- UNI must hold the $13.20 support to confirm reversal amid bearish momentum.

- Market optimism grew with rising active addresses, lower exchange reserves, and liquidation imbalances.

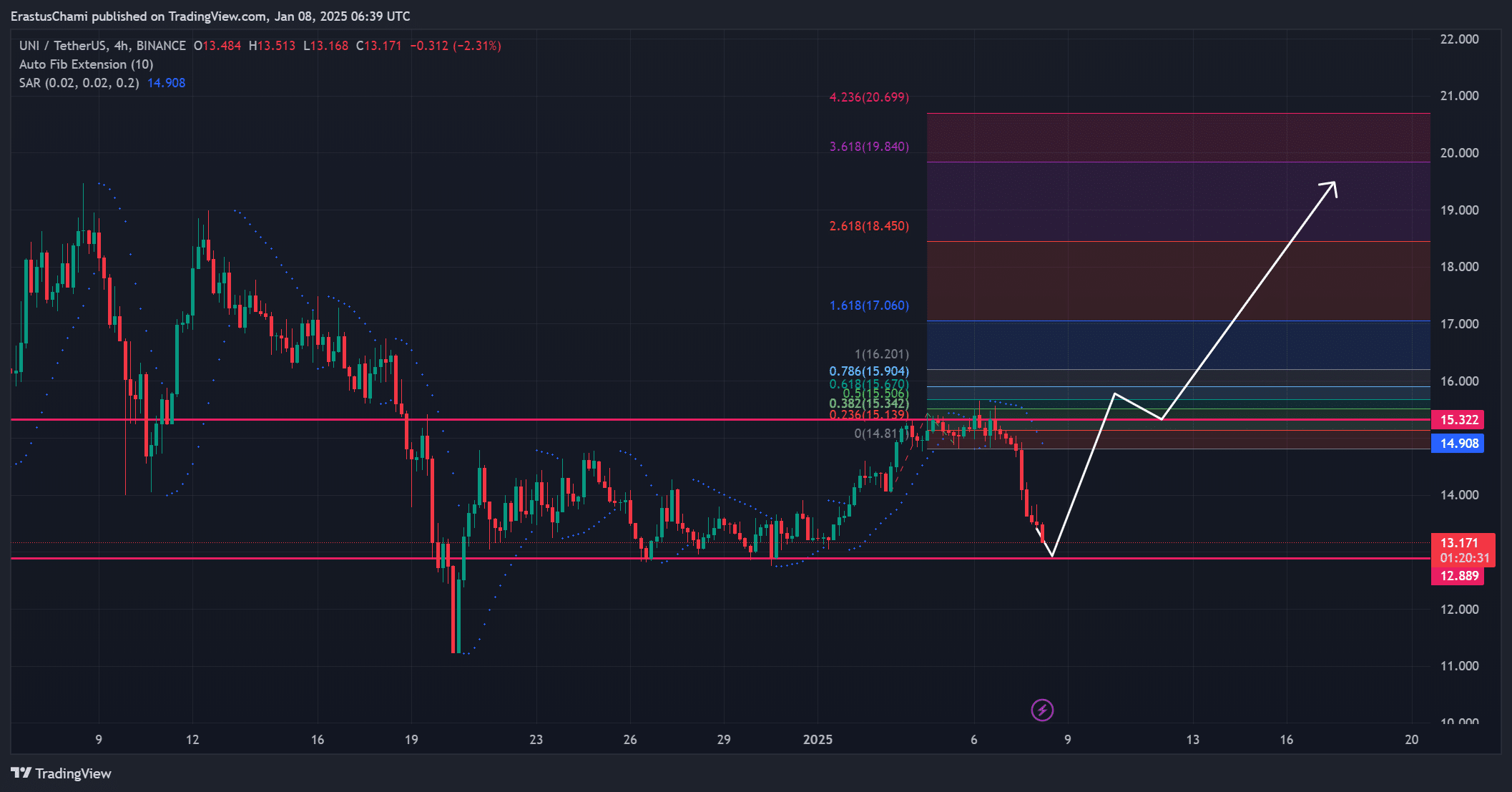

After setting off a TD Sequential buy signal on its 4-hour chart, Uniswap [UNI] has drawn considerable interest, fueling hope for a possible price rebound.

Currently valued at $13.17 per unit, UNI has experienced a decrease of 11.89% over the past day, and now stands at a pivotal juncture.

The crucial $13.20 price point must hold firm for the token’s price to steady and potentially halt its current decline. As a result, traders are keenly observing if this indicator could give Uniswap (UNI) the push it needs to recover.

UNI price analysis: Will support levels hold?

The University Network International (UNI) is experiencing significant downward pressure due to a steep drop in its value, from $15.32 to its current price range.

In simpler terms, the significant points marked as Fibonacci retracement levels on the chart acted as resistance barriers at $15.90 and $17.06 for the UNI token. For it to continue its upward movement, these resistance levels need to be surpassed.

As an analyst, I’m observing that the Parabolic SAR currently stands at $14.90. This indicator hints that a downward trend may persist if the $13.20 support level fails to hold strong.

Neglecting to sustain this critical level might result in a continued drop towards $12.88, causing unease among investors. Consequently, everyone is watching closely to see if buyers will regain control at this significant point.

Cautious optimism lingers

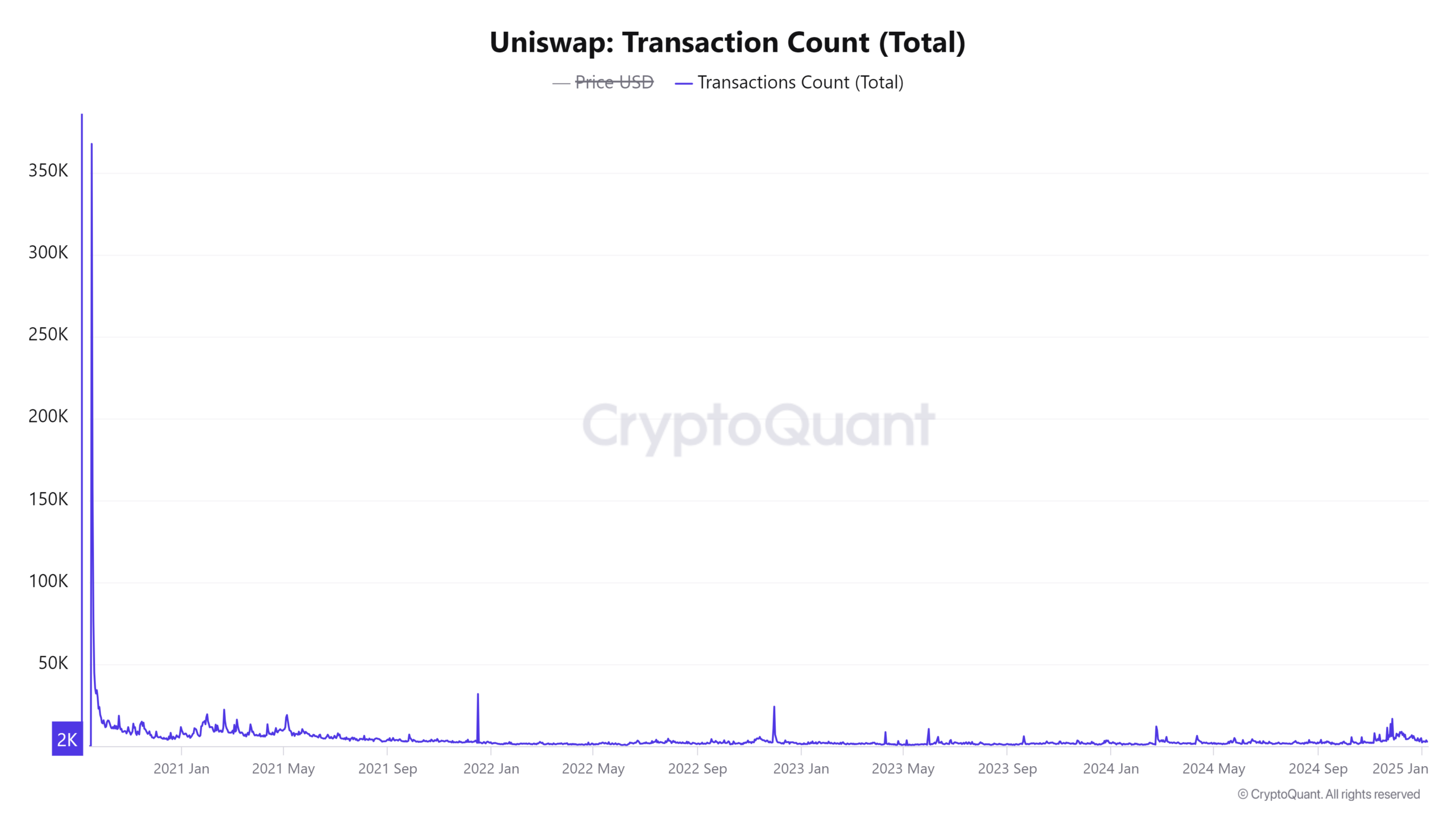

The analysis of on-chain indicators for UNI showed a somewhat positive but guarded perspective, as there were modest enhancements in network activity that brought about a touch of optimism.

user engagement appears to be growing modestly as there’s been a 1.12% uptick in active accounts over the past day.

Moreover, the number of transactions grew slightly by 1.01%, suggesting a slight upsurge in network activity. Yet, this increase is quite modest and might not signal a significant shift in attitude.

Consequently, even though the basics exhibit a certain toughness, they aren’t robust enough just yet to ignite a clear-cut revival.

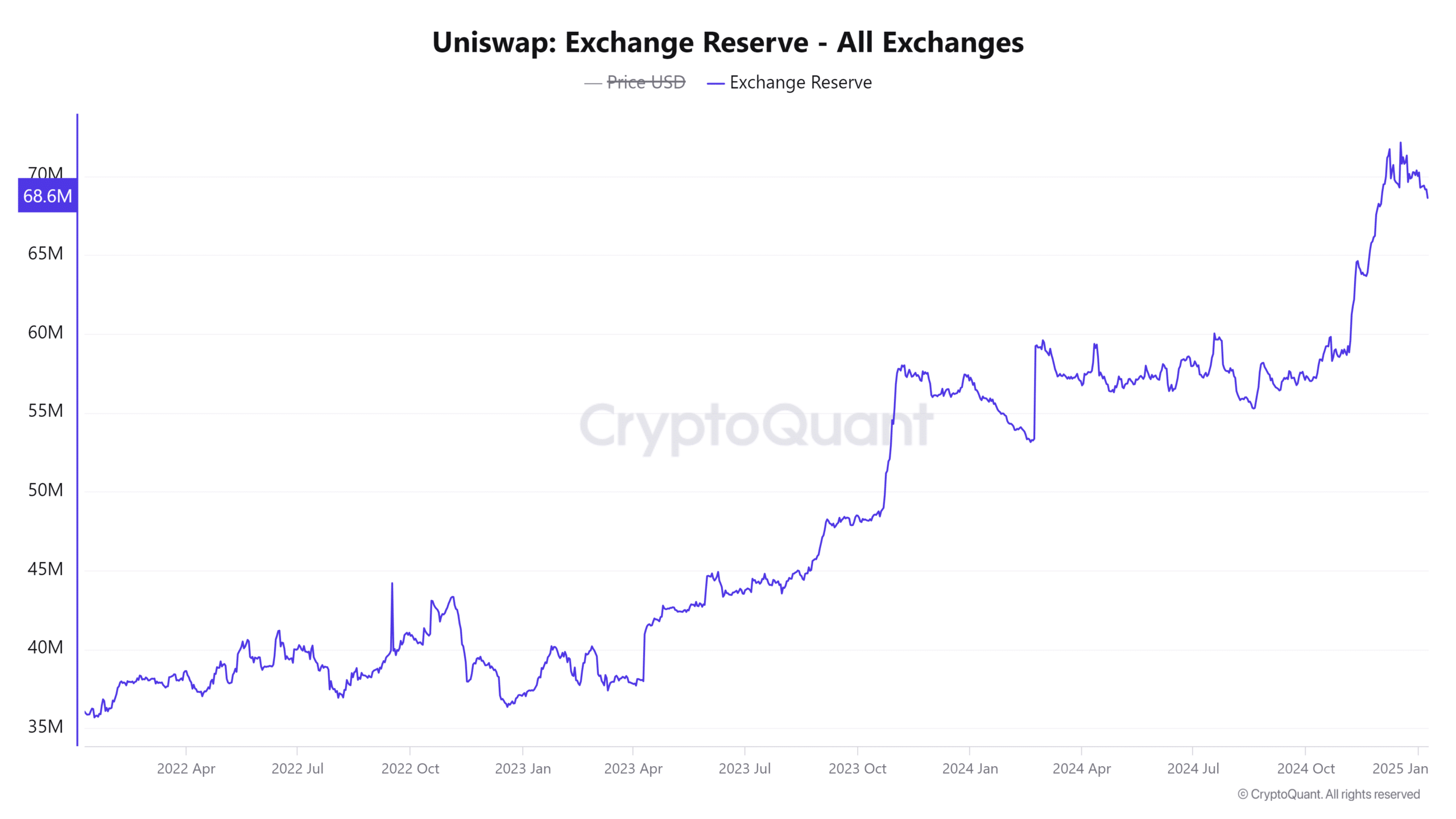

Declining exchange reserves mean…

In the last 24 hours, UNI’s exchange reserves have dropped by 0.75%, currently standing at approximately 68.63 million tokens. This reduction implies reduced selling pressure since there are now fewer tokens readily available for trading on exchanges.

On the other hand, it indicates a cautious outlook among investors, as they prefer to hold onto their assets instead of engaging in buying or selling activities.

Consequently, although there’s a slight improvement here, it’s unclear if it has the power to consistently push things forward.

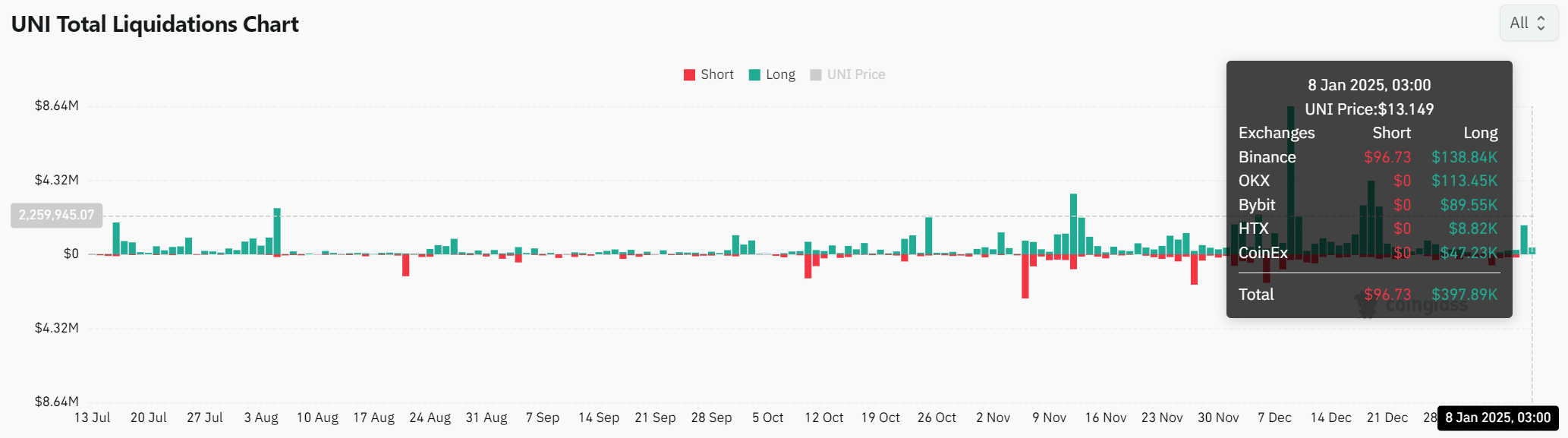

Liquidation data highlights market uncertainty

The data from the liquidation process offered additional understanding of the overall market’s mood. Specifically, the amount of long positions was a substantial $397,890, which was much greater than the $96,730 in short positions.

This imbalance reflected cautious optimism among buyers, who appeared to anticipate a rebound.

Nevertheless, even though UNI has encountered robust resistance points, there’s disagreement among investors about an immediate recovery. As such, traders ought to tread carefully and keep a watchful eye on critical pricing thresholds.

Can Uniswap reclaim bullish momentum?

UNI’s rebound potential hinges entirely on whether the $13.20 support level holds.

Read Uniswap’s [UNI] Price Prediction 2025–2026

Despite indications from the TD Sequential signal and on-chain statistics that a potential recovery might occur, the overarching bear market still presents a formidable challenge.

Should the price of $13.20 not hold, it’s probable that it may continue to drop. Despite the hopefulness present, UNI needs to firmly maintain its current level of support if it wishes to recover its bullish trend.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-08 12:10