- Bitcoin holdings seem to have stabilized, with notable buying activity seen among prominent addresses

- Whales are positioning themselves for a potential rally as liquidity inflows into the crypto market rise

Regardless of the overall market drop, Bitcoin [BTC] has been holding steady above $90,000 for an extended period, minimizing its recent weekly and monthly losses to 3.97% and 5.49%, respectively.

As the mood among investors seems to change and traders increasingly buy into Bitcoin, it may be ready for another price surge.

Accumulation gains momentum

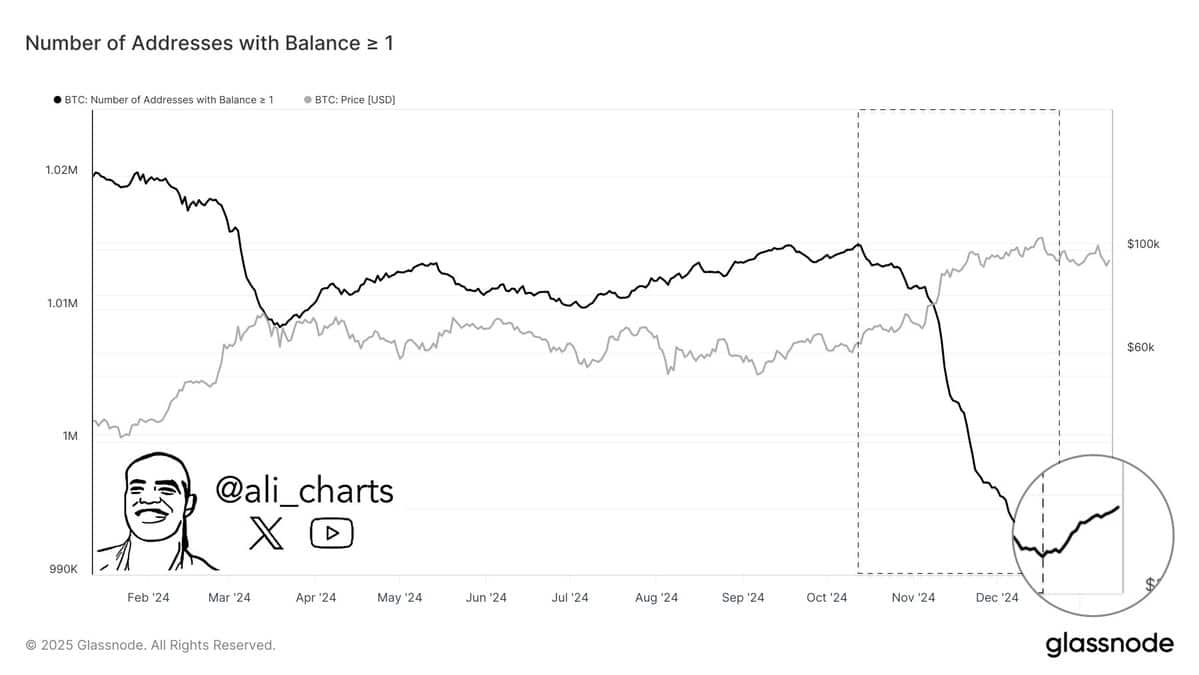

As an analyst, I’ve been monitoring the number of wallets containing at least 1 Bitcoin, and I’ve noticed a significant increase in Bitcoin acquisitions this year.

Based on their records, we’ve seen a substantial increase in the quantity of wallets containing over 1 Bitcoin. This trend is particularly noteworthy considering it follows a lengthy period of distribution starting in October, during which numerous Bitcoin owners were unloading their coins.

Building up holdings typically indicates that investors have regained trust in the market. As they move from offloading assets to keeping them, it suggests they expect continued worth and may choose to keep the investment, potentially sparking a surge in prices.

Additionally, AMBCrypto noted various signs suggesting an increase in optimism among traders. These indicators might signal a possible rise in Bitcoin’s price in the short term.

Liquidity surge and BTC investor adjustments

Over the past 24 hours, as reported by Whale Alert, the second-largest stablecoin provider within the cryptocurrency market, US Dollar Coin (USDC), has produced 250 million new coins for its reserve.

Generally speaking, an increase in the creation of stablecoins (minting) usually indicates a growing appetite for these digital assets among traders, who are preparing to invest more in cryptocurrencies. In the past, Bitcoin (BTC) has frequently gained value following similar surges in minting activity. If this trend persists, it’s possible that BTC’s price will incrementally climb over the next trading periods, driven by heightened interest in acquiring it.

Notably, there’s been a significant change among major Bitcoin investors who collectively hold approximately 2,535 BTC, equivalent to more than $239 million.

Investors are transferring their digital assets from the Kraken cryptocurrency platform to personal wallets, demonstrating increasing trust in Bitcoin. This move is particularly significant since it involves keeping their resources away from exchanges for enhanced safety.

3 separate transactions, initially held by Kraken, moved a total of 2,535 BTC to an unidentified wallet: one transaction for 620 BTC, another for 888 BTC, and the last one for 1,027 BTC.

Derivative traders unconvinced by BTC’s rally

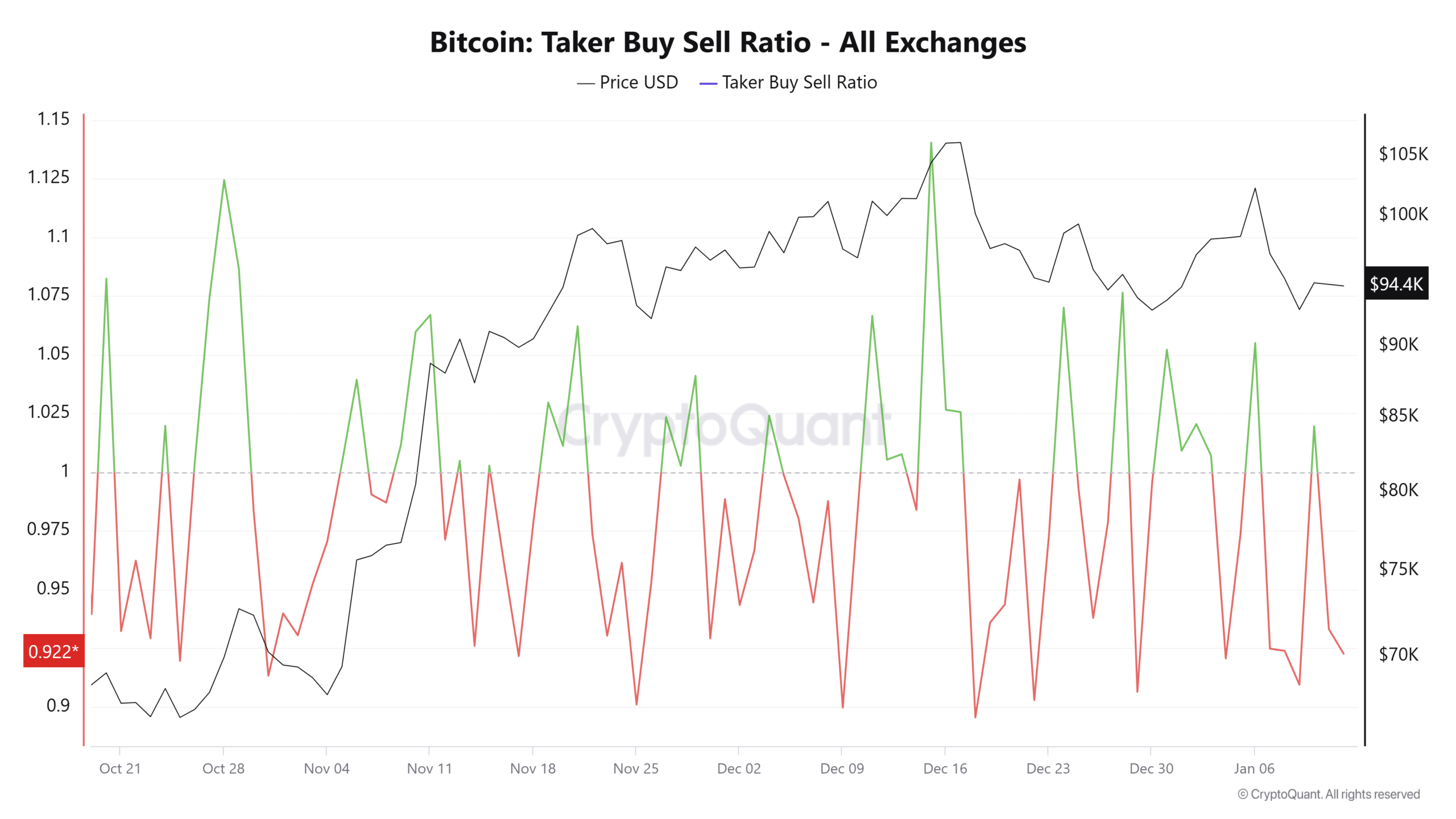

As per the Taker-Buyer Sell Ratio on CryptoQuant – a metric that gauges the balance between buying and selling activity in the derivatives market – it appears that sellers are currently holding sway over the market.

Currently, as I’m explaining this, the ratio stands at less than 1 (specifically, it’s 0.922), suggesting that there is more selling happening compared to buying. If this trend persists, it might slow down or delay Bitcoin’s current price surge.

Despite a small difference (less than 0.1) between the neutral zone and current conditions, increased investment in the market along with higher Bitcoin withdrawals from exchanges might boost confidence among derivatives traders. Such optimism could extend the ongoing upward trend in Bitcoin’s price as depicted on the charts.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Thief Build

- Gold Rate Forecast

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Elder Scrolls Oblivion: Best Sorcerer Build

- Ludicrous

2025-01-12 22:15