- AVAX has declined by 5.13% over the past 24 hours

- With a bearish crossover, Avalanche could decline as it remains stuck in a consolidation range.

As a seasoned crypto investor with battle-hardened nerves and a portfolio that’s seen more volatility than a rollercoaster ride, I must admit, AVAX’s recent dip has caught my attention. After witnessing its impressive run to $55, it’s disheartening to see it slide back down to the $40 range.

Following a prolonged rise and reaching its latest peak at $55, Avalanche (AVAX) has been finding it challenging to sustain its positive trajectory.

Consequently, the value of this altcoin fell to reach a minimum of $40. For the last fortnight, Avax’s trading activity has been confined within a narrow band, ranging from $47 to $55.

Currently, at the moment, Avalanche is being traded at $49.49, representing a 5.13% decrease in its day-to-day performance. Moreover, it’s important to note that over the course of a week, Avalanche has experienced a drop of 2.93%.

Prior to this, Avalanche had been on an upward trajectory, hiking by 55.26% over the past month.

The current market conditions raise questions about Avalanche’s future price movement.

What AVAX’s bearish crossover means

As reported by AMBCrypto’s analysis, at the current moment, there is significant downward pressure on Avalanche (AVAX), with a surge in selling activity. Meanwhile, the bullish trend for AVAX appears to be weakening as bears attempt to seize control of the market.

Over the last 24 hours, a downward trend has been reinforced by a bearish signal on the Stochastic Relative Strength Index (RSI). This signal, occurring at 30.09, suggests a brief period of increased bearishness in the short term.

It reflects a shift in sentiment from bullish to bearish, suggesting that sellers may gain control.

The change becomes more apparent when SMA crosses above the price, indicating a decrease in bullish energy. Consequently, it might suggest that the market is preparing for a period of correction.

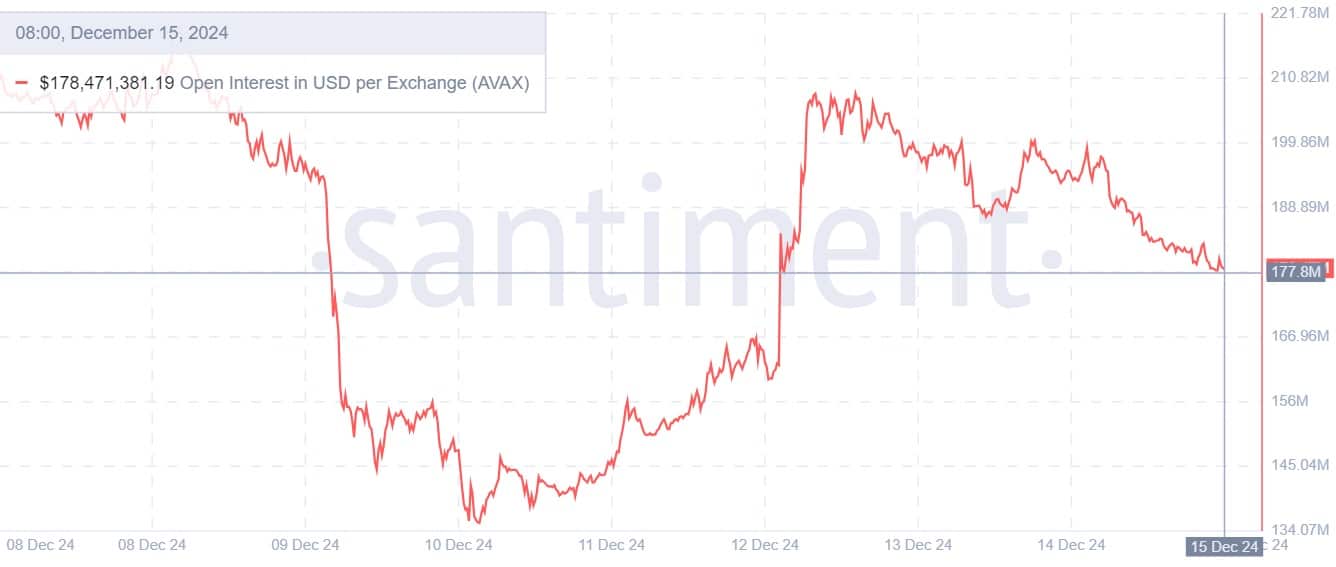

Over the last seven days, the total value of outstanding contracts for Avalanche on each exchange decreased, going from approximately $219.5 million to around $178.4 million.

A decrease in Open Interest indicates that investors are adjusting their positions, as they choose to exit rather than enter the market, with fewer newcomers willing to join at this time.

The dominance of pessimism towards AVAX is particularly noticeable among the big players. Consequently, there’s been a significant decrease in the amount coming in from large holders, dropping from 8.55 million to 2.12 million.

A significant drop suggests that the rate of investment from ‘whales’ (large investors) in this asset has decreased, indicating they are not currently purchasing this altcoin.

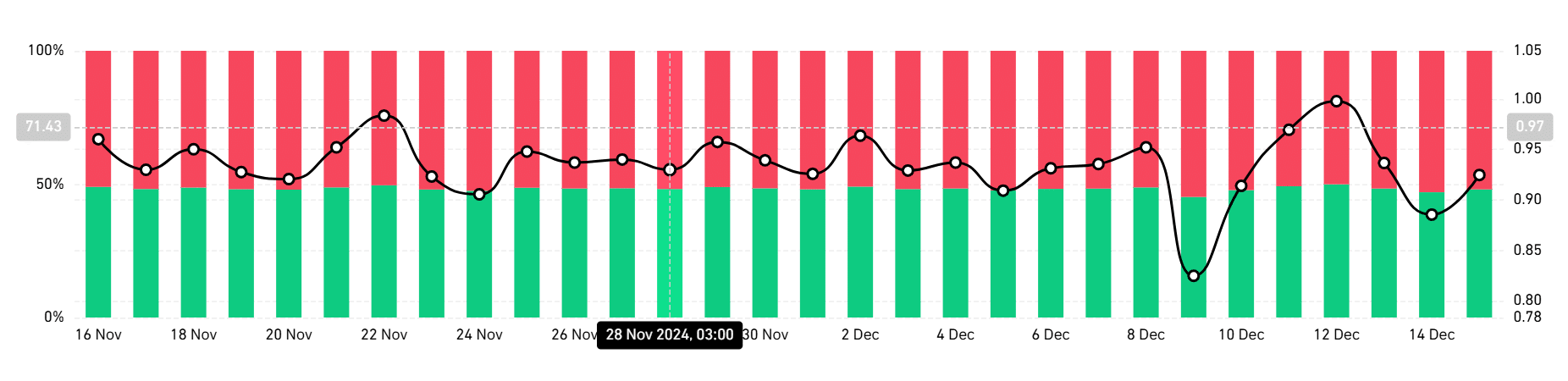

In summary, there’s been a significant prevalence of short selling in the market as indicated by daily charts, with short sellers holding about 51.96% of all positions, according to long/short ratio analysis.

As an analyst, I observe a prevalent trend where many investors are adopting a short position strategy. This suggests that a significant number of market participants anticipate a potential price decrease.

In simple terms, at the moment, Avalanche’s short-term trend seems to be leaning towards a downturn, which can be observed through a bearish crossover.

Read Avalanche’s [AVAX] Price Prediction 2024 – 2025

Based on the current market trends, there’s a strong possibility that Avalanche (AVAX) may continue its existing direction, potentially causing its price to dip towards around $43.

Moving forward, I anticipate that a breakout from the current consolidation period could potentially propel Avalanche’s price back up to $55. However, it’s worth noting that this level has presented resistance in the recent past over the last couple of weeks.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-15 17:11