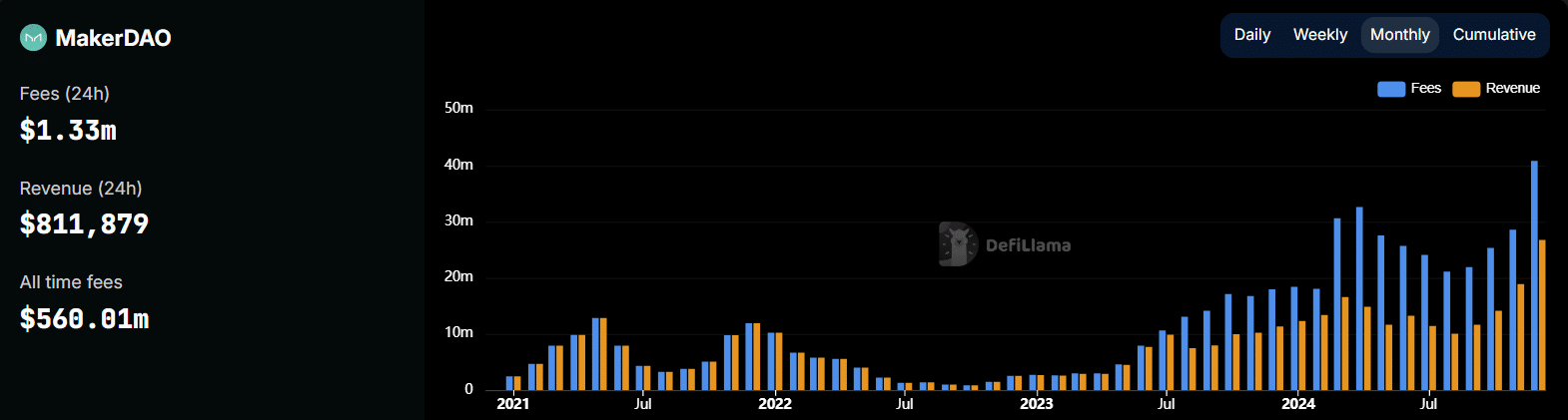

- MakerDAO monthly fees and revenues have surged to record highs, suggesting increasing network usage.

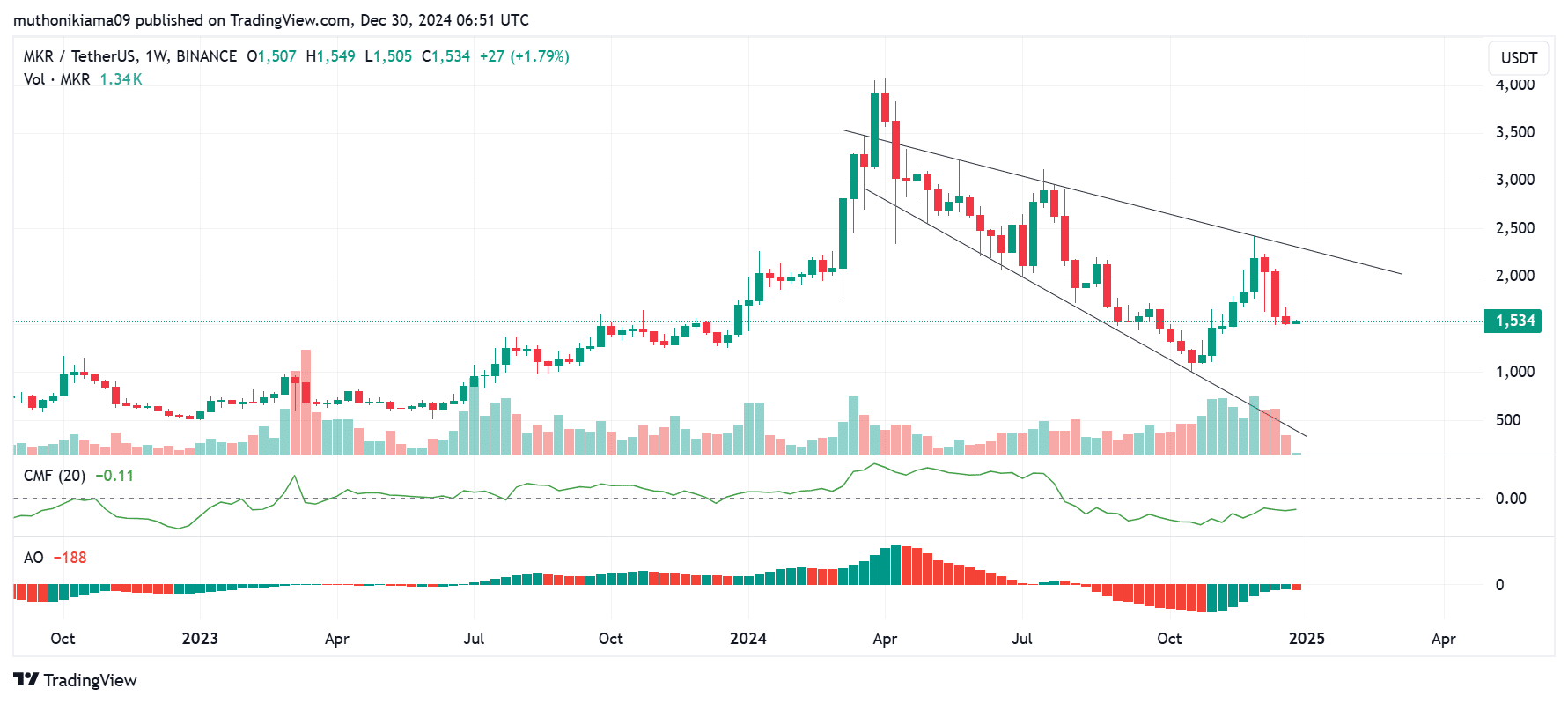

- MKR’s weekly chart shows mixed signals as the altcoin traded within a falling broadening wedge pattern.

As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I have learned to read between the lines and analyze trends to make informed decisions. Looking at MakerDAO (MKR), the network’s growth is undeniable, with monthly fees and revenues reaching record highs, indicating increasing usage. However, the altcoin’s performance in terms of price has been underwhelming compared to other alts this year.

The weekly chart for MKR shows mixed signals, trading within a falling broadening wedge pattern, which could suggest a bullish reversal if buyers enter the market. Yet, the Chaikin Money Flow (CMF) and the Awesome Oscillator (AO) indicate that sellers have been in control of the price action for quite some time now.

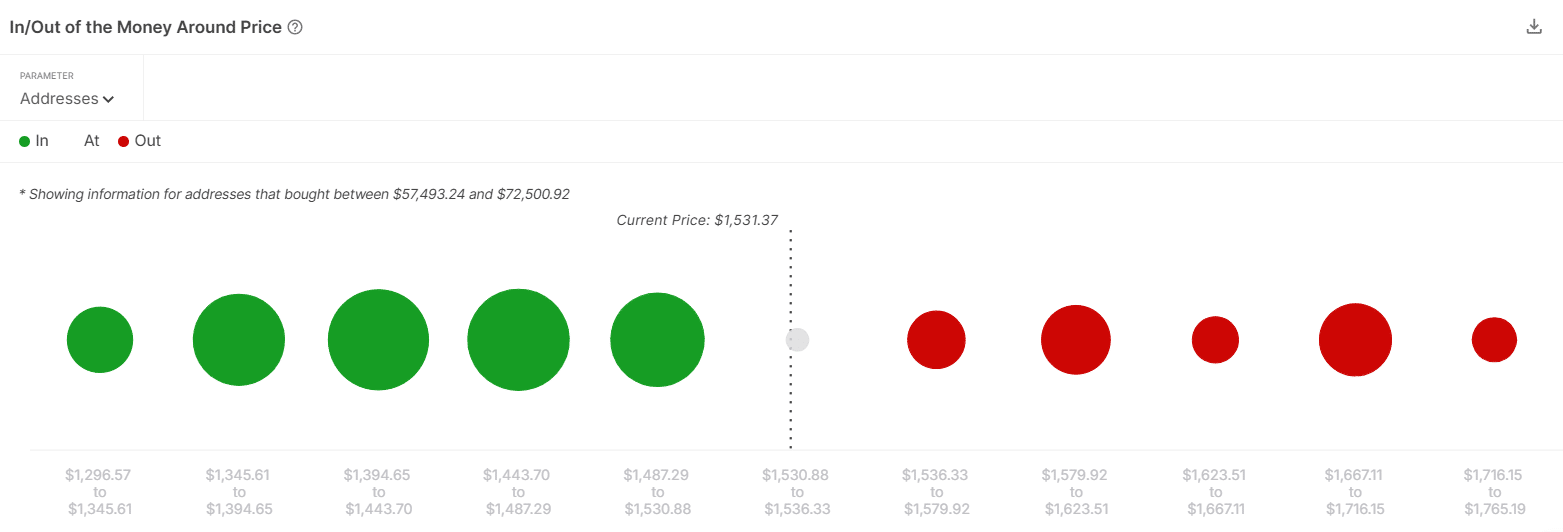

The demand zone at $1,440-$1,480 could offer support if MKR drops, while a rally past $1,700 might face resistance due to selling pressure from addresses holding MKR between $1,667 and $1,716. The declining open interest suggests that speculative activity around MKR has waned, which could result in price consolidation or even further bearish trends.

All things considered, while I am optimistic about the growth potential of MakerDAO as a network, I find it challenging to be overly bullish on its short-term price action given the current market conditions and technical indicators. But hey, remember, investing in crypto is like trying to catch a greased pig at a county fair – you never know what’s going to happen next!

At the moment, the Maker token (MKR) is being exchanged for approximately $1,523, representing a minor decrease of 0.58% over the past day. Unfortunately, MKR hasn’t kept pace with the top alternative cryptocurrencies this year in terms of performance.

Indeed, its market cap has decreased significantly, falling from a reported $3.66 billion in April to its present value of $1.3 billion.

Despite the weak performance, the MakerDAO network recorded significant growth in December.

As reported by DeFiLlama, the network’s monthly charges have reached an all-time high of more than $40 million, and the monthly earnings have exceeded $26 million as well.

If this trend persists, it might be beneficial for MKR’s value. Nevertheless, the weekly graph of MKR presents ambiguous indications.

MKR price analysis

The product has been moving inside a shrinking, widening triangle shape on its weekly graph. Typically, this formation indicates that the downward momentum might be decreasing, potentially leading to an upward shift in trend, which could be considered bullish.

To counteract the current downward trend in MKR, it’s crucial for investors to start buying. But, the Chaikin Money Flow (CMF) currently stands at -0.11, indicating that such buying activity has not occurred yet.

For the past five months, I’ve noticed that the Crypto Momentum Factor (CMF) has been trending negatively, suggesting that sellers have been dominating the market dynamics and driving down prices.

As a researcher, I observed that the Awesome Oscillator’s findings indicated a persistent bearish momentum. This was evident through the recurrence of negative histogram bars.

The highest point in the widening downward triangle formed by the MKR price movement is a significant barrier of resistance. Should MKR succeed in surpassing this level due to growing buyer interest, it might strive yet again for the 2024 peak that lies above $4,000.

Analyzing key demand and supply zones

The optimal price range for the Maker token is roughly between $1,440 and $1,480, as this is where approximately 2,530 different investors have made their purchases. If the price of MKR were to decrease, these buyers could potentially provide support by defending this zone. In other words, this range might act as a robust foundation for the token’s price.

Instead, moving beyond $1,700 may encounter resistance because there are approximately 1,290 wallets that bought MKR when its price was between $1,667 and $1,716.

These addresses might choose to sell once they become profitable, which could halt the rally.

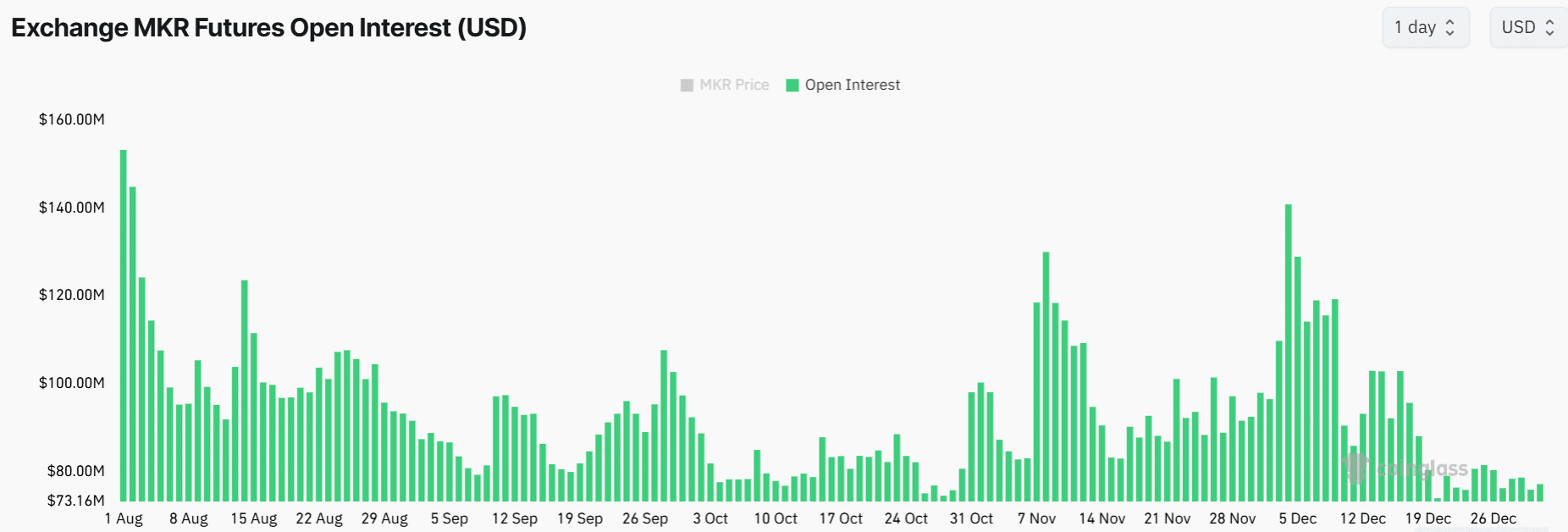

Speculative interest wanes

Based on my extensive experience in the cryptocurrency market, I have noticed that a decrease in open interest often indicates reduced speculative activity around a particular asset such as MKR. In my years of trading and analyzing various digital currencies, I’ve found this pattern to be quite common. When the number of open positions decreases, it usually means that traders are less eager to take on risky bets or hold their positions for long periods. This could be due to a variety of factors, such as uncertainty in market conditions, lack of liquidity, or even changes in the underlying fundamentals of the asset itself. In this specific case, the falling open interest around MKR might suggest that traders are growing cautious about investing in this cryptocurrency, possibly due to recent developments or trends within its ecosystem.

Following an all-time high of around $140 million earlier this month, the Open Interest for MKR has significantly decreased to approximately $77 million – a drop of almost 50%.

Read Maker’s [MKR] Price Prediction 2025–2026

The decline indicates a decrease in the number of derivative traders initiating fresh positions on Maker, potentially leading to a period of price stabilization.

As a seasoned trader with years of experience under my belt, I have observed that a decline in the market can often signal a bearish trend. This is especially true when there seems to be a lack of conviction among traders regarding future price movements. Over the years, I’ve learned that such trends are usually indicative of a broader economic uncertainty or pessimism. It’s essential for traders like me to stay vigilant and adapt our strategies accordingly, as market conditions can change quickly and without warning.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-30 14:16