- According to Amberdata, Bitcoin’s journey to $120k could be delayed.

- Slow Fed rate cut expectations and institutional positioning could negatively impact BTC

Traders focusing on options for Bitcoin (BTC) are looking at a potential $120,000 price mark by March. Yet, current institutional arrangements and economic factors may cause this forecast to be postponed.

According to the latest report from crypto analytics firm Amberdata, elevated U.S. inflation could pose a temporary threat to Bitcoin and the broader market in the near future. The report highlights this issue as one potential short-term risk.

In the coming days, we’ll gain further insights about inflation due to the releases of the Producer Price Index (PPI) on Tuesday and the Consumer Price Index (CPI) on Wednesday. If these figures suggest a robust economy and an increase in inflation, it would imply a bearish outlook for bonds. This could indirectly influence stocks and other risk-related assets as well.

Over the past week, I’ve noticed a notable adjustment in the market and Bitcoin’s recent dip to the lower end of its range. This correction seems to be driven by heightened anticipation of fewer Federal Reserve interest rate reductions in 2025. Interestingly, market predictions suggest that there’s nearly a 98% probability that the Fed’s next rate decision on 31st January will hold steady.

According to Coinbase analysts, they have expressed a similar conservative perspective, influenced by broader economic trends and sales from long-term investors. They predict that Bitcoin’s potential growth may be restricted in the near future.

Bitcoin’s $120k target

Many predictions suggest that a Bitcoin rally surpassing $100k is probable due to favorable policies proposed by the incoming president, Donald Trump, particularly the establishment of a Strategic Bitcoin Reserve (SBR).

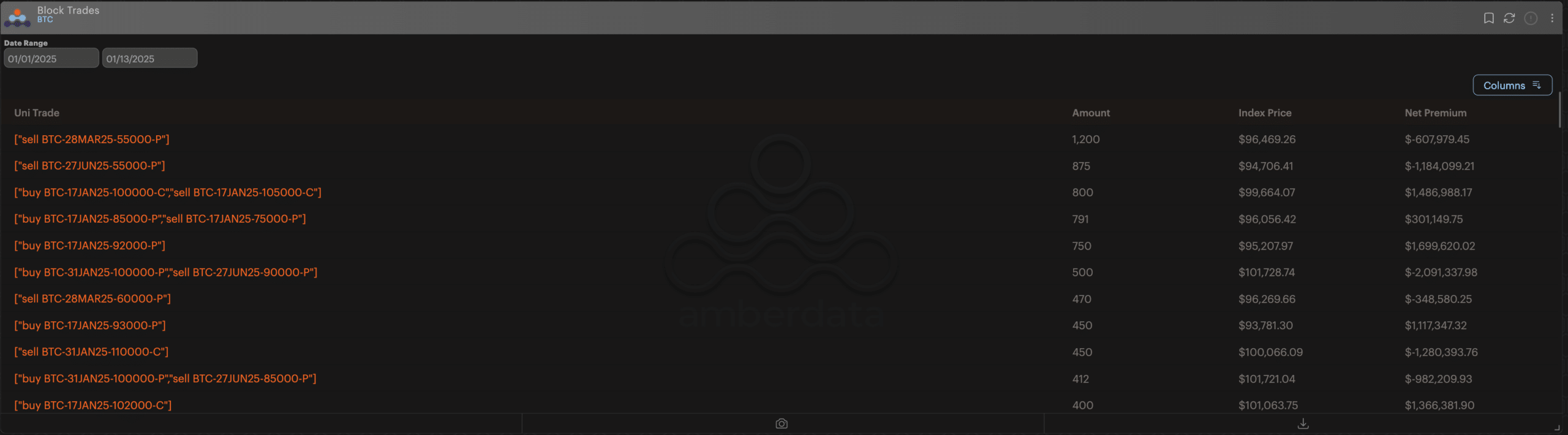

Nevertheless, Amberdata has warned that it’s likely that any policy changes have already been factored into current prices. Additionally, they pointed out that large-scale traders seem to be wagering on a possible fall in Bitcoin price to around $55,000. This speculation could potentially hinder the achievement of the $120,000 target.

In the analysis of significant Bitcoin transactions, institutional investors appear to have a positive outlook on Bitcoin’s price. Instead of purchasing call options, they’re choosing to sell put options for March at $55k and June at $55k. This strategy suggests they’re betting against potential volatility, meaning they believe the price will be relatively stable within these ranges.

As an analyst, I often employ puts as a strategic tool when I’m looking to protect my investments from potential downturns. These are essentially bets that the market will experience a decrease, which larger entities might use to mitigate risks linked to adverse price movements.

Amderdata mentioned that opting for selling put options over purchasing them might decrease the anticipated volatility, hinting at less dramatic price fluctuations or increased price consistency. This could potentially cap a significant surge towards $120k.

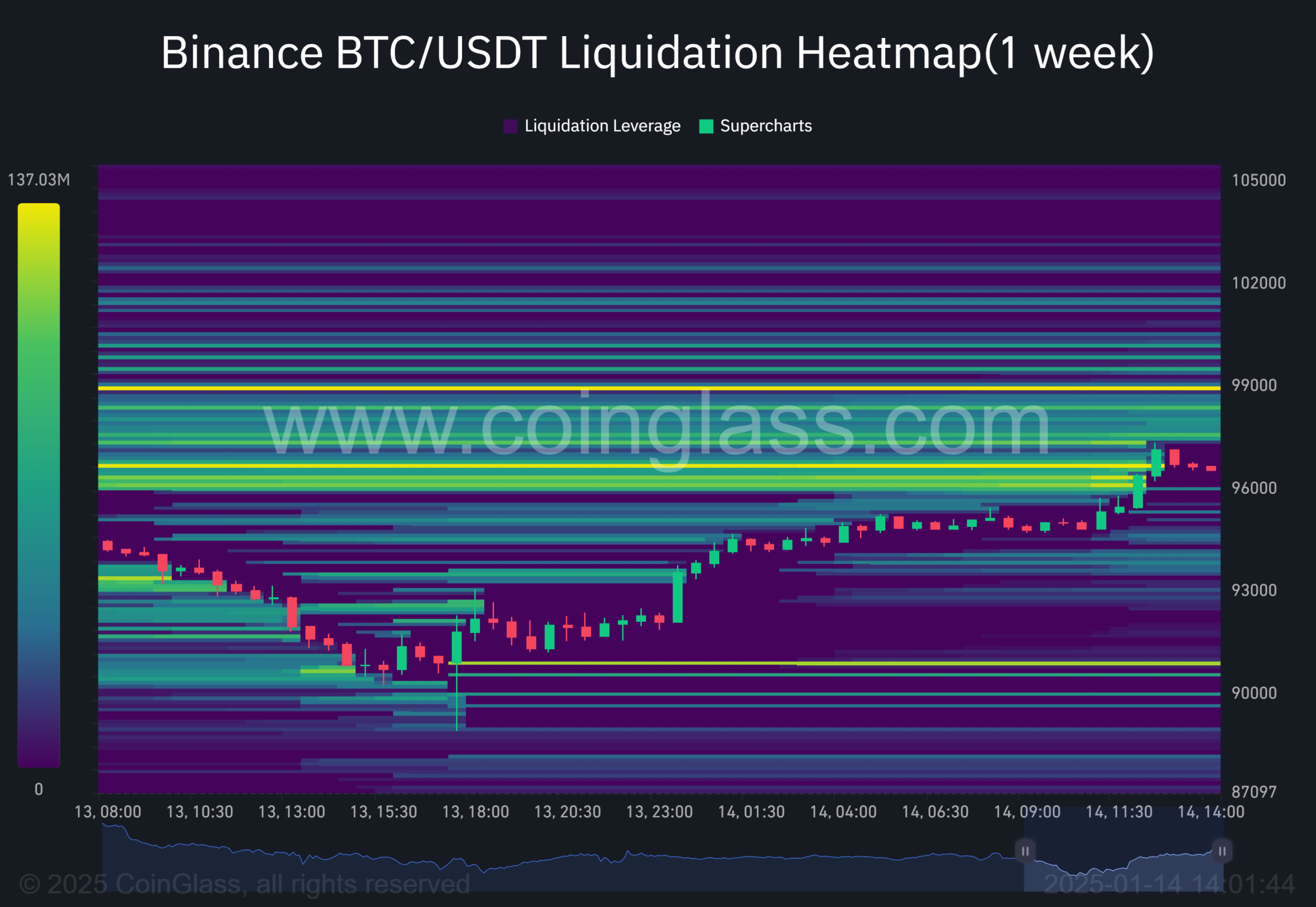

Currently, Bitcoin has surpassed $95,000, with the surge primarily due to a ‘liquidity sweep’ occurring at $96,000 (marked by a bright yellow area). Additional areas of potential liquidity can be found at $99,000 and $90,000. These points might have additional impact on its price movement.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- ETH/USD

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

- Patrick Schwarzenegger Strips Down in Shocking White Lotus Scene You Have to See!

- AUCTION/USD

- White Lotus Star Parker Posey Waited 20 Years for Role

2025-01-14 16:07