- Bitcoin outflows from exchanges peaked at $148 billion when it hit $88K, establishing a strong support base.

- Now, an even more robust base has emerged, a signal you should approach with caution.

As a seasoned crypto investor with a decade of experience under my belt, I’ve seen my fair share of market highs and lows. The recent surge in Bitcoin (BTC) has been nothing short of breathtaking, especially considering its meteoric rise from $67K to $102K in just 40 days. However, the current situation is a classic case of “be careful what you wish for,” as the influx of stablecoins into exchanges could be a warning signal that investors are cashing out at this golden entry point.

The limited issuance of 21 million units for Bitcoin (BTC) has propelled its total market value above the $2 trillion mark, with a single BTC currently worth around $102,383. This underscores just how significant the game has become.

Despite Bitcoin’s current value being significantly less than the combined worth of century-old assets such as bonds and real estate ($450 trillion), its recent surge from $67K to $102K within a span of 40 days suggests an imminent future that’s hard to overlook.

But, as is often the case with fast gains, the short-term outlook for Bitcoin is far from certain.

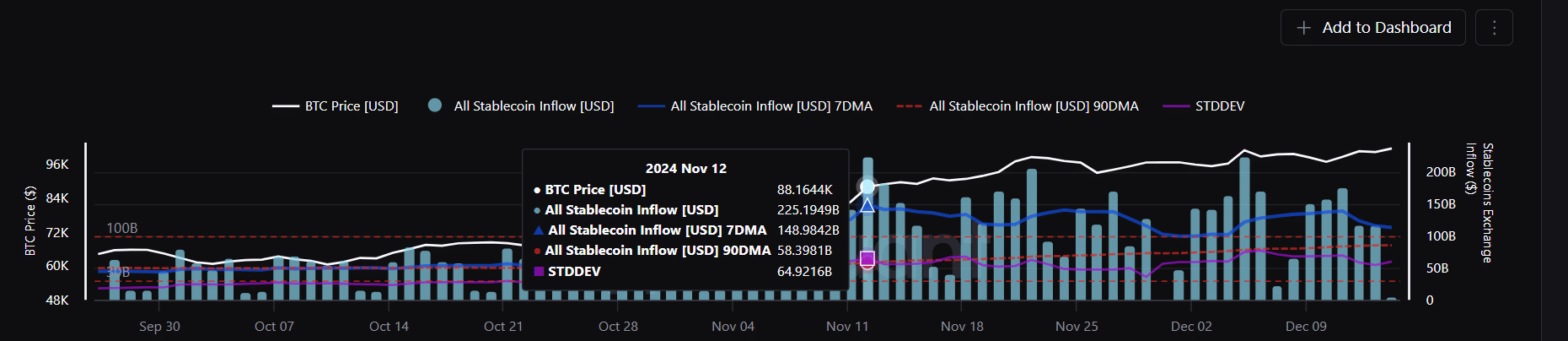

As an analyst, I’ve noticed that a staggering $148 billion worth of stablecoins have poured into the market when Bitcoin hit the $88K mark. These savvy investors have managed to secure a substantial 15% profit margin at this price point, making it seem like a lucrative entry opportunity for others.

From my experience as a crypto investor, I’ve noticed that the allure of cashing in on substantial profits can be hard to resist. This can lead to a high-pressure scenario, pushing my risk tolerance to its limits as the market prepares for possible selling waves.

Massive stablecoin influx could be a warning signal

Normally, an influx of stablecoins into cryptocurrency exchanges usually indicates a positive or bullish trend in the market. This suggests that investors are preparing to purchase Bitcoin once the market’s volatility decreases.

During the election, it was especially noticeable how a surge, often referred to as the “Trump effect,” led to an influx of significant funds, resulting in approximately $2 billion of new USDT being created.

From my personal perspective as a crypto investor, the increased flow of stablecoins seemed to fuel a significant rise in Bitcoin’s demand. This surge propelled Bitcoin’s price to an astounding $88K within just a week.

At this price level, the interest in Bitcoin reached its maximum, as around $148 billion worth of stable coins, particularly ERC-20 tokens, poured into trading platforms.

Investors had a strong belief that Bitcoin could surpass $100,000, though this optimism may have subsided after the election-related price increases settled down.

Source : CryptoQuant

This leads us to some intriguing discoveries: Initially, these investors find themselves in a profitable position, which gives them the option to either hold onto their investments or sell them for a gain.

2nd, as the momentum from the recent election wanes, the market is yearning for a new impetus to prevent investors from pressing the ‘sell’ button.

Thirdly, if sales begin, the main concern becomes whether the market possesses enough resilience to withstand the strain.

Even though we’re deep into December, Bitcoin hasn’t managed to surpass its previous record peak, a feat it achieved momentarily at around $104,000 about a week back.

Since then, it’s been in a holding pattern, leaving market watchers divided on its next move.

Are Bitcoin investors losing their risk appetite?

It’s evident that the $88,000 price point holds a strong appeal as it served as a viable entry point. This was further illustrated when Bitcoin experienced a slight dip of approximately 5% to $90,000, four days following its initial test at the $99,000 level.

However, prior to any significant drop, a 4% recovery the following day swiftly restored its positive status. Subsequently, three times attempts were made by the ‘bears’ (those who predict falling prices) to drive Bitcoin down to that same level, yet all efforts have proven unsuccessful.

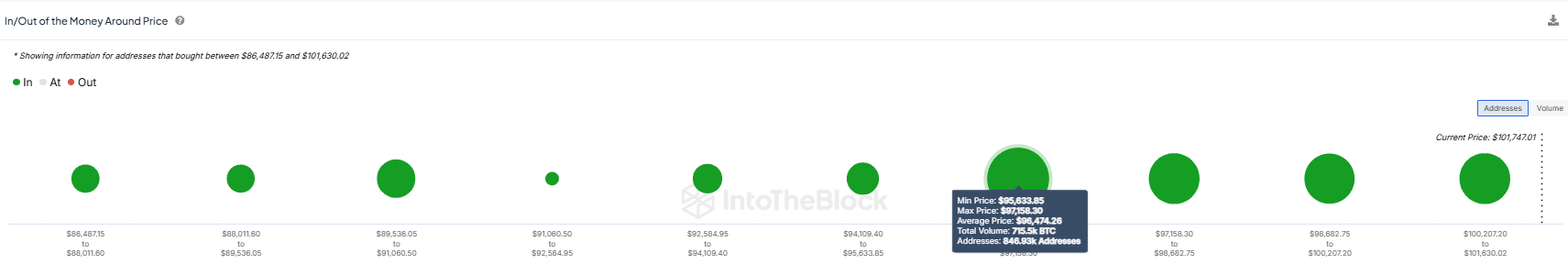

As a result, a new bottom has formed between $94K and $96K.

What makes this notable is that the graph demonstrates a substantial increase in stablecoin influxes, as approximately $131 billion entered exchanges at this particular price level.

Moreover, an astounding 840,000 addresses (the most at this level) collectively own approximately 715,500 Bitcoins.

Source : IntoTheBlock

Maintaining a position in Bitcoin becomes crucial as it needs to stay above the $94K to $96K range, as this area offers robust backing.

On the one side, it appears that established investors are taking up the role of buyers to offset the downward trend in the market.

Conversely, there’s a noticeable change: Investor enthusiasm for speculation seems to be decreasing. As Bitcoin’s price rises, an increasing number of investors appear to be adopting a more conservative stance, regarding the price as excessively high to enter.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This pause suggests that individual investors might be holding back, hoping for a price drop before jumping into the market. Notably, the stablecoin sector seems to indicate that the $96K mark could be a promising entrance point.

This could be something to keep an eye on in the coming days.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-15 20:08