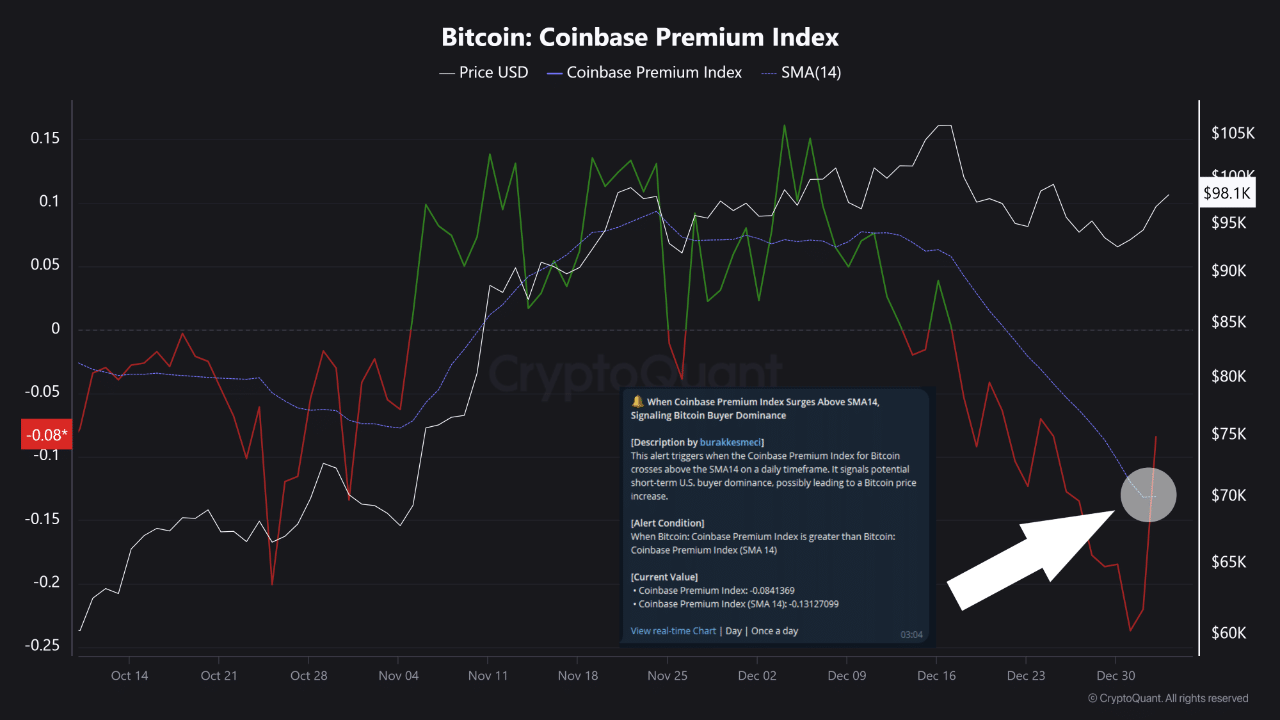

- Coinbase Premium Index rebounded, indicating greater U.S demand for BTC

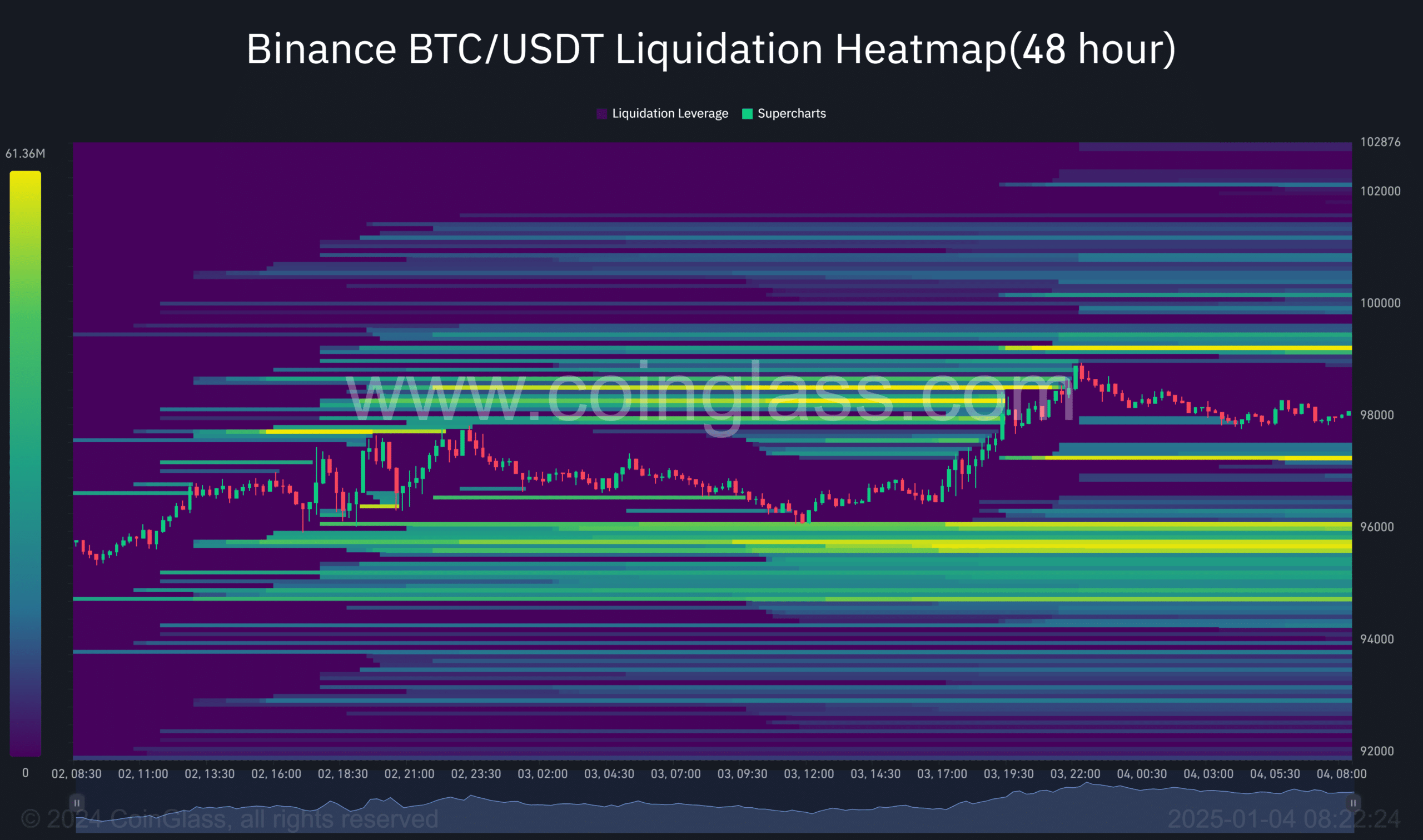

- However, there seemed to be massive lower liquidity that could constrict BTC in a price range

As a seasoned analyst with over a decade of experience in the financial markets, I find myself intrigued by the current state of Bitcoin (BTC). The rebound in U.S demand, as indicated by the Coinbase Premium Index, is indeed a bullish sign for BTC enthusiasts like me who have been patiently waiting for a resurgence in interest from American investors.

However, it’s important to keep an eye on the potential constraints that could arise due to lower liquidity levels. The concentration of upside liquidity between $99k and $100k is encouraging, but the lack of liquidity at certain price points below this range could potentially push BTC towards a price range of $96k-$95k in the short term.

The recent inflows into U.S BTC ETFs, particularly Fidelity’s FBTC and Ark Invest’s ARKB, are promising signs of institutional demand returning to the market. But whether this will be enough to trigger a bullish breakout above $100k remains to be seen.

In terms of my personal investment strategy, I would advise caution at these price levels and perhaps consider taking profits if BTC approaches $100k. After all, as an analyst, it’s always important to remember that even the most bullish markets require a healthy dose of humor to keep things in perspective: “If Bitcoin ever reaches a million dollars, I’ll be a billionaire… but until then, I’ll just have to settle for my modest millions!

On January 3rd (Friday), Bitcoin [BTC] surged close to $99k due to an increase in U.S demand, as suggested by the Coinbase Premium Index. Interestingly, this index had fallen to a 12-month minimum as U.S retail and institutional investors adopted a cautious stance during the holiday season, leading to risk-averse strategies.

In simpler terms, the index has managed to regain its 14-day average value for the first time in almost a month’s span. As per analysis by CryptoQuant expert Burak Kesmeci, this suggests that American investors hold more control over the market.

If the Coinbase Premium Index rises above its 14-day moving average, suggesting strong demand from Bitcoin buyers, it might serve as a preliminary sign that American investors are reasserting their control over the market.

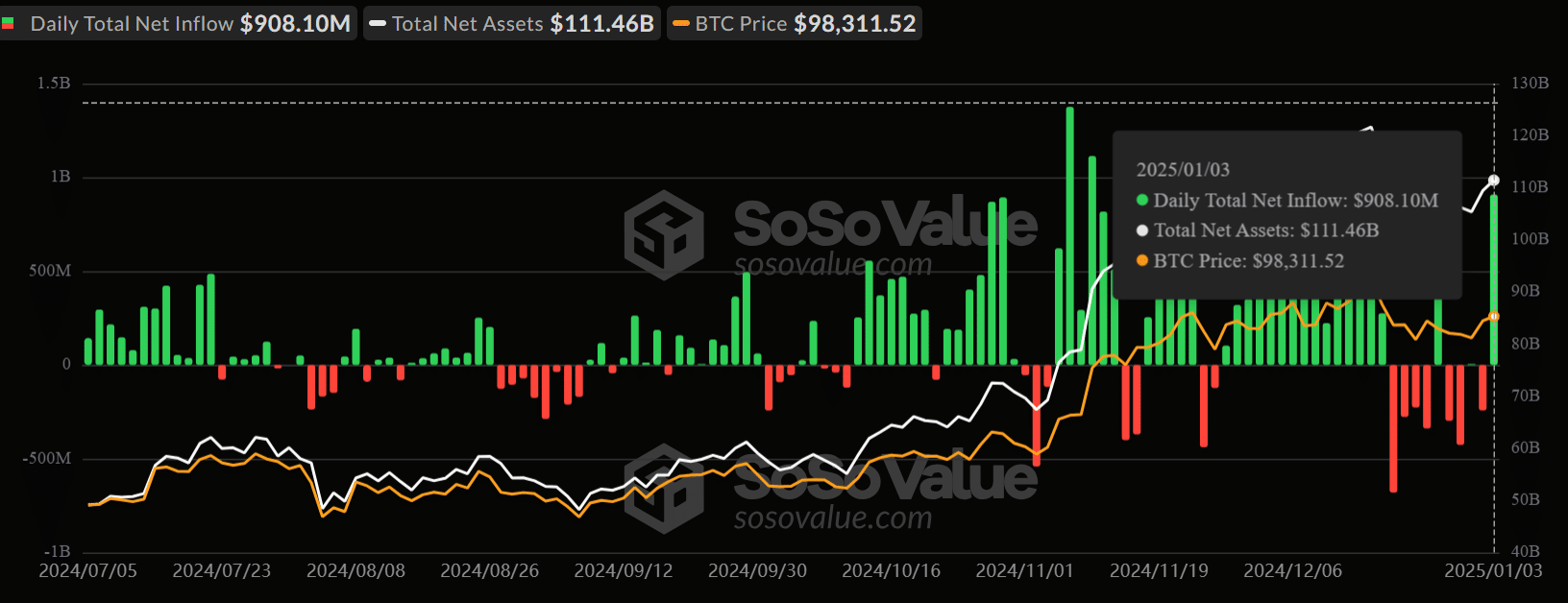

Bitcoin ETFs log $908M daily inflows

The pattern was likewise noticeable throughout the United States Bitcoin Exchange-Traded Fund (ETF) market. On Friday alone, they attracted approximately $908 million in daily net inflows, which represented a monthly peak.

In reality, despite starting the year with withdrawals, BlackRock’s IBIT experienced an inflow of approximately $253 million on Friday.

1) Fidelity’s FBTC took the lead with $357 million in investments, followed closely by Ark Invest’s ARKB with $222 million inflows. This shows that institutional interest is returning and helped Bitcoin reach a steady high of $98.9k.

As a crypto investor, I’ve noticed that the recent upward trend can be attributed to a liquidity rush, as there was a substantial amount of short positions stacked at the $98k mark earlier in the week. Now, it appears that the potential for further growth lies between $99k and $100k, where significant upside liquidity is currently concentrated.

Additionally, it appeared that areas with reduced liquidity (similar to bright yellow zones) were found approximately at $97,200, $96,000, and $95,000.

Based on the current market conditions, it’s possible that the price could trend downwards towards the range of $97,000 to $95,000, as there appears to be a higher concentration of liquidity at lower prices.

Read Bitcoin [BTC] Price Prediction 2025-2026

In other words, the liquidation heatmap indicates that Bitcoin might move within a short-term price band of around $96,000 to $100,000.

It’s yet uncertain if the high demand for Bitcoin ETFs will lead to a price surge exceeding $100k.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-04 15:03