- Spot Bitcoin ETFs absorbed 4,349.7 BTC, far surpassing miner supply this week.

- Institutional demand tightens liquidity, amplifying Bitcoin’s price sensitivity and volatility risks.

As a seasoned analyst with years of experience navigating financial markets, I find myself increasingly captivated by Bitcoin’s metamorphosis into a macroeconomic asset of choice for institutions. The staggering inflows into spot Bitcoin ETFs this week have left me awestruck, as they dwarf the weekly miner supply output. This trend underscores the shifting landscape of our financial world and raises critical questions about Bitcoin’s ability to meet escalating demand.

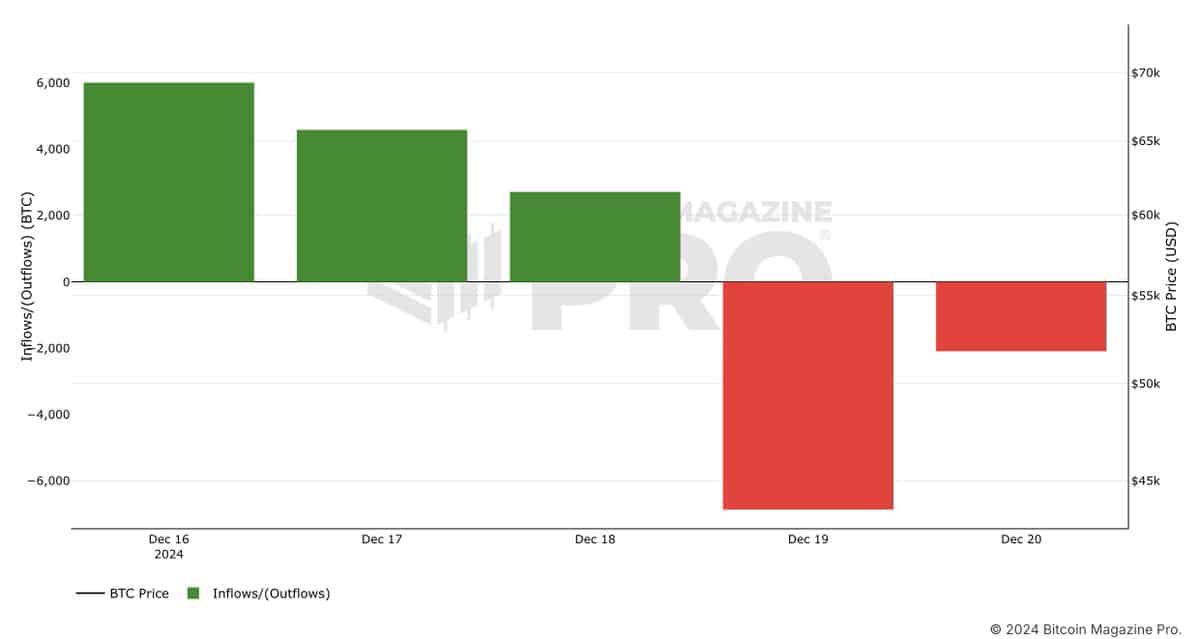

The demand for Bitcoin from institutions remains robust, persisting even through periods of price fluctuations. Over the last week, Bitcoin spot ETFs attracted approximately 4,349.7 Bitcoins, valued at around $423.6 million – a figure almost twice as much as the 2,250 Bitcoins mined during the same timeframe.

This imbalance highlights the growing dominance of institutional investors in shaping market dynamics and raises critical questions about Bitcoin’s ability to meet escalating demand.

Bitcoin ETFs absorb liquidity faster than miners supply

Bitcoin ETFs are proving to be crucial for institutions seeking involvement in Bitcoin. They provide a less complex option compared to directly holding the asset. This past week has shown shifting trends, as ETFs have gathered more Bitcoin than what miners can currently produce at this time.

The divergence between ETF inflows and miner output reflects tightening liquidity in Bitcoin markets. While miners grapple with post-halving challenges, ETFs continue to absorb a significant portion of the circulating supply.

Despite the recent falls in Bitcoin’s price, it seems that institutional investors remain resolute in their long-term investment strategy regarding Bitcoin. This unwavering stance strengthens the currency’s allure for purposes beyond simple speculation, highlighting a broader recognition of its potential role in macroeconomics.

Institutional inflows dominate

During the month of December, there was a staggering inflow of $5.5 billion into Bitcoin ETFs that focus on spot trading. This has significantly increased the disparity between the need for and availability of Bitcoins. The sudden increase in demand clearly showcases institutional faith in Bitcoin’s long-term potential, even amid temporary price adjustments.

On the other hand, this imbalance might lead to increased market turbulence, since restricted liquidity can make prices more responsive to changes in investor feelings.

As I delve deeper into the intricacies of the Bitcoin market, it’s clear that there’s an escalating dependence on institutional capital. This shift in dynamics underscores a transformation in Bitcoin’s market structure.

Liquidity squeeze heightens volatility risks

The continuous difference between ETF investments and mining output has resulted in a tightening of market liquidity, making Bitcoin more vulnerable to price fluctuations.

If demand from institutions stays strong, a limited supply might lead to an increase in prices due to pressure. On the other hand, since many institutional investors own a large portion of the market, their selling could intensify price drops during market declines.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As Bitcoin’s function as a safeguard against economic fluctuations becomes more significant, its market encounters difficulties in maintaining a balance between institutional adoption and stability.

Paying close heed is crucial for investors, as the direction of Bitcoin’s price is more and more impacted by the changing waves of institutional opinion.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- Solo Leveling Arise Amamiya Mirei Guide

- AUCTION/USD

- See Channing Tatum’s Amazing Weight Loss Transformation

- Kim Kardashian Teases New Romance in Latest Dating Update

- Paige DeSorbo and Craig Conover’s Massive Fight Pre-Breakup

2024-12-23 07:03