- The recent Ginger upgrade increased Celestia’s throughput by 5X.

- Despite the update, TIA’s price remained muted — what’s next?

As a seasoned analyst with over a decade of experience in the crypto space, I’ve witnessed numerous projects rise and fall based on their technical upgrades and market sentiment. The recent Ginger upgrade on Celestia, a scalable data availability solution for Ethereum L2 transactions, has undoubtedly been a game-changer. Boasting a 5x increase in throughput, Celestia is making waves in the industry with its impressive performance.

However, it’s disheartening to see TIA, the native token of Celestia, failing to capitalize on this positive development. Despite the strong fundamentals and low fees, TIA’s price remains muted, suggesting a lack of market interest and bullish sentiment. This is not uncommon in the crypto world, where technical achievements don’t always translate into immediate price appreciation.

That being said, I believe that this could present an excellent opportunity for long-term investors who are willing to weather the storm. The current bearish sentiment and low social traction could signal a buying opportunity for those with a risk appetite. However, it is crucial to remember that the crypto market is unpredictable, and even the most promising projects can face unexpected challenges.

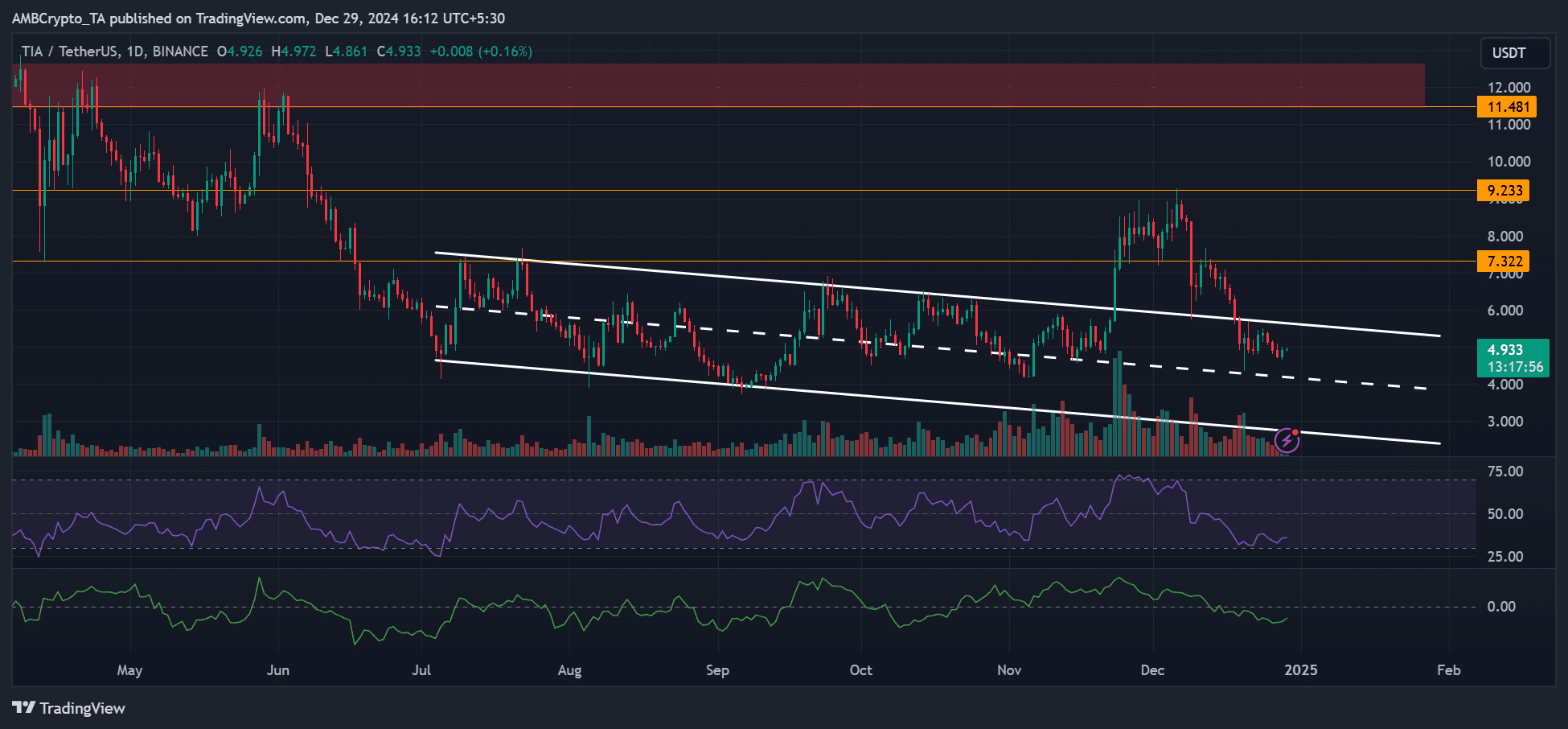

In terms of price predictions, if TIA manages to break out from its current channel, we could see a potential 60% gain towards $7.3. On the other hand, if it fails to do so, we might witness further declines, potentially dropping to the channel’s lows.

As they say in the crypto world, “buy the dip but don’t catch the falling knife.” So, tread with caution and always do your own research before investing. And remember, if you can’t explain it simply, you don’t understand it well enough!

As an analyst, I can attest that Celestia’s [TIA] latest Ginger upgrade, which has effectively doubled the data accessibility, is indeed proving beneficial in streamlining the processing of Ethereum [ETH] L2 transactions. This upgrade significantly enhances efficiency and reliability within our system.

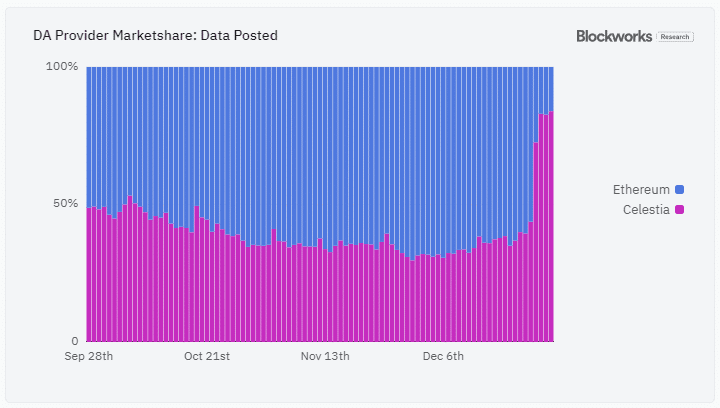

As a crypto investor, I’ve been following the developments at Celestia closely, and the recent upgrade has truly been a game-changer. According to Blockworks Research Analyst Dan Smith, this update led to a whopping 5x increase in throughput – a remarkable improvement indeed!

Yesterday, Celestia reached an unprecedented peak – it processed approximately 11.85 gigabytes of data, with EclipseFND contributing nearly all of it. This is five times more data than what was posted to Ethereum blobs and at a fee that’s 99.6% lower per megabyte of data.

Impact on TIA price

For those who are new to this, Celestia’s Data Availability (DA) function offers a scalable method for storing and validating transaction data outside the blockchain, particularly for L2 transactions.

Besides, Celestia is currently the cheapest DA provider for ETH L2 transactions.

Smith thinks that Celestia’s combination of affordability and high transaction volume may make it the preferred choice for other layer 2 transactions among decentralized applications (DA).

Even though there was a favorable announcement about TIA’s native token, it displayed bearish indications across its on-chain data and pricing graphs.

TIA’s social engagement and positivity scores have fallen to their lowest points since before the significant rally in November, indicating decreased market enthusiasm and a predominantly negative outlook. This suggests that a substantial market recovery may be delayed over the next few weeks due to low investor interest and bearish sentiments.

But is the weak sentiment a great risk-reward buying opportunity?

On the price graphs, TIA experienced a significant drop, approximately 50%, following its recent high point. This decline wiped out all the advancements made in November. The stock fell from $9.2 to a bottom of $4.3, before briefly hovering above the previous trading range.

Over the last few days, I’ve noticed a downtrend in the market, as indicated by the falling Daily Relative Strength Index (RSI) readings and the southward trajectory of the Chaikin Money Flow (CMF). This seems to suggest that demand has been waning, and there appears to be an increased outflow of capital.

Read Celestia [TIA] Price Prediction 2025-2026

Based on my years of experience analyzing financial markets, it appears that if the technical chart indicators do not reverse soon, TIA could break through its mid-range and potentially fall to the channel’s lows. This is a common pattern I’ve observed in many market cycles, so it’s important for investors like myself to keep a close eye on the situation and make adjustments accordingly to protect our investments.

From another perspective, if we see a strong breakout beyond the current range, it could push the price towards $7.3, potentially yielding a 60% increase.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-30 08:08