- Cardano whales bought 10 million ADA tokens in 24 hours.

- ADA has declined by 8.82% over the past day.

Over the last seven days, Cardano (ADA) saw a substantial upward momentum. However, it has since reversed its course, with the digital coin falling from $1.15 to a 24-hour low of $0.98 at this moment.

This downturn presents an excellent chance for purchasing, as major investors are now buying at lower prices following the dip. As per crypto expert Ali Martinez, within the last 24 hours, significant Cardano investors have bought approximately 10 million ADA tokens.

Any impact on ADA?

Although the recent buying activity by large investors (Cardano whales) is predicted to boost the altcoin, the price charts have not shown a clear increase as of now.

Currently, the price of Cardano stands at $0.9914, representing a 8.82% decrease over the past day. Earlier, ADA was moving upward and had increased by 16.92% in the previous week’s trading period.

Despite the daily dip, ADA investors remain optimistic, and the markets have not turned bearish.

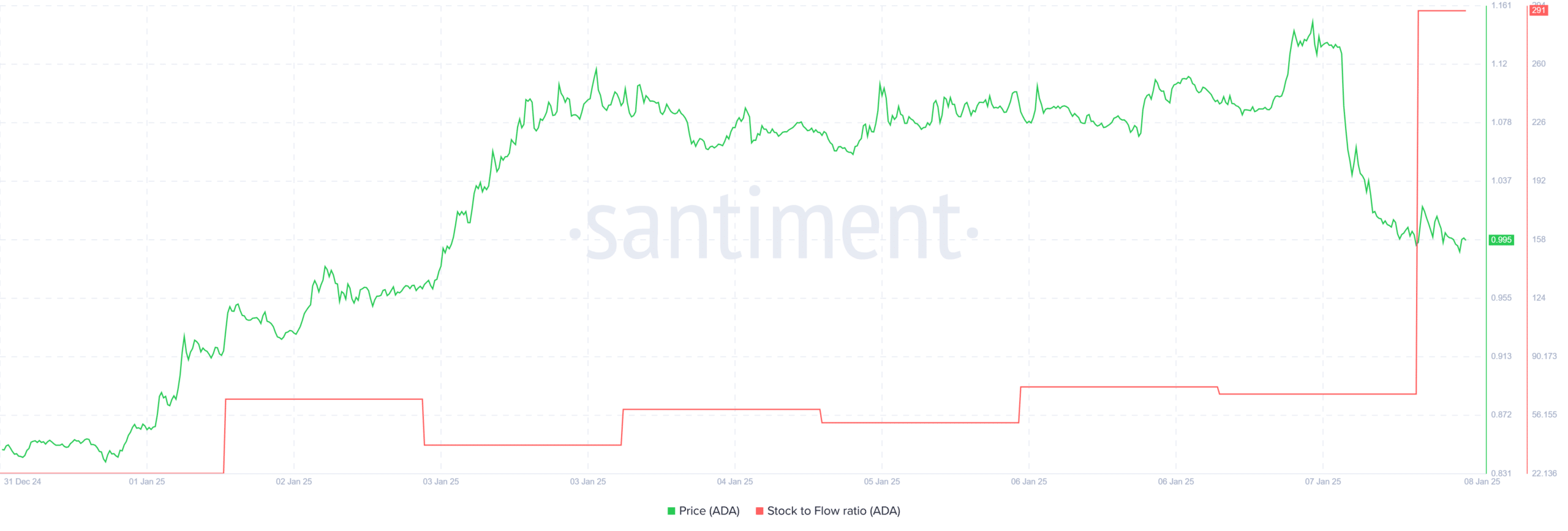

As a crypto investor, I’ve noticed an optimistic trend that’s becoming increasingly clear – the growing rarity of my chosen cryptocurrency, Cardano (ADA). This scarcity is evident in the surge of its Stock to Flow Ratio (SFR), which has climbed to an impressive 291.37.

When the Supply-to-Funds Ratio (SFR) increases, it indicates that investors are aggressively buying and holding onto their tokens rather than selling them on exchanges. Over time, this reduction in available supply often leads to an increase in price due to the basic economic principle of supply and demand.

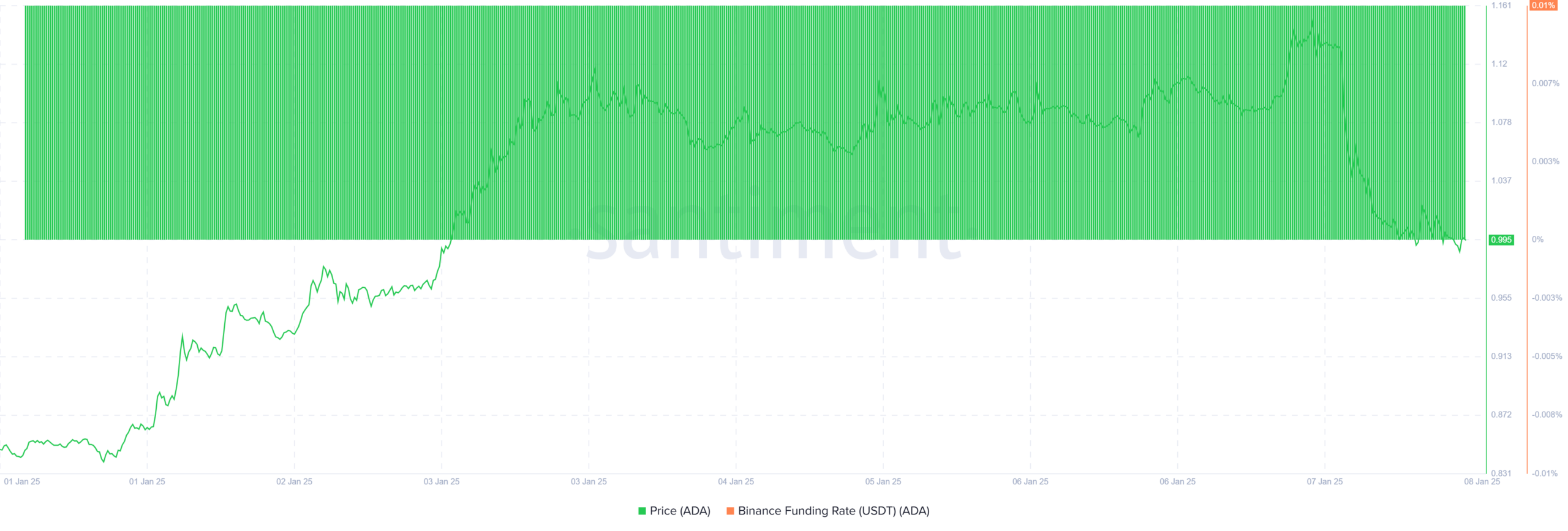

Moreover, the trading activity on Binance suggests a robust optimism among traders, evident through the positive Binance funding rate.

When the funding rate becomes positive, it typically means that more investors are betting on ADA’s price increase, as they predominantly hold long positions. This indicates a general expectation among traders that ADA’s value will go up.

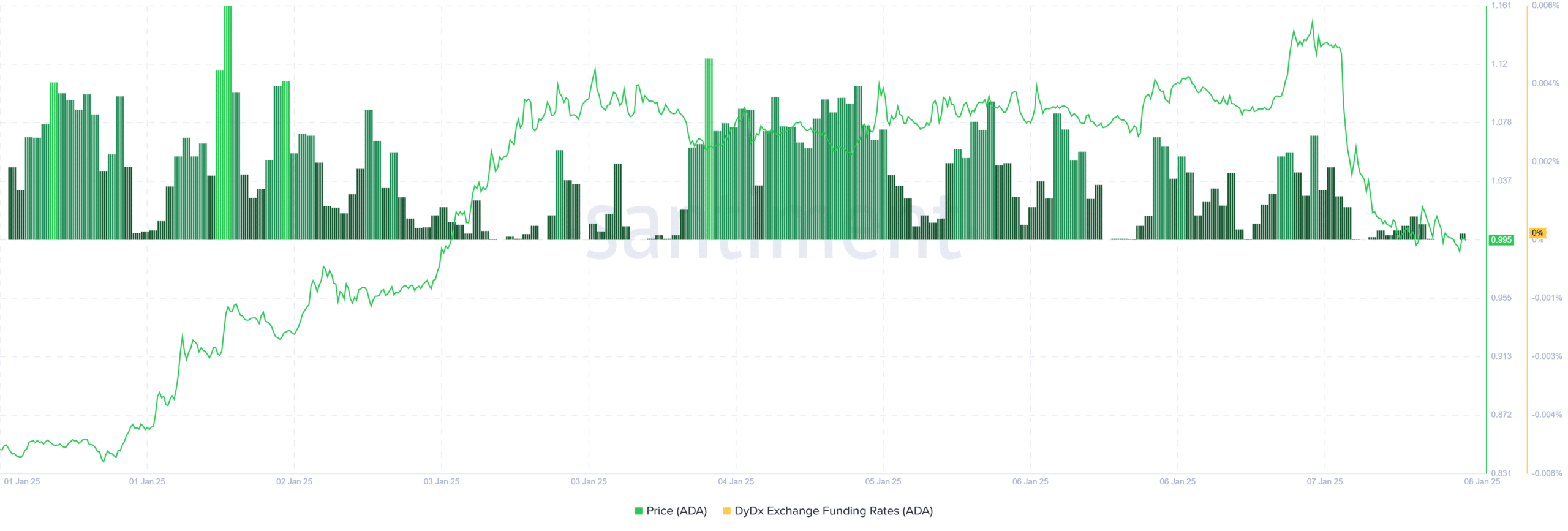

The increasing preference for long positions is further supported by the favorable DyDx Exchange lending rate. When this lending rate becomes positive, it signifies that investors on various platforms are prepared to cover extra costs in order to maintain their trades.

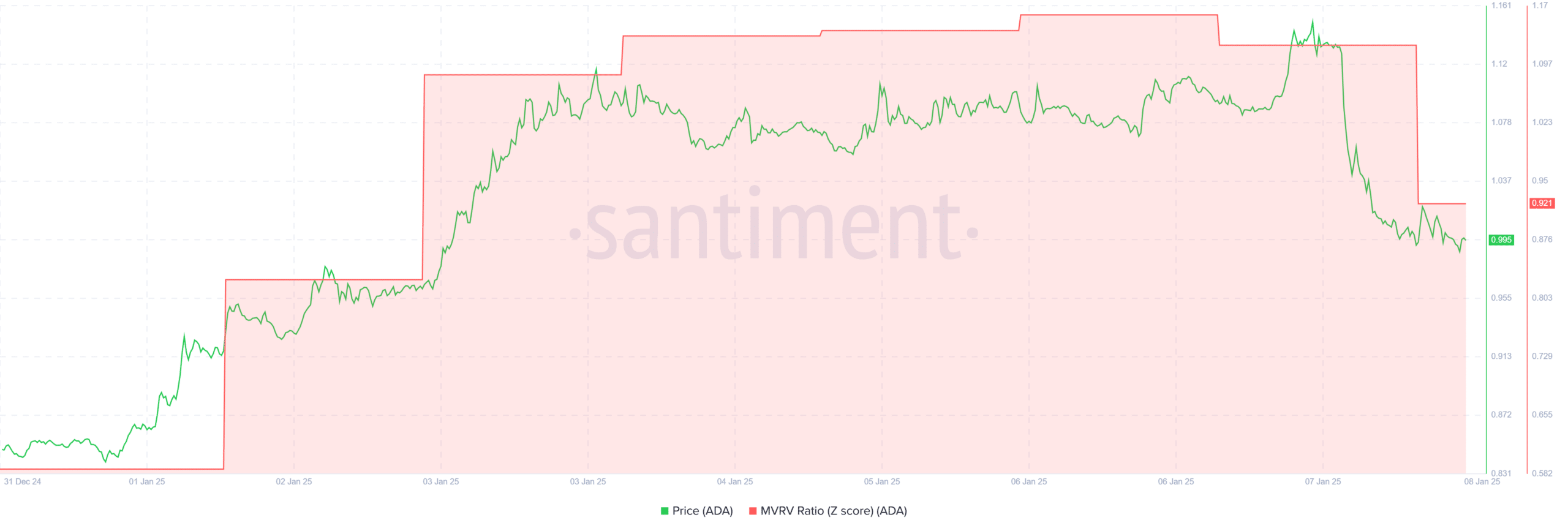

In summary, the Multi-Asset Value Ratio (MVRV) of Cardano has now fallen to 0.92, which is a signal that it might be an opportune moment for investors to consider purchasing ADA at relatively low prices. Historically, when the MVRV dips like this, it often indicates a reversal in price trends as more and more buyers flood back into the market.

As a researcher, I find myself observing a resilient upward trend in the cryptocurrency market, specifically with Cardano (ADA). Though we’ve experienced a temporary retreat, the general sentiment among investors remains optimistic, as they foresee a rebound and further growth for ADA.

Read Cardano (ADA) Price Prediction 2025-26

If the favorable feelings persist, it’s possible for Cardano (ADA) to reach approximately $1.11 again. Conversely, if the recent downward trend persists, there’s a possibility that ADA could drop to around $0.8 before trying to regain an upward trajectory.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-08 13:11