- Binance exchange saw strong growth in stablecoin inflows, aiding in its market dominance

- A recap of BSC network activity and BNB’s price action is worth highlighting too

As a seasoned crypto investor with years of experience navigating the volatile digital asset market, I can confidently say that Binance’s dominance has been nothing short of impressive this year. The exchange’s strategic move towards stablecoins seems to have paid off handsomely, as it now controls a staggering 67% of the total stablecoin reserves, making it the most liquid exchange in the market. This liquidity translates into a significant impact on crypto flows and demand.

The influence and dominance of Binance in the cryptocurrency market appears to be growing stronger as the market becomes increasingly active. Notably, it’s been observed that the platform has experienced an increase in the use of stablecoins recently, which suggests a rise in its overall liquidity.

Based on a recent study by CryptoQuant, about two-thirds (67%) of all stablecoins deposited across all platforms are being held by Binance. This means that Binance is the exchange with the highest liquidity level. As a result, it plays a significant role in shaping the inflow of cryptocurrencies.

In 2024, it’s been reported that Binance has received approximately $22 billion in inflows of stablecoins, making it the leading force driving demand in the cryptocurrency market this year. This surge in demand has technically boosted Binance’s transaction activity, which should lead to increased revenue.

Binance smart chain network activity recap

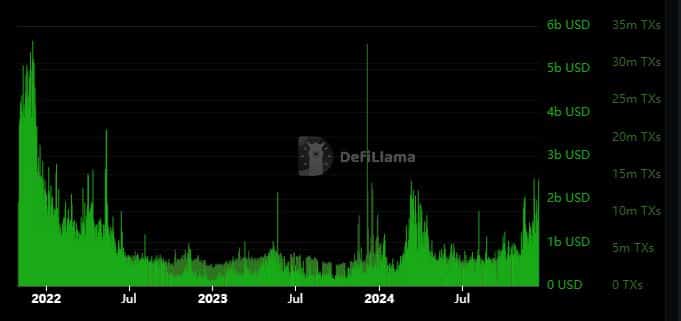

As a researcher, I’ve observed an impressive growth in the stablecoin marketcap within the Binance Smart Chain (BSC) throughout 2024. The smallest marketcap for stablecoins, which I noted on January 21st, was a modest $32.71 million.

This was courtesy of a short-lived dip, which quickly recovered back above $4 billion.

Over the past three months, the market capitalization of the stablecoin issued by the BSC (Blockchain Service Cooperative) saw a substantial increase. Initially valued at approximately $5.01 billion in early November, it reached $6.60 billion by December 13. It’s important to mention that this growth largely reflects the network’s liquidity rather than the exchange itself.

The volume of BSC transactions has seen significant growth during Q4 as well. In fact, just within the past day, the volume peaked at an impressive $2.43 billion, making it the second occasion this month that it crossed the $2 billion threshold.

Even though there’s been a significant increase recently, trading volume hasn’t yet reached the record highs seen during the peak of the bull market in 2021. Concurrently, the number of daily transactions has risen from around 3 million in September to over 5 million.

BNB’s price recap

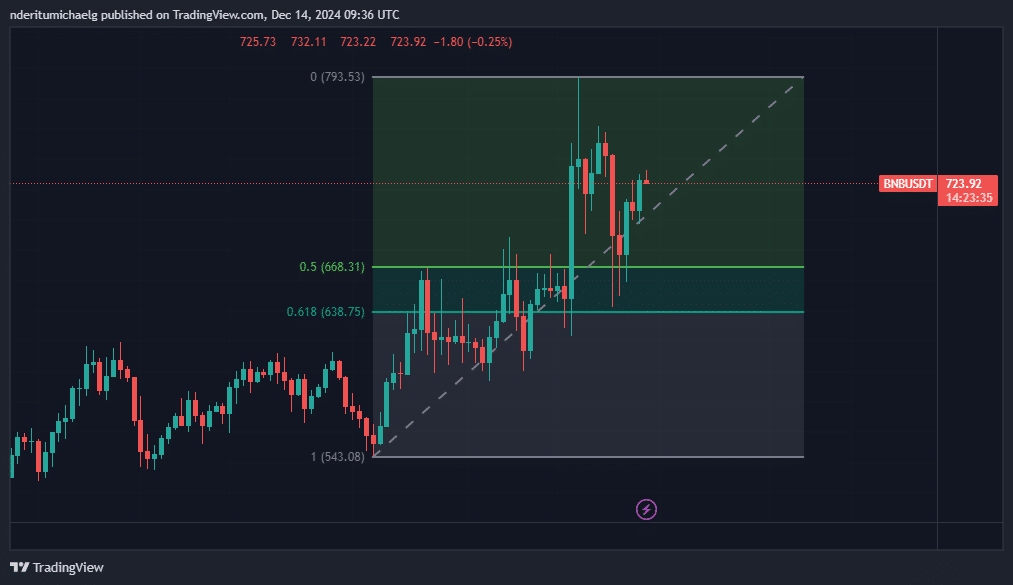

In simple terms, it appears that BNB has significantly profited from the positive market trends in 2024 due to its bullish nature. However, when looking at shorter timeframes, BNB started this week with a bearish trend, evident in a steep decline from its recent all-time high.

Initially, the price plummeted to as low as $642, leading to a temporary halt within a significant Fibonacci retracement level. Subsequently, the price rebounded and surpassed $700 again. At the moment of this composition, the altcoin was worth approximately $723.91.

The dip in the price falling short of $800 previously had appeared to dampen spirits, but the altcoin’s resurgence during the latter part indicates a possibility that it might surge beyond this mark before the month concludes.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-15 06:15