- SOL was showing strong signs of life, with its TVL nearing a new ATH and bullish performance across key internal metrics.

- All signs pointed to continued momentum, but….

As an analyst, I can’t help but notice the resurgence of Solana [SOL] this new year. After a challenging month-long slide from its all-time high (ATH) of $264, it seems patience has been rewarded for its HODLers. Solana has made a comeback, pushing its price back into the double digits, restoring levels last seen in mid-December.

There’s yet a lot left to explore, as the latest influx of $1 billion into the stablecoin market is being utilized. At present, the total value locked on Solana is rapidly approaching $12 billion.

It appears that the groundwork for a significant surge is being established. Overcoming the $220 mark might indicate a prolonged period of growth and recovery.

Even though outside market conditions might disrupt these strategies, is it plausible for Solana to buck the trend and maintain its position based on its strong internal performance indicators?

Solana’s tech is powering SOL’s comeback

Statistically speaking, SOL merely requires a 20% boost to hit its all-time high (ATH). Given the strong comeback it’s made so far this year, some may find this task seemingly straightforward.

Solana’s vibrant activity suggests it’s thriving due to its advanced technology and increasing transactional activity. Notably, the network fees have surged by 13% over the past day, reaching a significant $16,698.88, demonstrating high levels of network utilization.

Moreover, it’s not just this; the momentum behind Pumpfun, Solana’s token creation project, is also picking up speed. Daily addresses are almost touching 250,000, indicating that liquidity is being channeled across various applications within the network. Total Value Locked (TVL) merely scratches the surface of what’s happening here.

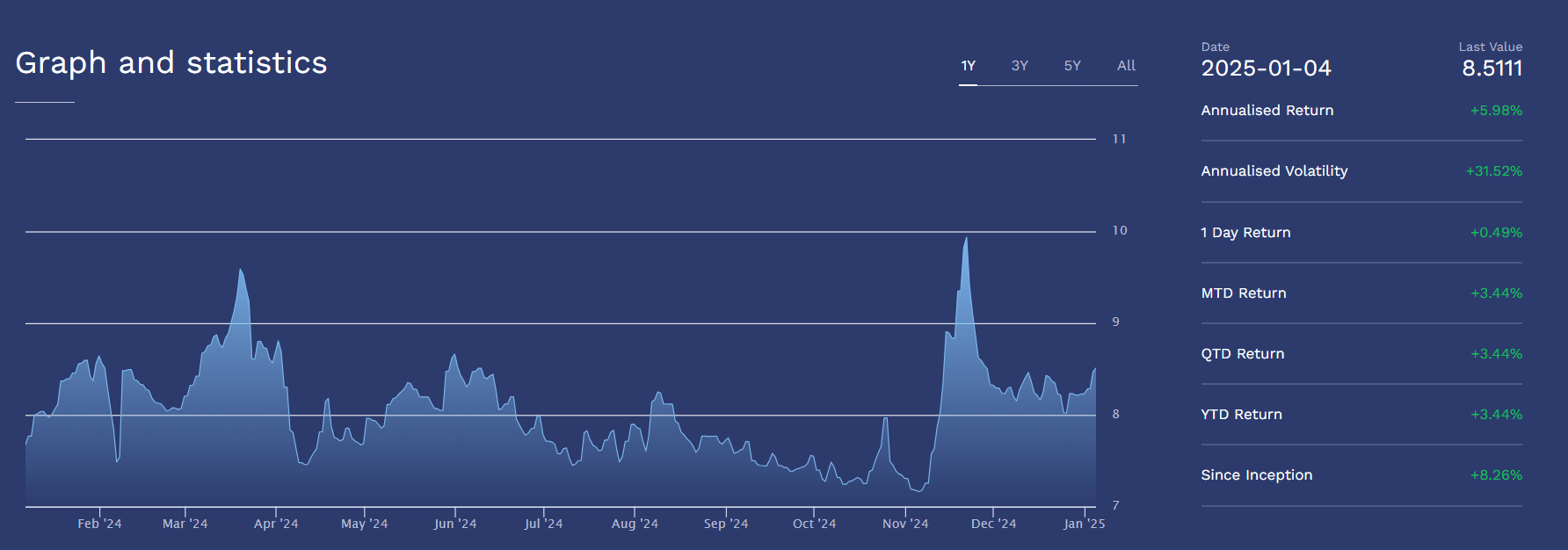

Digging deeper, the return on staking is rising too, jumping by 5% to hit 8.5%.

Increased earnings from SOL are leading to a surge in interest, as investors move towards staking their tokens for enhanced profits. This escalating interest is mirrored in the increasing Total Value Locked (TVL), indicating an upward trend in the amount of liquidity being secured.

As a researcher delving into the world of blockchain technology, I find that Solana’s powerful infrastructure is propelling widespread acceptance and injecting novel liquidity into its system. However, the question arises: What might this imply for its market value?

To begin the New Year, SOL experienced a significant increase of more than ten percent. Important signs such as the MACD crossing point are becoming optimistic, while the RSI has yet to reach an overextended state. If this positive trend persists, it appears that a prolonged rise is imminent.

But certain factors shouldn’t be overlooked

To surpass the $220 mark, Solana requires an ideal confluence of events – a harmonious blend of optimistic internal and external factors working together flawlessly, without any conflicting elements.

To begin the year 2025, Solana showed remarkable momentum, starting at $190, and Open Interest (OI) at approximately $4.78 billion. Moving ahead to the present day, its value has climbed to $215, and the Open Interest has soared to $5.85 billion – a significant increase of 22.38% in merely one week.

Not only did Solana experience a significant increase, but this surge also moved the SOL/BTC pair into positive territory, indicating that investors view Solana as a strong competitor. This perception is further supported by an observable rise in trading activity.

Read Solana’s [SOL] Price Prediction 2025–2026

Nevertheless, this upward trend proved short-lived. With Bitcoin approaching the $100K milestone, external circumstances seem to be changing once more, causing the SOL/BTC ratio to dip back into negative territory again.

This event provokes thoughts about if Solana’s latest surge was merely a short-term peak triggered by users migrating to its platform due to faster transaction speeds and potentially increased yields.

As an analyst, I see that Solana, from my point of view, has room for improvement when it comes to capturing investments and standing tall against its competitors.

While there’s no certainty that Solana will surpass the $220 mark, should it successfully navigate through any external challenges, it might open up possibilities for an exciting leap forward.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-07 03:03