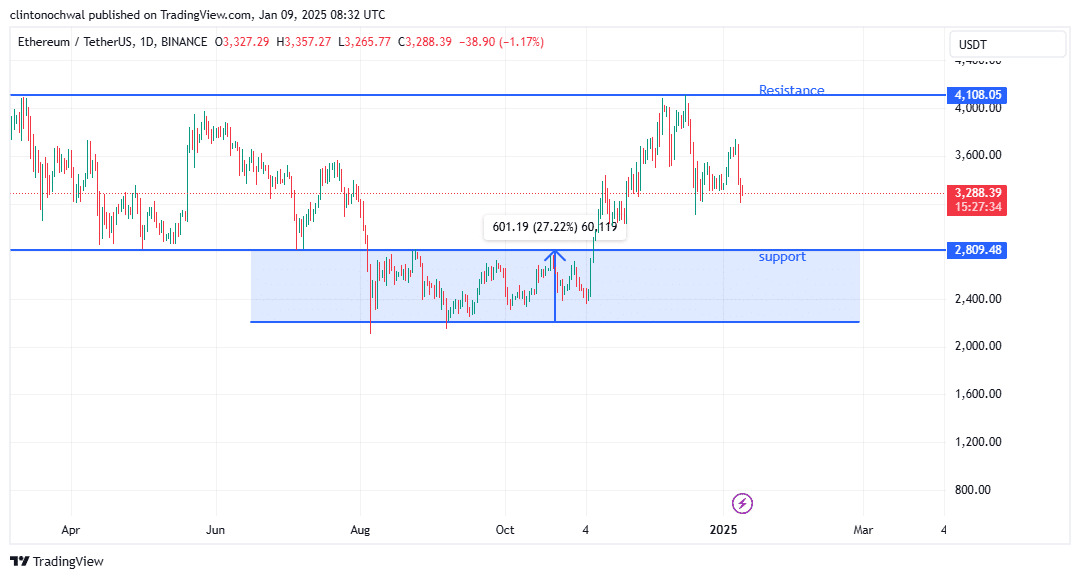

- Ethereum’s recent price action has revealed critical support and resistance levels that traders should monitor.

- As ETH broke below the $3,593.46 support, Open Interest in Ethereum Futures contracts initially rose.

Recently, Ethereum (ETH), the second most valuable cryptocurrency as measured by market cap, has dropped below an important support line, causing unease among traders due to this development.

With Bitcoin [BTC] undergoing its own correction, Ethereum has shown signs of further retracement.

Analysts predict that $2,809 could be a likely area where cryptocurrency may collectively gather strength, possibly leading to an upcoming surge. This scenario implies there might be a more significant downturn before the positive trend in prices continues again.

Support and resistance levels

Keeping an eye on crucial support and resistance points in Ethereum’s current market behavior is vital for traders. Over a four-day period, Ethereum’s price fluctuations have been significantly influenced by significant support and resistance thresholds.

At $2,809.48, a significant level of support could be found, whereas the closest point of potential resistance was at $4,108.05. These points serve as crucial markers for traders observing possible changes in direction or continuation in Ethereum’s price trend.

At the current moment, the price is close to $3,297.19 and a drop below $3,593.46 indicates a strong downward trend, suggesting bearish market conditions.

As a researcher, I find myself observing that this level seems to be situated near the middle ground between areas of support and resistance. This could hint at a period of consolidation, suggesting a pause before the next substantial movement in the market.

As a crypto investor, if Ethereum (ETH) manages to maintain its position at around $2,809.48, it might signal a robust accumulation zone for long-term traders, suggesting potential growth in the future. However, should ETH fail to hold this support level, it could lead to further price drops, potentially igniting a broader market pessimism.

Bears giving up?

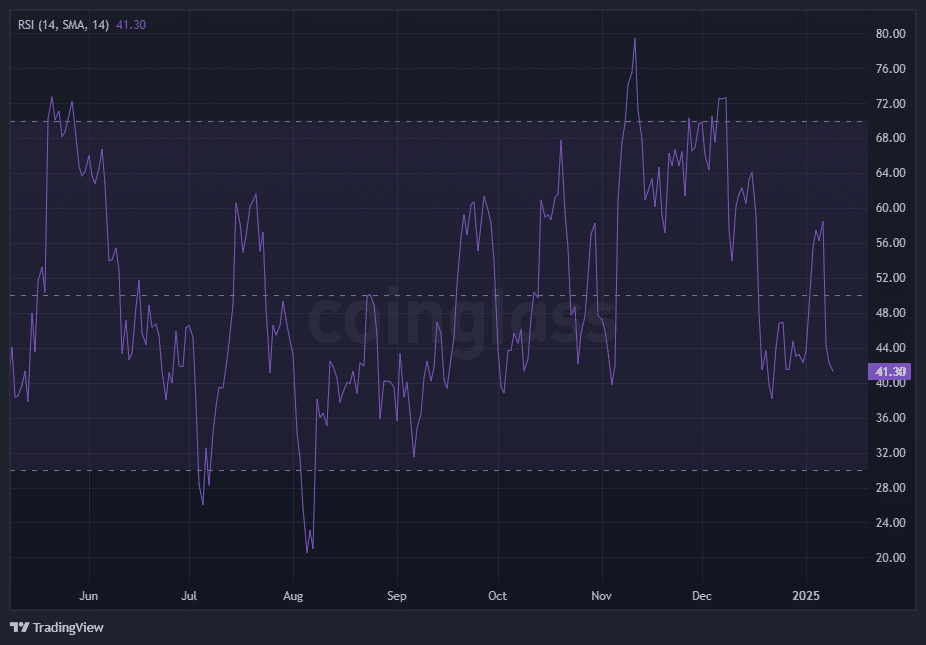

The Relative Strength Index (RSI) offers valuable insights about the present momentum and future trend predictions for Ethereum’s price movement.

According to the graph, the Relative Strength Index (RSI) is decreasing, indicating an increase in selling activity and a weakening of bullish momentum.

As the Relative Strength Index (RSI) nears the oversold level of 30, it suggests that the current downtrend might be running out of steam, indicating a possible shift in market momentum.

In simpler terms, the Relative Strength Index (RSI) analysis continues to be vital in interpreting Ethereum’s current trend. At present, the RSI readings, which represent recent price fluctuations, indicate a rise in selling activity.

As ETH trends closer to $2,809.48, the RSI may dip further toward the oversold threshold of 30.

This would signal a potential bounce or consolidation, depending on market sentiment.

Keep an eye out for a strong RSI bounce over 40, as this could suggest an upswing heading towards $4,108.05, which aligns with potential recovery. Ignoring this could mean that Ethereum might continue following a downward trend.

Ethereum: Assessing market sentiment

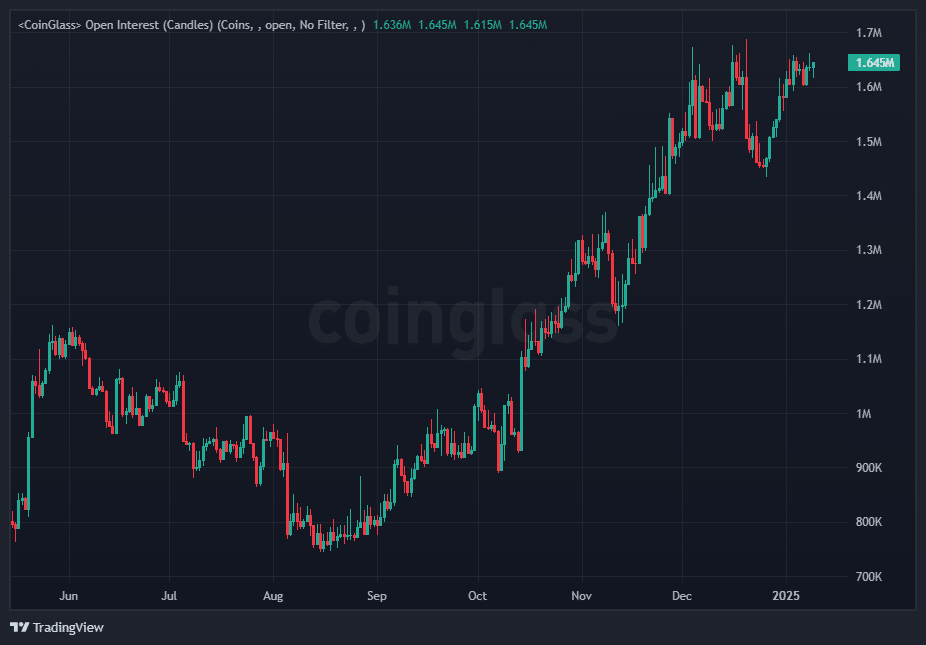

The amount of open agreements (futures and options) in the market, often referred to as Open Interest, is an essential indicator used to assess the level of investor involvement and the general market mood.

For Ethereum, the latest drop in price has been paired with varying patterns, uncovering crucial tendencies.

Upon the decline of ETH beneath the $3,593.46 resistance level, my observation shows an initial surge in the number of open positions in Ethereum Futures contracts. This increase hints at a rise in speculative behavior among traders, as they seem to be readying themselves for potential additional losses.

As the price falls, increasing participation from traders usually indicates growing pessimism, suggesting they believe the downward trend will persist further.

After the significant correction to $3,318.41, I noticed that Open Interest started to level off, suggesting a decrease in speculative intensity and perhaps market uncertainty.

A notable decrease in Open Interest could suggest that the market is starting to cool off, as traders are likely closing their positions and waiting for more definitive signs before making further trades.

Instead, seeing continued rises in Open Interest, particularly close to the $2,807.13 support area, might suggest that long-term investors are stockpiling or that there’s growing speculation about a potential recovery, from my perspective as a crypto investor.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Since the price fluctuations of Bitcoin can impact Ethereum’s market behavior, it’s essential for traders to stay vigilant and regularly check critical points and indicators to make informed decisions.

If the price bounces back from its $2,807.13 support, it could spark a resurgence of bullish trends. However, if this support level isn’t maintained, it may trigger more substantial corrections.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-09 17:12