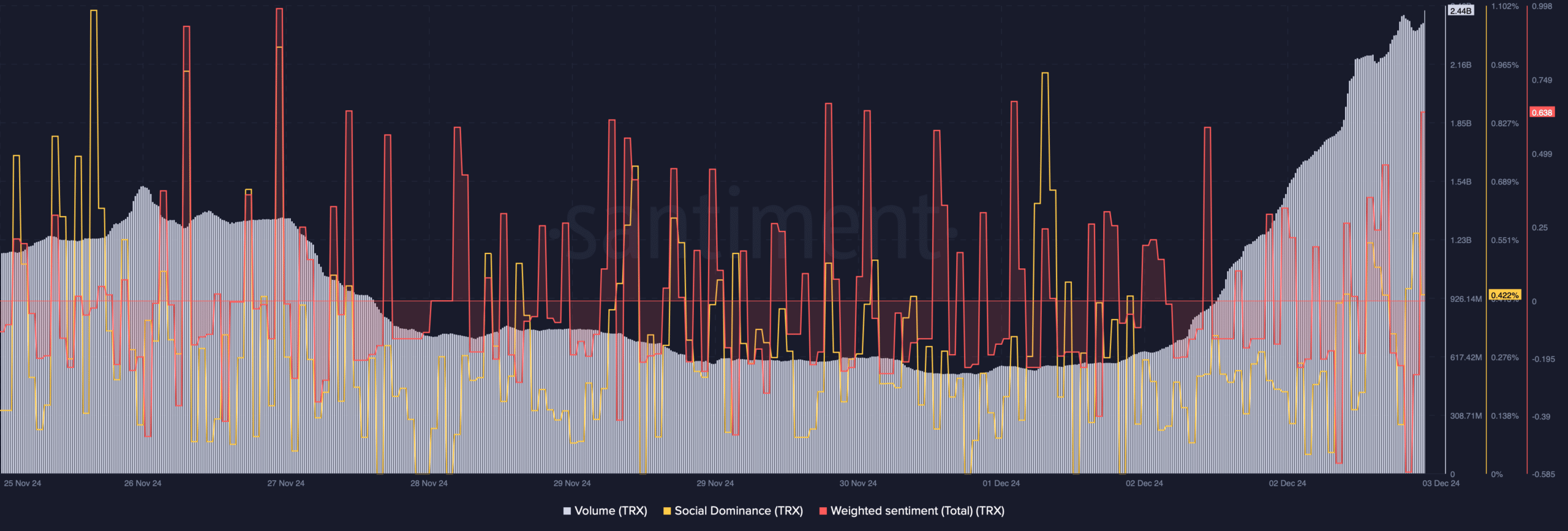

- TRX’s trading volume increased along with its price.

- Technical indicators hinted at a continued price rise.

As a seasoned analyst with years of experience under my belt, I must admit that Tron’s [TRX] latest all-time high (ATH) has piqued my interest. The robust trading activity and technical indicators suggest a continued price rise, but history has taught us to never underestimate the potential for market volatility.

🌪️ EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

New research shows euro-dollar volatility about to spike — are you ready?

View Urgent ForecastOnce more, Tron (TRX) is grabbing attention due to hitting a new peak record (all-time high), with strong trading actions fueling its progression.

With this recent all-time high (ATH), Tron (TRX) moves a step closer towards joining the elite top 10 cryptocurrencies. Could TRX surpass Avalanche [AVAX] and seize the 10th position, or will it experience a setback beforehand?

Tron’s touches an ATH!

Last week, a surge in buying interest for Tron tokens caused their price to rise by approximately 28%. In just the past day, there’s been an even steeper increase, with TRX spiking by more than 16%, setting a new record high of around $0.234.

At present, the gap in market capitalization between TRX (Tron) and AVAX (Avalanche) stands at approximately $1 billion. Should TRX continue its growth trend, there’s a possibility that it could overtake AVAX to claim the spot as the 10th largest cryptocurrency by market cap.

Will TRX continue to pump?

To determine if TRX might keep rising, AMBCrypto studied key indicators related to the token’s activity on the blockchain.

Based on data from Santiment, it appears that the trading volume for TRX experienced a substantial boost as its price rose. An uptick in trading activity during a bull market tends to reinforce the positive trend.

The rise in the token’s price has also boosted its social indicators. For example, it continued to hold a significant position in terms of popularity within the cryptocurrency market, demonstrating the widespread recognition of TRX.

However, despite reaching an ATH, TRX’s Weighted Sentiment dropped soon after—indicating rising bearish momentum.

Despite a few concerns, the token’s performance indicators seemed promising. Data from Coinglass showed an upward trend in Tron’s funding rate. An increasing Funding Rate in cryptocurrencies typically suggests a positive outlook and anticipation among traders that prices will go up.

Traders, who anticipate a price rise, are ready to spend more to maintain their long positions, as this belief guides their actions.

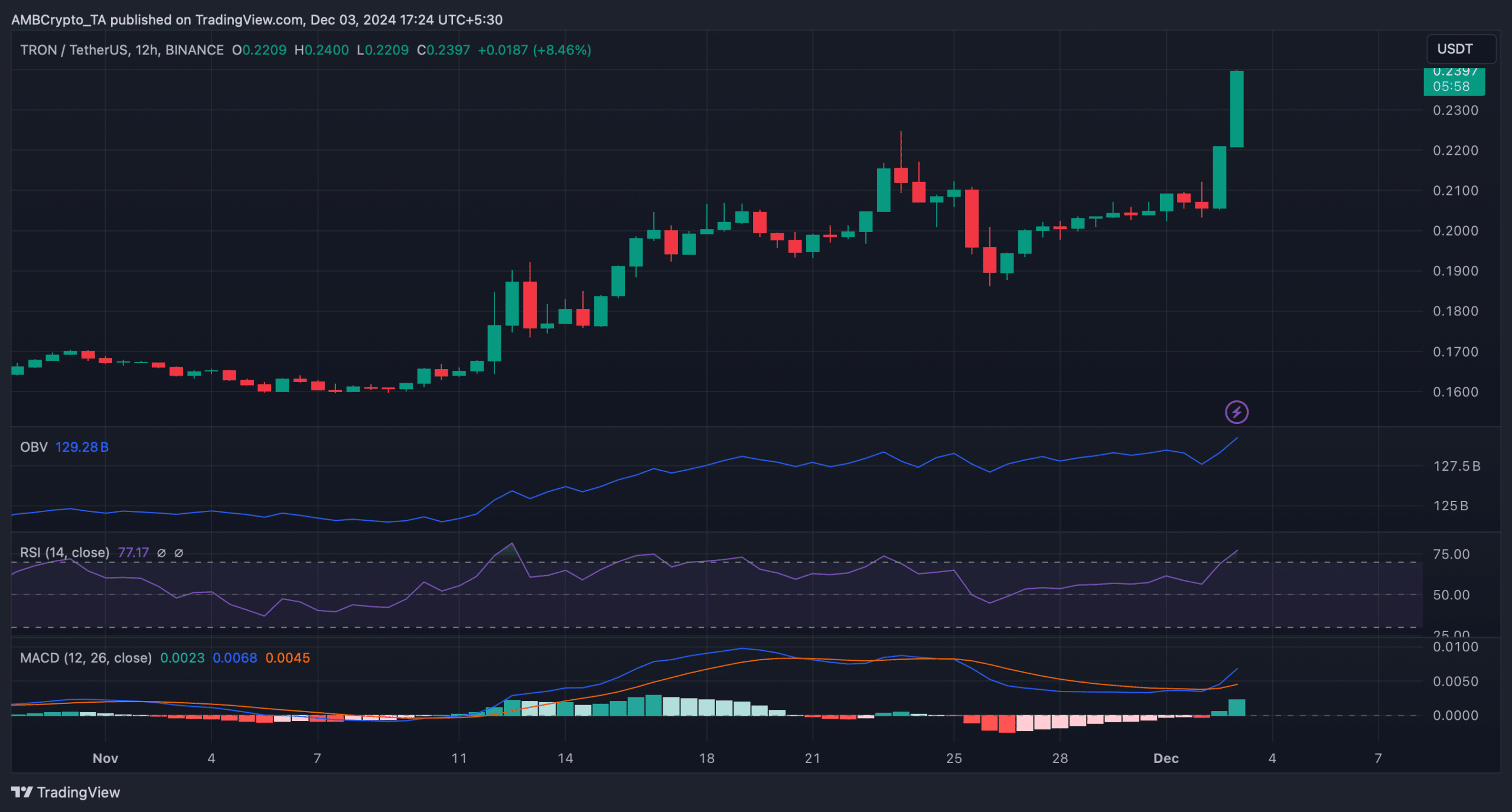

The increase in the On Balance Volume (OBV) suggests that more trades were executed during periods when prices increased, compared to periods when prices decreased.

As a researcher, I observed that the Moving Average Convergence Divergence (MACD) of TRX signaled a strong bullish trend, implying further price growth. On the other hand, the Relative Strength Index (RSI) for Tron moved into overbought territory, indicating potential market saturation or a possible correction.

This might motivate investors to sell and, in turn, push TRX’s price down.

Read TRON’s [TRX] Price Prediction 2024-25

As I observed, there was a significant surge in Tron (TRX) prices reaching new heights, and it seemed coincidental that the network’s activity followed suit. Analyzing Artemis’ data, I noticed a striking rise in the number of daily active Tron addresses, indicating increased user engagement on the platform.

As an analyst, I observed a parallel upward trajectory in the daily transaction chart, signifying a surge in network activity that collectively propelled us to a fresh All-Time High (ATH).

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Silver Rate Forecast

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-12-04 07:06