- Currently, BONK trades within a double bullish pattern, indicating accumulation and the potential to achieve a higher price level.

- However, on-chain sentiment remains mixed. While some metrics highlight a bearish presence, others suggest increased liquidity, leaving the market divided.

As a seasoned researcher with over a decade of experience in the crypto market, I have learned to navigate through the intricacies and unpredictability that characterizes this dynamic space. Currently, BONK presents an interesting case study, exhibiting a double bullish pattern within an accumulation zone. While the technical indicators suggest a strong upward momentum for the memecoin, the mixed on-chain sentiment remains a potential obstacle.

In my opinion, it’s like observing a see-saw at a playground – one side is up while the other is down, and you never know when it will tip over. The bullish signals are evident, with BONK trading within two bullish patterns and technical indicators such as RSI and Aroon pointing towards strong buying activity. However, the decline in Open Interest and Exchange Netflow data indicate bearish sentiment that could delay or slow down its upswing.

If I were to compare this situation to real life, it would be like planning a picnic but facing unpredictable weather – you pack your sunscreen and sandwiches, hoping for clear skies, but the forecast keeps changing. In this case, we can only hope that the market will favor the buyers and BONK will resume its rally sooner rather than later.

Lastly, a bit of humor to lighten up the discussion – I guess it’s true what they say: “You can’t predict the crypto market any more than you can predict the weather. In both cases, it’s better to just bring an umbrella and some sandwiches.” So let’s wait and see if BONK’s rally will be a sunny day or just another rainy picnic!

Over the past month, I’ve noticed a downturn with BONK (Bonk), as it dipped by 25.29%. Unfortunately, this period hasn’t been fruitful for investors looking to make gains. However, there seems to be a hint of recovery in its recent price action, with the asset showing a modest increase of 0.16% over the last 24 hours.

According to AMBCrypto’s analysis, there are robust indications pointing towards a bullish trend for BONK, contributing to its recent small increase. Yet, whether this upward trend for BONK will continue is unclear because the opinions of traders do not align, which could potentially cause issues.

A double bullish pattern in the accumulation zone

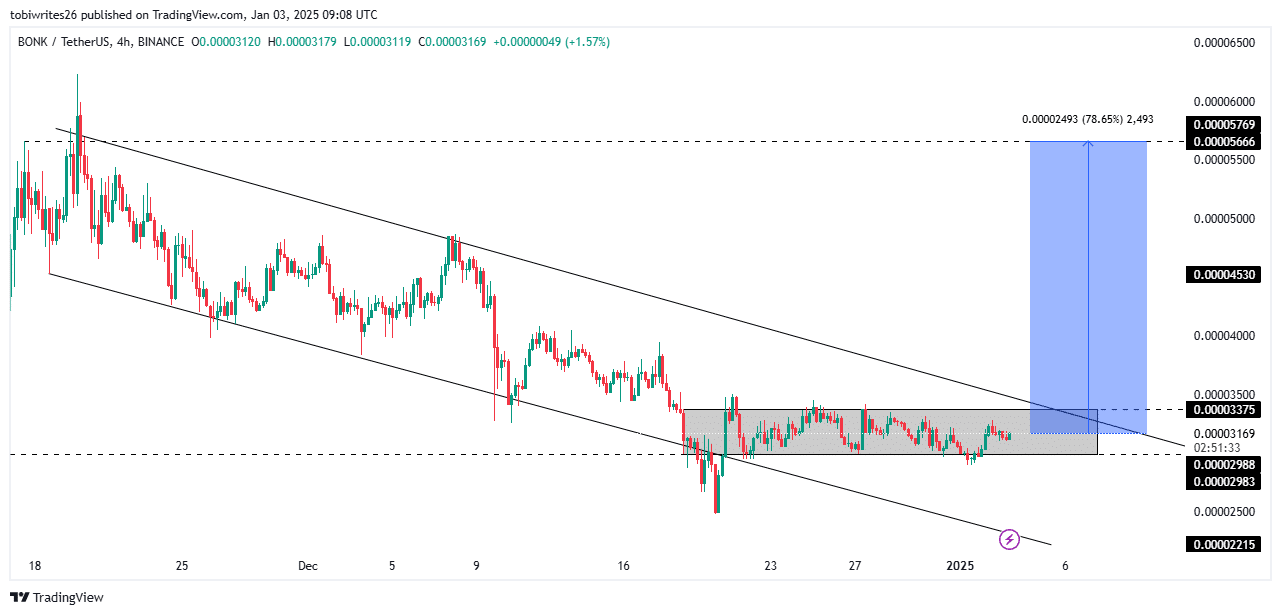

Currently, BONK is being exchanged within two positive market structures: a more extensive downward trending funnel and a gathering period inside this funnel, indicating continuous buying activity.

As an analyst, I often observe that a descending channel signifies a trend where prices are consistently lowering, as buyers are willing to purchase at decreasing costs before the market starts to rally. Within this pattern, the consolidation phase – represented by a rectangular box – demonstrates the distribution of prices between clearly defined support and resistance levels during a period of price stabilization.

If BONK manages to break free from its current consolidation and surpass the resistance line of its descending channel, it could potentially trigger a substantial surge in price, possibly reaching around $0.00005666 – which represents a potential 78.65% increase from its current value.

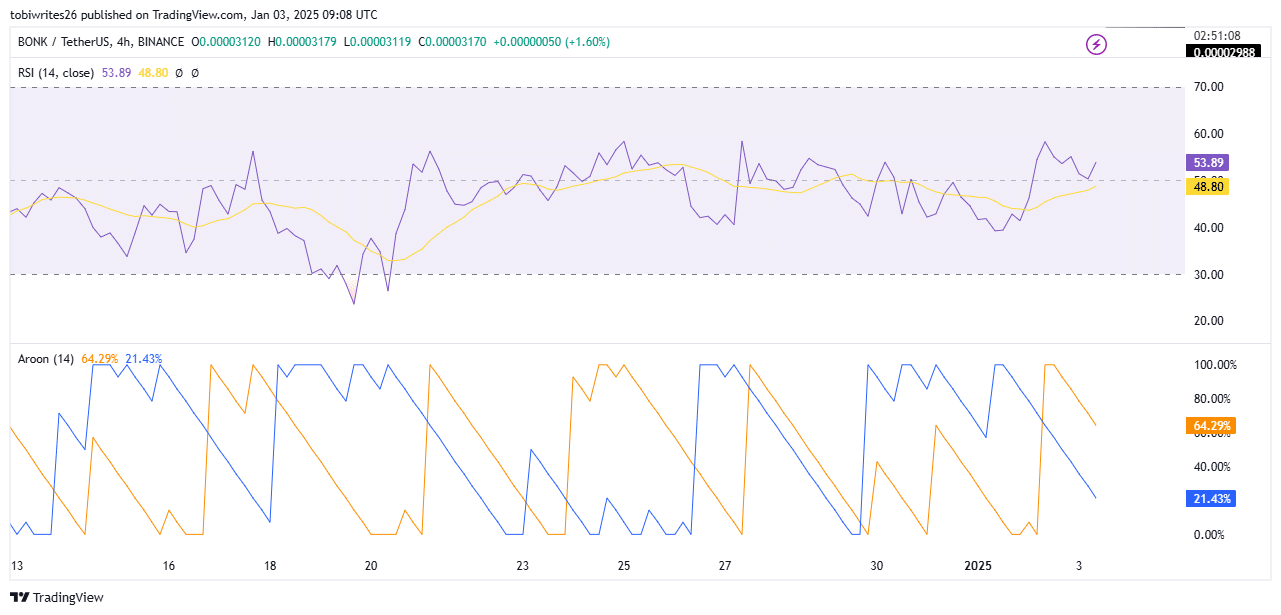

Based on technical analysis, these optimistic views are reinforced by various indicators. Specifically, the Relative Strength Index (RSI), which gauges price movement’s strength, has shown a bullish signal by rebounding perfectly from the non-directional line at 50 and currently sits at 53.89, hinting at growing momentum in an upward direction.

In simpler terms, when the Relative Strength Index (RSI) consistently remains over 50 and is rising, like in the case of BONK, it suggests a stronger possibility of further price growth.

As a researcher, I’m observing a significant bullish confirmation from the Aroon indicator. Specifically, the Aroon-Up (represented by orange) stands at 64.29%, significantly higher than the Aroon-Down (blue), which is currently at 21.43%. This disparity suggests robust buying activity and implies that BONK is continuing its accumulation phase, indicating a strong upward trend.

As a researcher, I explore market trends by creating an Aroon indicator that calculates the elapsed time from recent price highs and lows to gauge their strength and direction.

Nonetheless, AMBCrypto notices a degree of market uncertainty, as particular groups appear to be experiencing selling pressures.

Potential delay in BONK’s upswing

The memecoin may experience a pause or slowdown before continuing its upward trajectory.

Currently, the Open Interest (OI) has decreased by about 4.97% within the last 24 hours, falling to approximately $12.15 million. Generally, a decrease in OI indicates a bearish outlook since it suggests less trader activity or closing of positions.

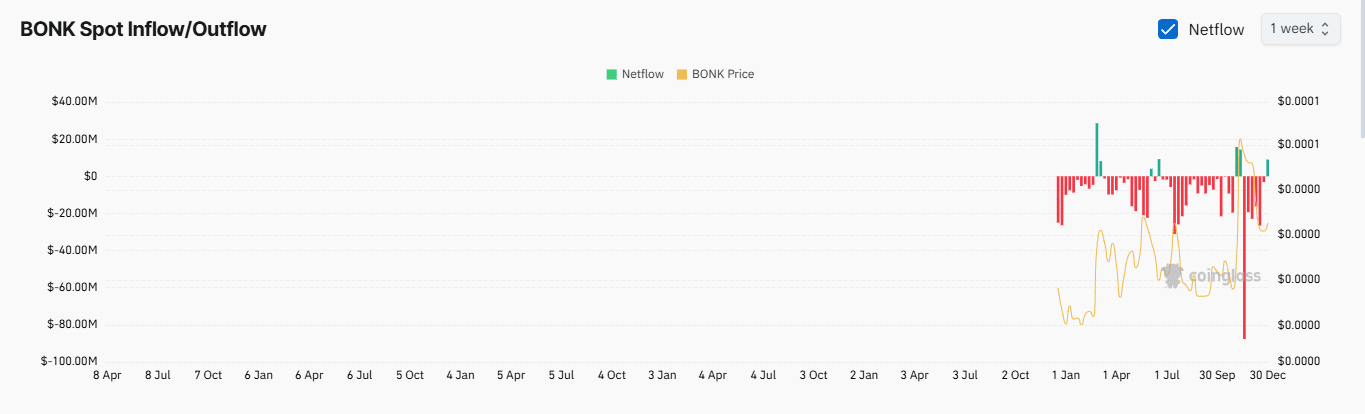

Based on my years of experience in the financial markets, I have noticed that a large influx of funds into exchanges, such as the $7.85 million inflow seen for BONK over the past week, can often signal unfavorable trends. While it’s important to remember that market behavior is complex and not always straightforward, my personal observation has been that these types of situations tend to be followed by periods of volatility or even potential decline. As an investor, I would approach this situation with caution and consider carefully the underlying reasons for such a significant movement in funds before making any investment decisions.

This action indicates higher selling activity, as more market players are moving their holdings to trading platforms.

Based on my extensive experience in the volatile world of cryptocurrencies, I believe that BONK may continue to stay in a consolidation phase for a while if current trends persist. However, should buyers show increased interest and start accumulating the asset, I am confident that it could reignite its rally more swiftly than expected. As someone who has witnessed multiple market cycles, I can attest to the power of investor sentiment and the potential impact it can have on coin performance. Therefore, keeping a close eye on buyer behavior could prove crucial for those seeking to capitalize on potential gains in this memecoin.

TVL growth for BONK

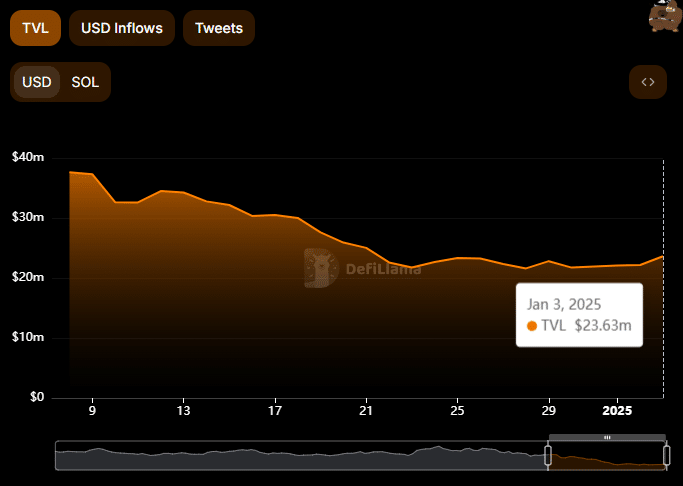

The amount of Bonk Staked SOL (bonkSOL), a type of liquid staking token linked to BONK validators, has experienced a notable increase.

Read Bonk’s [BONK] Price Prediction 2024-25

As of now, the TVL stands at $23.59 million, marking its highest level since the 21st of December.

The significant increase in funds flowing into the validator pool for this popular meme coin is anticipated to create a series of beneficial impacts, ultimately benefiting the coin, BONK.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-04 03:04