- PEPE surpassed UNI to become the 23rd largest cryptocurrency by market capitalization after a significant rally.

- PEPE saw a new all-time high, with rising Open Interest suggesting potential for continued momentum.

As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I find myself both intrigued and cautiously optimistic about the meteoric rise of PEPE (the memecoin, not the frog). Its recent surpassing of Uniswap [UNI] in market capitalization is a testament to the power of community-driven projects and the ever-evolving landscape of the crypto ecosystem.

Pepe (PEPE), a fast-growing digital currency based on memes, has made a notable advancement by surpassing Uniswap (UNI) in terms of total market value.

As per information from CoinGecko, PEPE has moved up to be the 23rd most capitalized cryptocurrency, knocking UNI into the 25th position.

This shift reflects the increasing momentum of memecoins within the broader crypto ecosystem.

As a crypto investor, I’ve noticed an exciting turn of events for the meme coin PEPE, which seems to be riding on a consistent uptrend. This surge is evident in both its growing market capitalization and increasing price points, making it an intriguing prospect in my portfolio.

In the last four weeks, PEPE’s worth has skyrocketed by more than double its original value, and on the 8th of December, as trading commenced, the memecoin hit a record peak of $0.00002716.

Initially, it had risen, but more recently, it’s dipped a bit, currently valued at $0.00002602, indicating a decrease of about 4.3% compared to its highest point.

Although it experienced a setback, the token’s success over the past period outshines UNI’s performance. While UNI continues an upward trajectory with a 98% increase in the last month, it faced a 3.2% drop in the last day, causing its trading value to decrease to $17.69.

UNI remained 60.6% below its all-time high of $44.92 recorded in May 2021.

Liquidations highlight market volatility

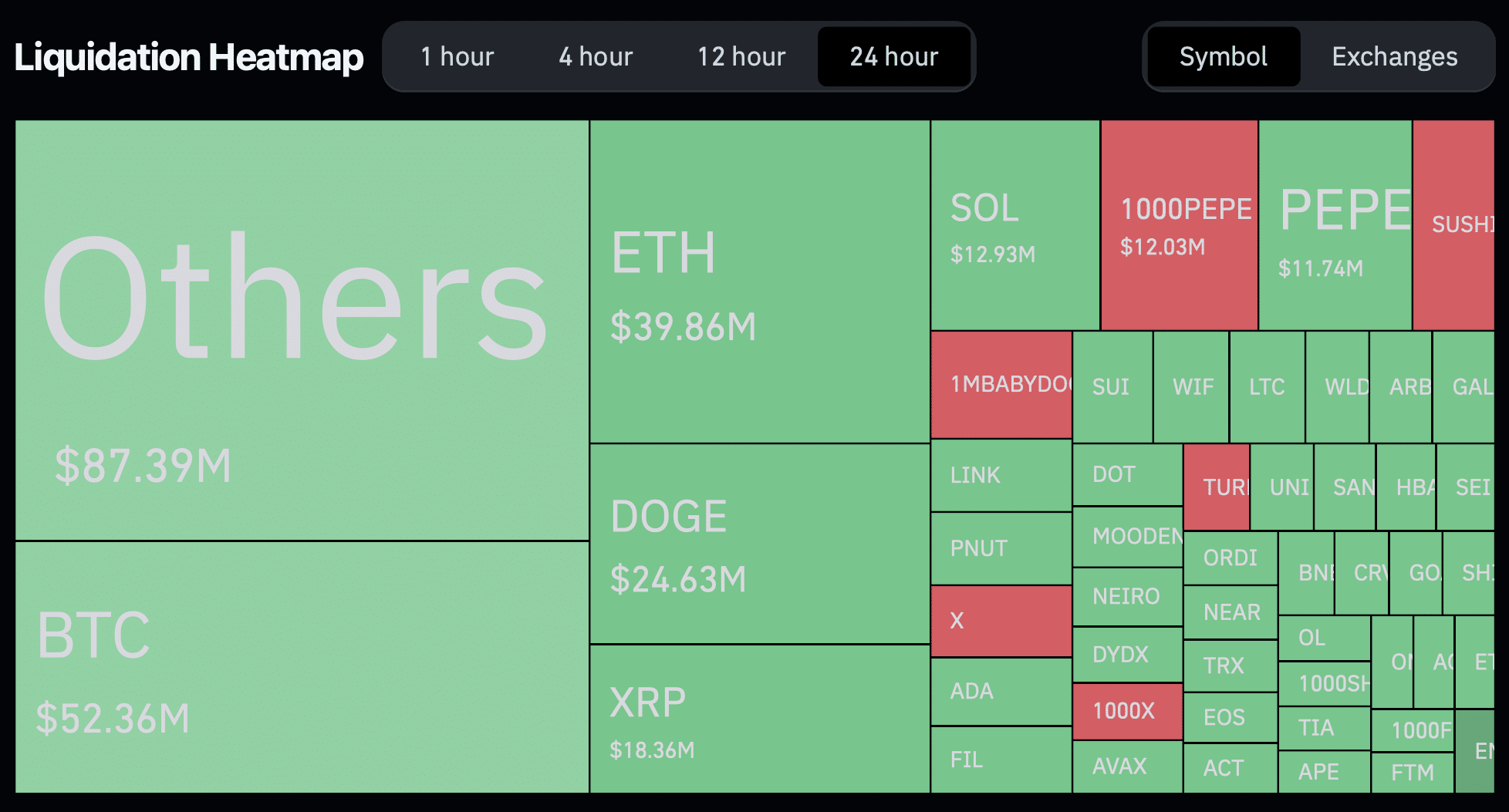

Though the rise in PEPE’s value has brought profits to certain investors, it’s important to note that not everyone has experienced such gains. An examination by AMBCrypto of data from Coinglass showed that during the last 24 hours, there were crypto marketwide liquidations amounting to a staggering $359.99 million.

In total, PEPE contributed approximately $11.74 million to our balance, but it was the long positions that faced most of the losses. To be precise, a significant $8.19 million from long positions was closed, while $3.54 million was lost in short positions.

This highlights the significant risk associated with leveraged trading, even amid bullish trends.

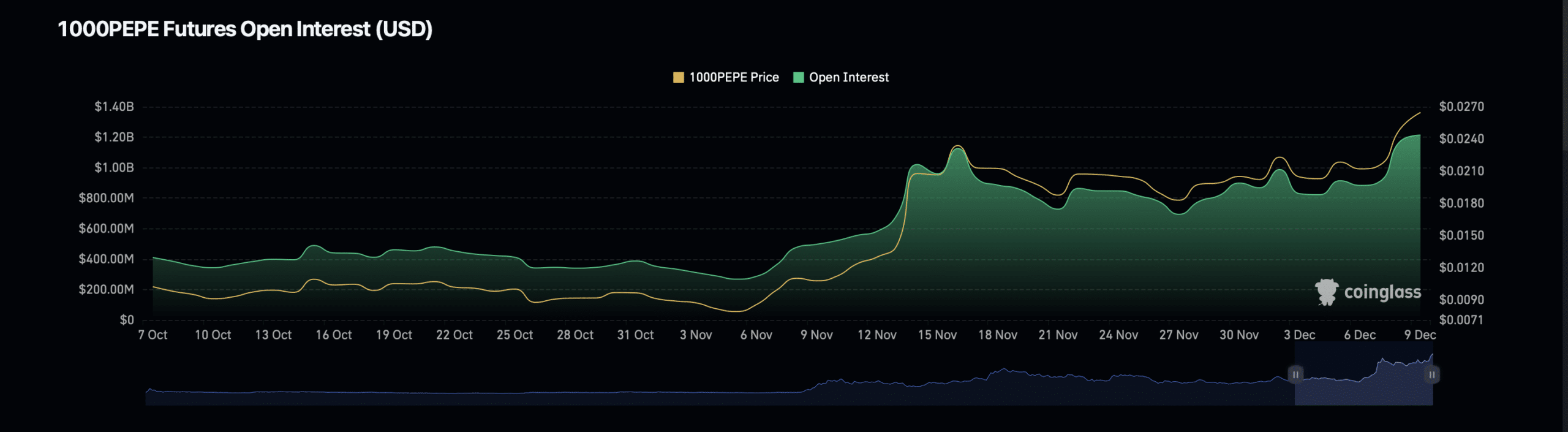

It appears that key indicators are pointing towards a potential continuation of PEPE’s upward trend. The Open Interest, a figure representing all pending derivative agreements, has risen by 4.22%, reaching approximately $1.19 billion.

Additionally, PEPE’s Open Interest volume has surged by 9.34%, reaching $6.16 billion.

Realistic or not, here’s UNI’s market cap in PEPE’s terms

An increase in Open Interest frequently signifies increased trading action and investor enthusiasm, implying ongoing faith in the token’s prospect for expansion.

On the other hand, these rises might indicate possible market instability because excessive speculation could cause dramatic price fluctuations.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-09 17:11