- The Fear and Greed Index crypto hits 49, reflecting a cautious market poised for its next move.

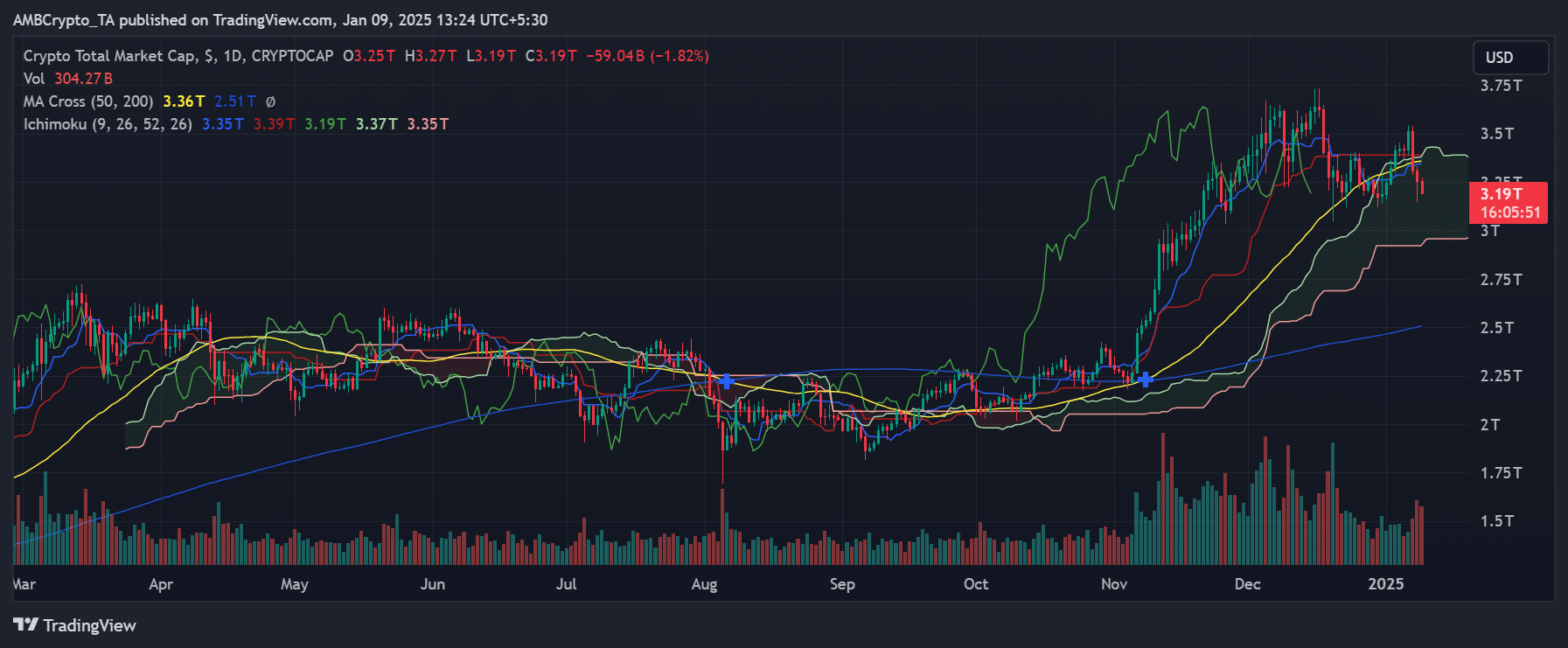

- Consolidation dominates with the total market cap at $3.19T, as traders awaited clearer signals from macroeconomic trends.

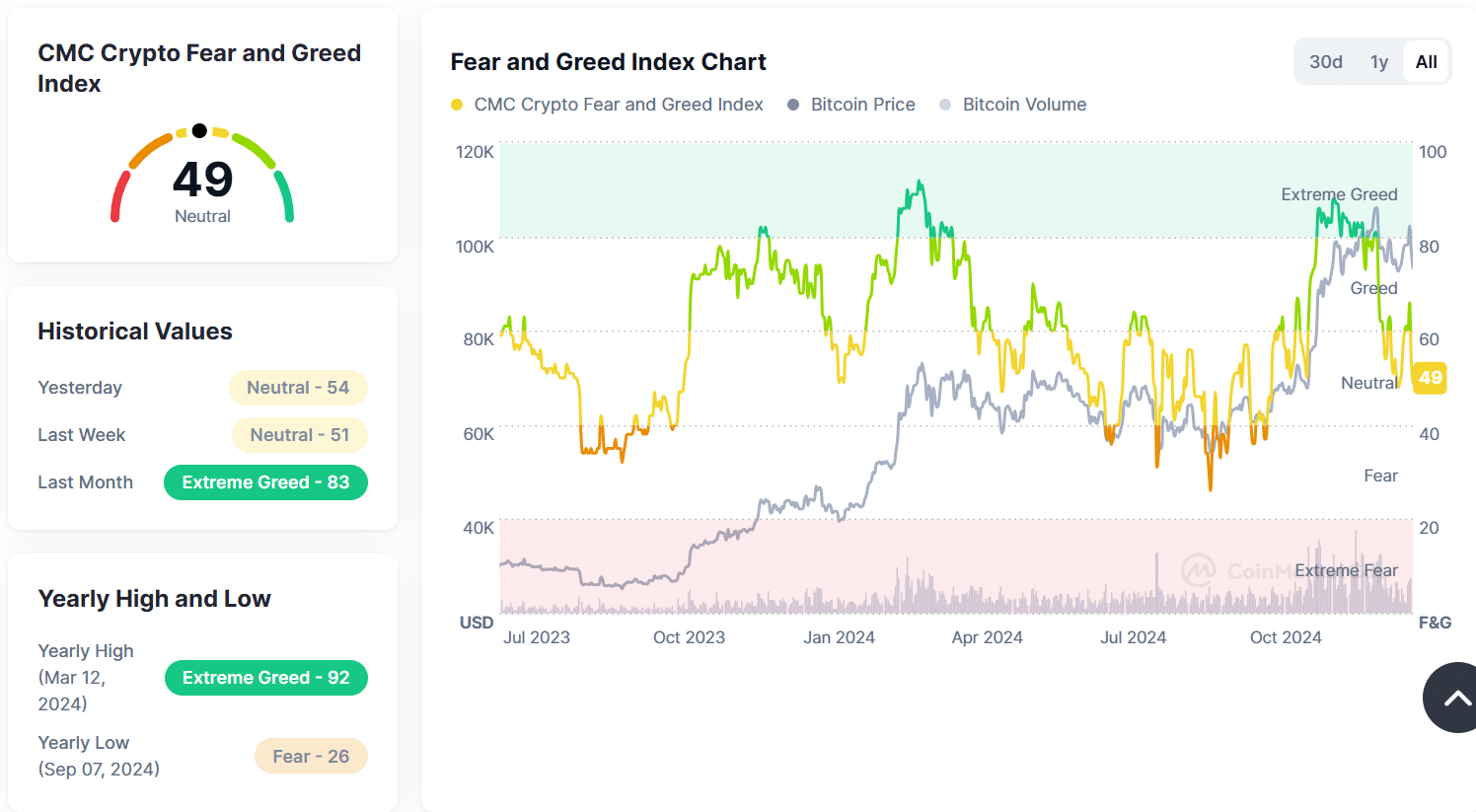

Currently, the world of digital currencies is exhibiting a sense of careful balance, with the Fear and Greed Index reading 49, indicating a state of neutrality.

This change indicates a less optimistic outlook following several turbulent weeks, and it marks a move away from the ‘Extreme Greed’ levels of 83 that were seen in the previous month.

Currently, the overall cryptocurrency market capitalization appears to be following a pattern of consolidation, indicating that prices might continue moving within a certain range for now. A significant trigger could be needed to push them beyond this range.

Fear and greed index crypto: Market uncertainty

Over the past month, the Fear and Greed Index has been steadily dropping, moving from an extreme greed level of 83 to a neutral state of 49 as we speak now.

This decrease highlights an increasing apprehension amongst market players, largely driven by economic factors on a global scale, like robust U.S. employment figures and the possibility of interest rate increases from the Federal Reserve.

Yesterday, the historical values I’ve been tracking told an intriguing tale. My analysis showed that the sentiment was Neutral at 54 points, which wasn’t too far from where it stood a week ago at 51 points. However, today, the index seems to be precariously balancing on the verge of fear, hinting at potential shifts in public sentiment that warrant closer examination.

This shift suggests that the market is showing uncertainty, as traders are choosing to remain cautious and observe upcoming significant economic occurrences later in the week before making further moves.

Consolidation in total crypto market cap

As I observe the cryptocurrency market at this moment, the total market capitalization stands at approximately $3.19 trillion, a slight dip of 1.82% compared to the figures recorded over the last 24 hours. The Ichimoku Cloud and moving averages on the chart offer invaluable insights into the current market structure, helping me better understand its trends and potential future movements.

Just now, the market value dropped beneath the 50-day moving average, which is currently at $3.36 trillion, suggesting an increase in temporary downward price pressure.

Yet, the Ichimoku Cloud indicates potential support at $3.19 trillion, implying that a major price drop could potentially be prevented if purchasers decide to enter at this point.

At approximately $304.27 billion, the trading volume suggests a fairly active market, yet it seems insufficient to generate the needed impetus for a significant price move in either direction.

If no significant event arises, like softened comments from the Federal Reserve or positive economic reports, it’s expected that the market will stay within its current limits, moving sideways rather than significantly up or down.

How the fear and greed index crypto moves is also important.

What’s next for crypto markets?

In simpler terms, since the cryptocurrency market is currently stable and its total value isn’t changing much, we don’t anticipate major price fluctuations in the near future.

However, several scenarios could unfold based on market conditions.

If optimistic economic trends continue, there’s a possibility that investor sentiment could swing back towards greed, potentially causing Bitcoin and Ethereum to reach or even surpass their all-time highs again.

The ongoing trend could propel altcoins too, possibly causing the overall market capitalization to surpass the $3.4 trillion ceiling of resistance.

Instead, if there’s a shift towards fear, it’s possible that Bitcoin and Ethereum might dip below their present values. This could pull the overall market capitalization down towards, or even below, $3 trillion.

If there’s no substantial event or factor influencing it, the market could continue moving sideways, staying between approximately $3.15 trillion and $3.35 trillion. In this scenario, the prices of Bitcoin and Ethereum might hold steady at their current values.

These moves will impact the fear and greed index crypto.

Caution in neutral markets

In simple terms, the overall feeling about cryptocurrencies is neither overly positive nor negative, suggesting an equal measure of hopefulness and wariness among investors.

In simpler terms, how the prices move over the short term may depend on consolidation, as investors keep an eye out for indications from broader economic data and international market trends.

Though the Fear and Greed Index indicates uncertainty, it serves as a starting point for possible growth if external factors improve positively.

For now, patience and close monitoring of key support and resistance levels are essential.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Solo Leveling Season 3: What Fans Are Really Speculating!

- ETH/USD

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

2025-01-10 03:04