- Grayscale listed Aerodrome among its top 20 projects of interest for Q1 2025

- Smart DEX traders are in the distribution phase, but some wallets have recently bought AERO

As a seasoned researcher with years of experience in the cryptosphere, I find myself intrigued by the recent developments surrounding Aerodrome (AERO). Grayscale’s endorsement places it among the top 20 projects for Q1 2025, and smart DEX traders have seen impressive gains followed by a distribution phase – a classic cycle in this volatile market.

The strategic placement by Grayscale underscores AERO’s promising fundamentals and market potential. However, the ongoing selling pressure from whales could temper short-term price prospects. As a researcher, I’ve seen many instances where the wise old saying, “Buy low, sell high” doesn’t always hold true in crypto – it’s more like “Buy high, hope for the best, and sell higher, if you’re lucky!”

In this case, AERO’s future price movements could exceed its previous high of $2.38, offering an entry point for traders keen on leveraging these shifts. But remember, in crypto, nothing is ever certain – it’s always a rollercoaster ride! So buckle up, folks, and let’s see where the AERO journey takes us next!

Grayscale adding Aerodrome (AERO) to its top 20 for Q1 2025 could be interpreted as a reflection of investor interest. In essence, this placement may imply a possibility of increased investment, particularly since Grayscale’s endorsements frequently draw market focus.

Historically, this acknowledgement has often caused an increase in the value of highlighted properties. Consequently, Aerodrome’s profile might significantly rise, attracting not only individual but also institutional investors.

The spotlight could catalyze further development and partnerships, potentially enhancing returns.

As an analyst, I’ve noticed a strategic move by Grayscale that underscores the compelling fundamentals and market prospects of AERO in the forthcoming quarter. This strategic positioning suggests a strong belief in AERO’s future performance.

Smart DEX trading and price prediction

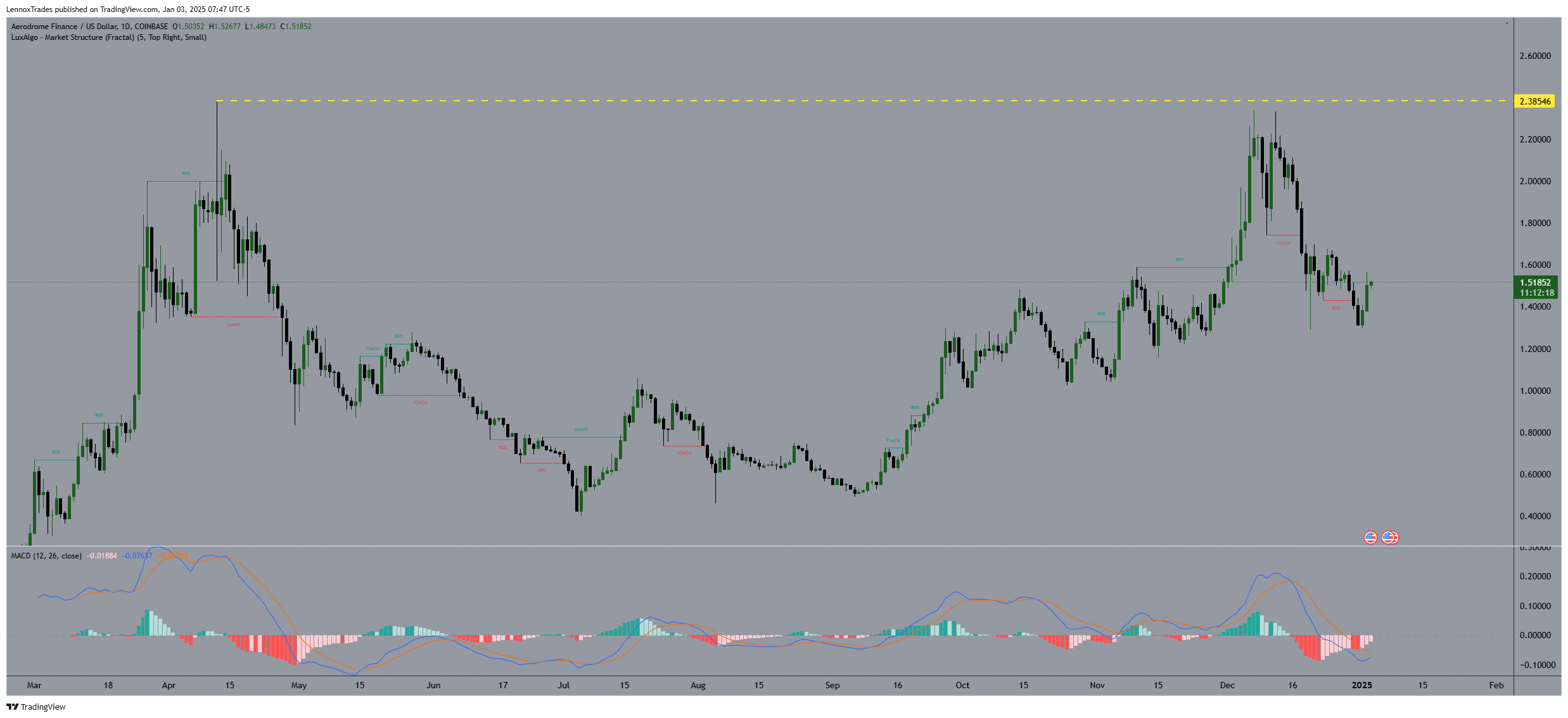

Shrewd traders utilizing Decentralized Exchanges (DEX) profited substantially from AERO, realizing approximately 30 times their initial investment as it surged from its lows to its peaks. This sudden buildup followed by a sell-off suggests strategic buying and selling decisions, particularly around these accumulation points.

Currently, these traders have shifted their strategy to distributing assets, which could suggest a decrease in demand to buy in the short term, potentially leading to a drop in prices.

Contrarily, I’ve noticed that some big players, or “whales,” have been regularly dispersing their AERO tokens, with daily transactions valued anywhere from half a million to seven million dollars.

The widespread dispersion of this asset stands in sharp contrast to the positive views expressed by prominent entities such as Grayscale, suggesting a disparity in opinion between big investors and institutional viewpoints. In other words, while major players like Grayscale remain optimistic, large holders seem to have a different perspective.

Although small investors have recently made some purchases, the intense selling activity from large investors (whales) might curb the immediate price rise potential.

Originally priced at $2.38, AERO’s value has experienced a dip, causing it to move into a more unpredictable range characterized by repeated buy and sell indications, suggesting conflicting feelings amongst investors.

Actually, the market setup of LuxAlgo suggests a possible break, indicating potential for strong upswing as well as encountering substantial barriers.

This change could pave the way for AERO to attempt surpassing its past record, providing a potential opportunity for traders who want to capitalize on these transitions. Consequently, AERO’s price might climb above its all-time high of $2.38.

AERO’s TVL, profitability, and active addresses

Ultimately, it’s worth noting that Aerodrome demonstrated financial stability with a Total Value Locked (TVL) of approximately $1.409 billion and a market capitalization of about $1.117 billion. The daily trading volume reached $54.03 million, indicating strong activity, while its annualized revenue stood at an impressive $339.06 million – a clear indication of active trading and revenue generation within its system.

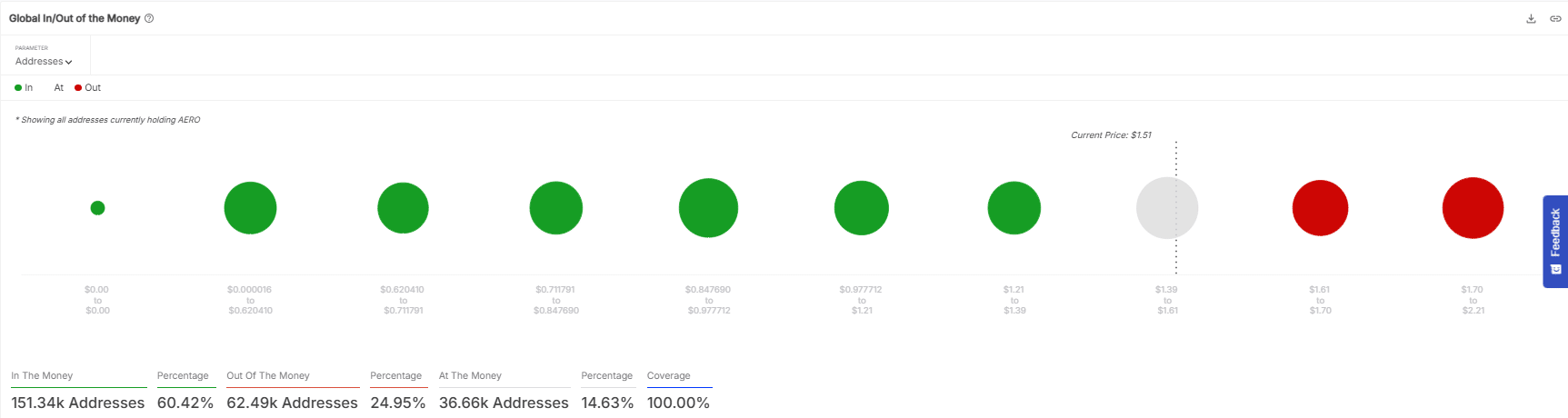

Approximately 60.42% of AERO token holders were in a profitable position based on the current market price. Since their purchase price was lower than the current market price of $1.51, this suggests that there might be an increased likelihood of these holders choosing to sell their tokens.

As a crypto investor, I find myself in one of three categories: 24.95% of us are currently ‘out of the money,’ meaning we’re holding onto our investments with hopes that prices will rise higher. Another 14.63% of us are ‘at the money.’ This situation suggests a crucial crossroads, where decisions to buy or sell could hinge on short-term price fluctuations. It’s an intriguing time for strategic moves in the crypto market!

1) The number of daily active addresses for the monitored asset decreased by 29.10%, hinting at a drop in user interaction according to IntoTheBlock. However, a 6.47% increase in new addresses suggests some growing interest. Additionally, the count of zero balance addresses went up by 13.89%, possibly indicating that some users are leaving their positions.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-04 11:04