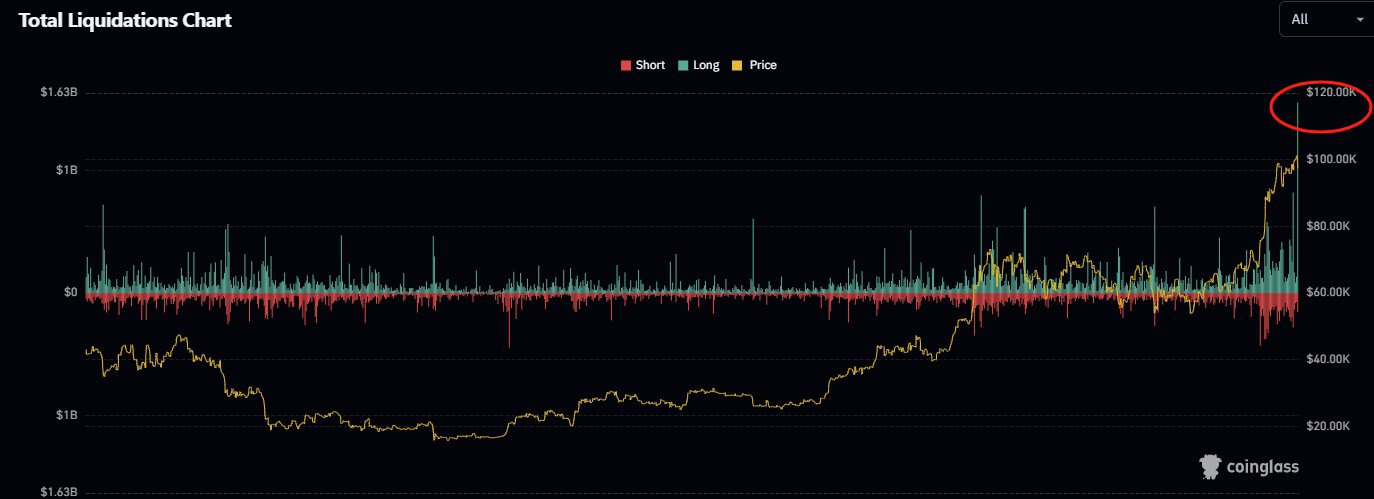

- Over the past 24 hours, the market recorded its largest single-day liquidation, with traders experiencing significant setbacks.

- ETH and DOGE holders were among the hardest hit, as prices tumbled during the sell-off.

As a seasoned market analyst with over two decades of experience under my belt, I’ve seen my fair share of market volatility – but the past 24 hours have been particularly noteworthy. The global crypto market’s $1.71 billion liquidation is a stark reminder that even the most promising rallies can turn sour in an instant.

The global cryptocurrency market cap dropped by 4.11%, falling to $3.47 trillion. Trading volume, however, surged by 114.40%, reaching $352.9 billion as investors reacted to the volatility.

According to market experts, the expected surge in alternative cryptocurrencies (altcoins) might be temporarily postponed due to a change in investor mood and unpredictable market circumstances.

Market sweep: $1.71 billion liquidated

As a researcher, I’ve observed an unexpected dip in the cryptocurrency market that’s resulted in substantial losses for traders, leaving them bewildered and seeking strategies to navigate this challenging period.

According to Coinglass, the previous 24 hours saw the greatest one-time liquidation event and the highest number of impacted traders in this market cycle so far.

Coinglass reported:

Over the last day, a staggering 569,214 trades resulted in traders losing their positions, accumulating to a significant sum of $1.71 billion in total liquidation.

Such market aggression suggests there might be further drops, particularly in the altcoin sector. The broad wave of panicked selling has undermined investor trust as traders scramble to safeguard their earnings during escalating volatility.

As an analyst, I would warn that altcoins might need some time to regain their pace, given the current market sentiment isn’t signaling immediate readiness for a rebound.

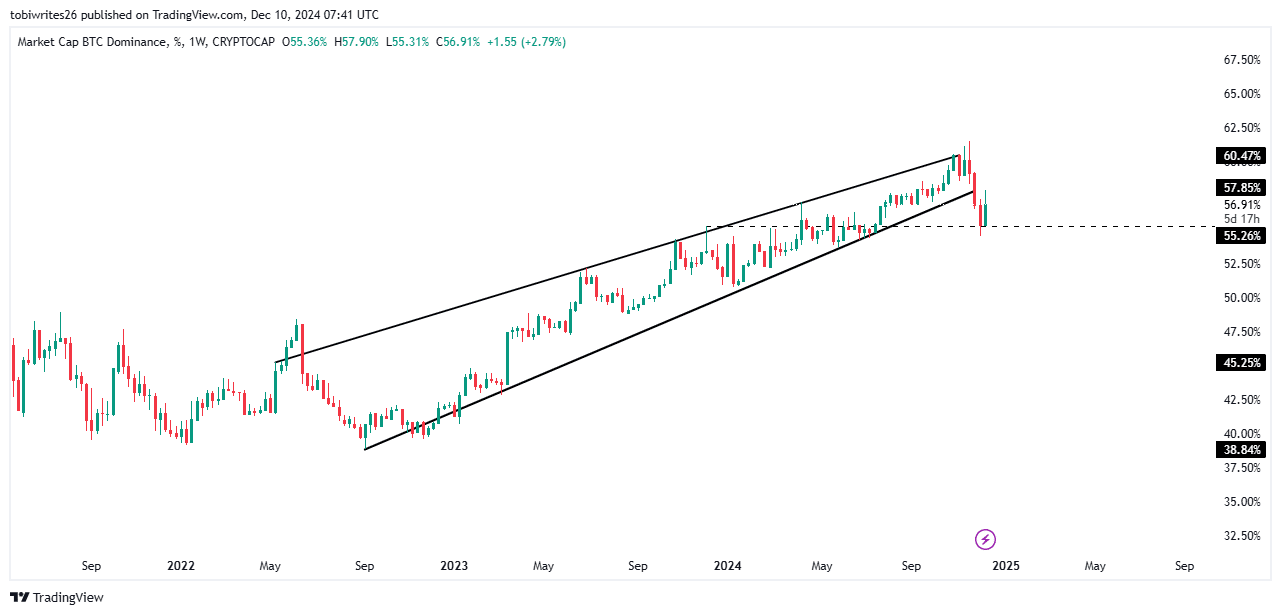

Altcoins weaken as Bitcoin dominance climbs

Over the last 24 hours, Bitcoin’s dominance (BTC.D) has significantly increased, peaking at 57.90%, which is an uptick from its previous level of 56.86%. This surge suggests a change in market trends, indicating that Bitcoin is exerting more influence over the cryptocurrency market.

Bitcoin’s dominance saw an upward trend primarily due to its rebound from the robust 55.26% support point. This resilient barrier provided the necessary push that fueled Bitcoin’s restored vigor.

Normally, when the value of BTC.D decreases, it’s usually a sign that altcoins are gaining strength and might experience surges. On the other hand, an increasing BTC dominance chart suggests that funds are returning to Bitcoin, making it difficult for altcoins to keep their momentum.

Should Bitcoin’s dominance in the cryptocurrency market continue rising, it could lead to additional declines for alternative coins, thereby reinforcing the existing bearish sentiment within the market.

ETH, DOGE lead with $350 million liquidated

In simpler terms, during the recent market drop, Ethereum (ETH) and Dogecoin (DOGE) experienced the most significant losses in terms of liquidation among other alternative coins, as per information from Coinglass.

As a crypto investor, I witnessed a combined loss of approximately $350.56 million between Ethereum (ETH) and Dogecoin (DOGE) in my portfolio. To be more precise, ETH accounted for around $249.48 million, while DOGE contributed about $101.08 million. This substantial loss occurred as the market took an unexpected turn, moving against our predictions, thereby forcing positions to be liquidated.

Read Dogecoin [DOGE] Price Prediction 2024-2025

In this context, long traders suffered significant losses, amounting to approximately $213.28 million on Ethereum (ETH) and $83.13 million on Dogecoin (DOGE). This trend indicates a market that is predominantly biased towards pessimistic views, or bearish sentiment.

A bounce-back might take place if there’s an increase in interest for these resources again, perhaps instigated by big investors (the so-called ‘whales’) buying them up while the prices are low. In this case, the recovery could happen faster than expected.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Elder Scrolls Oblivion: Best Thief Build

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-10 15:36