- Solana’s $180 support level is crucial for its price action in 2025

- Social volume and decreasing active addresses may signal further losses for Solana

2025 marks the start, and the crypto market is witnessing increased volatility, causing various assets to approach crucial support zones. One such asset drawing significant attention is Solana [SOL], currently lingering near the vital price mark of $180. This figure represents a significant level for traders, as they anticipate potential fluctuations in the market.

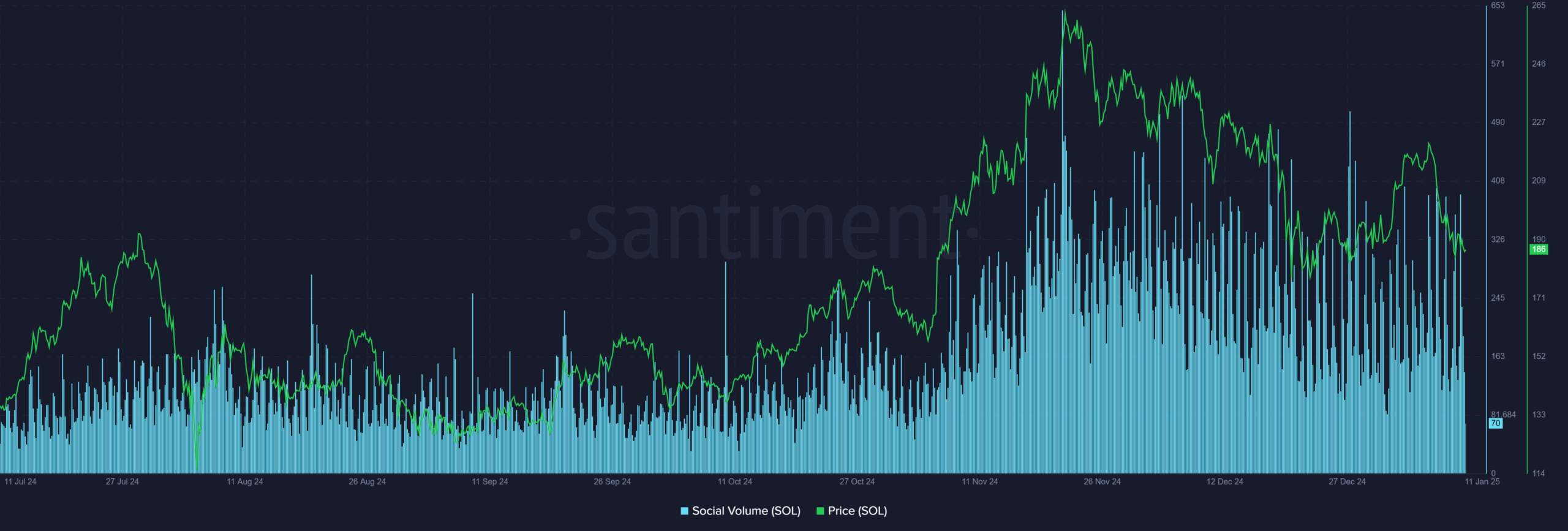

Social volume – A signal for Solana’s price moves

It’s clear from the chart that Solana’s social activity levels have a strong link to changes in its price – periods of high social volume tend to be followed by substantial price swings. In other words, increased social activity frequently signals upcoming price instability.

For several months now, there’s been increased conversation about Solana on various social platforms, which seems to align with a rising trend in its price – Implying a possible price surge driven by public sentiment.

On the other hand, with social volume staying high, it could serve as a two-sided instrument. This heightened activity might indicate excessive market excitement, or alternatively, hint at an upcoming shift in trend.

Paying close attention to current trends, traders ought to stay vigilant for sudden changes in sentiment, particularly if Solana can’t maintain a position above $180. Continual increases in social activity without corresponding price rises may indicate decreasing backing and potential future drops.

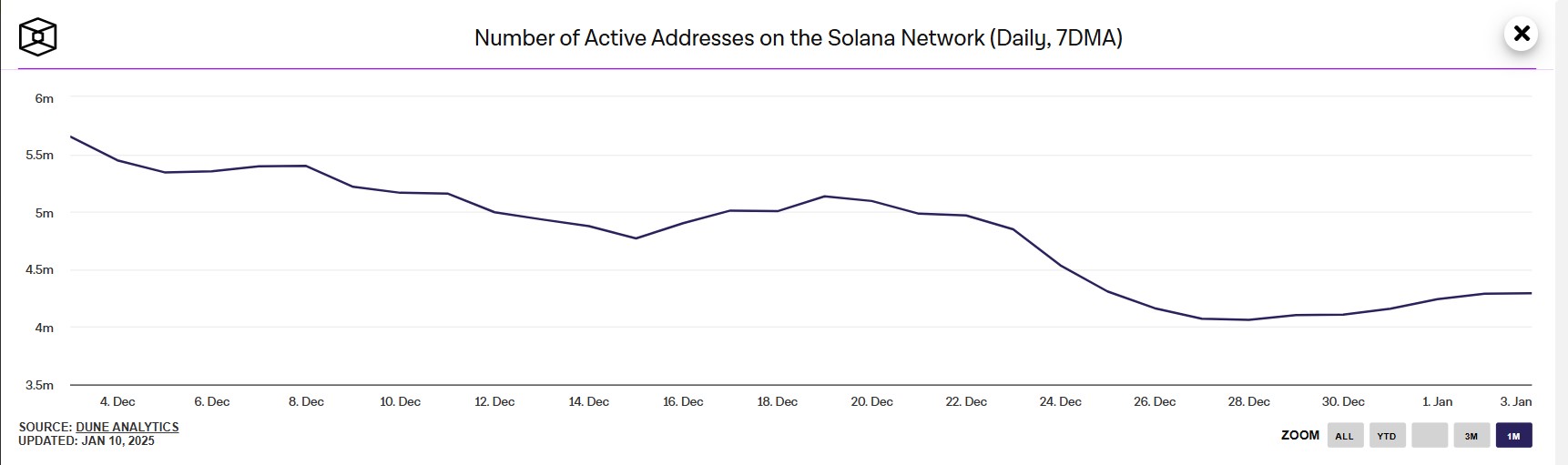

Decreasing active addresses

Over the course of December, there was a significant decrease in the number of active Solana addresses, which is concerning. Specifically, between early and late December, active addresses dropped dramatically, going from around 5.9 million to approximately 3.6 million – A reduction of more than 40%.

Despite a slight improvement at the beginning of January, the metric is still significantly below its past peaks, suggesting less network interaction and user involvement.

The decrease in active users is causing worry because it might signal a loss of value and trust among the user base. In the past, significant reductions in active accounts typically foreshadowed market pressure leading to falling prices, suggesting decreasing interest from buyers.

Maintaining Solana’s price around $180 might depend on halting this downward trend. If there isn’t a substantial increase in on-chain transactions, the threat of continued price decline becomes quite significant.

Read Solana’s [SOL] Price Prediction 2025–2026

Solana – What’s next?

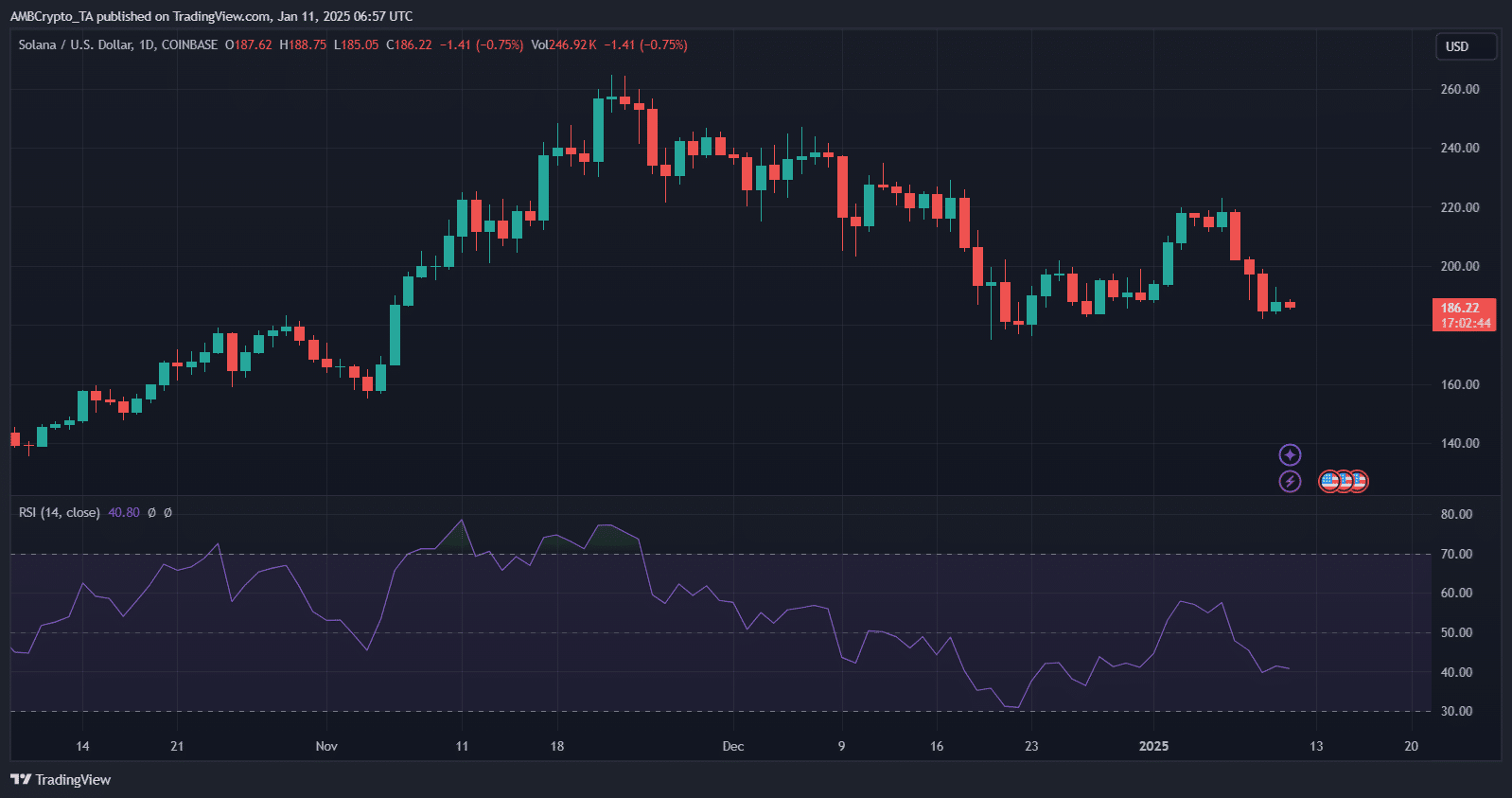

At the moment I’m observing Solana, and it appears to be showing a delicate balance, with $180 serving as a crucial turning point. The Relative Strength Index (RSI) suggests a bearish trend, moving towards oversold territory, which could potentially trigger more selling if Solana falls below the $180 mark.

In simpler terms, potential drop-off points could be around $165 first, then a range between $130 and $150, where there may be more solid resistance to further falls.

Souce: TradingView

Positively speaking, recovering around $190 might indicate a relief rally that could aim for $200. Yet, low trading activity and decreasing on-chain activity may limit any significant gains. If there’s no renewed buying enthusiasm or fresh fundamental drivers, Solana could slide into a lengthy consolidation period or even experience a more substantial downturn. This underscores the crucial role of $180 as a critical turning point.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Kidnapped Boy Found Alive After 7 Years

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Silver Rate Forecast

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Avowed Update 1.3 Brings Huge Changes and Community Features!

2025-01-11 15:03