- Aptos achieves new ATHs in terms of TVL and stablecoins, confirming positive network growth.

- Assessing the potential for an APT bullish breakout as things get heated up in the derivatives segment.

As a seasoned crypto investor with a knack for spotting promising networks and their native tokens, I find myself quite intrigued by Aptos [APT] at the moment. The network’s recent achievements in terms of Total Value Locked (TVL) and stablecoins have caught my attention, signaling a robust and sustained growth that many other top blockchains failed to maintain in November.

As an analyst, I observed that the Aptos Network (APT) wrapped up November on a high note, experiencing a significant increase in network activity. In contrast, many leading blockchains saw a pullback or a notable decrease in their pace during the final week of November.

Over the past four weeks, Aptos has continued to build on its previous progress, a trend that is clearly visible now with the latest record highs achieved.

As an analyst, I’m thrilled to report that the network’s total value locked reached an all-time high (ATH) of $1.203 billion on December 1st. Additionally, its stablecoin market capitalization also hit a new historic peak of $311.45 million. This significant growth is a positive indication of the network’s strength and potential.

2024’s latter half saw a significant surge in network activity, as evidenced by the numerous high points reached. To put it into perspective, Aptos’s Total Value Locked (TVL) increased by more than $400 million in November alone.

The network’s TVL (Total Value Locked) nearly doubled from its record low in July, which was approximately $309.63 million. This dip was the network’s lowest for the latter part of 2024.

Although these crucial measures support the network’s strong current operation, might they also hint at potential future trends for Advanced Persistent Threat (APT)?

Is APT on the verge of a breakout from November resistance?

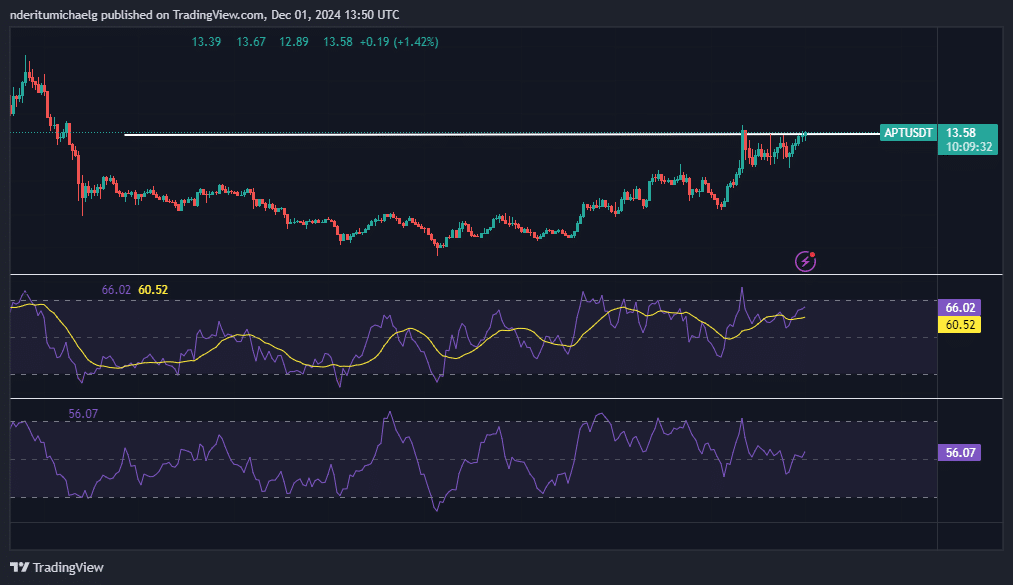

The cryptocurrency APT, originating from Aptos, showed a promising uptrend at the beginning of November. However, this upward momentum seemed to be halted around mid-month. Since then, it has been moving laterally, and there appears to be a noticeable resistance level forming at the $13 price point.

The digital currency has faced difficulties in surpassing its resistance level, yet it might manage to achieve this by the end of the current week. As of now, APT is being traded around $13.55 and is attempting another push towards the mentioned resistance area.

source: TradingView

The trend of APT’s Relative Strength Index (RSI) and Money Flow Index (MFI) has shifted upward, moving above their 50% thresholds. This suggests a rise in bullish energy. It’s plausible that the current record Total Value Locked (TVL) in Aptos and high market capitalization of stablecoins could stimulate investor optimism.

Such an outcome could potentially trigger a bullish extension well into the first week of December.

Additionally, these findings were backed up by an increase in open interest up to approximately 326 million dollars at the moment of reporting. Yet, this figure remained lower than the peak of around 359.26 million dollars reached at the beginning of November.

Conversely, the increasing volume of positions in the derivatives market suggested growing momentum.

Read Aptos’ [APT] Price Prediction 2024–2025

Funding rates provided further directional clarity since open interest cuts both ways.

On many leading exchanges, there was a significant increase in favorable investment returns for Aptos, hinting at a possible bullish trend that could unfold over the coming week.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-02 13:11