- The significant drop in activity on the Bitcoin network could exert additional downward pressure on the cryptocurrency’s price.

- A key resistance level, where notable sell orders are concentrated, could further challenge Bitcoin’s ability to sustain its current value.

Over the recent days, I’ve noticed Bitcoin [BTC] trading within a narrow band between $93,000 and $94,000, suggesting a pause in clear market momentum. This prolonged standstill might be an indication of the market’s strength, yet it also underscores hesitation regarding the next significant price shift.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

View Urgent ForecastOver the last day, Bitcoin’s value dipped slightly by 0.75%, but interestingly, the trading activity significantly increased by approximately 68.66%, reaching a volume of $29.41 billion. This could potentially indicate an increase in selling pressure in the near future.

AMBCrypto analyzed broader market sentiment to assess whether this selling activity might increase.

Drop in network activity: Will BTC slide lower?

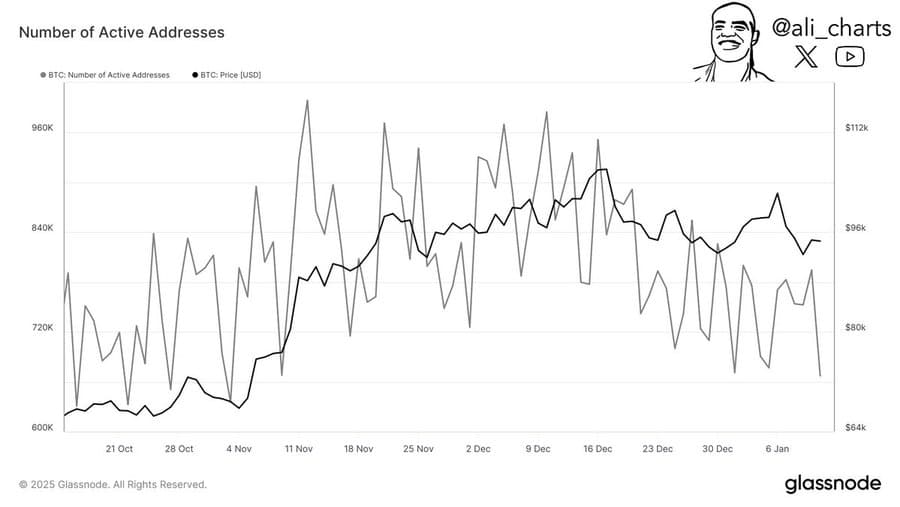

Over the past month, I’ve noticed a striking drop in the level of activity on the Bitcoin network. The number of active addresses, my fellow crypto enthusiasts, has been consistently dwindling.

Presently, we’re seeing a decrease in the number of active addresses down to approximately 667,100 – this is the lowest figure since November 2024.

A decrease in active Bitcoin addresses might mean less user involvement in the network, possibly implying lower transaction frequency. Such reduced participation could hint at decreasing enthusiasm, which might lead to a fall in Bitcoin’s price.

As a researcher examining Bitcoin’s distribution, it appears that a significant chunk of the total supply might be controlled by the active addresses still in circulation. Any increased purchasing activity from these entities could plausibly instigate a surge in market prices.

Obstacle to future rally

If more people actively buy Bitcoin, the value might reach a significant resistance level as it continues to rise, based on information from IntoTheBlock.

As a researcher exploring Bitcoin’s market dynamics, I’ve been studying IntoTheBlock’s “In/Out of the Money Around Price” metric. This tool helps me pinpoint areas where supply and demand are concentrated. In the current context, between $95,900 and $98,600, there seems to be a significant concentration of sellers, potentially suggesting that Bitcoin might encounter selling pressure in this range.

Approximately 1.46 million addresses are currently waiting to sell around 1.29 million Bitcoins at the present level.

Should Bitcoin manage to surpass its current resistance level, there’s a chance it might regain the $100,000 area. But if it fails to breach this point, it could potentially fall below $90,000, suggesting potential for further price decreases.

Increased supply puts BTC rally in doubt

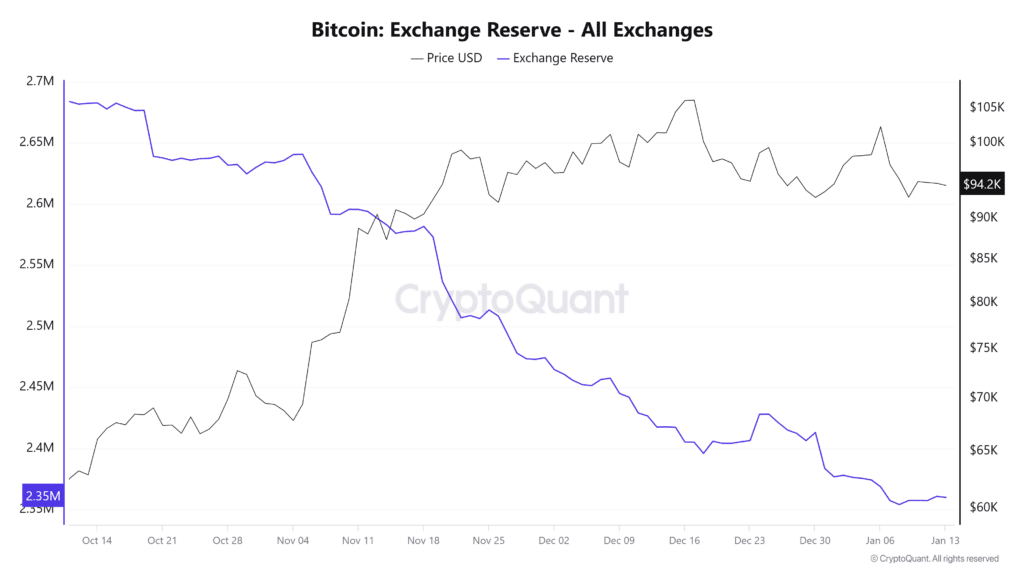

Based on data from CryptoQuant, it appears that the reserves of Bitcoin on exchanges are growing steadily. This trend suggests an increase in the quantity of Bitcoin being held on trading platforms, which could potentially boost the overall supply.

– Read Bitcoin (BTC) Price Prediction 2025-26

Beginning January 8th, Bitcoin (BTC) reserves on exchanges have been gradually rising, going from about 2,354,000 to 2,360,000. This tendency often indicates a potential for increased selling pressure on the asset at its current price, as a rise in exchange reserves is usually a warning signal.

Should the accumulation of exchange reserves persist, it may potentially impede Bitcoin’s capacity to surge beyond its present value range.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- EUR PKR PREDICTION

- Dragon Ball Daima’s Shocking Production Timeline Revealed!

- Solo Leveling Season 3: What You NEED to Know!

2025-01-14 02:15