- PEPE’s near-term trajectory will depend heavily on its ability to hold the $0.000018-$0.00002 support zone

- The memecoin’s derivates data highlighted mixed sentiment with a slight edge for bulls

As a seasoned researcher with a knack for deciphering market trends and a penchant for riding the wildest of crypto rollercoasters, I find myself intrigued by the trajectory of PEPE. The memecoin’s recent exponential rally has been nothing short of breathtaking, reminding me of the time I accidentally bought a coffee with Bitcoin back in 2013.

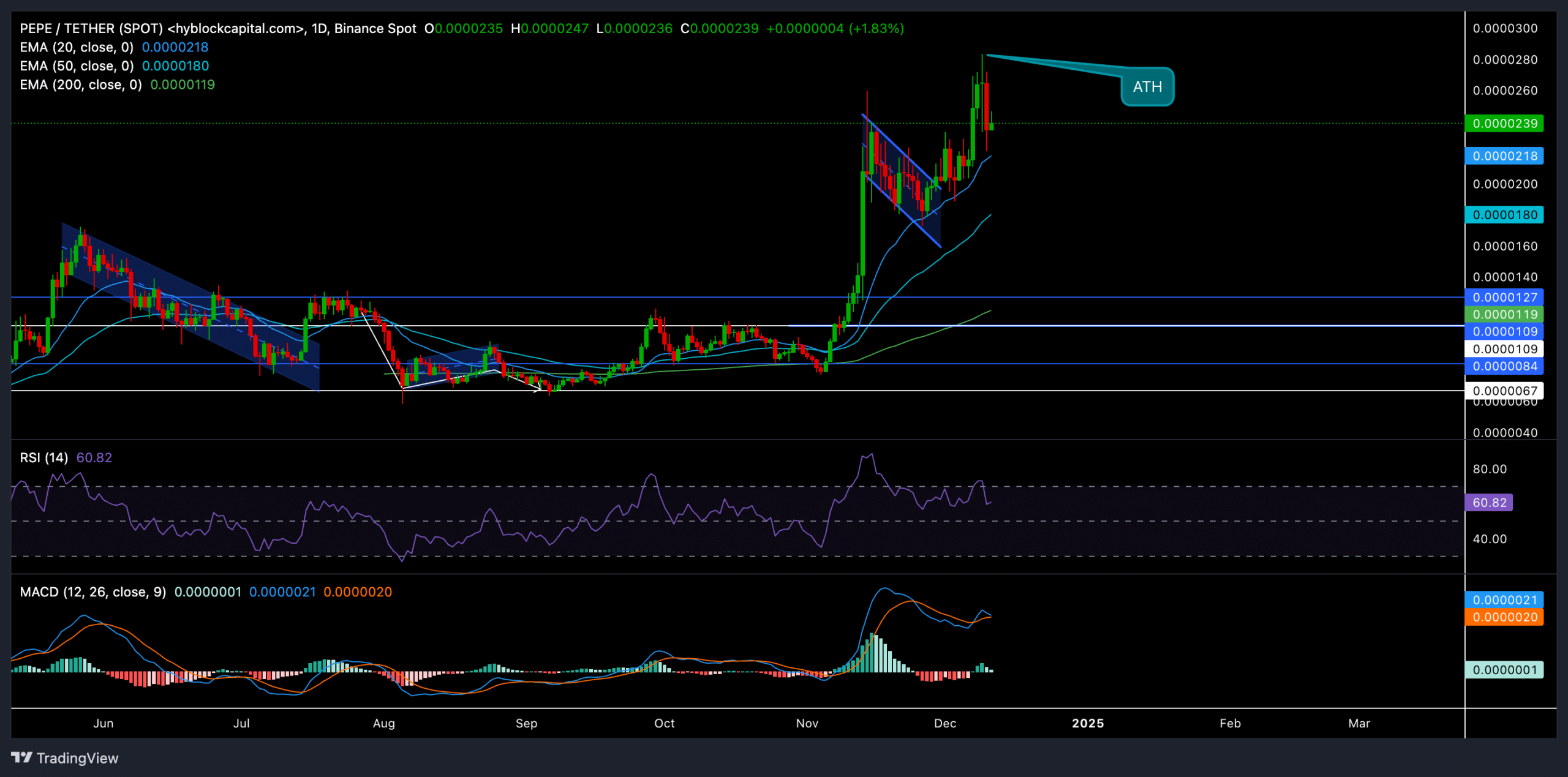

PEPE experienced a massive surge of approximately 250% in the last while, peaking at a record high (personal best) of $0.0000284 on December 9th. This rapid expansion occurred during the general upswing of meme-based cryptocurrencies and Bitcoin’s continued optimistic trend on its price charts.

As I analyze the current market situation, at the moment of my observation, PEPE is trading at $0.0000239. Notably, its 20-day Exponential Moving Average (EMA) seems to be offering robust support during this recent correction. If we continue to observe a persistent rebound from this level, it could catapult the price into a phase of price discovery. This dynamic could potentially lead PEPE to reach a new All-Time High (ATH).

Critical levels to keep an eye on

Recently, following its all-time high (ATH), the price of PEPE has fluctuated between $0.000018 and $0.0000247, indicating a greater degree of uncertainty in the market.

The key levels to watch out for are –

Support: The $0.000018-$0.00002 range, aligned with the 20-day EMA, is a critical support zone for buyers. A dip below this range could invalidate the prevailing bullish trend, exposing the token to downside risks towards $0.000015.

Overcoming the $0.000025 barrier in a strong move might pave the way for buyers to aim for the previous all-time high (ATH) at $0.0000284. Breaking through this level could potentially initiate a longer bullish trend, possibly taking the price up to $0.00003.

Based on the technical indicators we’re analyzing, there appears to be a tentative positive outlook. At the moment, the Relative Strength Index (RSI) is around 61, indicating a moderate level of bullish energy. It seems that we’re not yet in overbought territory, but it’s important to note that a period of consolidation could be on the horizon at these current levels.

The MACD had not yet completed a full downward crossover, suggesting possible short-term selling influence. But remember, it’s advisable to watch for the Signal line to steady up before anticipating a change in trend direction.

Derivatives data revealed THIS

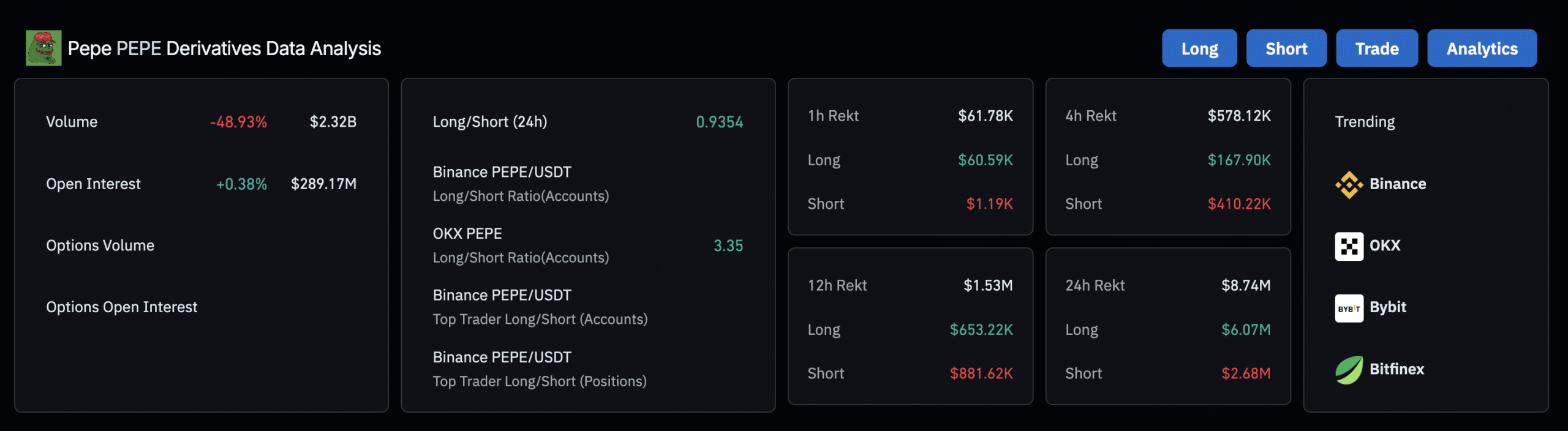

In my analysis, I’ve observed a significant decrease of approximately 48.93% in trading volume over the last day. This drop suggests a diminished level of market activity following the recent surge, which could indicate that traders are taking a pause after the latest rally.

The Open Interest increased by about 0.38%, suggesting a modest increase in cautious trading activity. Meanwhile, the long/short ratio overall leaned slightly towards neutral with a value slightly less than 1. In contrast, on OKX, the long/short ratio indicated a clear bullish tilt as it was significantly more than 3.

In summary, the total liquidations during a 24-hour period reached $8.74 million. This was made up of $6.07 million in long liquidations and $2.68 million in short liquidations. The significant amount of long liquidations indicates that the recent price adjustment caught many over-leveraged long traders by surprise, potentially leading to their positions being liquidated.

The persistent upward trend of Bitcoin might fuel a prolonged surge in the value of the meme coin, PEPE. Yet, it’s crucial for traders to exercise caution as PEPE’s significant volatility may result in sudden price drops.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- AUCTION/USD

- Solo Leveling Arise Amamiya Mirei Guide

- See Channing Tatum’s Amazing Weight Loss Transformation

- Fire Force Season 3: Release Date and Plot Revealed!

- How to Install & Use All New Mods in Schedule 1

2024-12-12 12:07