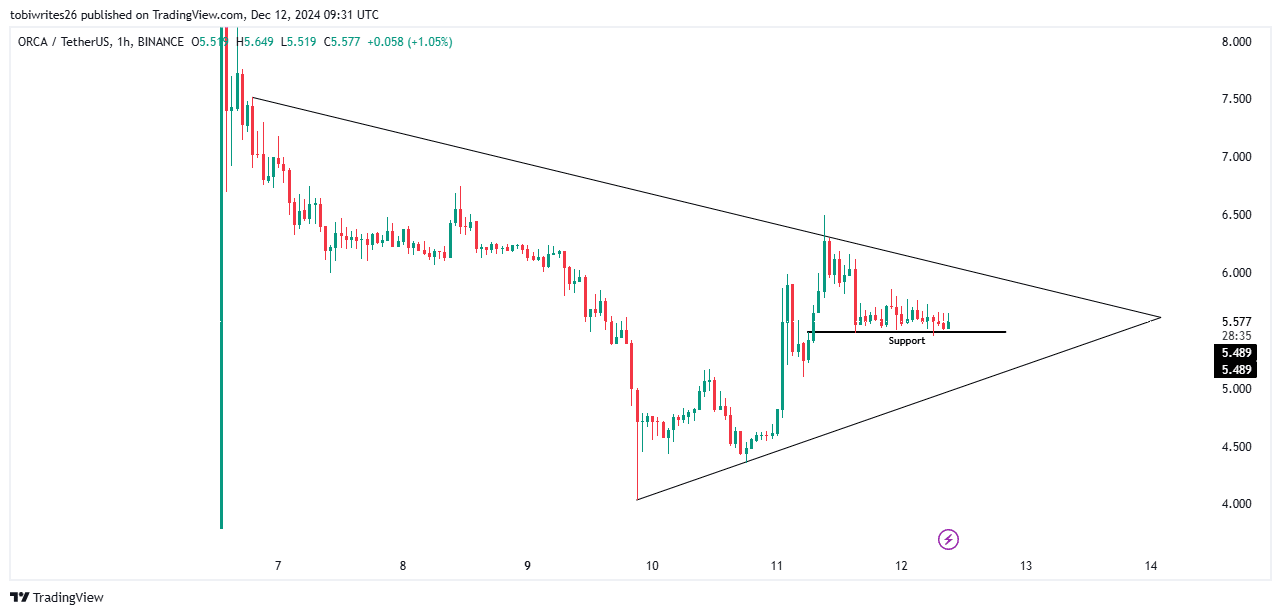

- ORCA crypto was trading within a symmetrical triangle pattern at press time.

- There was adequate buying pressure from market participants.

As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I find myself intrigued by Orca [ORCA] at this juncture. The symmetrical triangle pattern it has formed suggests a bullish overall structure, but the recent decline has left me slightly concerned. However, the increased buying pressure and sustained momentum from market participants offer hope for an impending rally.

Orca [ORCA] has recorded a 15% gain over the past week due to increased market interest.

Nevertheless, the force propelling its rise seems to have weakened, leading to substantial selling that resulted in a 6.73% decrease in price over the past 24 hours.

Regardless of the drop, AMBCrypto’s examination hinted at a potential recovery for ORCA, even at its present prices.

Orca crypto: Rally now depends on…

The general shape of ORCA’s organization stayed optimistic as it moved inside an ascending triangle formation, where the value fluctuated between clearly marked areas.

Yet, inside this symmetrical triangle, ORCA’s value appears to be decreasing and is currently rebounding from a crucial support level, a point in the past that typically halts any additional falls.

If the current backing sustains and stimulates further growth, ORCA might progressively move towards its upcoming significant goal of $7.5.

AMBCrypto examined the general opinion about ORCA’s future direction by looking at various technical indicators and blockchain statistics. These additional data points offer valuable clues regarding ORCA’s possible trend.

Momentum is gradually building

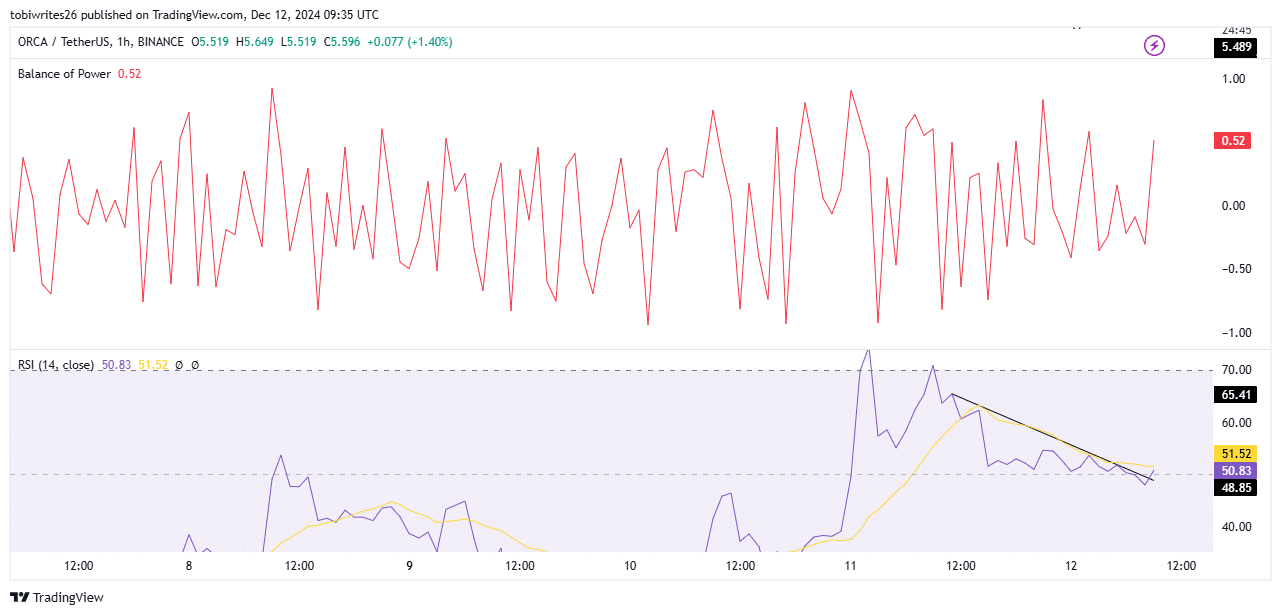

By examining market trends, AMBCrypto discovered which group has the most impact, finding that at present, the bullish investors hold the dominant position.

The conclusion was backed up by the Balance of Power (BoP) indicator, a tool that gauges market trends by examining the ratio between buying and selling activity to predict possible shifts in direction.

At the time of writing, the BoP surged to 0.52, reflecting the market’s sustained strength.

In my analysis, I’ve observed that the Relative Strength Index (RSI) has breached its previous trendline pattern. Earlier, when it dipped below the neutral zone, it signaled a market downturn.

Conversely, it’s now surged back up to 50.83, indicating a potential buying opportunity and suggesting increased demand that may push the asset price even higher from its present position.

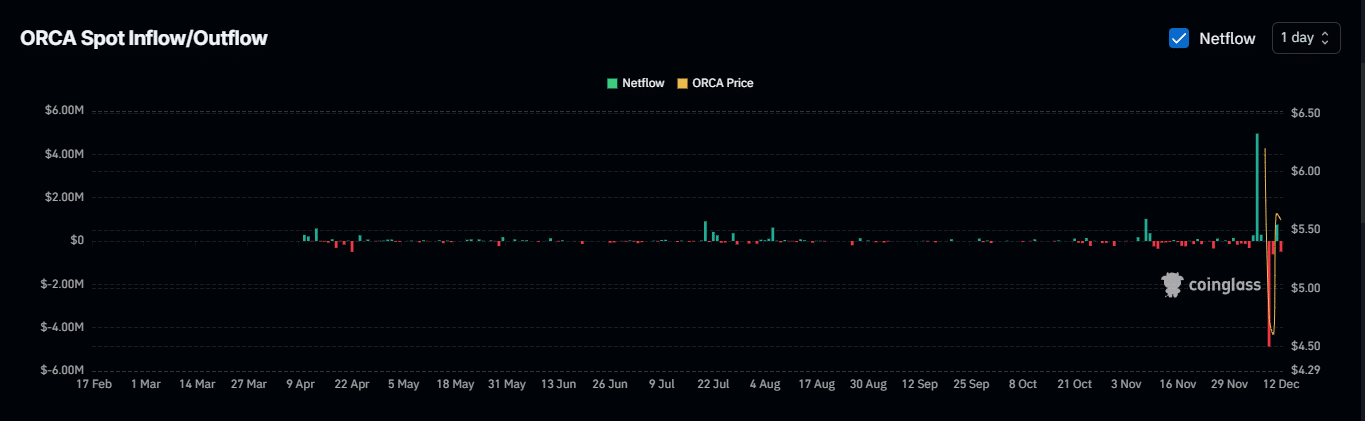

Investors turn bullish

It appears that investors are shifting their ORCA assets from exchange storage to personal wallets, with a cumulative amount of $444,650 transferred thus far.

Transferring assets from exchange wallets to personal wallets usually indicates a rise in investor trust or confidence. It’s an indication that these investors prefer a long-term investment strategy, showing no immediate plans to offload their holdings.

Read Orca’s [ORCA] Price Prediction 2024–2025

At the same time, we’ve seen a substantial increase in Open Interest, which is an indicator of derivatives trading volume. Over the past day, this figure has grown by approximately 14.24%, bringing it up to $18.64 million.

If this upward trend continues, it will further strengthen the asset’s bullish outlook.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-13 09:43