- MicroStrategy and BTC topped 2024 world asset performers.

- Will the firm’s bold BTC strategy pay off again in 2025?

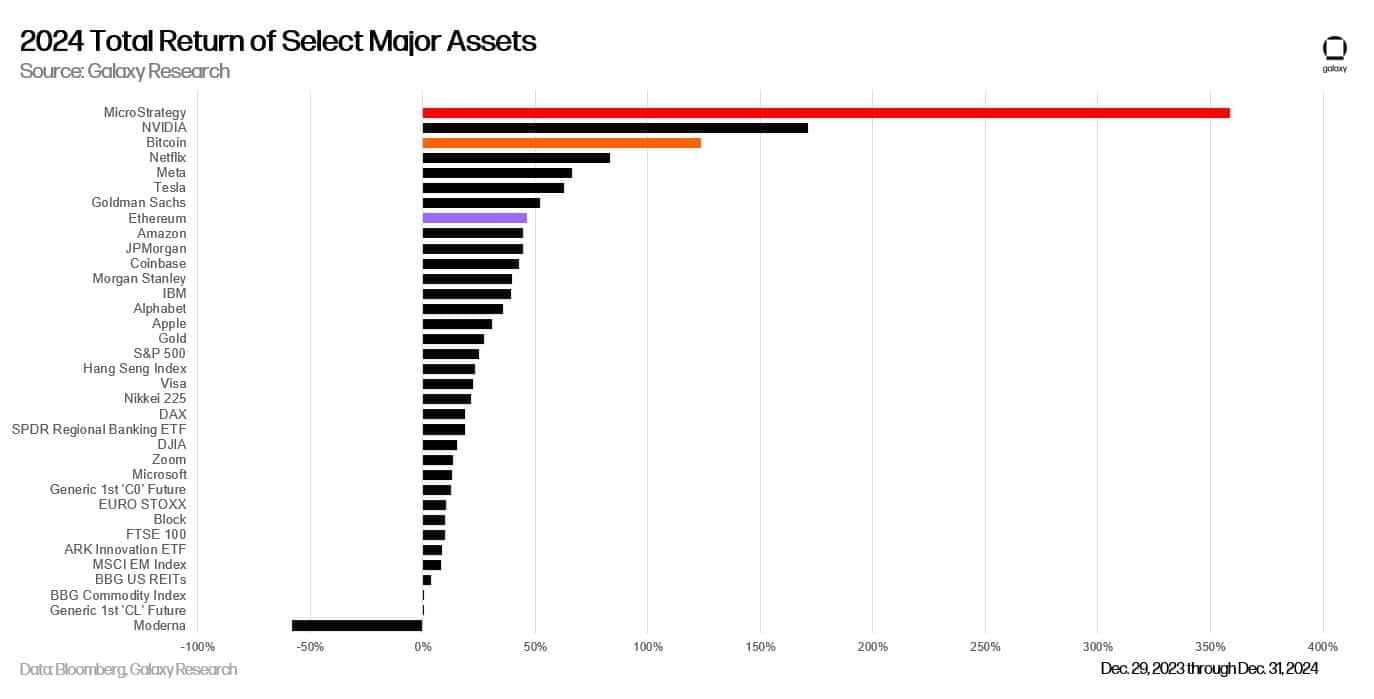

As a seasoned researcher with years of experience in the financial markets, I can confidently say that MicroStrategy’s [MSTR] bold Bitcoin [BTC] strategy has proven to be a game-changer in 2024. The firm’s remarkable yearly performance, which saw MSTR share 1st place with Palantir Technologies on the list of world asset performers, is a testament to the power of strategic investment and foresight.

Having followed MicroStrategy’s journey since its acquisition spree in Q4 2024, I am convinced that their aggressive bet on BTC was not just a gamble but a calculated move based on a strong belief in the future potential of cryptocurrencies. The fact that BTC ranked third and Nvidia came in second further underscores the interconnectedness of these digital assets with traditional markets.

While it’s too early to tell if MSTR’s strategy will pay off again in 2025, I find myself intrigued by their plans to issue additional shares to accelerate their BTC acquisition program. This move, in my opinion, reflects a long-term vision and commitment to capitalize on the growth potential of BTC.

However, as with any investment, there are risks involved. The recent sell-off during the holiday season served as a reminder that even the most promising investments can experience turbulence. Nevertheless, I believe that the current low prices and weak sentiment could provide an excellent opportunity for savvy investors to capitalize on this discounted entry point.

In a lighter note, I’ve always found it amusing how financial markets can sometimes resemble a rollercoaster ride – ups, downs, twists, and turns. But as we navigate these volatile waters, it’s essential to remain cautious, informed, and open-minded, just like a seasoned sailor navigating the high seas!

It appears that MicroStrategy’s bold Bitcoin [BTC] purchasing strategy in 2024 has proven successful, as per Galaxy Research findings. The company’s shares, identified by the ticker MSTR, emerged as the top-performing global assets of 2024, boasting a remarkable yearly growth rate of 358%.

Mastercard and Palantir Technologies (PLTR) both took the leading position, as Mastercard is a software firm that also provides data analytics services to cryptocurrency businesses, similar to Palantir Technologies.

In a recent ranking, Bitcoin placed third, with Nvidia finishing second. Notably, Alex Thorn, who leads research at Galaxy Digital, pointed out that the leading two performers had connections to Bitcoin. He expressed this by stating that the top-tier players were associated with Bitcoin.

In terms of performance adjusted for risk (Sharpe ratio), Mastercard topped the list, while Bitcoin came in third. Interestingly, two out of the top three performing assets in 2024 were related to Bitcoin.

MicroStrategy’s BTC bet

It’s not surprising that MSTR had an outstanding annual performance, given that its founder and ex-CEO, Michael Saylor, is a strong advocate for Bitcoin (BTC). He holds the view that Bitcoin tends to surpass many U.S. stocks in terms of performance.

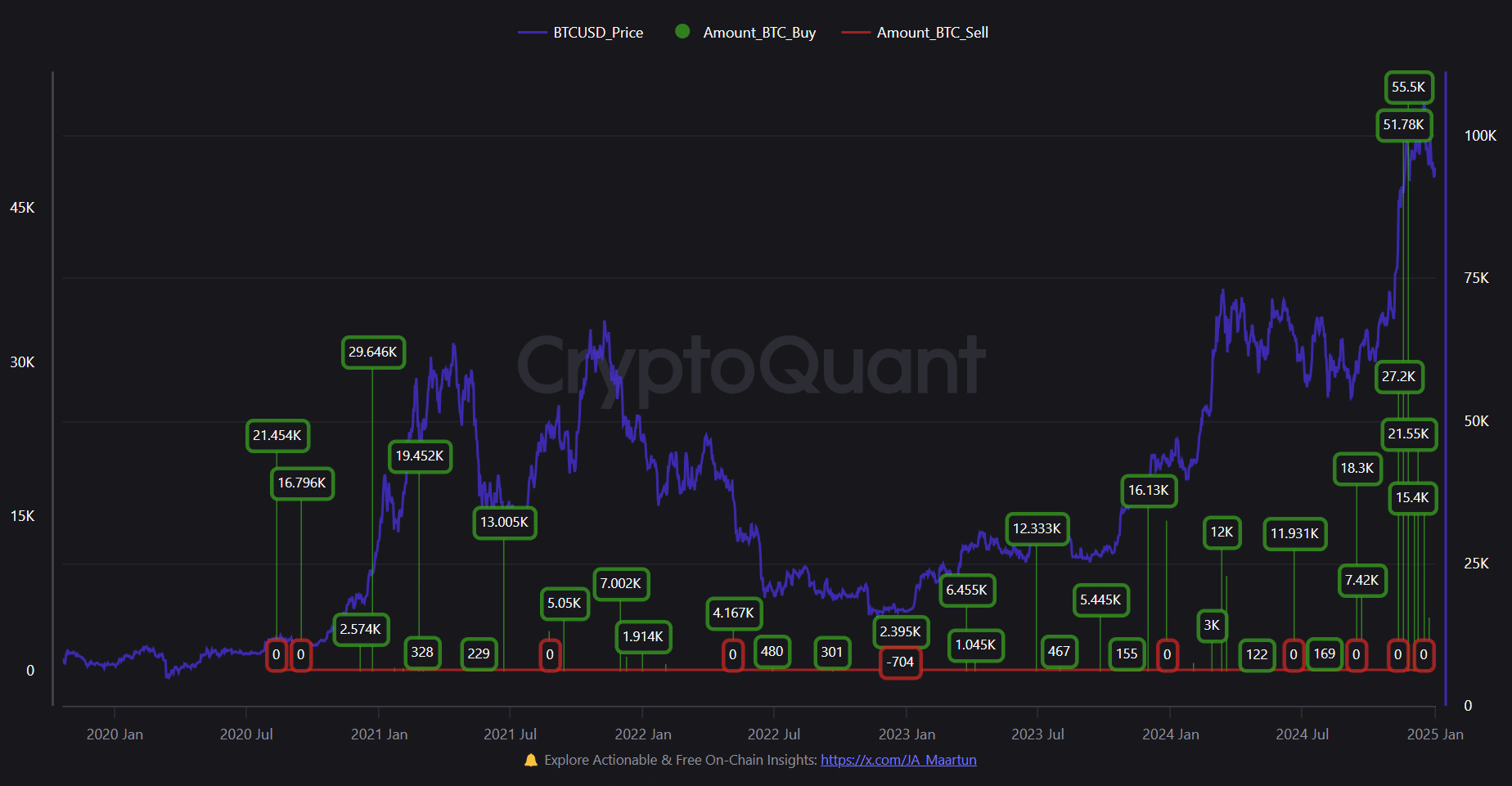

In response to Bitcoin’s rising value, the company purchased an impressive quantity of the digital currency (approximately 446,400 Bitcoins), giving them a significant stake in its circulation, controlling roughly 2.2% of the entire supply as of late 2024.

It’s worth noting that the peak buying activity took place in Q4 of 2024. Remarkably, during the month of November, the company made over 107,000 Bitcoin purchases, with a total value exceeding $10 billion, across just two transactions.

Although growth in acquiring Bitcoin (BTC) decelerated in December, the company intends to initiate a substantial stock offering program to boost its Bitcoin strategy. They’ve recently unveiled their intention to expand MicroStrategy’s (MSTR) share count beyond 10 billion to meet their objectives.

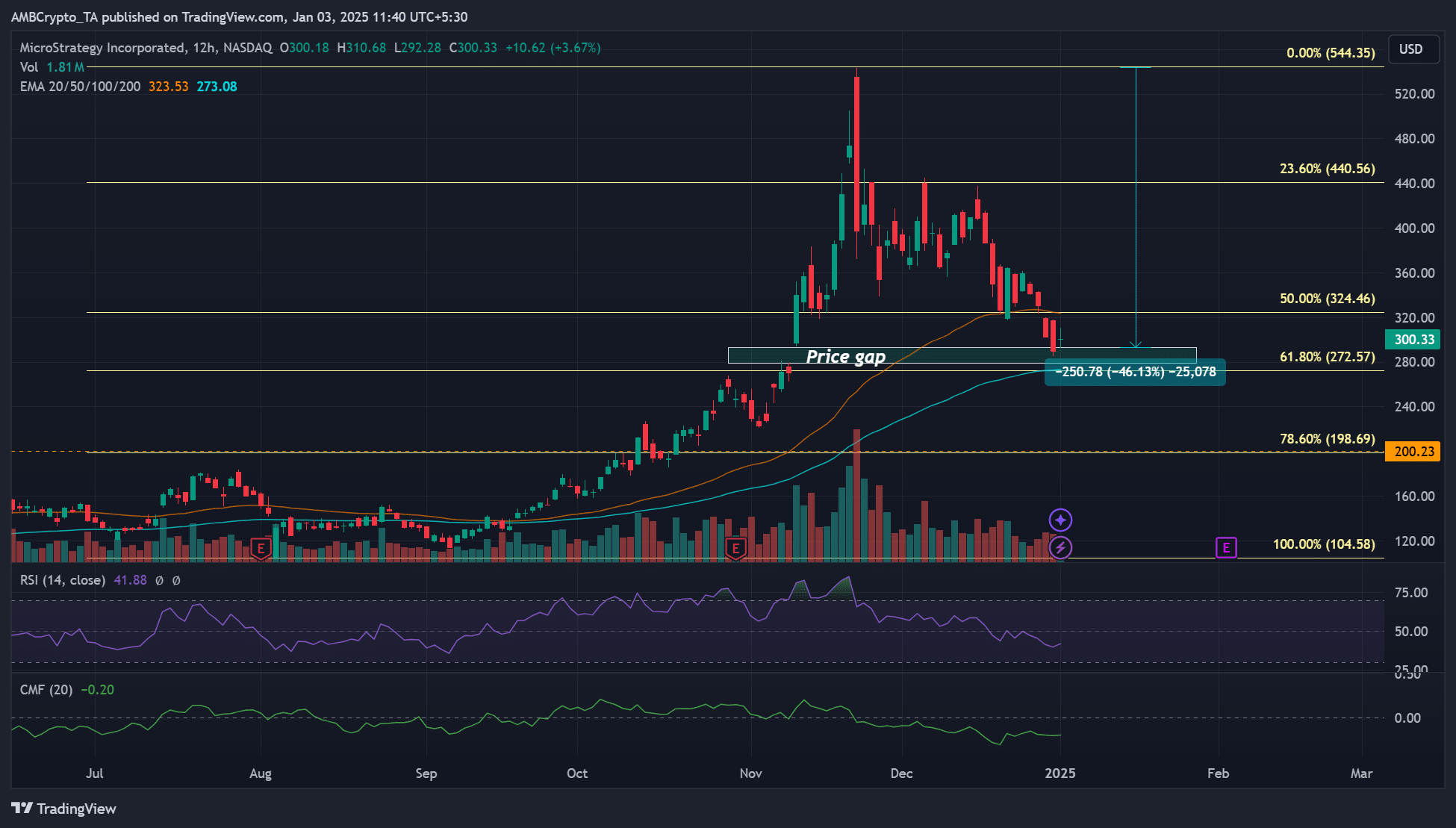

2025 is yet uncertain whether Mastercard’s daring move with Bitcoin will prove profitable once more. At present, however, their stock has dropped by 46% due to a significant Bitcoin sell-off over the holiday period.

During that timeframe, Bitcoin decreased from approximately $108,000 to a minimum of around $92,000, then attempted a rise to $97,000 in early January.

Nevertheless, the rate of decline for MSTR slowed down where it met the price difference and the significant 61.8% Fibonacci level (approximately $300). In simpler terms, the drop in MSTR’s value decreased when it hit a notable price gap and the 61.8% Fibonacci level around $300.

A number of financial analysts think that the current low and subdued optimism might offer the most advantageous deal for purchasing MSTR shares.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-03 14:16