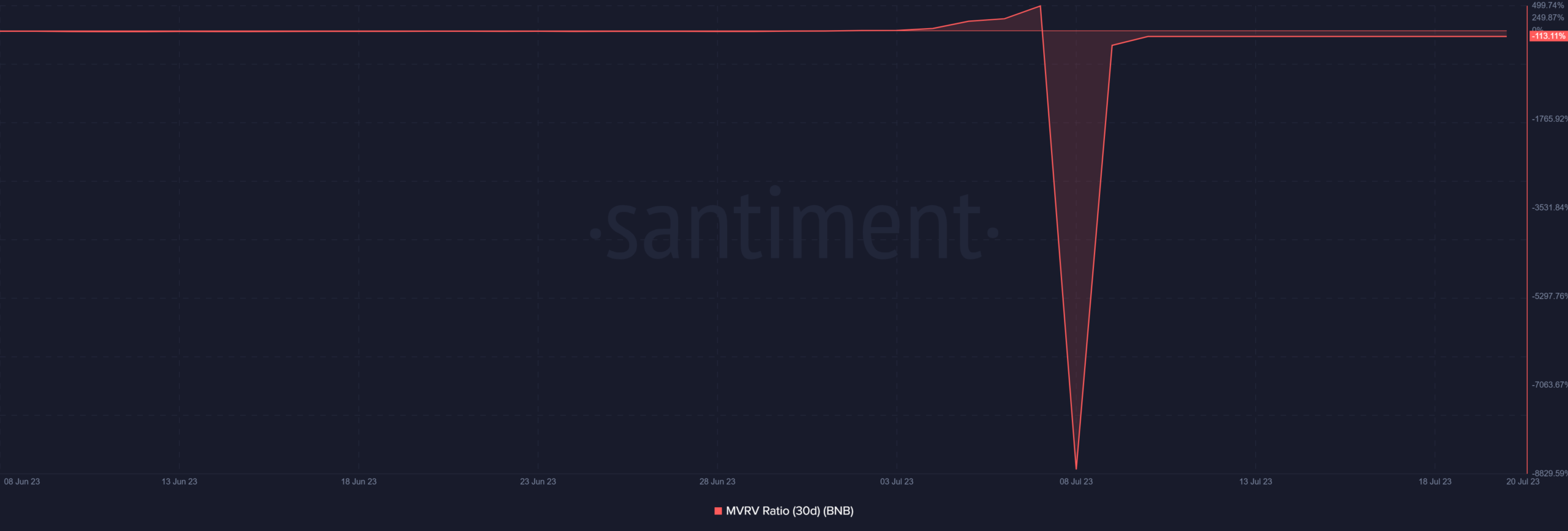

Currently, Binance’s BNB Multi-Version Realized Value (MVRV) is indicating a subdued trend, significantly falling into the undervalued range with an MVRV of approximately -113%. This suggests that BNB is currently undervalued and holders have experienced substantial losses.

Historically, when the Market Value to Realized Value (MVRV) for Binance Coin (BNB) is relatively low, it tends to be followed by an increase in its price. However, if there’s not much trading volume to back it up, BNB might continue to trade within its current price range, rather than experiencing significant upward corrections.

Binance current trend: Stability or stagnation?

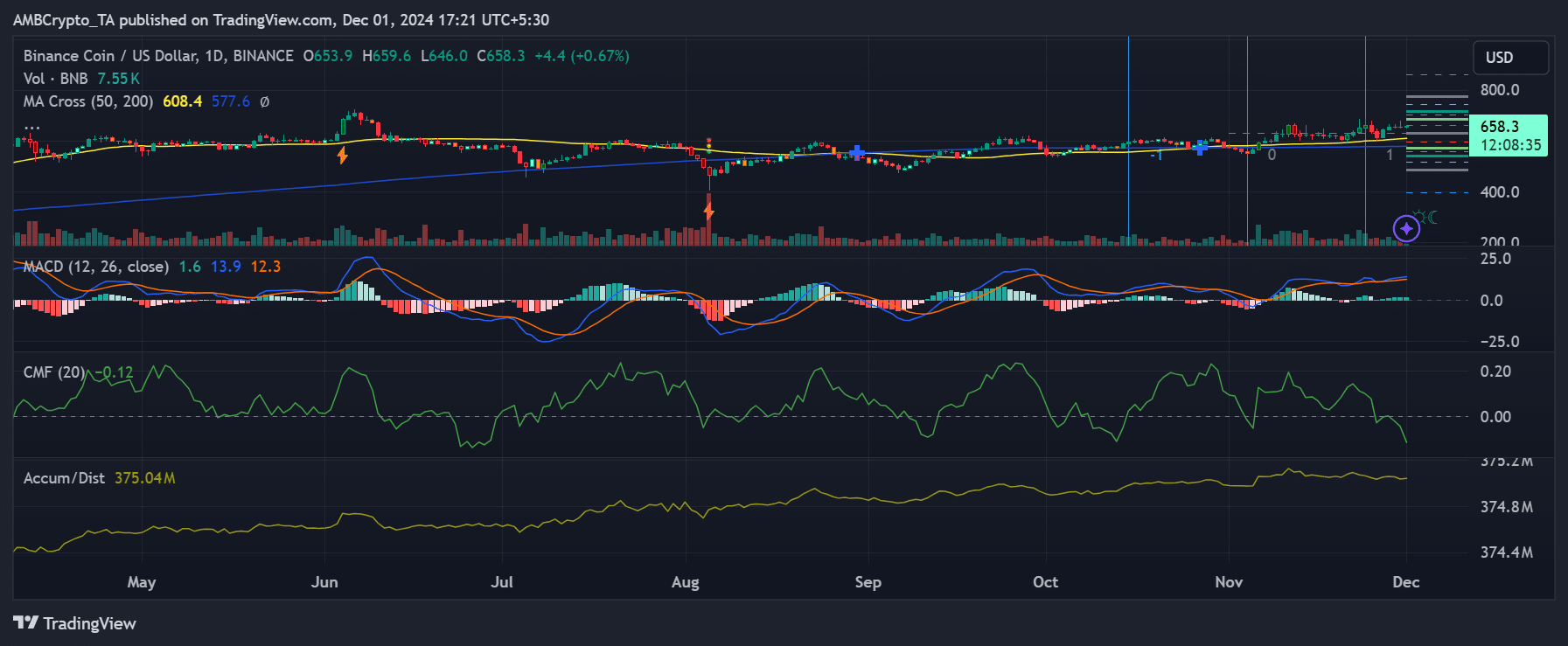

The daily graph of Binance’s BNB reveals a period of close-knit price movement, with the value primarily staying near $658.3. The MACD signal indicates a modest bullish drive, but the Chaikin Money Flow (CMF) hints at minimal capital influx towards this asset.

The consistency in Accumulation/Distribution levels suggests that there’s not much intense buying or selling activity happening right now.

The 50-day moving average is positioned nicely higher than the 200-day average, indicating a positive market direction. Yet, the absence of significant increase in trading volume leaves doubts about the longevity of the ongoing trend.

Binance still in contention

To rekindle its progression, it’s crucial for BNB to surge past $670, accompanied by a rise in transaction activity. On the flip side, if it can’t maintain its present position, there’s a possibility that BNB could challenge the $640 support barrier.

In the short run, Ripple‘s influence may eclipse Binance Coin, but Binance Coin’s integral part in the Binance platform guarantees its significance for the long haul.

Although XRP’s surge has caused a rearrangement in the hierarchy, Binance Coin’s statistics suggest a phase of stabilization rather than an overall decrease.

XRP may have the spotlight for now, but BNB’s stability suggests it is far from out of the game.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-02 11:03