- The Bitcoin trilemma helps explain why the blockchain has very low transaction speeds

- Improvements in scalability can boost functionality and promote BTC adoption

As a seasoned researcher with years of experience delving into the intricacies of blockchain technology and its applications, I have witnessed the evolution of Bitcoin (BTC) from a niche digital currency to a global phenomenon. Over the past decade, I’ve observed how Bitcoin has navigated the complexities of the blockchain trilemma – striking a delicate balance between scalability, decentralization, and security.

The most recent halving in 2024 marked a turning point for Bitcoin as it solidified its status as a viable store of value and hedge against inflation. Institutions like MicroStrategy have leveraged this mechanism to their advantage, adding more fuel to the fire of Bitcoin adoption. However, one cannot overlook the challenges that lie ahead in the quest for mass adoption – namely, the need for faster transaction speeds and lower fees.

Enter Lightning Network (LN) and other Layer 2 solutions. These innovations hold immense potential for reshaping the usage of Bitcoin by boosting transaction speeds and reducing fees, thereby fostering adoption even for micropayments and casual spending. In my view, LN’s expansion to incorporate stablecoins in 2025 will be a game-changer, making real-world payments using crypto a reality.

Furthermore, the development of Layer 3 solutions such as Impervious and Cosmos promises to unlock new possibilities for blockchain technology. These advancements could transform Bitcoin into not just a store of value, but also a practical medium for exchange – a return to its original vision.

That said, I must admit that sometimes it feels like we’re playing a never-ending game of whack-a-mole with the challenges faced by Bitcoin and blockchain technology. But as long as there are dedicated developers and forward-thinking minds working tirelessly to push the boundaries of what’s possible, I have faith that we will continue to make strides towards achieving mass adoption and unlocking the full potential of this remarkable technology.

And on a lighter note, I sometimes find myself pondering: If Satoshi Nakamoto were still around today, they might say – “I didn’t realize I was inventing a global currency when I just wanted to make online transactions faster and cheaper!

On the 19th of April, 2024, the latest Bitcoin [BTC] reduction in reward took place. Now, miners only receive 3.125 BTC for each block they mine, which has decreased the overall supply and pushed miners to improve their mining equipment. This event also underscored the rarity of Bitcoin, making it a plausible option as a means of storing value.

During the previous economic cycle, Michael Saylor, a co-founder and former CEO of MicroStrategy (MSTR), recognized an opportunity to leverage this mechanism for his company’s benefit. He now views it as a protective measure against potential inflation.

To safeguard his bitcoin reserves from inflation, he isn’t hesitant to employ borrowed funds to acquire even more Bitcoin. In his own words, “The best use of money and time is investing in more Bitcoin.” He suggested that one should invest all available funds into Bitcoin, and then dedicate all spare time to determining what can be sold to buy more Bitcoin, as he stated in January 2024. Since then, the value of Bitcoin has surged by approximately 115%.

His well-known determination suggests the thought that an increasing number of organizations might incorporate Bitcoin into their assets.

As a researcher delving into the world of blockchain technology, I am constantly pondering about the expectations of its users beyond mere investment and inflation hedging. What unique features or advancements are they anticipating? Looking back at 2024, what significant developments took place that impacted Bitcoin’s on-chain users? And, as we venture into 2025, what can we foresee for the BTC community in terms of new technologies, applications, and user experiences?

Bitcoin trilemma

As a tech enthusiast with years of experience in the digital world, I’ve come to appreciate the transformative power of blockchain technology. In my view, the three essential elements that make it stand out are scalability, decentralization, and security.

Scalability, in my perspective, is crucial for any technology that aims to serve a large number of users efficiently. It’s about being able to handle an increasing volume of transactions without compromising on speed or reliability, which I believe is particularly important given the growing demand for digital services today.

Decentralization, on the other hand, is what sets blockchain apart from traditional systems. The distribution of decision-making and control across the network empowers users and eliminates the need for intermediaries, fostering a sense of trust and fairness that I’ve rarely seen in other technologies.

Lastly, security is paramount when dealing with sensitive digital information. The network’s ability to defend against fraud and attacks gives users peace of mind, knowing their assets are protected, which is something I value greatly as someone who has experienced the consequences of data breaches firsthand.

In essence, these three elements make blockchain technology a promising solution for our increasingly interconnected world, offering scalability, trust, and security in ways that traditional systems simply can’t match.

One significant hurdle for Bitcoin is achieving scalability, yet its Proof of Work system ensures an extremely secure network. It’s worth noting that while decentralization isn’t a major weakness, over time, Bitcoin mining has tended towards centralization thanks to the development and expansion of mining pools.

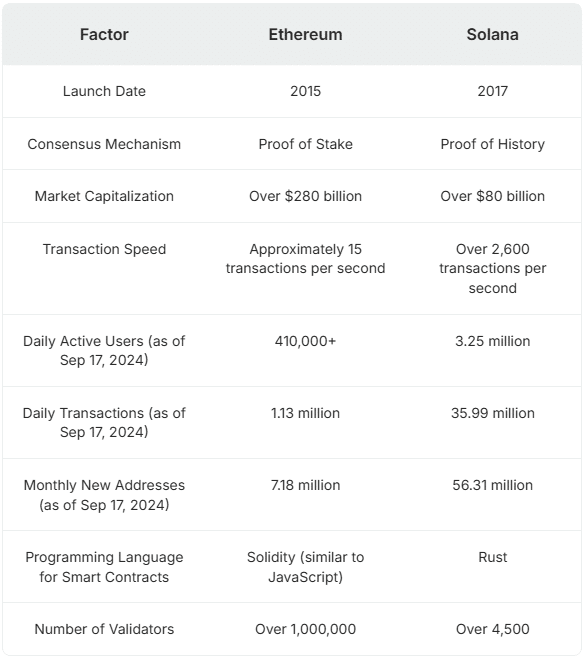

In simpler terms, Bitcoin’s blockchain can process approximately 7 transactions every second. On the other hand, Ethereum (ETH) and Solana (SOL) manage around 15 and an impressive 2,600 transactions per second, respectively. This situation is known as the “blockchain trilemma,” which emphasizes the challenges in balancing security, decentralization, and the ability to handle a large number of transactions efficiently – all at the same time.

To achieve greater transaction processing speeds (TPS), networks often need to compromise on either security or decentralization by reducing the number of participating nodes. This trade-off allows for increased efficiency and faster performance. Conversely, highly decentralized networks can find it challenging to maintain high speeds and efficiency due to their distributed nature.

Solutions to the scalability problem

As more people become familiar with Bitcoin over time, it’s expected that both its popularity and the number of users will grow significantly. This growing interest from users might result in an increased need for the Bitcoin network’s blockchain, leading potentially to improvements in its usefulness and worth for users.

In contrast to networks like Ethereum and Solana that offer a wide range of uses in decentralized finance (DeFi) and have higher transaction per second (TPS) rates, Bitcoin, as a Layer 1 solution, was designed with a lower TPS and more limited application scope. To accommodate increased complexity and scale for future applications, the Bitcoin network must consider adopting Layer 2 solutions.

As a crypto investor, I find layer 2 solutions to be particularly appealing because they’re constructed on pre-existing blockchains, eliminating the need for a comprehensive network-wide agreement to be deployed – a requirement that layer 1 solutions demand. This flexibility makes them a more alluring choice.

Among the current Layer 2 solutions, we have the Lightning Network, Stacks, and Merlin Chain. Notably, Stacks is designed to incorporate smart contracts into Bitcoin without modifying the base protocol. Originally known as Blockstack, it underwent a rebranding in October 2020. In essence, Stacks serves as a Layer for Bitcoin-based smart contracts, expanding the network’s capabilities to include features such as decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized application (dApp) functionalities.

Lightning Network and its potential in 2025

The concept of Lightning Network was introduced back in 2015, and it officially started functioning in 2018. Its purpose is to enhance transaction speed and lower costs by facilitating transactions outside the primary blockchain.

Yet, it encounters some hurdles. The Lightning Network enables users to make transactions swiftly by establishing channels between them for ongoing payments. This significantly reduces the transaction fee, bringing it down to about $0.001 from the current average of $2.8 per transaction, and facilitates quick completion within seconds.

By August 2024, LN boasted approximately 15,000 to 54,000 payment channels, with a channel Bitcoin liquidity exceeding 5,000. It has incorporated innovative wallets like Muun and Phoenix, enhancing user convenience. The increasing acceptance in regions such as Asia, Africa, and Latin America is making online shopping more feasible. The usage of LN is bolstered by businesses such as Bitrefill, a retailer of cryptocurrency gift cards, and OpenNode, a BTC-accepting payment processor for merchants.

In 2025, if Lightning Network extends its platform to support stablecoins for transactions instead of just Bitcoin, it could significantly contribute to widespread cryptocurrency adoption. By integrating with stablecoins, we might experience real-world payments using crypto stablecoins and nearly instant global settlements for foreign exchange transactions anywhere in the world.

Beyond Layer 2s

The possibilities for Bitcoin Layer 2 solutions are vast, yet they may not be the end of the line. A subsequent development, Layer 3 solutions, could emerge, which would be constructed upon the scalability of Layer 2. These advanced solutions aim to improve interoperability and introduce specialized functionalities tailored for specific applications.

Layer 3 offers adaptable features that can be fine-tuned to meet unique requirements, enhancing both functionality and efficiency. By facilitating connections between various blockchains and alternative Layer 2 systems, it broadens the scope of what blockchain technology can achieve.

One instance of a Level 3 Bitcoin application is Impervious, a browser constructed upon the Bitcoin platform. This browser operates in a decentralized manner, ensuring that all data exchanged is done so securely and confidentially, thus eliminating any possibility for data monitoring. Moreover, it offers freedom from censorship.

Transactions are handled swiftly through the Lightning Network, allowing messages and document transfers to occur nearly instantaneously before being recorded on the blockchain later. Each transaction carries a fee, but some may find the enhanced privacy justification enough.

Cosmos is a Layer 3 solution that’s not related to Bitcoin. Its primary purpose is to resolve the chaos caused by multiple blockchains, by creating a connected network often referred to as a “blockchain internet”. This network allows for secure data exchange between separate blockchains. To increase efficiency, it uses a technique called sharding for scalability. This means that dApps can take advantage of assets and features from various blockchains, expanding their capabilities.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Utilizing Bitcoin Layer 2 solutions could revolutionize blockchain usage by providing lower transaction costs and faster speeds. This enhancement encourages public adoption, even for small transactions like micropayments or casual spending. Progress in this area would demonstrate that Bitcoin is not only a store of value but also a functional tool for exchange, as originally intended.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Elder Scrolls Oblivion: Best Thief Build

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-01 20:09