- A recent report has revealed an interesting connection between global inflation and the crypto market cap.

- Is the recent ‘dip’ in the crypto market cap just a false alarm, or is volatility looming?

As a seasoned researcher with over two decades of experience in financial markets, I have witnessed numerous market fluctuations and economic cycles. The recent surge in the crypto market cap, followed by its subsequent dip, has piqued my curiosity and sparked some concerns about what lies ahead for 2025.

Having closely observed the intricate relationship between global inflation, interest rates, and the bond market, I believe that we are on the brink of a highly volatile year for both the crypto and bond markets. The U.S. bond market, in particular, is under immense scrutiny given its critical role in funding the government.

With the incoming administration’s focus on hardline policies that could potentially drive inflation, it’s essential to keep a watchful eye on the Fed’s interest rate decisions. A hike in rates would undoubtedly make bonds more appealing, causing the crypto market to take a hit. However, I believe that this dip might be more about speculation than actual changes in borrowing costs.

In my view, investors should consider diversifying their portfolios by allocating some funds to cryptocurrencies as a hedge against potential economic downturns and rising inflation. As for the crypto market’s recovery, it remains uncertain; however, I am optimistic about its long-term growth prospects given the increasing popularity of digital assets among investors seeking better returns.

Lastly, let me share a little joke to lighten the mood: “Why did Bitcoin cross the road? To prove it wasn’t tethered to the dollar!

One year ago, the total value of the cryptocurrency market stood at a robust $1.72 trillion. However, as we speak, that figure has skyrocketed to an impressive $3.27 trillion – marking a significant 90.11% increase since the beginning of the year.

Interestingly, half of that growth came in Q4 alone.

Without a doubt, the “Trump pump” played a crucial role, sparking a tremendous surge of new investment into the cryptocurrency market.

However, 2024 closed with the market still 11% off its peak from mid-December.

As a crypto investor, I can’t help but wonder if this expanding disparity is a hint of what lies ahead as we approach what seems to be the most turbulent first quarter in recent memory.

The crypto market must be prepared for a volatile 2025

Remarkably, a fresh report by Grayscale has revealed an intriguing correlation between the cryptocurrency and bond markets.

The value of cryptocurrencies has grown so much that it exceeds the worth of the United States’ high-yield bond market, nearly doubling its magnitude. It’s evident that investors are increasingly attracted to digital assets as they seek higher yields.

Despite this massive growth, the crypto market’s recent double-digit dip is not just a fluke.

2025’s hint from the Federal Reserve about fewer interest rate reductions has ignited a bit of apprehension, leading to a complex situation for financial markets.

Generally speaking, an increase in interest rates makes bonds more appealing to investors. This is because the return or yield on these investments becomes higher as well.

Given the Federal Reserve’s tendency to reduce interest rate reductions, it’s only logical that investors are gravitating towards bonds due to their consistent yields. This situation might pave the way for a possible revival in the bond market by 2025.

Responding to this, the cryptocurrency market, known for moving opposite to bond prices, has experienced a downturn. However, this drop could primarily be due to speculative trading related to interest rate increases, rather than any substantial modifications in lending rates.

So, is the crypto market poised for a turnaround, or are we looking at a longer dip?

The U.S. bond market under scrutiny

Technically, bonds play a critical role in how the U.S. government raises funds.

Nevertheless, as interest rates increase, they often carry a significant cost – it’s no surprise that President-elect Donald Trump has been vocal about the Federal Reserve’s hesitation to lower lending rates.

As a long-time investor in cryptocurrencies, I find myself closely watching the current political climate and its potential impact on the market. Trump’s hardline policies have been a source of concern for many investors, as we anticipate rising inflation to be a result. However, November’s modest core PCE inflation growth has come as a surprise, suggesting less price pressure than anticipated. This could be a pivotal moment for the crypto market, as it indicates that the economic landscape may not be as volatile as initially expected. As someone who has weathered multiple market cycles, I understand the importance of remaining adaptable and cautious in these uncertain times. It’s crucial to stay informed and make smart decisions based on current data and trends. The crypto market is known for its volatility, but it also offers exciting opportunities for those willing to take calculated risks. Let’s see how things unfold in the coming months.

Furthermore, data released midway through December showed a peak in ongoing jobless claims over the past three years, suggesting possible financial stress for the economy.

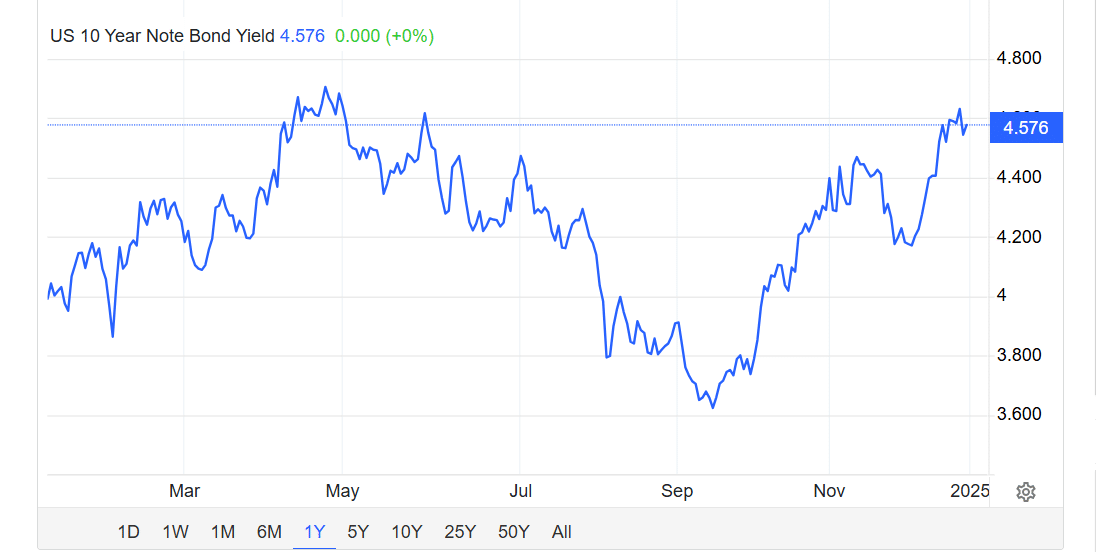

Currently, the rate on a 10-year U.S. Treasury bond has decreased to 4.576%. This is a drop from its most recent high of 4.6% which was seen since late May, marking the peak level.

Due to these changing circumstances, the government might revise its strategy regarding interest rates on loans, considering the heavy burden of debt it currently carries.

Given my personal experiences and observations, it appears that the current financial landscape might be pointing towards a shift in investment strategies, particularly towards cryptocurrencies. As someone who has been closely watching global economic trends for many years, I can’t help but notice the increasing buzz surrounding Bitcoin [BTC] as a strategic reserve. This is especially true in light of potential economic downturns on the horizon. In my opinion, it could be wise to start refocusing our investment efforts towards this digital asset class, given its resilience and potential for growth, even during turbulent times.

Read Bitcoin’s [BTC] Price Prediction 2025-26

2025 is shaping up as a significant milestone for both the traditional bond and digital cryptocurrency markets. As the bond sector grapples with escalating issues, the crypto market appears to offer an attractive investment prospect.

However, the actions taken by the government in response to changes in overall economic patterns, specifically regarding interest rates, will be crucial to observe closely over the next few months.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- AUCTION/USD

- Solo Leveling Arise Amamiya Mirei Guide

- See Channing Tatum’s Amazing Weight Loss Transformation

- Fire Force Season 3: Release Date and Plot Revealed!

- How to Install & Use All New Mods in Schedule 1

2025-01-01 15:04