- Terra Classic (LUNC) is eyeing breakout with targets at $0.00058046, $0.00098584, and $0.00139122

- Rising trading volume and cautious bullish sentiment can drive LUNC as traders monitor key support levels

As a seasoned analyst with over a decade of experience in the crypto market, I find myself intrigued by Terra Classic (LUNC). The technical patterns and market indicators suggest that this token could be on the verge of a significant breakout, potentially reaching levels last seen during the bull run of 2021.

The consolidation phase we’re currently witnessing seems to be setting the stage for a potential rally. However, as someone who has seen more than a few market cycles, I can’t help but remember the old adage: “Bull markets climb walls of worry.” So, while there are mixed signals in the charts, it’s important to keep an open mind and stay nimble.

The rising trading volume is a positive sign, indicating increased interest from traders. Yet, the declining Open Interest could suggest some indecision. As always, the derivatives market provides valuable insights into the sentiment of traders, and the current ratio of long and short positions seems to be hinting at cautious optimism.

If LUNC can hold its key support levels and build on its bullish momentum, we might just see it reach those price targets. But remember, in the world of cryptocurrencies, anything can happen – even a whale deciding to go for a swim at the most inconvenient time! So, as always, do your own research and never invest more than you’re willing to lose.

Now, on a lighter note, I can’t help but wonder what kind of whale would be swimming in $LUNC waters. Maybe it’s a Terra-naut, exploring new depths in the crypto market!

Attention is intensely focused on Terra Luna Classic (LUNC) within the cryptocurrency world, as recent analysis suggests the possibility of a significant breakout that could lead to an impressive surge of over 1,100%. Currently, LUNC is trading at $0.0001115 per unit, with a daily trading volume of approximately $23.8 million.

Over the past week, the value of the token increased by approximately 2.20%. However, it experienced a decline of around 2.02% within the last day as well. Currently, with a circulating supply of approximately 5.5 trillion tokens, the market capitalization of $LUNC is about $614 million and some change.

Based on Javon Marks’ examination, past surges in the price of $LUNC reached significant milestones, primarily due to substantial trading volume and market involvement. Presently, the chart indicates a possible repeat breakout that could potentially reach prices of $0.00058046, $0.00098584, and $0.00139122. This is more likely if bullish energy continues to grow under advantageous circumstances.

Technical patterns point to consolidation and potential for upward movement

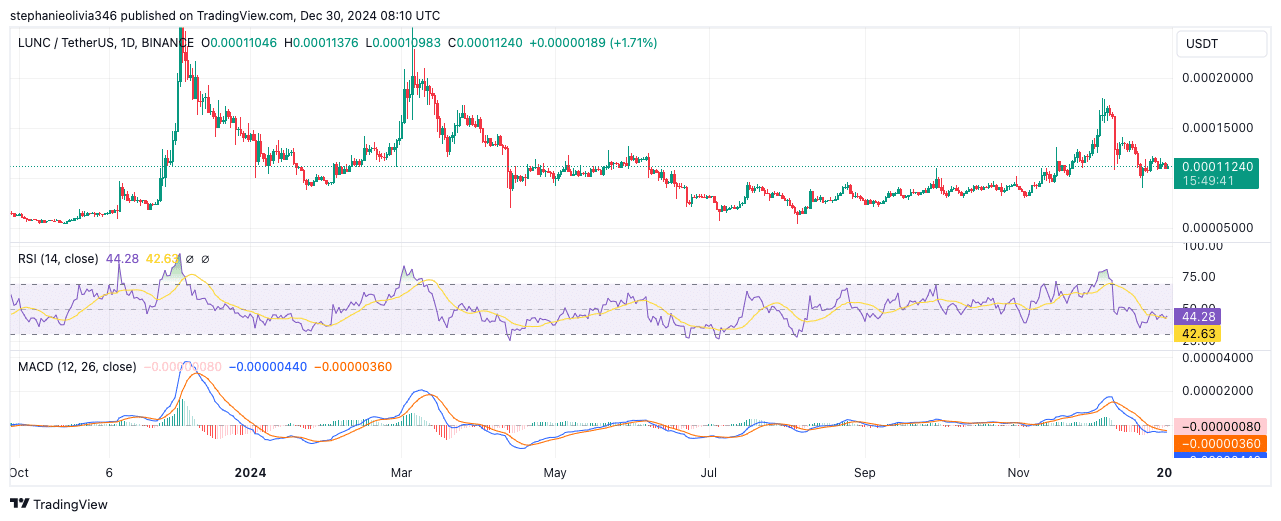

The chart of Terra Classic suggests it’s going through a period of consolidation, which might pave the way for upcoming bullish movements. Analysts have observed this stage before and noted patterns like higher lows and either symmetrical or rounded shapes. Such trends typically signal a potential breakout for LUNC.

Currently, these technical signs are sending conflicting messages. To illustrate, the Relative Strength Index (RSI) stood at 43.49, suggesting a bearish trend yet approaching the neutral zone, hinting at potential market equilibrium or stabilization.

Furthermore, the MACD (Moving Average Convergence Divergence) showed a downward crossover, where the MACD line stands at -0.0000087 beneath the signal line at -0.00000362. This indicates a decrease in momentum’s strength. A significant support level has been found at $0.00009883, and if this holds, it could set the stage for potential recovery.

Derivatives market highlighted greater trading activity

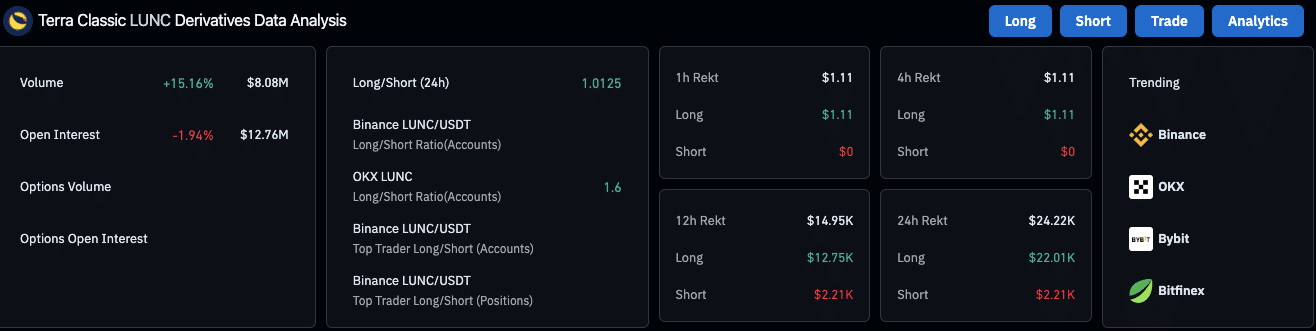

As an analyst, I observed a significant surge of 15.16% in the daily trading volume of Terra Classic’s derivatives market, reaching approximately $8.08 million. This notable increase suggests a growing enthusiasm among traders, hinting at heightened interest and activity within this market.

As an analyst, I observed a decrease of 1.94% in open interest, which now stands at $12.76 million. This suggests that certain market participants have closed their existing positions. The intriguing part is this reduction in open interest coincides with increased trading activity. Such a situation might indicate a degree of uncertainty or indecision among the market players.

Moreover, the long/short ratios indicated a somewhat hopeful yet balanced outlook. On Binance, this ratio was approximately 1.0125, suggesting that the number of long and short positions is nearly equal.

Meanwhile, OKX reports a ratio of 1.6, reflecting a stronger bullish sentiment among its traders.

Liquidation data suggests low leverage activity

Over the past day, a total of $24,220 in positions were liquidated. Of this amount, approximately $22,010 was from long positions, while only $2,210 came from short positions. This suggests that traders betting on price increases (bullish traders) have been experiencing difficulties due to recent market fluctuations.

From my own experience in trading, I can attest that lower liquidation figures often point towards reduced leverage activity. This, in turn, minimizes the risk of experiencing dramatic price fluctuations, a lesson I learned the hard way during some particularly volatile market periods.

Due to these advancements, Terra Classic continues to be an asset that attracts close attention from traders, as they consider the possibility of another price surge.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-31 10:15