- Bitcoin ETFs have attracted strong inflows, outpacing subdued demand for altcoin ETFs like Ethereum

- Layer 2 advancements expand Bitcoin’s utility, challenging Ethereum and bolstering its market dominance

According to JPMorgan’s latest analysis, it is predicted that Bitcoin (BTC) will maintain a dominant market presence through 2025. Currently accounting for approximately 55% of the overall cryptocurrency market capitalization, Bitcoin consistently surpasses Ethereum and other alternative coins. The analyst team, headed by Nikolaos Panigirtzoglou, pointed out several reasons that solidify Bitcoin’s status as the leading digital currency, implying its lasting significance amidst a progressively competitive environment.

Bitcoin’s market dominance

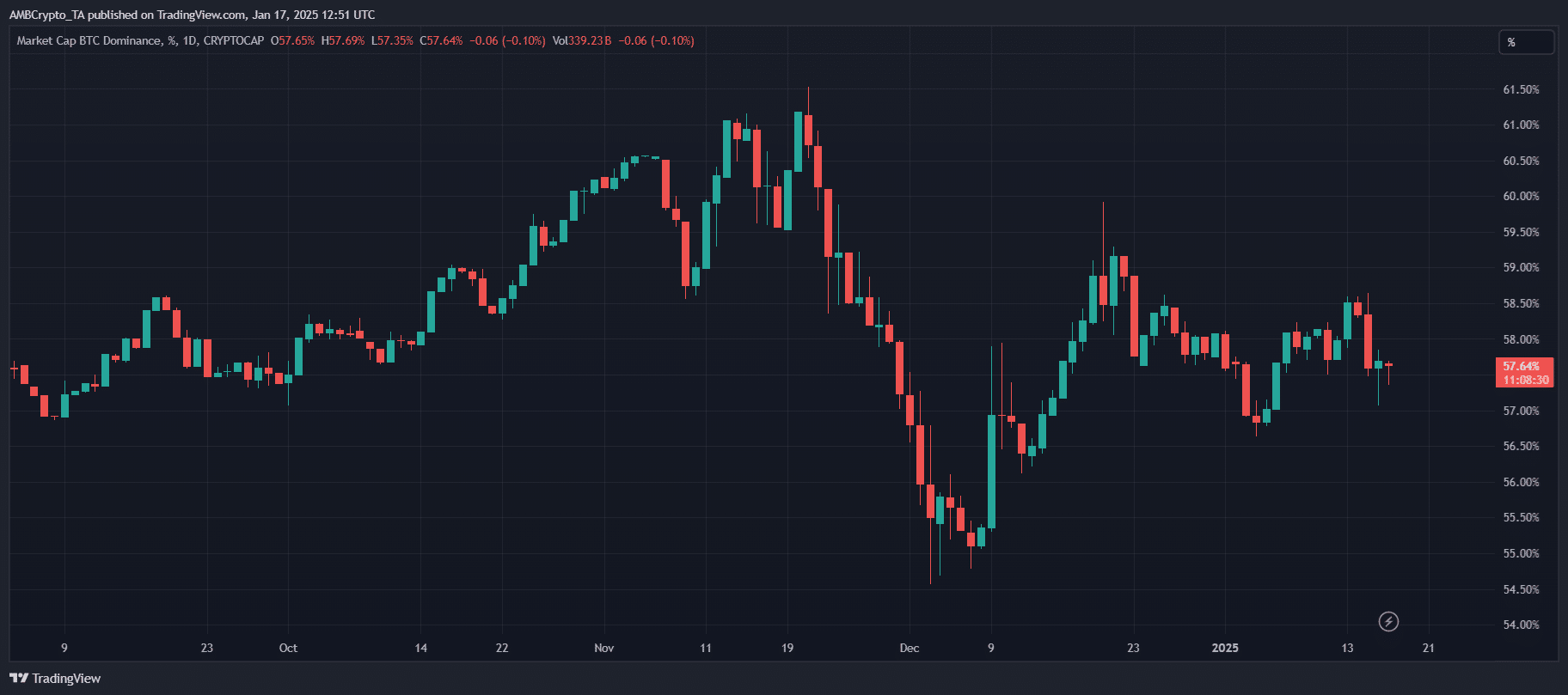

Over the past while, Bitcoin’s control in the crypto market has been bouncing around between approximately 57% and 58%, demonstrating a steady robustness even amidst volatile market scenarios. This resilience is largely due to Bitcoin being seen as the preferred form of value storage during times of doubt, and because altcoins have faced regulatory challenges.

As Ethereum’s supremacy remains steady but unyielding, and alternative coins struggle to make progress, Bitcoin persists in reaping benefits stemming from institutional interest and its long-standing reputation. In essence, the graph itself indicates periodic adjustments, a common occurrence within market cycles.

In summary, Bitcoin’s influence over the market during 2025 underscored its lasting popularity and demonstrated its crucial impact on shaping the market environment.

What’s behind it?

JPMorgan analysts have identified eight major factors that might keep Bitcoin’s market leadership through 2025. Leading the list is Bitcoin being viewed as a digital equivalent of gold, resulting in substantial investments into Bitcoin ETFs on the spot market, while ETFs for other cryptocurrencies like Ether have seen limited demand with only $2.4 billion invested thus far. Furthermore, the continued strategy by MicroStrategy to acquire $42 billion worth of Bitcoin is also a significant contributor, as it’s only halfway through and expected to fuel market growth.

The accumulation of cryptocurrency reserves by U.S. states and banks in the future could advantageously boost Bitcoin’s status as a reserve asset, making it more prominent. Moreover, advancements in Bitcoin’s secondary networks have given rise to smart contract functionality, posing a challenge to Ethereum’s leading position in decentralized applications.

The trend for institutional blockchain applications has been moving towards private networks, lessening their dependence on public chains like Ethereum. Simultaneously, new projects such as Base are concentrating more on infrastructure development rather than token distribution, leading to a decrease in value for altcoins. Furthermore, the ambiguity regarding U.S. regulatory guidelines is fueling interest in Bitcoin as the market becomes more concentrated.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Shifting market dynamics

The market is shifting, as Bitcoin is increasingly challenging Ethereum’s leading position in practical applications. The development of Bitcoin’s Layer 2 features, like the ability to execute smart contracts, broadens its function beyond just a means for storing value, strengthening its influence in the market.

The trend in blockchain adoption is leaning towards the use of private networks, which offer greater privacy and customization, making platforms such as Ethereum less relevant for digital bond trading. Additionally, projects that focus on infrastructure like Coinbase’s Base indicate a shift away from strategies based on tokens, instead directing value to private corporations.

In the United States, unclear rules about regulations are slowing down the wider use of alternative coins, thereby extending the process of market concentration. Despite a generally careful outlook and economic sensitivities, Bitcoin’s ability to adapt and its increasing appeal among institutions are helping it maintain its leading role.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-18 09:11