- Bitcoin dominance is a crucial gauge of where investors are funneling their money.

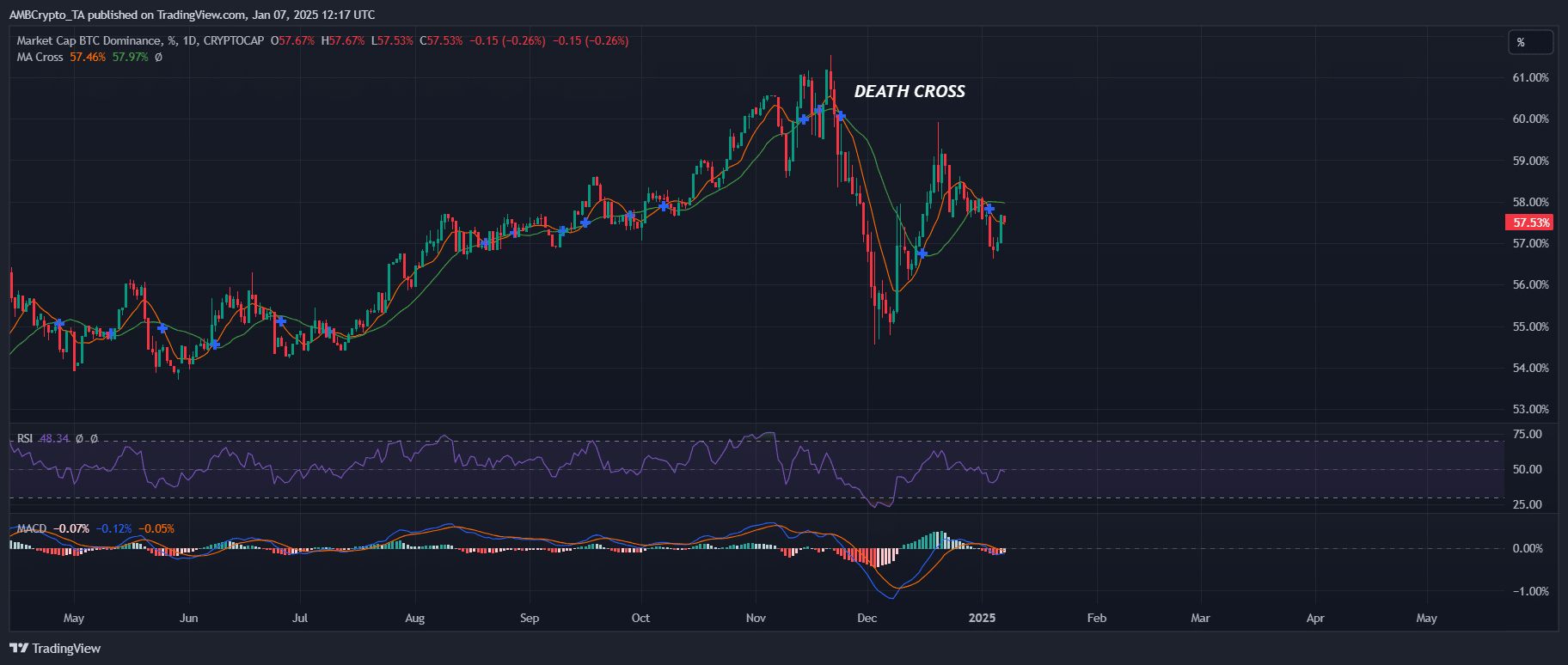

- The emergence of a death cross after four years isn’t just a technical signal – it’s a clear warning.

As an analyst, I observed that at the commencement of the new year in 2025, Bitcoin [BTC] experienced a significant surge, regaining the price point of around $102K following a fortnight of market fluctuations. However, it’s worth noting that this price increase didn’t quite manage to restore its previous level of dominance within the cryptocurrency market.

Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastThis might indicate that alternative cryptocurrencies (altcoins) are beginning to attract attention, as investors are actively seeking opportunities for diversification.

So, is a repeat of the 2021 cycle on the charts?

Normally, when the influence of Bitcoin decreases, it’s usually a good indication that a period where alternative cryptocurrencies will become popular, known as an “altcoin season,” may be approaching. At present, this theory seems to be becoming more convincing.

For about a week now, the financial market has been showing positive signs as high-value alternative cryptocurrencies have experienced double-digit growth. Although it’s too soon for definite forecasts, the trends suggest something worth monitoring closely.

Four years back, Bitcoin began the first quarter of the year holding a dominance of 72%. However, within just about four months, its dominance dropped below 40%, coinciding with the appearance of a “death cross” pattern on its dominance graph.

Responding to the situation, Ethereum‘s [ETH] price soared from $737 in January to an impressive peak of $4,183 by May – a staggering increase of 467%. Interestingly, this surge was four times greater than Bitcoin’s 107% growth during the same timeframe.

Could it be that we’re seeing history repeat itself in the market? It appears there might be some signs pointing in that direction. Notably, for the first time in four years, a “death cross” formation occurred on the Bitcoin dominance chart back in mid-November.

In those two weeks, Bitcoin’s dominance in the market decreased from 60% to 54%. At the same time, Ethereum experienced a rise of 30% and closed above $4K.

However, over the last four years, there have been numerous changes. Although a death cross typically predicts an altcoin surge, it doesn’t guarantee that Ethereum will take the forefront of this movement.

The crypto landscape has evolved, and fresh contenders could rise to take the spotlight.

So, who could take the lead as Bitcoin dominance slips?

It’s noteworthy to mention that memecoins are causing quite a stir, consistently appearing at the top of the weekly gainers list with increases exceeding 50%. Intriguingly, it’s worth noting that three out of the top five tokens are based on memes, suggesting that the popularity of memes is escalating.

Consequently, this upward trajectory underscores a tendency among investors to pursue swift, temporary profits, particularly as Bitcoin surpasses the $100K mark. It’s evident that memecoins are mirroring this trend.

It’s quite intriguing to see that meme-inspired tokens are currently surpassing conventional altcoins. For instance, consider Dogecoin (DOGE) in relation to Bitcoin (BTC). We’re on the verge of a surge as the Moving Average Convergence Divergence (MACD) is showing a bullish trend.

Read Dogecoin’s [DOGE] Price Prediction 2025–2026

The main point is that investors appear to be focusing on the excitement rather than the lasting worth, which means the meme coin market requires careful monitoring.

With growing demand for less expensive, stable cryptocurrencies as competition for Bitcoin, the attention on meme-based coins might intensify further.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2025-01-08 05:11