- LMWR has surged by 62.13% over the past 24 hours.

- Market indicators suggest that LimeWire is till undervalued.

As a seasoned analyst with over two decades of experience in the crypto market, I have seen my fair share of bull runs and corrections. Looking at LMWR’s recent performance, it seems we might be witnessing another potential gem in the making.

Over the past week, LimeWire (LMWR) has seen a significant surge in its value following a local low at $0.1707. This upward trend has propelled it to a five-month high of $0.47.

Following that price surge, there’s been a market adjustment. At present, LimeWire is being traded at $0.3975. Interestingly, this represents a 62.13% rise compared to the previous 24-hour period.

During that timeframe, the altcoin’s trading volume significantly increased by approximately 672.12%, peaking at around $56.92 million. Meanwhile, its market capitalization saw a rise of about 51%, reaching $114.42 million.

Similarly, it’s shown significant growth in both weekly and monthly charts, increasing by 103.46% and 226.74%, respectively. However, despite this price surge, LMWR is still around 79.53% below its record high of $1.92.

The question that arises after the recent pump is whether LimeWire can sustain the rally.

Can LMWR sustain its rally?

Based on AMBCrypto’s examination, there’s a robust surge in LMWR right now. This surge has led to an increase in demand for the altcoin, with buyers taking control of the market.

The increase in control from buyers is evident via a growing Stochastic Relative Strength Index (RSI). Following a bullish crossover a week ago, it has significantly increased, reaching 99. This strong rise indicates that the demand to buy exceeds the desire to sell.

This occurrence is additionally supported by a higher-than-normal number of buyers over sellers, as suggested by a positive Chaikin Money Flow (CMF), currently at 0.06 for LimeWire.

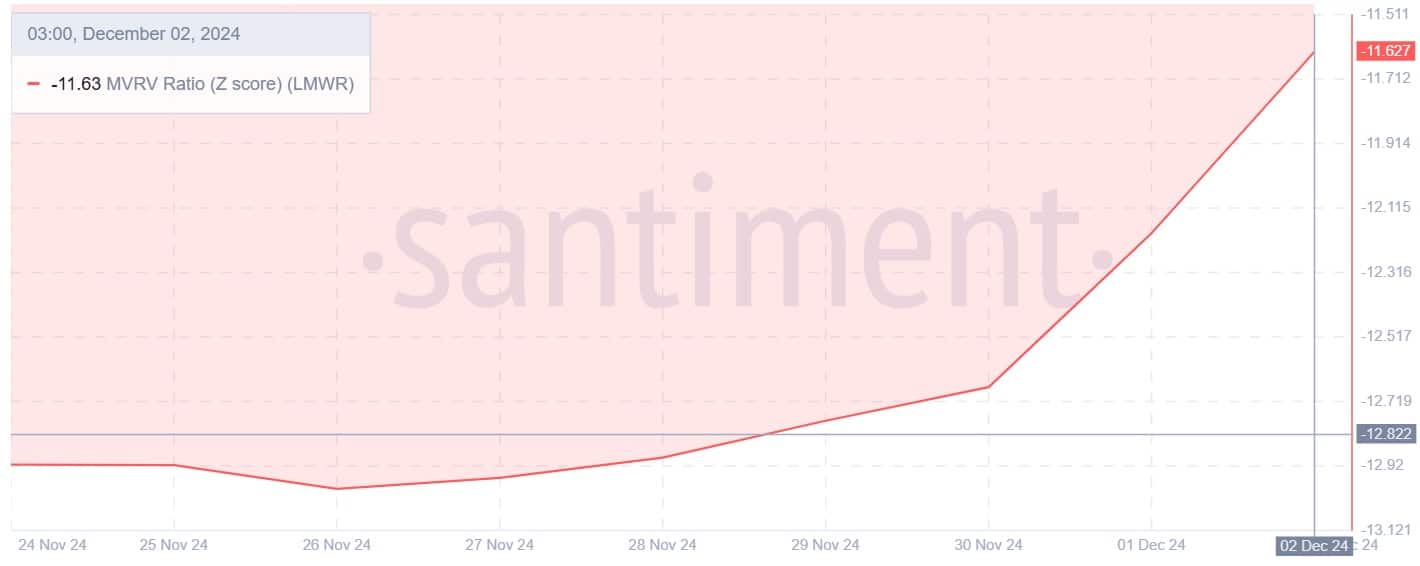

Despite an uptrend, LimeWire’s MVRV Z-score remains negatively positioned at -11.63, having slightly increased from its previous value of -12.19. In simpler terms, the MVRV score, which indicates the value of LimeWire relative to its cost basis, is still showing a loss.

If the MVRV (Momentum Value Ratio Vortex) score is less than zero, it might indicate that the current price of LMWR’s altcoin is lower than its average purchase price, suggesting that the market may be underestimating or undervaluing the altcoin.

From my perspective as an analyst, historically, a Z score below zero has signaled a potential buying opportunity. This is because when assets are considered undervalued, they tend to attract increased buying interest, which in turn reduces the influence of sellers and sets the stage for market recovery.

In other words, this suggests that LMWR is currently underestimated by the market, offering potential for expansion since its full worth is not fully recognized yet.

Essentially, LimeWire might be underestimated at its current price levels. This affordability has sparked a surge in demand for buying the stock, leading to robust buying activity. As investors take control of the market with optimistic expectations, there’s a possibility that LMWR could witness further price increases.

Therefore, if the current conditions hold, the altcoin will find the next resistance around $0.70.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-02 19:03