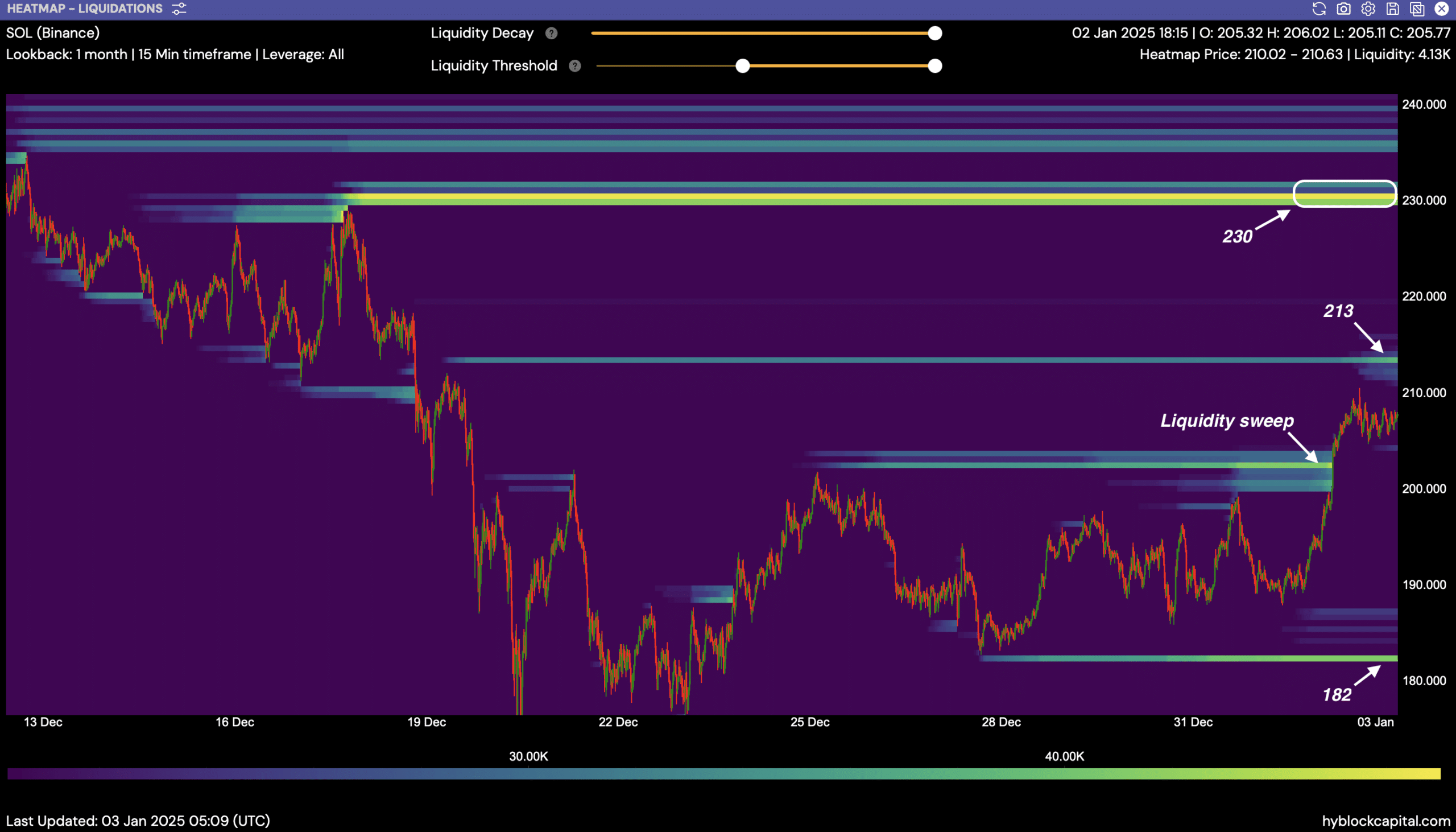

- Solana sweeps the liquidity after a bullish breakout from a consolidation pattern.

- Polymarket predicts a 77% probability of a Solana ETF approval in 2025.

As a seasoned crypto investor with a knack for spotting trends and patterns, I’ve witnessed the volatile yet exciting landscape of digital assets unfold over the past few years. With my finger firmly on the pulse of the market, I’ve learned to read between the lines and anticipate the next big move.

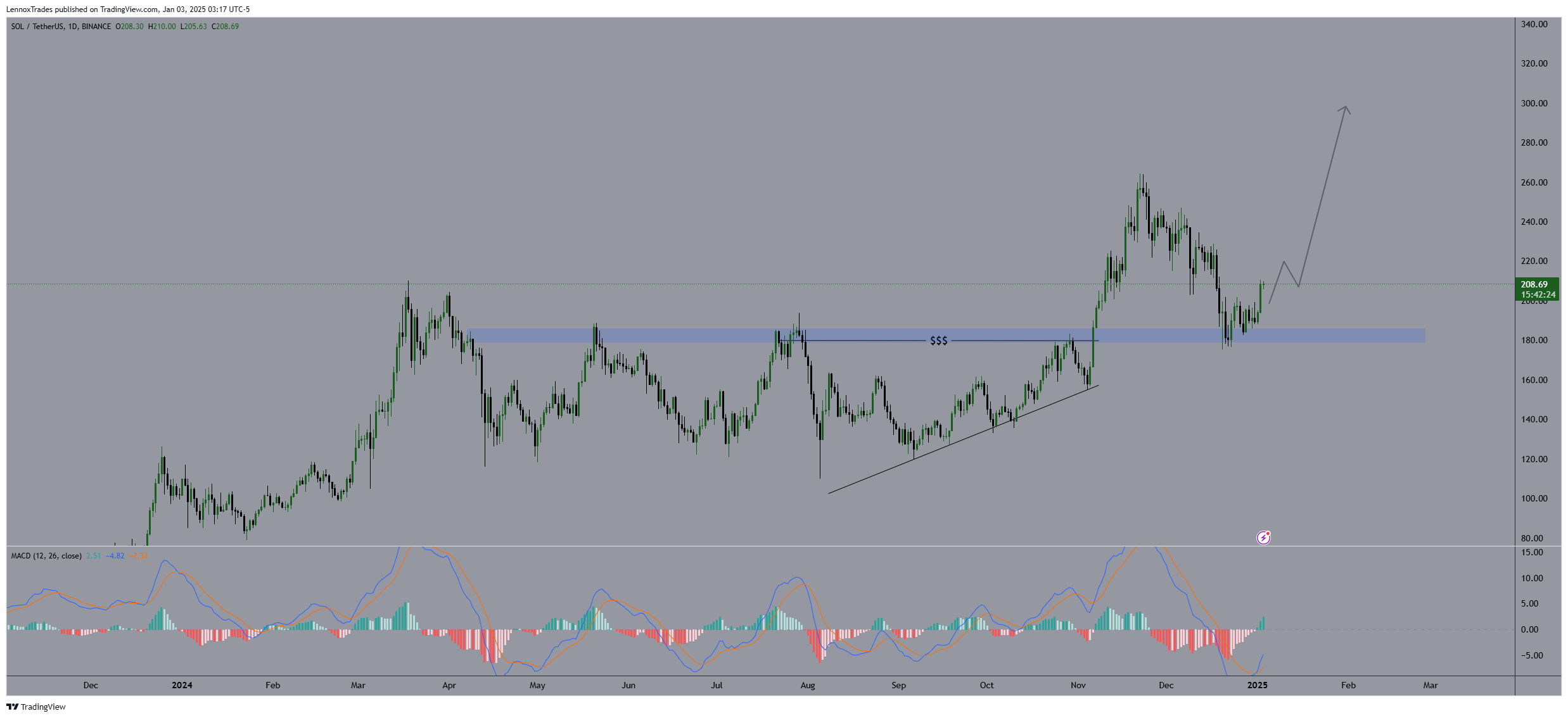

Recently, Solana [SOL] has caught my attention after its impressive breakout from a consolidation pattern, leading to a swift upward movement. This bullish momentum is reminiscent of Bitcoin‘s surge in 2017 – a ride I wasn’t able to fully capitalize on due to my skepticism at the time.

The liquidity clusters near $213 and subsequently $230 are areas I’ll be closely watching, as they could either signal strong buying support or potential sell-offs if SOL breaches these levels. If Solana manages to consolidate above these critical levels and maintains its upward trajectory, it could sustain its rally, with a potential push past $230 if conditions remain favorable – a move I wouldn’t want to miss this time around!

The 77% probability of a Solana ETF approval in 2025, as predicted by Polymarket, adds fuel to the fire. If history repeats itself, we could see a surge in price similar to what Bitcoin and Ethereum experienced upon their respective ETF approvals.

However, I’ve learned not to get too carried away in this space – after all, crypto is like a rollercoaster ride: it goes up, it goes down, but the views at the top are always worth it! So, while I’ll be keeping a close eye on Solana, I’ll also keep my seatbelt fastened tight and enjoy the ride.

Joke: You know what they say – the best time to invest in crypto is when your friends are tired of hearing about it, but the second-best time is always now!

The price of Solana’s SOL token experienced a surge as it broke free from an ascending triangle formation. This breakout propelled a rapid increase in value, causing Solana to breach significant pre-designated areas with high liquidity.

Following surpassing the $182 mark, SOL is swiftly moving towards regions of increased market activity around $213 and then further to $230. These areas could potentially serve as points for either resistance (where sellers may try to halt the price increase) or support (where buyers might step in to prevent a price drop).

In these regions, a high volume of trading takes place, which can impact the price trends that follow.

If Solana reaches these thresholds, it may encounter selling pressure at resistance points or discover robust buying interest if it falls into lower price ranges instead.

If Solana (SOL) manages to establish itself firmly above these crucial thresholds and continues moving upward, it could pave the way for possible additional profits.

The trend indicates that the price of SOL might continue climbing, possibly surpassing $230 as long as the positive circumstances persist.

Price action and prediction

Following Solana’s rise above the $200 mark, it signaled a bullish advancement stemming from the prior consolidation beneath this point, as highlighted in our previous analysis at AMBCrypto.

This development follows the creation of an ascending triangle structure, implying that there is a buildup happening and indicating a possible continuation towards increased values.

Significantly, the price peaked at $208.69, confirming its progress and preparing the ground for potential future growth.

The potential resistance point for the next price increase lies approximately at $230, derived from past peak prices within the price range where the asset has been stabilizing.

As a researcher, I’m observing a persistent bullish trend in Solana. If this trajectory persists, it might push Solana towards challenging certain levels. Such a move could ignite a rally that could potentially carry on well into the mid-year.

This suggests that the ongoing bullish trend is robust and sustained, with $182 acting as a crucial level of support, while $230 represents the next potential goal.

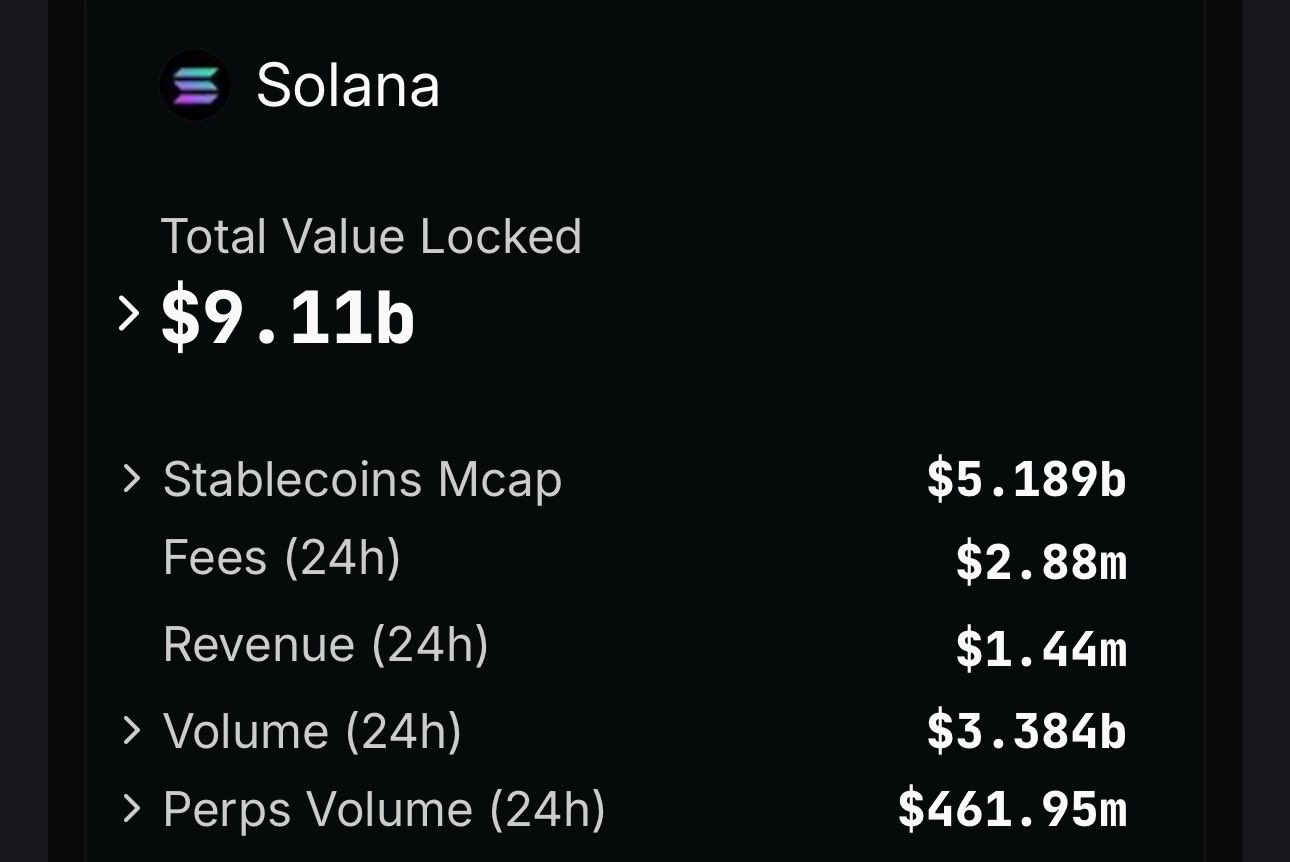

SOL ETF, market cap and TVL

Based on predictions made by Polymarket, it’s likely that a Solana Exchange Traded Fund (ETF) will receive approval in the year 2025, with an estimated probability of 77%. This optimistic outlook regarding regulatory approval might have a favorable effect on Solana’s market value.

Historically, the expectation or announcement of an Exchange-Traded Fund (ETF), like those for Bitcoin [BTC] and Ethereum [ETH], often results in a rise in prices as it signifies growing mainstream recognition and larger investments pouring into these assets.

Based on my extensive experience in the financial industry and following the latest developments in the sector, I believe that Matthew Sigel from VanEck might be onto something with his belief that the probability of approval could be underpriced. As someone who has witnessed numerous market fluctuations and trends, I can attest to the fact that sometimes, the market’s sentiment can overlook potential opportunities. Therefore, it is always important to remain cautiously optimistic and keep a keen eye on such situations. In this case, given Matthew Sigel’s insightful track record, it would be prudent to consider his perspective and potentially reevaluate our investment strategies accordingly.

Should it gain approval, Solana might witness substantial growth in its worth, drawing in both individual and professional investors who are keen on capitalizing on the ETF’s market debut.

The value of the Solana network’s market capitalization surpassed $100 billion once again, marking a significant recovery. This resurgence stands out against the backdrop of unpredictable market fluctuations, suggesting robust support and practical applications within its community.

Simultaneously, the $9 billion Total Value Locked (TVL) in Solana demonstrated growing interest and use of its functionalities, indicating a possible future growth and deeper involvement within Decentralized Finance (DeFi) platforms.

Read Solana’s [SOL] Price Prediction 2025–2026

This situation might lead to an increase in Solana’s valuation levels, which could boost its standing in the market favorably.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Solo Leveling Arise Amamiya Mirei Guide

- See Channing Tatum’s Amazing Weight Loss Transformation

- Kim Kardashian’s Hilarious NSFW Confession Gets Silenced by Animal Noises!

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- How to Install & Use All New Mods in Schedule 1

- Kim Kardashian Teases New Romance in Latest Dating Update

- Paige DeSorbo and Craig Conover’s Massive Fight Pre-Breakup

2025-01-04 04:08