- Market sentiment around BNB turned bearish in the last few days.

- In case of a bullish trend reversal, BNB might target $744 first.

As a seasoned researcher with years of experience tracking cryptocurrencies, I’ve seen my fair share of market fluctuations. Last week, BNB was riding high, fueled by the bullish sentiments of investors. However, the recent correction has left me wondering if this is just a temporary blip or the start of a larger downtrend.

Last week, much like other cryptocurrencies, the buyers of BNB had the upper hand and drove up the price to double-digits. However, the price decrease seen over the past day indicates a correction that has temporarily halted its climb. The question remains whether this correction will mark the end of BNB’s price increase trend.

BNB’s 10% weekly surge!

Last week, I noticed an impressive 10% surge in the value of my BNB coins, propelling their price up to around $721. This significant increase in value resulted in a staggering market capitalization close to $104 billion for BNB.

Meanwhile, Binance Research posted a tweet highlighting major developments in the crypto space.

The tweet mentioned the declining BTC dominance, and a 6% rise in the DeFi TVL sector. Apart from this, the tweet also mentioned that the crypto market entered the “extreme greed” phase as the fear and greed index had a reading of 80%.

The excessive desire for profit in the market contributed significantly to the decline in BNB’s price fluctuations. In fact, its value dropped by more than 2% within the last 24 hours.

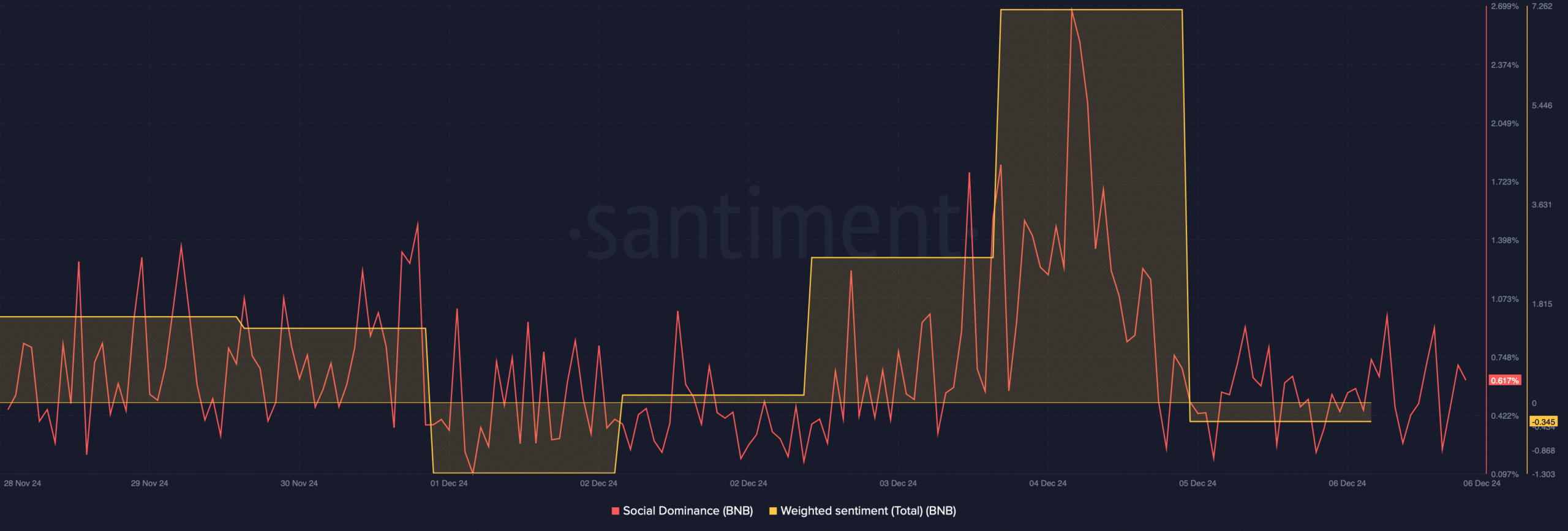

The latest downtrend in the coin’s market value has also affected its social performance indicators negatively. To illustrate, following a significant surge, Binance Coin (BNB) saw a drop in its social influence, suggesting lessened interest or popularity.

A comparable pattern was likewise observed in its weighted emotion chart, signifying a surge in pessimistic feelings among market participants.

Will this downtrend continue next week?

To determine if BNB might continue falling in value, AMBCrypto analyzed other relevant data sets. We discovered that the coin’s long/short ratio exhibited a slight upward trend over the past 24 hours. This indicates that more investors are taking long positions rather than short ones in the market, often suggesting an impending price increase.

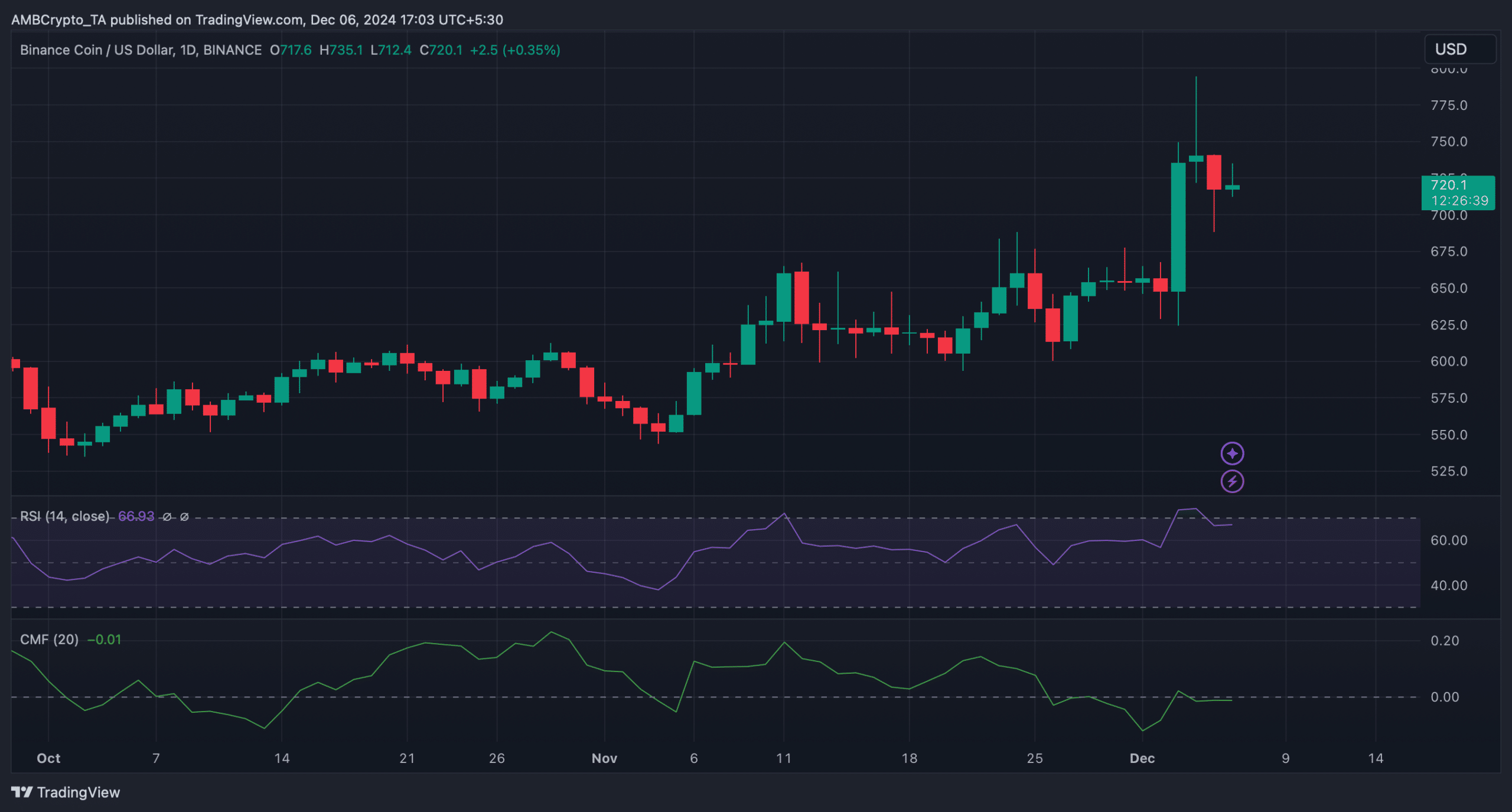

Moreover, over the past day, the trading volume of the coin decreased by 33%, potentially indicating a shift from bullish to bearish trends in the near future. Yet, there were also unfavorable signs for the coin. The BNB’s Relative Strength Index (RSI) showed a downward trend.

Furthermore, the Chaikin Money Flow (CMF) moved horizontally, suggesting little significant buying action was occurring. During these periods, it often indicates extended phases of price movement remaining relatively stable.

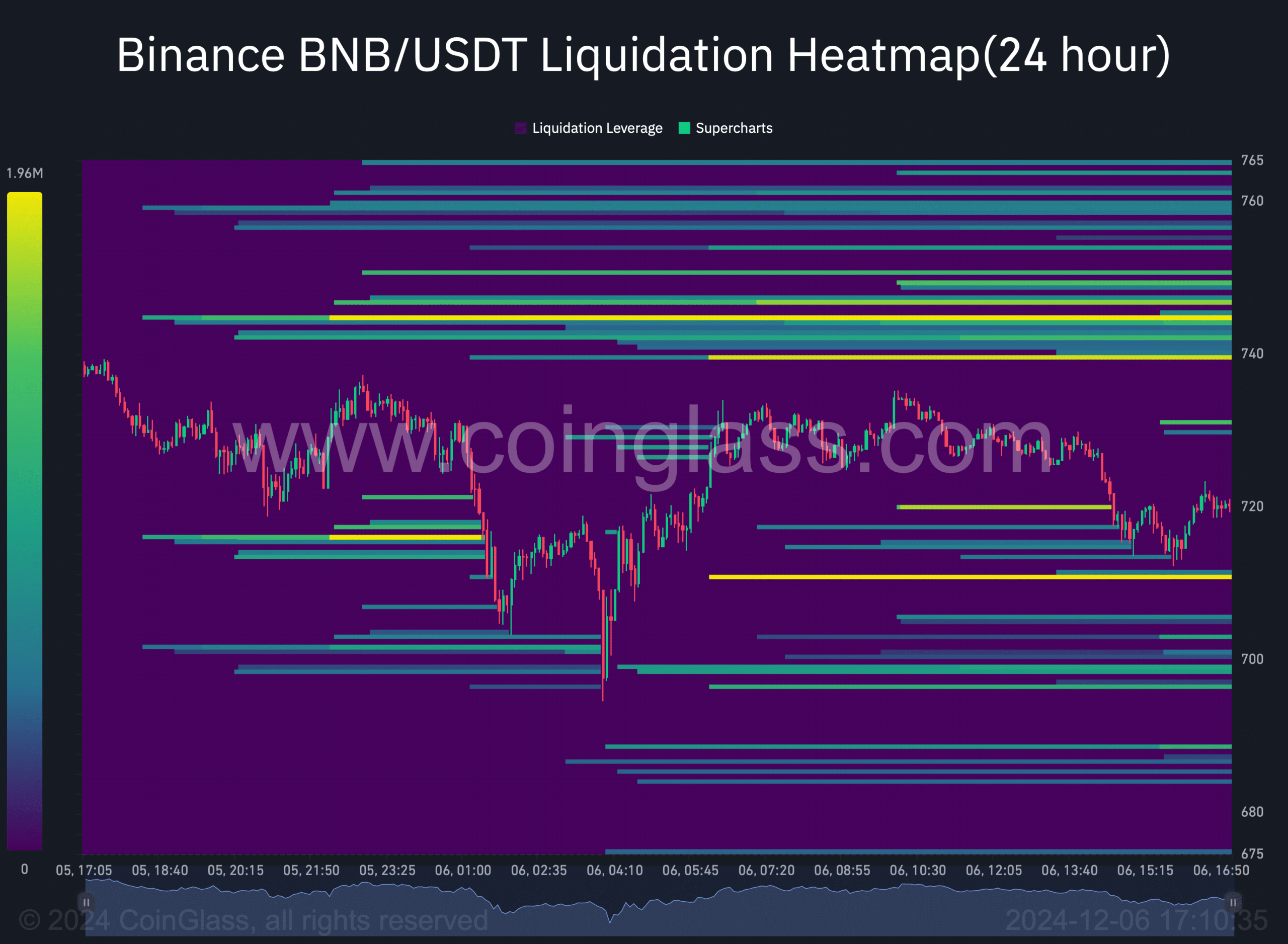

As an analyst, I’m observing the current market trends of BNB. If the downward momentum persists, I foresee BNB dipping to around $710. Conversely, should the bullish sentiment regain strength, pushing the price upwards, we could potentially see BNB revisiting its previous high of approximately $744 once more. This is due to a substantial liquidation barrier present at that level for BNB.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

When the rate of liquidation increases, it frequently leads to price adjustments. Consequently, if BNB wants to aim for higher objectives, it must surpass that particular level.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-07 09:11